"Stocks as a collective have been in a sideways pattern for a little while, although that masks the picture beneath it. Facebook is up nearly 17 percent year to date. The S&P 500 is up 2 and a half percent. Apple is up 14 percent year to date whilst the index is up .... you know, two and a half percent. JP Morgan is down over one-third of a percent year to date. That trade of lagging tech stocks and shoot the lights out financials has unwound a little here."

To market to market to buy a fat pig Stocks in Jozi clawed their way back (a little) after a poor show to begin with. Financials were the least bad of the lot. There was a smattering of green here and there, AngloGold Ashanti at the top of the leaders, as was Hammerson and Amplats. Hey talking Amplats, it was reported by Reuters that Amplats chief turned up at the mining Indaba in a wheelchair, he had been hurt by a buffalo during the holidays. What? See - South Africa's Amplats CEO injured by buffalo. Imagine for a second if it was the Impala chief, what the headline would be. What is an encounter with a buffalo? Sounds dangerous and he is lucky to have made it alive. Would any other CEO be injured in this way, perhaps in Kenya, perhaps a different kind of buffalo in Asia. And perhaps in Australia, where there is a host of wild things, including Nick Cummins.

MTN fell heavily after the "lack of full information" trading statement, the stock recovered from the worst of the day, ending down 1.7 percent on the session. I suspect that the long brooms have been brought out here, the operating environment is hardly easy in Iran and Nigeria, those territories are looking a little worse for wear. Iranian sanctions imposed by the US and of course the Nigerian president is on extended leave as a result of poor health (we are led to believe that he is ok!), the country is certainly seeing a market unwind of the currency there.

Of course there is the State of the Nation speech tonight, I am not too sure why the excitement, do you remember the last one and what happened after that, or even the one before that? Nope, thought not. I guess politicians with the trappings of power (all sorts). See this if you like Stephen and his analysis - Power Deck: How will Zuma deal out his SONA cards? Nice read as ever from this chap, I like him a lot.

Across the seas and oceans wide, at the corner of Broad and Wall in New York, New York, stocks were mixed by the close. The nerds of NASDAQ clocked another all time high, closing up 0.15 percent. The broader market S&P 500 added around half of that, whilst the Dow Jones Industrial Average slipped around one-fifth of a percent by the close. All indices were off their worst levels, there were numbers overnight from Gilead that fell flat, in some part, a victim of their own success. The stock was trading at a 52 week low by the close.

In news that is relevant for us, Amgen stock sank over 2 percent after hours - Regeneron, Sanofi win stay of U.S. order blocking cholesterol drug sales. I think that the next key date is in March. Confusing for the general public, I wonder what doctors will dispense to their patients, knowing that there could or might be another ban of the sales of the cholesterol drugs for Sanofi/Regeneron.

Just a couple of days back, Amgen was granted FDA approval for a drug called Parsabiv. If you can understand the release from the company, you may well be in the company of fewer - First New Treatment In More Than A Decade For Secondary Hyperparathyroidism In Adult Patients On Hemodialysis. We continue to accumulate what is a great company, buy on any weakness.

Stocks as a collective have been in a sideways pattern for a little while, although that masks the picture beneath it. Facebook is up nearly 17 percent year to date. The S&P 500 is up 2 and a half percent. Apple is up 14 percent year to date whilst the index is up .... you know, two and a half percent. JP Morgan is down over one-third of a percent year to date. That trade of lagging tech stocks and shoot the lights out financials has unwound a little here.

Linkfest, lap it up

Oh no. My favourite Stats guy has died. Hans Rosling. You will remember him for his bubbles, here is the visual representation of the same thing via his platform -> Income per person, GDP per capita in Dollars/year adjusted for inflation and prices. Hans had a way with stats, an amazing fellow that fought health problems from the age of 20. His work will be kept going by his daughter in law and son, some amazing "stuff" they do. That representation can be watched in a short video - 200 Countries, 200 Years, 4 Minutes - The Joy of Stats. If you are ever feeling a little down about the state of the world, watch this piece. We have made significant progress over the last 200 years and will no doubt do the same over the next two. This one is also great, Dollar Street - See how people really live.

The announcement that Tesla confirms retooling of factory for Model 3 this month, will 'pause' Model S/X production for a week will no doubt be fleshed out when the company has results on the 22nd of February. This is all in anticipation of the ramp up for the Model 3 roll out, where machines build machines for the production line. Are these the first few steps to full automation on the production line? Perhaps, see from last year, same source - Elon Musk goes on a 'machines building machines' rant about the future of manufacturing.

I am lucky, I have a great job where I never stop learning, day in and day out. There are no two days the same. Ever. It turns out that continual learning is very good for you, learning new stuff along the way makes you very clever, from the Harvard Business Review - Lifelong Learning Is Good for Your Health, Your Wallet, and Your Social Life.

TV, streaming and all that, the way we watch has certainly changed significantly over the last decade. The fact that you could record something from your decoder, that was a breakthrough. With the likes of Netflix, Showmax, Amazon Prime and the like, you can watch whatever you want, whenever you want. Bloomberg reports - Apple Hires Amazon's Fire TV Head to Run Apple TV Business. We think that Apple have loads of room to move in this segment of the market. The fellow being hired (with a great name), Timothy D. Twerdahl, used to be at Netflix too, as well as an earlier streaming business, Roku. No guesses next as to what happens at Apple. Content? Sure.

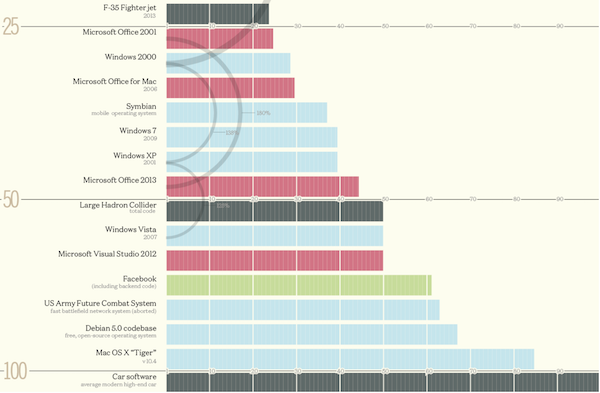

Ever wondered why software companies have 100s of thousands of employees? It is so they can create and maintain the millions of lines of code - How Many Millions of Lines of Code Does It Take?. Facebook for example is around 56 million lines of code, and growing.

Home again, home again, jiggety-jog. Stocks have traded on balance better at the start here. Earnings continue all through the next couple of weeks, perhaps Mr. Market can take stock by the end of the month then, I suspect that we will view this last earnings season in a favourable light.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment