"Ever-present naysayers may prosper by marketing their gloomy forecasts. But heaven help them if they act on the nonsense they peddle."

To market to market to buy a fat pig Let us keep this section short and sharp, there is much to do on the companies front. Friday saw another steep drawdown in the commodities section, down over three percent on the session. That brought with it the rest of the market, down over a percent by the end. Bidcorp had another dig day, the stock was up over four and one-third of a percent by the close. Reinet and BATS also rallied hard, Hammerson and Amplats added over a percent.

It was unfortunately the negative end of the scoreboard that outpaced the "winners" over two to one, Glencore, Anglo and Kumba all down over 5 percent. Some concerns that the rally in commodity prices is waning a little. The stronger Rand (relative) also brought with it most of the dual listed stocks lower on the day. Speculation still continues to swirl on the appointment of a new finance minister, the rumour mill is talking about a deputy shuffle to Mr You-know-who. Time will tell sportslovers.

Across the oceans and seas vast, stocks in New York, New York managed to just eke out a gain by the time the closing bell was rung (pushed) on the floor. That is very much a ceremonial process these days, in reality the floor is not really needed and is a shadow of the former self. More efficient in the age of the machines no doubt. We still read books where there are Kindles and e-books, I meet many people who tell me that they enjoy reading in physical format, the smell of the book and the feel. Not the fact that you may lose your place, not that. I read nowadays exclusively on my phone, I prefer that to reading on my Kindle, really .... that is me.

Stocks rallied into the close (after a weak looking futures market) and the Dow Jones managed another positive session, albeit only 0.05 percent to the good by the close, 11 days in a row now. The broader market S&P 500 managed three times that, still, a modest gain of 0.15 percent on the session. The nerds of NASDAQ added a little more than that. We are coming to the end of the last quarters earnings season, so far, I suspect that Mr. Market liked what they saw, within reason really. It looked like big banks and energy were trumped by big pharma and industrials on Friday.

It was Warren time again over the weekend, you can download and read his annual letter, it is ALWAYS worth a read. The Berkshire Hathaway website looks like it was made in 1996 and the format has been stuck with since. I guess that is Charlie and Warren's style, keep it very simple. That has worked for them over the years.

The 2016 letter can be found amongst all the others, dating back to 1977. For anyone in investing, looking for insight from a great investor, it is all available there for you. All you need is an internet connection (not free) and a piece of hardware (not free either). I commented to Michael this morning that I thought Super Rugby was dead, I started reading the letter rather than watch the Lions squeak through against the Currie Cup champs. Nerd, I guess. I had watched the cricket earlier.

There were a few favourites inside the office, Bright liked this:

" .... every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold. When downpours of that sort occur, it's imperative that we rush outdoors carrying washtubs, not teaspoons. And that we will do"

What Warren means is that when the times get tough, they (Berkshire) must definitely NOT be meek, they must capture the opportunities with both hands. i.e. When stock prices are depressed, scoop them up with aplomb. And these opportunities do not come around all of the time, they definitely do not. Often, in my experience, retail investors get scared off when good companies have lower share prices. It happens. The "right" thing to do, is to buy more. Of course, not all of us have the liquidity that Berkshire has.

Michael quite liked the fact that Buffett recommended the Phil Knight (Nike founder) book, Shoe Dog, as the best book he read last year. Agreed, it was pretty epic, read it if you have not had a chance. Michael also liked in particular the second part of this paragraph:

"American business - and consequently a basket of stocks - is virtually certain to be worth far more in the years ahead. Innovation, productivity gains, entrepreneurial spirit and an abundance of capital will see to that. Ever-present naysayers may prosper by marketing their gloomy forecasts. But heaven help them if they act on the nonsense they peddle."

Exactly. The point is brilliantly made. What he suggests is that there are always people telling you that the world is going to end, the outlook is terrible and so on ..... if they had to short the market in perpetuity, lucky for them they would wipe out quickly (the pain would be swift). The short answer is to stay long "forever". Don't necessarily resign yourself to never selling shares, just know that quality trumps all.

And then my favourite piece of the letter:

"Charlie and I cringe when we hear analysts talk admiringly about managements who always "make the numbers." In truth, business is too unpredictable for the numbers always to be met. Inevitably, surprises occur. When they do, a CEO whose focus is centered on Wall Street will be tempted to make up the numbers."

It goes to the core of one of our previous messages, from just over a month ago titled Expect Analysts to Expect. It is not our job to get excited or disappointed about the immediate results. That is for the balance of the markets. Sure, it "feels nice" when the company executes relative to the market expectations in a hurry and "feels nice" when the share price pops after results. Equally, it feels awful when the opposite happens. You should though temper your emotions to only change your mind if you think that the opportunity is too good to pass (buy more shares) or if you think something has changed fundamentally and the business is in terminal decline (then sell it).

All in all, once again a riveting piece, worth the read for investors of the professional and novice kind. Being able to articulate your investment style and get that through in the easiest possible way is an art in itself. He may not be able to serve up a cordon bleu dish, or day trade forex, he certainly knows a lot about investing in real businesses over decades. So listen to him. And keep on keeping on.

It is also Oscar time. I always think that the "winners" are those who get the most at the box office, that means all the people who watched (and bought a ticket) thought that was the best film. For instance, during 2015, 5 of the top 11 biggest grossing films of all time were released. From the Furious 7 to Minions, Star Wars: The Force Awakens, to Jurassic World and Avengers: Age of Ultron. I have only watched Minions. Not one of these films was nominated for best film, yet the "fans" all bought more tickets to see these over Spotlight, The Big Short, Mad Max and the Revenant, as well as Room, bridge of Spies and Brooklyn. I have seen most of those, the nominated films, and thought they were all excellent.

My only question is this .... like with the Trump win as president for the US and with the Brexit vote (72 percent voter turnout), are the Hollywood elite out of touch with the wishes of the masses? If entertainment is chosen by the masses and they choose to watch movies about dinosaurs coming to life, people shooting lasers at each other in a far-far away planetary make-believe land, or movies about good looking people and fast cars (or little yellow creatures wandering the world, looking for a new master), should one view these awards as an "artist perspective"?

Isn't it the same as saying to the Olympians, look, I know you jump the furthest and run the fastest, I think that in terms of technique, you are not quite good enough, we are going to give the gold medal to the person in 10th place, they had a superb jumping and running technique. Or am I wrong? I know it is about the art and the enjoyment, surely all those buying tickets are "voting" for best movie, whether I prefer Tom Hanks to Vin Diesel or not. For the record, on a highest grossing films of all time, adjusted for inflation, Gone with the Wind is in first place. Avatar and the original Star Wars in second and third place respectively. Art is subjective, box office numbers don't lie. Even if the wrong envelope for best picture was given out.

Company corner

Bidcorp reported results for their first half to end December last week Thursday. Since the results, the stock price is up around 15 percent, in just two trading sessions. In fairness, the stock price was trading near (about four percent above) an all time low before their rally. Before you saw "WHAT?", remember that the company was unbundled from Bidvest less than a year ago, so their unbundling has been less than 12 months. So perhaps it is more fair to say that they were trading at a 12 month low.

The stronger Rand does not help the group, they are no longer just a South African business, as they were in the past. We prefer the foods business over the services business, both are "good", we prefer the expansion plans and geographical reach, as well as the margins. Bidcorp (or BidFood as we like to call them, they are rolling that brand out internationally) has a market cap of 90 billion Rand, relative to the services business Bidvest, which has a market capitalisation of 55 billion.

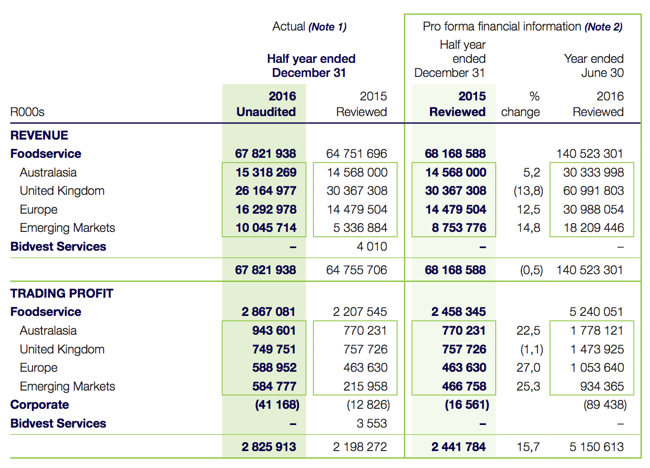

So let us peek at the numbers. Headline earnings per share increased 20 percent to just over 600 cents for the first half of the 2017 financial year, on revenues that were essentially flat (pro forma). The distribution was/is 250 cents per share, the group was really chuffed that they had managed to also pay down net debt by 2.6 billion Rand and slash it to 1.7 billion Rand. Trading margins also improved substantially, from 3.6 to 4.2 percent. As you can tell from their size and scale, they are relatively un-geared.

I suspect that the market likes this too, the fact that they may be in a position to continue to acquire businesses here and there, which has always been the style. As they noted during the six months, whilst there were no material acquisitions, they bought nearly 500 million Rands worth of other businesses in Australia, Brazil, Belgium, Italy and Fresh UK. Fresh UK? Bidvest Fresh UK - Campbell Brothers, Oliver Kay, Hensons. They are always "busy".

Herewith a breakdown of their "global" business, all markets bar for the UK business firing on all cylinders:

Why own this business? I mean, what makes this business so very interesting? For starters as Paul always says when someone points out that cigarettes are addictive, food is more addictive. People are getting busier and richer, which means they are more likely to favour eating out or packaged food. The more handling of fresh food for the consumer and customers out there, the better for Bidcorp. The "prospects column" deliver you a little about the strategy in the coming years, and sums it up *nicely*:

"Our foodservice businesses worldwide are executing on the strategy of rebalancing the exposure between contract, national and independent customers in their respective markets. We see our future as a "foodservice" provider, as opposed to a "logistics" operator. Innovative technology-based solutions for customers and global procurement opportunities continue to gain traction as part of our value-add service to grow market share. Fresh produce, Meat categories and Value Add Processing continue to be areas of unexploited potential in many regions."

We continue to add to this wonderful business. We like the management team, we like the global reach across developed and developing markets. Did you know that this company is the largest listed Foodservice outside of the US? Great team, great trajectory and adding stability to your portfolio.

Linkfest, lap it up

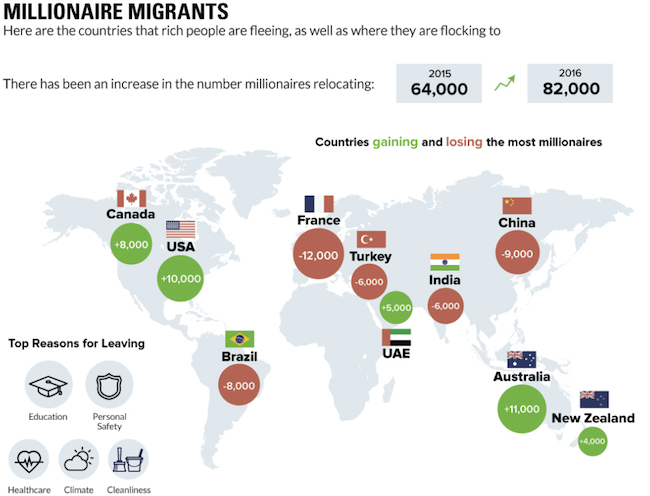

No surprise seeing Brazil and Turkey on this list, political instability has resulted in poor economic performance which is a good reason to find "greener pastures". I suspect that a few terror attacks in France coupled with an unfriendly tax code is what is making people consider moving - Millionaire Migrants: Countries That Rich People Are Flocking To. As the internet makes the world a smaller place, it gets easier and easier to move countries. We live in a global village, governments need to realise this.

Investing isn't easy or everyone would do - I Survived The BULL Market of 2017.

"As fun and profitable as this boom has been for so many, it is not easy to make money investing. The hardest part of this last boom has been getting and staying invested. For those that did, you are smart, if even for just ignoring all the headlines that have scared most out along the way."

Home again, home again, jiggety-jog. It is Naas Botha and Graeme Pollock's birthdays today, that is pretty special that two of our favourite sporting sons share their special day today. I saw Pollock once as a kid, he was batting 4 for the "mean machine", made just less than 50 and smashed 10 fours, nothing in the air and no obvious chances. Obviously it was later in his career, which meant that running was only for youngsters. The scoreboard said "The Maestro", I recall it well. Naas? Nope, never live, only on the box on the weekends. Markets are lower across Europe and have opened mixed here today.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment