"The problem asset of the last 6 months has been New Look, where the valuation multiple has been decreased in combination with lower earnings. A double whammy on the carrying value of the asset! New Look has gone from their biggest asset to the number 3 position now."

To market to market to buy a fat pig The rampant Rand rallies to a 16 month high against the US Dollar, yet somehow I don't see headlines suggesting that due to political stability confidence has returned. Twitter is full of crickets in this regards, not the T20 type, rather the evening in your garden type, happy that they have survived another day escaping the hadedas. I can bet your bottom Rand, Dollar, Euro, whatever currency you transact in, that if the Rand had experienced along with other EM (emerging market) currencies a sell off (i.e. was trading at 14 ZAR to the Dollar and above), Twitter would have been ablaze with the chattering classes calling the State of the Nation speech a shame and a disaster for investors of all sorts. Such is life, we neglect the good and try and reason and wrestle with the bad.

At the same time as this "good news" was presenting itself to Mr. Market, the inflationary impact is likely to be in the consumers favour, even if the CPI numbers from yesterday look horrid. Year on year increases for staples above ten percent, it is most especially tough for households that are always living from paycheck to paycheck. The only good news is that beer prices are only up 2 percent year on year, at least a brown bottle can help the pain of paying 17 percent more for bread and cereals, from this time last year. 21 percent more for sugar, sweets and desserts. Tiramisu anyone? 14.5 percent more for hot beverages, I presume that is tea and coffee, and not a hot toddy.

Check out the Consumer Price Index - January 2017 from StatsSA. In other news, did you know that the category "Books, newspapers and stationery" still make up 0.64 percent of the basket. Whereas tobacco takes up 1.93 percent of the basket, beer 1.98 percent and wine 1.05 percent. Bread and cereals? A mere 3.21 percent. Meat is a big one, 5.46 percent of the basket. Of course, no two baskets are the same, this is just a fair indication of the average basket out there, in both rural and urban areas.

Right back at markets quick sticks. The All Share inched higher by 0.04 percent, financials added just over one quarter of a percent, resources were the big losers, down just over seven-tenths of a percent. Gold miners sagged 1.4 percent, platinum miners gave up two and three-quarters of a percent. Amplats sank on a day that they released results, it seems that they are also forgoing a dividend. I am wondering what the parent is thinking about all of this? i.e. Anglo American, where to next, they seem to be boxed in here in terms of looking for buyers for certain assets. Nedbank, Remgro and MTN were at the top of the leaderboards, Amplats understandably (down nearly five percent), AngloGold Ashanti and Sasol (all Rand hedges) were at the top of the losers column!

What the .... ? Banks, financial institutions and with false bids and offers is what the competitions commission is suggesting, on the US Dollar/Rand. "The Commission found that from at least 2007, the respondents had a general agreement to collude on prices for bids, offers and bid-offer spreads for the spot trades in relation to currency trading involving US Dollar / Rand currency pair. Further, the Commission found that the respondents manipulated the price of bids and offers through agreements to refrain from trading and creating fictitious bids and offers at particular times." Read the full release.

Very naughty for all the parties concerned to "monkey" with the spread, real numbers that importers and exporters use to price their goods and services. My only thoughts are as follows ..... each and every day I see adverts for Forex trading platforms with good looking people driving fast cars and enjoying the life of the rich and famous. These adverts are being targeted at retail customers, people who open accounts quickly and easily, and get trading with huge leverage, let loose on currency markets.

I suspect that most of these people who sign up, have no idea that they are swimming in murky blood laced full of great white sharks. You are going to get eaten. Yet ..... all these people with few forex trading skills and a credit card can be in the same waters as the sharks. And we think that the banks and financial institutions are somehow "fair" in all of this. Nope. The small guy runs out of oxygen, the pool is fake and the sharks feast on the flailing fish, whilst the big guys meet, greet in chat rooms and decide when they are going to "be involved". If .... of course the competitions authorities are right. Expect a settlement soon, is my sense.

Stocks in New York, New York rose to record levels again, the Dow Jones Industrial Average added just over half a percent, the broader market S&P 500 added exactly half a percent whilst the nerds of NASDAQ nearly clocked a two-thirds of a percent gain. That tax plan .... my sense is until there is absolute clarity, the market participants, i.e.. the broader community are expecting fireworks. I hope for the sake of the levels and expectations that it is all justified, otherwise we all know the story, shoot first and then ask questions later.

Company corner

Tuesday morning we had an NAV update from Brait for the end of their 3Q. The markets knee jerk reaction was to sell the stock down 6% but then as people read further and adjusted expectations, the stock price recovered to actually finish the day up around 1%!

The reason for the initial sell off was the NAV number coming in 21% lower than it was 3 months ago, now sitting at R82.45. The underlying assumption there though is that the Pound/ Rand exchange rate is 16.95 (currently at 16.13).

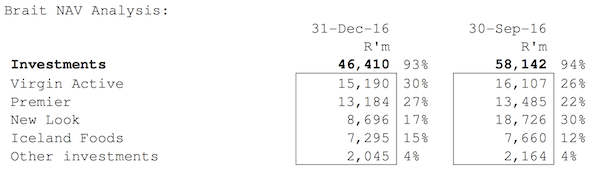

Since the Brexit vote the stock has had a very rough time, roughly losing half of its value. A big factor being the huge devaluation in the Pound. The Pound has lost around 25% of its value when compared to the Rand and given that their biggest assets, New Look & Virgin Active are valued in Pounds, currency translation matters in this case. See the current asset break down below.

The problem asset of the last 6 months has been New Look, where the valuation multiple has been decreased in combination with lower earnings. A double whammy on the carrying value of the asset! New Look has gone from their biggest asset to the number 3 position now. Why the drop? UK sales have been down, like for like sales are down 4.6%. Adding pain to the situation, the weaker Pound means that they are paying more for their stock, so lower margins.

There is a bright side though, their international push. International sales were up 17.9% thanks to their big move into China, store count currently sitting at 106. The international segment is still small for the overall business but as time goes on, will become more significant.

Going forward, I think the New Look valuation multiple will stay the same. It may take a few more quarters for the sales and by extension the profit numbers to stabilise but given the reduced size of New Look their impact should be muted.

I think going forward, the share price will trade in line with our currency (weaker Pound, stronger Rand being bad for the share price). If you have endured the sell off of the last 8 months, I would say that selling now will probably be around the bottom, time will tell though.

Linkfest, lap it up

An update on the Elon Musk tunnel project, getting us around quicker and avoiding traffic will save us all bucketloads of time and money. It seems very difficult and very hard, to say the least - Elon Musk's Next Frontier Is Underground. for the record, we think the fellow is a genius, and have holdings in Tesla, which is trading near all time highs. As is the rest of the market.

Never sitting still, Showmax are taking on the low bandwidth areas of Europe, TechCentral has the story - ShowMax takes first step into Europe. We stay and remain long Naspers, and we think that this is still a fantastic opportunity.

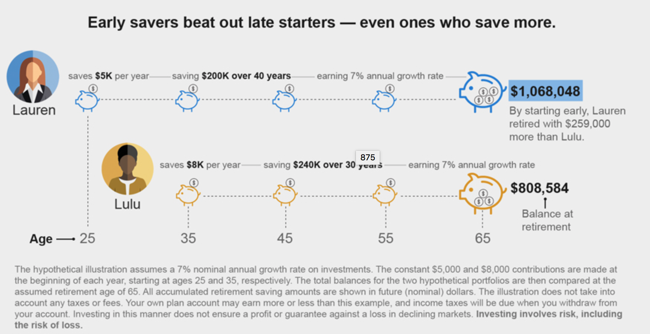

I know it is a couple of days after Valentine's day, here is an interesting one on saving early, teach your kids and yourself (if you are young), the benefits of starting early - Four financial ways to say "I love you". The graphic goes with a 7 percent per annum return and shows that Lauren with her ten year head-start on Lulu, from a savings perspective, is likely to always stay ahead, despite the lower contributions. Courtesy Fidelity.

Added to that - The One Thing You Have that Warren Buffett Doesn't. Time. The same exercise from above, this presumes a 6 percent return. It really is as easy as saving 400 Dollars a month. The message is simple, start now, it is never too late.

Home again, home again, jiggety-jog. Woolies had numbers, and so did City Lodge. Both look stodgy reflecting the current economy. We will cover those tomorrow.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment