"I've said before that I see video as a megatrend on the same order as mobile. That's why we're going to keep putting video first across our family of apps and making it easier for people to capture and share video in new ways."

Attention: One of our sub-tenants is moving to Cape Town so we have some open offices to lease. There are 2 spaces available, one is 32 square meters, the other is 12 square meters. Fully serviced, in Melrose Arch. Please get in touch if you are interested.

To market to market to buy a fat pig Apple held it all together, I saw an Eddy Elfenbein tweet that went like this: "Apple is worth roughly 80 points in the S&P 500, and 880 points in the Dow." He also estimated that Apple added 5 points to the S&P gains on the day, in the end the maker of fine products had results that were cheered by Mr. Market, up over 6 percent on the day.

Old Jim Cramer from Mad Money is taking some credit for the call a while back of "own it, don't trade it", something which we subscribe to down here. And why not, the three month return of the largest company by market capitalisation is 15 and a half percent. One year, up 32 percent. All time high? May 2015, the stock topped 132 Dollars. Normally this is always the case, your return can only be measured where you draw your line in the sand. Did you know that Nike and Apple listed at about the same time? A piece of history for you.

At session end the Dow Jones Industrial Average gained 0.14 percent, the broader market S&P 500 managed to squeeze in a marginal 0.03 percent gain, whilst the nerds of NASDAQ added half a percent, buoyed by healthcare stocks to some extent, the pharma bosses meeting with number 1 at the White House seems to have been favourably received by Mr. Market. There was the small matter of a Fed meeting that revealed an expected wait and see approach - > Press Release: "The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run."

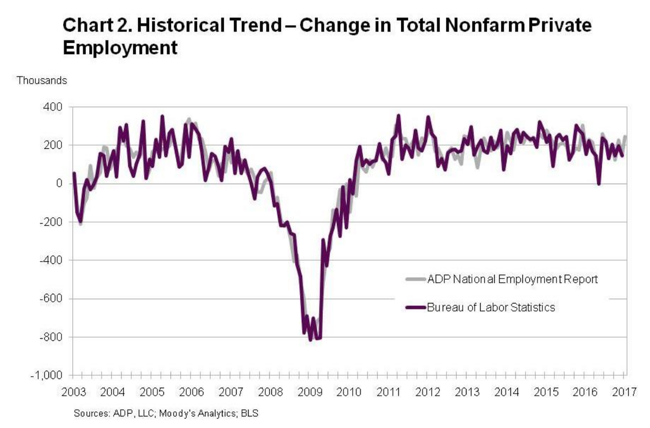

There was also the precursor to the non-farm payroll number (tomorrow), the private payrolls processor, ADP, releases an employment number every month titled - The ADP Employment Reports. Small business reported a surge in hiring, and as we suggested, sentiment may well be driving reality, and vice versa. This is the best month for employment (in their report) since June last year. And now that we have years after the financial crisis of 2008, we can unequivocally say that the recovery was V shaped and not bath tub shaped like the bearish forecasters said, check it out:

Things almost always turn out better than you believe at the time, the human spirit is powerful. Mind you, if you had woken up on the 14th of August 1961 in East Berlin, you had to wait until November 1989 to cross it. Formal demolition of the wall started in June 1990, completed in 1992. The wall was everything that represented "the wrong" with communism and the associated oppression. Border controls of capitalism normally keep out those trying to "make it" and live the dream, in communism they shoot you trying to get out. Oppression versus hope. 'Nuf said, cast your mind forward to Friday now, expectations have risen somewhat.

Locally we had markets higher on the day, the All Share index added six-tenths of a percent, Kumba had another screamer of a day, up six and one quarter of a percent. Resources led the overall charge, up over a percent on the day. General retailers fell nearly one and a half percent on the session. Woolies was at the other end of the spectrum, down over two percent on the day. Steinhoff had a smashing day, up over three and a half percent, albeit off a very low base. Still, not much by way of clarity from the pending deal, to create Retail Africa.

There were numbers from Vodacom, which we will review in due course, they looked OK at face value, by the end of the session the stock had sold off around one-quarter of a percent.

Company Corner

Facebook reported numbers after hours, for the full year and the fourth quarter. Another beat on both metrics, revenues income - Facebook Reports Fourth Quarter and Full Year 2016 Results. Revenues for the full year clocked 27,638 billion Dollars, an increase of 54 percent from last year. Wow. Net income for the full year topped 10 billion Dollars, up 177 percent from the year prior.

Earnings per share grew 171 percent to 3.49 Dollars, from 2015 to 2016. At this sort of growth rate the stock trades on 38 times earnings historic, which you would expect. Bloomberg has the forward multiple as 25.4x, with estimated earnings for the full year at 5.25 Dollars per share. That means that the simple PEG ratio is less than 1, at a very respectable 0.75 times forward. By most metrics, a spectacular failure of an IPO (as it was called at the time) has turned into a roaring success as a business. As the Zuck pointed out on the earnings call, yesterday marked five years exactly from when Facebook announced they were going to IPO.

And also, remember how the company was going to struggle to monetise mobile? Remember how the share price halved after the IPO, inside of the first six months of being listed? Mobile revenue now represents 84 percent of group revenue, up from 80 percent this time last year. And the group is hardly ex growth, I was quite astonished by the increases in users, you have to expect those to plateau at some stage, not everyone in the world will "sign up", even if that is the mission of the Zuck. Daily active users grew to 1.227 billion folks, 1.146 billion on mobile phones. Monthly active users grew to 1.86 billion, on mobile that number is 1.74 billion.

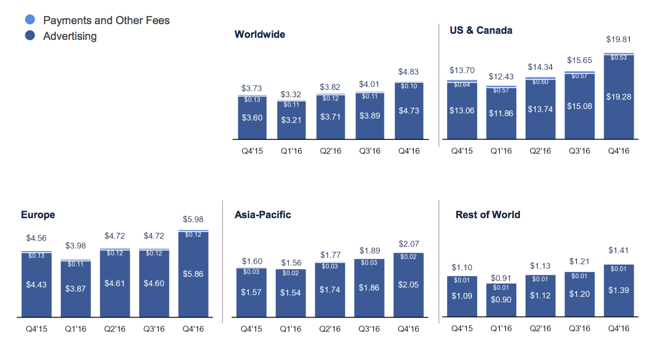

Advertising revenue is being driven (at a geographical level) by North America, Average Revenue Per User (ARPU) in the US and Canada now stands at 19.81 Dollars, for the whole world (all their users), it is 4.83 Dollars. In Europe that stands at 5.98 Dollars. Down in our part of the world (rest of world categorised) it is 1.41 Dollars. As per the annual report, just in case you were thinking that this was an annualised number or monthly number, it is not: "We calculate our revenue by user geography based on our estimate of the geography in which ad impressions are delivered or virtual and digital goods are purchased. We define ARPU as our total revenue in a given geography during a given quarter, divided by the average of the number of MAUs in the geography at the beginning and end of the quarter." Check out the global ARPU spread:

That 19.81 Dollars ARPU is basically 6.60 Dollars per user per month. Or advertisers in Canada and the US are spending 22 cents per user per day. Down here, in our part of the world, it is around one and a half cents per person using the platform per day. Even in Rand cents, that is next to nothing, 21 ZA cents per day on users. Advertisers certainly have plenty of scope to push hard with this advertising platform, I suspect that not everyone has gotten their heads around advertising in this way. Once they do, the fact that the database is so malleable and your target audience can be met so easily, there is big scope to grow.

Before the earnings call, which included guidance from the CFO (that is what everyone is making reference to) that ran a little short, the stock touched all time highs. This was the commentary in the prepared commentary from the CFO "Consistent with my comments on the Q3 call, we continue to expect that our ad revenue growth rate will come down meaningfully in 2017." That has attracted quite a lot of attention, meaningfully cannot really be quantified.

For the time being, the next focus is going to be on video. I am sure that the mobile operators are thrilled that more people are going to be watching videos on their phones! Zuck (second name Elliot) says on the (Conference Call): I've said before that I see video as a megatrend on the same order as mobile. That's why we're going to keep putting video first across our family of apps and making it easier for people to capture and share video in new ways.

The company is in great hands. Sheryl Sandberg, Mark Zuckerberg are about as dynamic as you can get. I suspect that what often happens with businesses like this is that they attract high quality talent, we often make the point that quality attracts quality. The core product is still the core product, the other platforms are growing like gangbusters too, and that presents multiple channels for advertisers. Instagram has 400 million daily active users (count me in there) and 600 million monthly active users. WhatsApp has 1.2 billion active monthly users (I am a daily user), sending 50 billion messages a day. Whoa. At peak SMS, the Zuck notes that there were around 20 billion messages being sent daily.

There is a careful balance on the user experience, I am very sure that they will get that right. i.e. The advertisers would prefer a more direct access, the users would prefer it toned down. This is also useful, the Zuck says in the prepared remarks: "In the past we've taken steps to reduce spam and clickbait, and now we're approaching misinformation and hoaxes the same way."

Lastly, what is the share price worth? Based on the old and trusted PEG ratio, I suspect that there may be as much as 20 percent upside over the next year, depending on user traction remaining the same, and advertisers seeking maximum bang for their buck. The biggest risk to their platforms is competition. It may come, other advertising platforms, I suspect that they will be trend setters for the time being. We maintain our buy recommendation up to the 150-160 Dollars range.

Under Armour released results two days back, pre-market. The market thought the results were absolutely awful, relative to their expectations, the stock was absolutely pounded. A drop of over one-fifth in a day means that the market was expecting a lot more than the company delivered. In part the lofty valuation has been as a result of the company having grown so quickly, so anything less than a meet would have been viewed negatively by the market. As a result of the company missing by a long way, relative to the lofty expectations, the result was a turndown of 25 percent plus for the voting shares (code UAA) and 23 percent (and a bit) for the non voting shares, (code UA).

Revenues grew 11.7 percent year-on-year on the comparable quarter, earnings per share and net income were lower than the prior year. Again, and I don't like to repeat this, a bit tough when the stock trades on a 30 plus multiple to justify that valuation. For the full year sales increased nearly 22 percent to 4.828 billion Dollars. Two huge bright spots were that international revenues grew 55.2 percent (still a small part of total sales at 16.5 percent), footwear revenue grew by 36 percent.

As I saw from a search, this sales disappointment breaks a 26 quarter streak where sales had grown by over 20 percent year on year. i.e. six and a half years. Now you can understand why the stock fell so heavily. Added to the slowing revenue growth was the fact that the CFO, Lawrence 'Chip' Molloy, who has only been there for a year, is leaving for personal reasons. A solid chap, a navy pilot for 10 years, his bio said. David Bergman, a company veteran, will step into the role as the new CFO. To add insult to injury, the company has cut their forecast pretty heavily.

There is an old story that describes the interaction between Mark Parker, the CEO of Nike and the late Steve Jobs, the founder and former CEO of Apple. It goes something like this, when Parker asked for advice, Jobs said the following: "Nike makes some of the best products in the world. Products that you lust after. But you also make a lot of crap. Just get rid of the crappy stuff and focus on the good stuff." I think Under Armour do this, their shoes and apparel certainly are not cheap, nor are they inferior in quality. Whilst CEO Kevin Plank is not exactly everyones cup of tea, he is hard charging and is a victim (on paper) of his own success. I am sure that Kevin Plank cares about the share price, as he well knows, there is little to nothing that he can do about it.

Having recently finished Phil Knight's book Shoe Dog, I remember that it took them 17 years before they were settled, Under Armour has just turned 20 recently. There have been some recent stumbles, some of them associated with the bankruptcy of a large distributor of their shoes and apparel. The stock now looks cheap, and perhaps for a reason, the folks trumpeting from the roof tops have all turned into doubting Thomas', price targets have been slashed and burned, now they are all scared. That may be the moment to own them, I am sure however we will get our opportunity to bolt on more over the coming year or so, you are going to have to be very patient with the recovery. Look out for a selective moment to own them, if you have them already, it is definitely a hold. Hang tough!

Home again, home again, jiggety-jog. Stocks in Japan are lower. Stock futures are lower, there is the small matter of Amazon and Amgen results tonight to look forward to, that should be very exciting! As always, we will attempt to keep up to date with all of these results.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment