"One thing that often shocks me, and you have heard us say this before, is the enormous pushback that companies such as these get from the broader community. They are shocked and outraged at the cost of the therapies, yet give little time and effort into trying to understand not only how much money is spent in developing the therapies, but the enormous positive impact that companies like Amgen have on broader society."

To market to market to buy a fat pig NFP (non-farm payrolls) Friday is always fun. As time has passed it has become less important, the actual number. Second guessing what market participants will think/do and how they are likely to act to the same information is about as predictable as being an Arsenal/Liverpool supporter (sorry -

There is a famous interaction/story between Walter Reuther, a union leader in the automobile space and a Ford executive (sometimes wrongly attributed to Henry Ford II), in which the Ford exec. proudly says "How are you going to collect union dues from all these machines?" Meaning of course, with the heavy automation and the lack of labour, the process of manufacturing would eliminate the union member dues. The correct and speedy answer from Reuther (from a speech given later) was "You know, that is not what's bothering me. I'm troubled by the problem of how to sell automobiles to these machines." And you must remember that this interaction took place in the mid 1950s. Automation and the replacement of humans with cheaper and more reliable machines is not a new thing, nor has it eliminated that many jobs. People skill up and stay relevant or

The market liked the jobs numbers, all except the materials/resources stocks, which sank in New York trade nearly a percent, more on that below. As for the rest, they all caught a bid and in particular financials (up nearly a percent and a half) as Trump policies set to ease the regulatory burden on that sector. Democrats called it a gift to Wall Street. Look at the smiling people in the picture - Trump Moves to Roll Back Obama-Era Financial Regulations. Indra Nooyi and Ginni Rometty on the left there, not that financial regulation has too much to do with their business.

The upshot of it all was that the majors rallied sharply, JP Morgan up three and a bit percent, Goldman Sachs added over four and a half percent, Morgan Stanley nearly five and a half percent, Wells Fargo two and three quarters of a percent, you get the picture! By the time the market closed Friday, Dow 20K was firmly back on an even keel, that index up nearly a percent on the session, the broader market S&P 500 added nearly three-quarters of a percent and the nerds of NASDAQ tacked on just over half a percent. Dragging those chaps lower was a worse performance (than anticipated) from Amazon, that stock sank three and a half percent. Not too worry, Visa added over four and a half percent to trade at an all time high.

On the local front there was a little concern over the Chinese raising interest rates (China Tightens Monetary Policy by Raising Money Market Rates), that certainly surprised all and sundry. What it meant was that with less liquidity, there would be a little less building activity. And that means a little less on the resources front, in terms of demand, forget the supply side. Of course, with an economy that relies on raw materials for export revenues, our local miners were bound to feel a little heat, the stocks have had such a good run recently. I have no idea what the long term outlook of the People's Bank of China is likely to reveal (from a policy point of view), I suspect that they will act when they see fit. It is not going to be easy, the Chinese Economic Miracle is still work in progress.

The stronger Rand did not help the resource stocks either, in the end, resource stocks as a collective were down 2.85 percent by the close, dragging the broader market, the Jozi all share index with them. We ended the day down 0.86 percent. Kumba felt the heat, both from the Chinese interest rate event, as well as announcing that they had settled with SARS, down nearly 8 percent by the close. Glencore had slipped five and a half, Anglo American just over four and a half. At the opposite end of the spectrum was PSG, Discovery and Nedbank, the prospect of lower inflation (with a stronger exchange rate) being a real win for local retailers and banks. Rate cut by the end of the year? Perhaps, we will have to wait and see, I would not think that it is completely out of the question though.

Company Corner

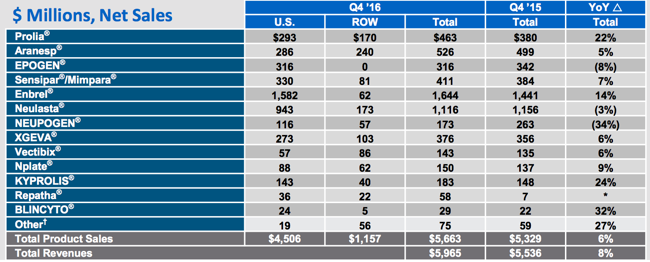

Amgen reported numbers on Thursday evening, after the market closed. I think for the purposes of this 4th quarter update, it is worth publishing a sales table of all of their therapies to explain where the business is right now.

As you can tell, their biggest selling drugs are Neulasta and Enbrel. Their fastest growing therapies are Prolia and Kyprolis. Of course, if you are looking for a breakdown of their therapies (everyone knows what a GoPro is, Neulasta outsells that on their own, not everyone knows what that is), visit the Amgen website - Amgen Products. Neulasta is a prescription drug given to you 24 hours after you have chemotherapy, in order to boost your white blood cell count. This builds greater protection against the chance of infection, i.e. the more white blood cells you have, the greater chance you have of fighting infection risks, should they arise. Enbrel is one of those therapies that treats multiple ailments, from Rheumatoid Arthritis to Psoriasis to Ankylosing Spondylitis (AS - spinal arthritis).

Prolia treats postmenopausal osteoporosis, by strengthening bones most especially in woman who would be prone to heightened risk of fractures. At two shots a year, it is an effective and affordable (in a developed world sense) at 1650 Dollars a year. More or less affordable and a whole lot better than the cost of the ongoing treatment associated with fractures as a result of weaker bone structures. Kyprolis, as per the website "is a prescription medicine for people with relapsed or refractory multiple myeloma who have received at least 1 previous treatment." Amgen bought the therapy when they acquired Onyx Pharma back in 2013.

It is a little complicated as an investor trying to understand all the multiple therapies that they have invested an enormous amount of time and money in, the research and development cost last year was 3.84 billion Dollars, relative to the total annual revenues of 22.991 billion. That is 16.7 percent of total revenues dedicated to the search for the next big blockbuster and ongoing trials and testing of existing therapies. 18.6 percent in R&D relative to product sales for the quarter (they have "other revenues"). Basic earnings per share for the year clocked 10.32 Dollars. The company pays 1.15 Dollars a quarter (pre-tax) in dividends.

The quarterly share buybacks were as much as the dividend check the company paid, very aggressive at these lower prices. That is nearly double (the dividend payment) from this time in 2014. The company has certainly been very generous with their dividends. On a simple historic basis, the stock trades on 16.3x earnings and has a yield of 2.74 percent. This after the results were well received and the stock managed to rally just under five percent Friday, to close at 167.53 Dollars.

One thing that often shocks me, and you have heard us say this before, is the enormous pushback that companies such as these get from the broader community. They are shocked and outraged at the cost of the therapies, yet give little time and effort into trying to understand not only how much money is spent in developing the therapies, but the enormous positive impact that companies like Amgen have on broader society. Getting back your health (admittedly at a cost), is essentially priceless.

The truth is, not everyone can afford these expensive and life saving therapies. I for one would much rather own a company (repeat always) that is dedicated to improving health and contributing positively to longevity, than one that does the opposite. The same said people that have pushback against big pharma, seem to have no problem with booze businesses. You get my drift? Paul sent the WhatsApp group a great Bloomberg story, it ties into the affordability of therapies, an Amgen drug - Repatha Will Test the New Drug Pricing Reality.

The company gave guidance for revenues of between 22.3 to 23.1 billion Dollars, earnings per share in the range of 11.8 to 12.6 Dollars (quite wide), which puts the stock on a 14.2 to 13.3 times earnings multiple forward. We think that there is plenty of room to move for this business, both in terms of existing therapies coupled with a strong pipeline. The company is awaiting further approvals on existing therapies (For Repatha and Kyprolis, as well as Xgeva and Blincyto) and new migraine (Erenumab, remember that name, like Carlos Brathwaite) and cancer drugs. Not expensive, a great history of returning cash to shareholders via dividends and buybacks and the ability to continue to bolt on acquisitions (the market capitalisation is an astonishing 130 billion Dollars) exists. We continue to add and hold this as a core in the healthcare segment of our portfolios.

Home again, home again, jiggety-jog. Whoa, the Super Bowl was a sight to behold, and that was a pretty amazing comeback from Tom Brady and his mates. Brady is 39 years old. Serena is 35, so is the Fed. Age my friends, it seems, is just a number in the modern era of the sports world. Someone hear Usain Bolt coming back? Maybe? 4 X 100m? Stocks across Asia are marginally better after a strong show into the close Friday, Hong Kong up over two-thirds and Japanese stocks up just under one-third of a percent. Expect a better start.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

vote for populists fall behind.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

No comments:

Post a Comment