"There is something more than the cute rewards program for you the shareholder, and indeed being part of the scheme as a member, alongside incrementally more healthy people. The more healthy the scheme members, the more profitable the scheme, the greater the buffer, the more likely for the scheme to do good by their members."

To market to market to buy a fat pig Yesterday was a tale of two parts to the market. There were the stocks on the one side of the scoreboard that had been impacted by a strengthening Rand, the likes of South32, Richemont, Amplats, AB InBev (and the like) and then those that had results Mr. Market liked (like a lot), and SA inc. stocks. As two of those stocks "concern" us, we will deal with them below in the company corner segment. Session end the Jozi all share index closed at nearly one-fifth of a percent higher, industrials were marginally lower with the legendary childhood book beast, the pushmi-pullyu having a big tug of war match. Remember, the Dr. Dolittle animal, half unicorn and half antelope. Richemont dragging the index lower on the one hand, Bidcorp sending it much higher on the other hand, good results.

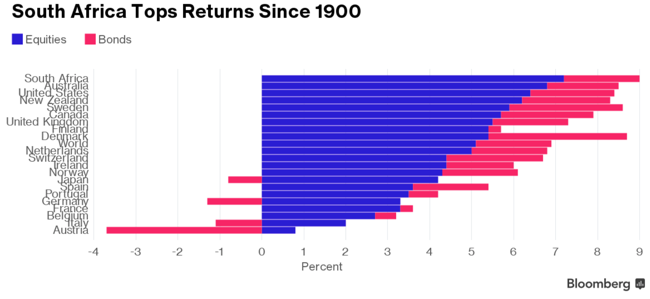

I picked up an interesting story from Bloomberg. Remember that whilst objects in the mirror may be closer than they seem, equally past performance is no guarantee for future returns, ok? Someone did a deep dive of all the stock market data available since the turn of the last century, over 116 years worth of data has been crunched and (drum roll again) - List of Top Equity Returns Since 1900 Starts With South Africa. True story sports lovers. Check out the associated graph, courtesy Bloomberg.

The line that I like the most is "Equities were the best performing asset in every country, showing over the long run there has been a reward for higher risk." We all knew that, we just needed some confirmation. And the reason why we did so well? "South Africa performed well partly because it is a resource rich country that has successfully developed into a broader diversified economy, and because it has made a peaceful transition from apartheid and remained stable." Pat yourself on the back. Now you may think that this is all water under the bridge and the future matters (and you are right), the article points out that the Russian and Chinese stock markets as a result of their revolution went to zero in 1917 and 1949 respectively. Zero. Zilch. Nil. And during World War Two, the Japanese stock markets went down by 96 percent. Wow. Just wow. See, revolutions and war are bad for stock markets, capital loses and then humanity is all the poorer for it.

Equally important in this relatively short article is how some businesses once dominated, and then the economy evolved: "In 1900, more than 80 percent of the U.S. stock-market's value was in businesses such as railroads, which are today small or extinct. Nearly half of U.K. companies by value are in sectors that didn't exist a century ago. Gold, once key to South Africa's wealth, has waned in importance and the biggest Australian companies are now banks."

What is the moral of the story? I am not entirely sure. What I do know is that paying attention in stock markets is absolutely vital. If the returns are great over the long run, it means that they are being "made" somewhere else as new industries take the proverbial mantle from older ones. For instance, Naspers has a market capitalisation of 954 billion Rand, 15 years ago the company was struggling to rotate to the internet era. The share price was 12 Rand. Over the last ten years, the Naspers share price has grown over 1000 percent, from around 170 Rand to today. That is a market cap, this time in 2007 of "only" 76 billion Rand. Anglo American on the other hand, has a market capitalisation of 299 billion Rand today. The stock is down 46 percent in ten years. Back then the market cap was around 510 billion Rand. Yes, Anglo was over six and a half times the size of Naspers ten year ago. Now ..... Naspers is over three times the size of Anglo. And you thought things didn't change that much in a hurry?

Across the oceans vast and wide, stocks in New York, New York were mixed, with the nerds of NASDAQ off by around four-tenths of a percent. I saw that NVDA was totalled, the stock down nearly 10 percent, quite a big analyst downgrade (Nvidia's stock rocked after analysts say it's time to sell) was the reason, as far as I could see. I think that this is an excellent business and may be a good opportunity. Tesla also sank over six percent, it was a day when high beta stocks took a whipping. Again, this is to be expected at some level, both sets of stocks have a huge bunch of short speculators around. The trading action of high multiple stocks is always going to be "difficult" to try and nail down. Best you not try!

At the other end of the market, the Dow Jones powered to another record high, powered is perhaps a strong word. The Dow clocked ten up sessions in a row. I saw an interview on CNBC with Treasury Secretary Steve Mnuchin (Man-nu-chin), in which he was clear that there would be a well thought through tax plan by August recess. Meaning voted and put forward, debated and implemented. This is going to be huge (I think you are goin' to love it). That may have been one of the reasons, industrial America may well be the winners on all of this.

In the end, the Dow popped over 20800 points, up 0.17 percent by the close. Basic materials were the laggards, commodity prices giving back after the Fed "real soon" rates raise is a sign of strength for the Dollar. The US Dollar that is, still the one and only currency of the world. And there I thought that the Rio Tinto numbers were good. The broader market S&P 500 managed a marginal gain, less than a single point gain (0.99 points) or 0.04 percent of a gain. That is all sports lovers!

Company corner

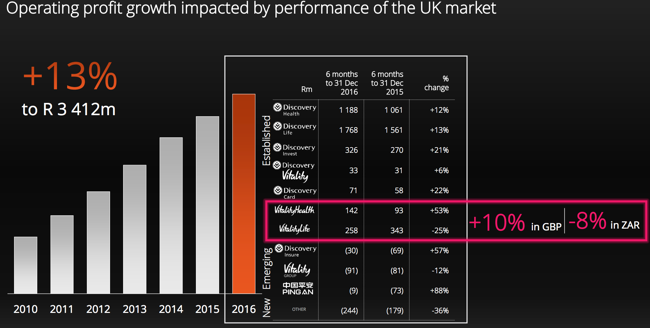

Discovery released interim results for the half year to end December yesterday morning. This is a great business. A business that was conceptualised by an incredible individual who has seen in large part his vision realised. Adrian Gore is not finished. He seems passionate about the business, he walks the walk and he talks the talk. And talk he can. At the results presentation he made it known that Brexit, the weaker Pound to the Rand and the weakness in the investments (statutory capital) in the UK (yields in Gilts powering to an all-time low) has had a negative impact on the UK operations.

The company cannot be responsible in any way for the actions of the UK citizens, and equally how the market responds to that, it is in the grouping of those factors beyond their control. Brexit weighed, when it all eventually settles (it may take a couple of years), it will be easier to have a comparable numbers. Until then, the cost of doing business in the UK, from a mindset point of view too, is going to be exceptionally hard to quantify. As Adrian Gore rightfully pointed out, they (Discovery) will focus on their business. For the record, see the slide below, the UK business "did" 10 percent better in Pound Sterling, negative 8 percent in Rand terms:

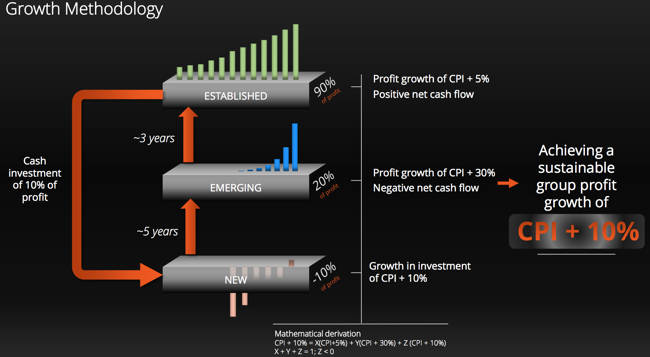

For the very first time that I can remember, the company in a slide in their presentation explained the business "trajectory" and route they follow. In other words, what their internal expectations are with the businesses that they start from scratch. For all intents and purposes, Discovery are a disruptor of the status quo, they take an industry that they think needs a shake up and change, they push it in the right direction adding technological innovations and leveraging off the human desire to be better. That is why New Year is such a big thing, people want to always "be better" than last year.

So here is a slide to explain that when the company starts motor vehicle insurance to take on their competitors in the market, what their time horizon is for that business to move into the category of developing and developed business. The three terms you have to remember are, new, emerging and then established.

To cut to the chase, the business for the time being is a Health and Life insurance business, with smaller contributions from the invest business. There are lots of opportunities that are likely to emerge in the coming years, most especially with regards to PingAn, Vitality (white labelling) and of course Discovery Insure. There are over 160 thousand insured vehicles out there, I can count myself one of those. I hate being told that I am about average relative to the other drivers on the road, I guess I am being compared to the average Discovery Insure driver. I suspect that within a year or two, the Discovery Insure business will be profitable, as will the Vitality business.

There is something more than the cute rewards program for you the shareholder, and indeed being part of the scheme as a member, alongside incrementally more healthy people. The more healthy the scheme members, the more profitable the scheme, the greater the buffer, the more likely for the scheme to do good by their members. i.e. All members benefit. What is quite interesting is that the lapse rate is greater if your "status" is lower. i.e. blue or bronze, then you are more likely to think that the expense is not for you. None of Discovery products are cheap, that is for sure.

The stock is not cheap either. It is not expensive either. At 16 times forward, with the growth in their business, through the technology innovations (the most technology savvy insurance business in the world), there is more growth to come. We are pleased with the initial market reaction, we are pleased with the outlook, notwithstanding some problem areas. We continue to accumulate the company.

Linkfest, lap it up

This is a nice problem to have, I think? - Sweden complains it is collecting too much tax. Having negative interest rates meant that some creative companies used the Swedish tax authority as a make shift savings account.

LTE is great! As our phones and computers get more powerful and as we consume more video, 5G will be needed to allow us to get all the data we demand as consumers - Verizon to Begin 5G User Trials in 11 Markets by Middle of Year.

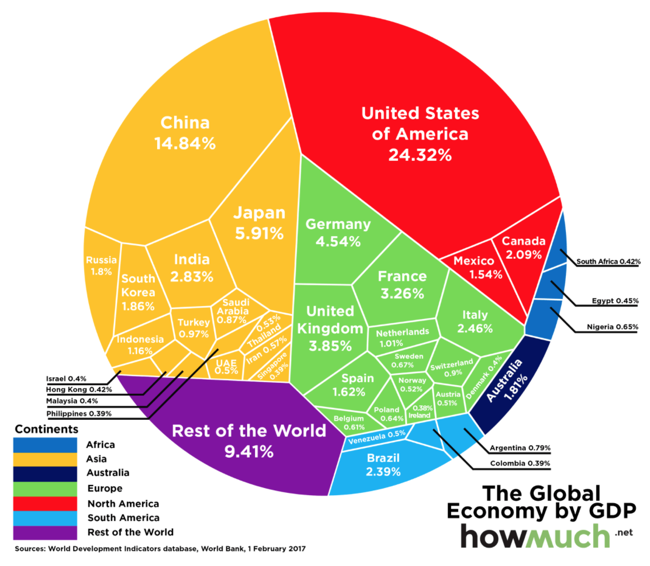

This is a nice visual, it tells you exactly how big or YUGE you think you are, relative to your peers. The $74 Trillion Global Economy in One Chart. There are only a few worth noting of size, the rest of us have to try a lot harder. The good news is that as time goes on, there will be more participants, Indonesia, India and the like (dare I say it Russia, Saudi and Brazil) which will lead to fewer global shocks when a specific economy slows.

Home again, home again, jiggety-jog. Claudio Ranieri was sacked 298 days after winning the league, Leicester City are a point away from relegation. True story. Such is the demanding world that we live in. Is this a clear sign that in fairy tales when they say "and they all lived happily ever after", they lied? Oh my word, it is that exciting time again when we all get to read the Warren Buffett letter to the Berkshire Shareholders. It is like a cult following of an old fellow in Omaha, one of the finest investors to have ever walked the planet.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment