"On the production front of the existing vehicles, the amazing Model S and Model X, the company managed to produce 77 percent more vehicles from the same comparable quarter last year. Revenues for the year grew 88 percent year on year, total gross margins grew year on year, both those metrics fell in the three months prior quarter."

To market to market to buy a fat pig It was budget day here yesterday, I was in a client interaction and didn't watch it live, as they say in the classics, the only certainties are death and taxes. This quote is often attributed to Benjamin Franklin, although it is said that this may have come from Christopher Bullock, earlier in the 18th century - The Cobler of Preston. Either way, we are always subjected to the awesomeness of government, who come and go with various ides of how your money should be spent. There are a whole hoard of people who will have opinions on what should and shouldn't be done with the funds, who should pay more tax and whether or not this is investment friendly or not. At the end of the day, the more growth there is in the economy, the more lolly there is to go around.

If a budget is seen as investment friendly, then the economy will no doubt grow at a faster pace than before. And by extension, people will spend more money, creating more opportunities. If the opposite is true, no matter how hard you try and make up the short falls, people will not invest and will pull away from the economy. As our old pal Kramer from Mad Money says, there is always someone making money out there. Unfortunately if you stifle growth, you are not going to get the inclusive growth you so wish for.

There is almost always going to be someone with better circumstances than you, there is almost always going to be someone with lot worse circumstances than you. In fact, I suspect that if you are interested in money matters, and hold investments, and by extension are reading this newsletter, it is more likely that you are in the bracket of people who have investable cash. And as such, you are more comfortable than most. As we all know however, money most certainly makes the world go around.

Anyhows, it was not the banks, financials and retail stocks that fell into the toilet, it was rather a large sell off in commodities that led us down nearly a percent overall. Resources fell as a collective nearly two and three-quarters of a percent. AngloGold Ashanti, Anglo American, BHP Billiton and Sasol were amongst the losers (Woolies too), whilst Capitec and Naspers were amongst the "winners" on the day. Winners in the top 40, there were only 6. There were a few results knocking around, not too many that were in our stable. This morning there is Bidcorp and Discovery we will cover those tomorrow.

Stocks over the oceans and far away, in New York, New York, were mixed. The Dow Jones Industrial average clocked the best winning streak in three decades, back when landlines and big hair was all the rage. The 80's. There was a release of minutes of the last meeting from the Fed - Minutes of the Federal Open Market Committee, January 31-February 1, 2017. The focus was on the paragraph where the committee suggested that rates could up "fairly soon", here it is for your reading pleasure:

"In discussing the outlook for monetary policy over the period ahead, many participants expressed the view that it might be appropriate to raise the federal funds rate again fairly soon if incoming information on the labor market and inflation was in line with or stronger than their current expectations or if the risks of overshooting the Committee's maximum-employment and inflation objectives increased."

Does that mean that March is "live"? Who knows, we are watchers like everyone else, and in so much that death and taxes is something that you cannot get around, it seems in the more modern era, worrying about interest rates is about as useful. You are not going to get around these. Session end the Dow had racked up another 32 points (0.16 percent), whilst the broader market S&P 500 was lower by a little over one-tenth of a percent, with the nerds of NASDAQ down by nearly the same.

The main sector dragging the market lower, unsurprisingly, were the energy stocks, those were off nearly a percent and a half. And basic materials, like the resource stocks taking pain here, those were down too, just over four-fifths. Facebook was the winner on the day, clocking another all time high. Did you know that Facebook trades on a PEG ratio of less than 1, which ironically puts them into the sights of what is considered a "value stock". Yes, I remember the disastrous listing, thanks very much.

Company corner

Tesla reported numbers after hours last night. Tesla is a business that is in build up phase, it is a hugely capital intensive business, led by a fellow that wants to change the world tomorrow. Elon Musk may not necessarily be the inventor of the electric vehicle, he certainly is at the beginning of a momentum shift where consumers are deciding that fossil fuels are not necessarily the future of powering automobiles. The combustion engine design has been tweaked over the decades, it certainly has not really changed that much in that time. Musk wants you back off the grid, he wants you to consume battery technology and be reliant on the sun for your power. I was chatting to a senior fellow who recently attended the mining indaba in Cape Town, he said that loads of people were interested in the raw materials for battery technologies. The more that the mining companies produce as a result of demand, the better for the consumer. You get the sense that the momentum shift is already afoot.

Let us take a look under the hood - Tesla Fourth Quarter & Full Year 2016 Update. The Model 3 production will start in July. The target is 5 thousand vehicles per week in the last quarter of this year, and then to ramp that up to 10 thousand vehicles per week in 2018. By my best count, that is looking at 500 thousand vehicles a year, something that they said they would achieve. As they say in the release, this will require an expanded network, which will require the company to have more charging points, more service functions, more retail outlets. Battery cell production has started at the Gigafactory 1. Remember that the company has recently acquired all of the shares of Solarcity.

On the production front of the existing vehicles, the amazing Model S and Model X, the company managed to produce 77 percent more vehicles from the same comparable quarter last year. Revenues for the year grew 88 percent year on year, total gross margins grew year on year, both those metrics fell in the three months prior quarter. The company recorded another quarterly loss, wider than anticipated. Total revenue for the year clocked 7 billion, up 73 percent from the year prior.

The outlook is also an important part for this company. No ..... it is everything with this business. If you are owning a piece of Tesla, you are owning a company that produces fine motor vehicles, in fact, the fastest production motor vehicle. And it happens to run on batteries. If you own Tesla, you are owning a piece of a business that is about to go mainstream, less of a product for the wealthy and environmentally conscious, and now more of a company that will start delivering a more affordable (hardly cheap at 35 thousand Dollars) mainstream vehicle. Coupled with that will be the storage powerwall, and the very exciting shingle roof (the normal looking roof that is a solar panel). So the company is setting their sights on becoming a multi channel, vertically integrated battery technology business.

They expect to deliver up to 50 thousand vehicles (Model S and X) for the first half this year, although meeting those lofty targets is often too hard. Musk and his team are certainly there to change the world, that is their goal. The investment thesis is simple. This is a business that is in massive ramp up mode. They are going to continue to spend like crazy whilst they are growing. That means that from time to time they may turn to their shareholders and other institutional investors. This means that you will be diluted. The market cap is 45 billion Dollars, bigger than Ford who produces a huge number more cars than them, heck, Tesla didn't even make 100 thousand vehicles last year. In January alone in the US, Ford sold 172 thousand vehicles.

That tells you that Mr. Market is expecting huge things from this business, they expect the company to reach their targets of producing half a million Model 3 vehicles. If not, then we may once again be seeing what is a wild stock price get even wilder. This is like a volatile relationship between two passionate on again, off again lovers. The short interest (those who have borrowed the shares in order to sell them short, profiting when the share price goes down) is nearly 35 million shares (out of 155 million in issue). There are lots of people who think Musk is just going to burn cash and be a failure, he has had a history of sailing very close to the wind, avoiding bankruptcy at the last minute a couple of times. He will win. I have conviction about that. The most successful first weekend launch ever (of orders placed for Model 3s) shows you the high demand for what is an amazing product.

Whilst you can almost never justify a business on paper that looks like this, I believe that we are in the early stages of something different in consumer behaviour. You should accumulate a few on weakness, there is always a lot of news about the business and the hyena like shorts (they take their chances like anyone else) that can see weakness in a flash. At that moment, if you really feel like you want a piece of the future, you should swoop. Until then, we are happy holders at the fringes. The stock is possibly going to open about flat from where they started yesterday morning, which means that the market got the pricing spot on. Well done Mr. Market, well done ......

Linkfest, lap it up

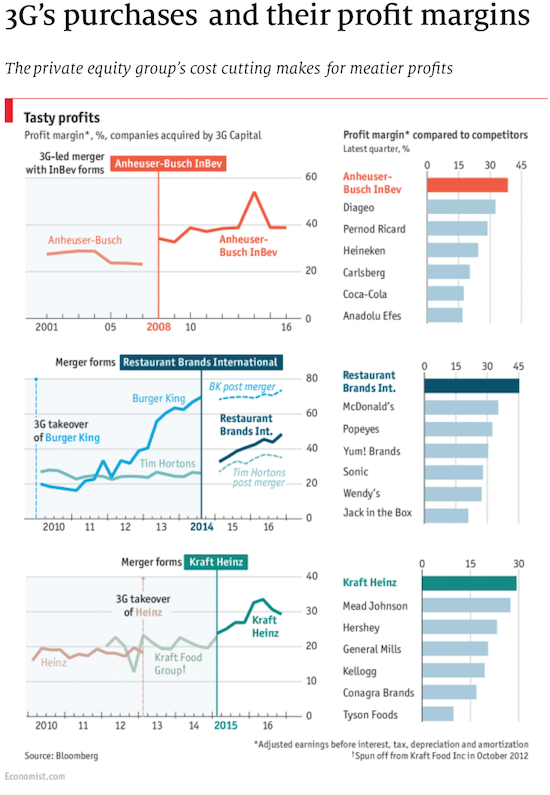

Bright found this interesting image of why 3G has been so successful when they take over companies. Anyone can cut jobs to boost short term profits, brining costs down without damaging the long term strength of a business is much harder - 3G's purchases and their profit margins

If you ever watch business TV, the market commentators generally throw around industry jargon. Here is the meaning for some of those words - Here's 40 Stock Market Terms That Every Beginner Should Know

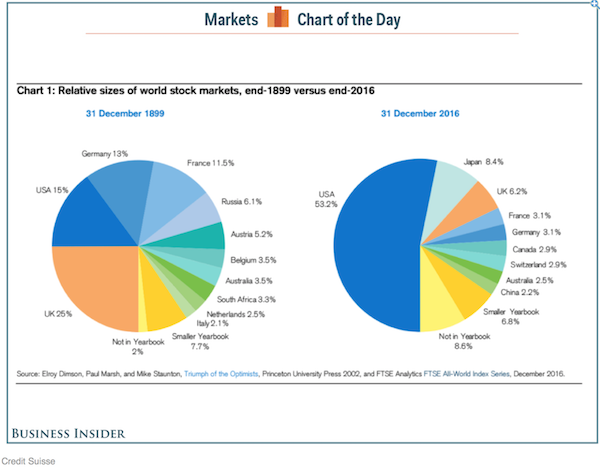

A 100 years is a long time and in other cases it is rather short. Have a look at how relative stock markets have changed in size. The graph below highlights why it is important to have some assets sitting in the US market, size brings options and quality - How global stock markets have changed in 117 years. The only thing missing from the graph is the absolute size of the global markets at each point in history.

Home again, home again, jiggety-jog. Stocks are lower across Asia, stock futures are mixed to lower. I am guessing that we will digest the "goodness" of the budget over the coming days and weeks, it will impact on us all. How investment is likely to react, time will no doubt tell.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment