"Via the Cerner Twitter platform, the company pointed out that only ten percent of all hospitals in the US allow patients to view, download or transmit records. This was research done by Nielsen. Only 15 percent of all patients have email access to their physicians. And only 20 percent have the ability to schedule appointments online, and to see the scheduling. Everything from billing systems to aftercare of patients has not advanced to the level that we would have expected, in a society that is technologically savvy."

To market to market to buy a fat pig Stocks in Jozi, the city founded on a giant pile of gold, added as a collective nearly one-fifth of a percent by the close. It was a tale of two halves, resource stocks were having a sorry time, financials were up around nine-tenths of a percent. Gold stocks as a collective slipped two and three-quarters of a percent. The longer and shorter returns in gold stocks (drawing of lines in the sand) are a sight to behold.

Over ten years they are down 45 percent. Over five years it is not that different, down 46 percent. Over a year they are down 17 percent. None of this tells you that there were some points in the last two years that a year-to-date return had been triple digits. In other words if you got lucky or were smart, or both, you could have secured returns that some people work half a decade or more to achieve.

The commodity majors were in the losers columns, South32 (down 3%), Anglo (down nearly 3%), Kumba (down 2.38%) all at the top of the board nobody wants to be on. On the other side was Mediclinic, up over three and one-quarter of a percent. Capitec enjoyed a solid day too, up nearly three percent. Hey, of course there was the State of the Nation speech, which looked more like re-runs.

That said .... democracy, we have a platform where this can be acted out. Although, with the strong arm presence of the army and a ton of cops, and three kilometres separating the people from their platform, something looks wrong. Read Ranjeni Munusamy's piece - Calamity Zuma and the Tenth Circle of Hell. Let us hope her last two paragraphs won't materialise. As Forrest Gump said when talking sadly of his friend Bubba Blue, "That's All I Have To Say About That".

Stocks across the way, in New York, New York (where the snow was thick and a cold snap came back with a vengeance), finished the day with new records. All up similar amounts, the Dow Jones closed up 0.59 percent, both the nerds of NASDAQ and the broader market S&P 500 added 0.58 percent on the day. It wasn't all sunshine, lollipops and rainbows (Lesley Gore), Coca-Cola continues to battle with a consumer changing their patterns, notwithstanding an earnings print that met expectations of the analyst community. The stock sank nearly two percent on the day, after forecasting a fall in earnings.

Re-modelling existing products into new will take some time, I can see it already as the company pushes back on sugar. There is a fabulous yield underpin of 3.4 percent, which no doubt will be maintained (if not grow, as the share price comes under pressure), the earnings may well drag the price down. The stock has underperformed the market badly over the last five years, don't feel bad for Buffett and Berkshire, they bought the shares back in the late 1980's, around 7 percent of the company for over 1 billion Dollars.

At September 2016, the value of the Coca-Cola company stake was 16.9 billion Dollars. As a result of the buybacks over the years, their percentage (in the last annual letter) was 9.3 percent. That is 400 million shares (exactly) that cost Berkshire 1.299 billion Dollars. The company paid 35 cents a quarter last year, Berkshire got 560 million Dollars (less tax) from their stake, just to hold. Added that there is a huge tax liability, I suspect Charlie and Warren will sit on this one , i.e. they won't sell and will change as the company changes alongside them. Think bottled water and lower sugar content sodas.

The Apple market cap nearly touched 700 billion Dollars. Half a percent more, and we will be there. A trillion Dollar market cap, that may still be a number of years away, at the pace of the Apple buybacks, that may see capital redeployed to buy back shares. As such, it then becomes harder and harder, in the short term at least. If I had to throw a few hats into the ring, Alphabet is a sure contender. Microsoft would have to double from here. Berkshire is fourth in line with a market cap of a little over 400 billion Dollars. Yip, we are going to have to wait a while for the trillion dollar company.

Company corner

Cerner, the specialist information technology healthcare company reported numbers after the market closed. Last year was their toughest year in a long time, spend on hospital systems slowed as uncertainty around government action in the healthcare sector increased. The fewer benefits for the public at large, from a healthcare point of view, will mean that the hospital industry will have to operate on lower costs with possibly lower outcomes. These numbers are for the full year and the last quarter, let us look at the FY numbers to get perspective. Revenues hardly budged at all, clocking 5.446 billion Dollars. The revenue backlog did rise 12 percent, which is pleasing, to nearly 16 billion Dollars. There was a shift in the sales mix to more annuity business, services and support and maintenance at the expense of new sales. This reflects what we were talking about above.

Expenses were up 11 percent when compared to the prior year, which is not "small", some of that included voluntary separations, which also impacted on operating margins. For the full year, 2016, adjusted EPS clocked 2.30 Dollars, up 9 percent from the year prior. The company bought back shares to the tune of 700 million Dollars last year. They are not paying dividends at all, for the duration of the listed entity, they have not paid any dividends. And with the growth trajectory set at quite a "high" level, I suspect that we are unlikely to see a dividend any time soon.

Yet there was not much by way of growth over the last year, which explains why in large part the stock has trended lower and lower. At the after-market price of 51.65 Dollars (down over four percent), the stock trades on 22.45 times earnings and is not delivering the earnings growth that the market expected. At least not in the short term. Guidance, let us have a look at that quickly. For the full year, the company expects revenues to grow at 8 percent and earnings at the midpoint of the range at (2.44 to 2.56 Dollars a share) at 9 percent. That is a little over 20 times earnings at the midpoint, which puts the PEG ratio at over 2 times, which is by no means cheap.

Often when analysing a business and trying to discern (which ironically is the name Cerner in Latin) whether it is a good investment or not, you need to look at the management, the product and the market and try and work out whether people are going to need more, or less of their products in the future. Margins and cash flows are also an important part of the puzzle. For the most part, hospitals and paperwork go hand in hand. The founding premise of Cerner is to make healthcare easier, eliminate humans in critical areas of hospital and doctor to patient service (from dispensing to administration of medicines, to critical care and monitoring) with the same objective, to improve the outcome. And by that, eliminate mistakes, cut down on paper and improve productivity. Who wouldn't be thrilled by that outcome?

Via the Cerner Twitter platform, the company pointed out that only ten percent of all hospitals in the US allow patients to view, download or transmit records. This was research done by Nielsen. Only 15 percent of all patients have email access to their physicians. And only 20 percent have the ability to schedule appointments online, and to see the scheduling. Everything from billing systems to aftercare of patients has not advanced to the level that we would have expected, in a society that is technologically savvy. That is where I think that the business has huge potential. The stock price might however not be "right" at this point in time. If you hold the stock, expect that the market is going to take a dim view on the outlook. Know that you are in the early stages of what will become a huge business, the complete digitisation of the industry. And that will be better for all of us. Hold. A good company, in a good sector, going through a bit of a funk.

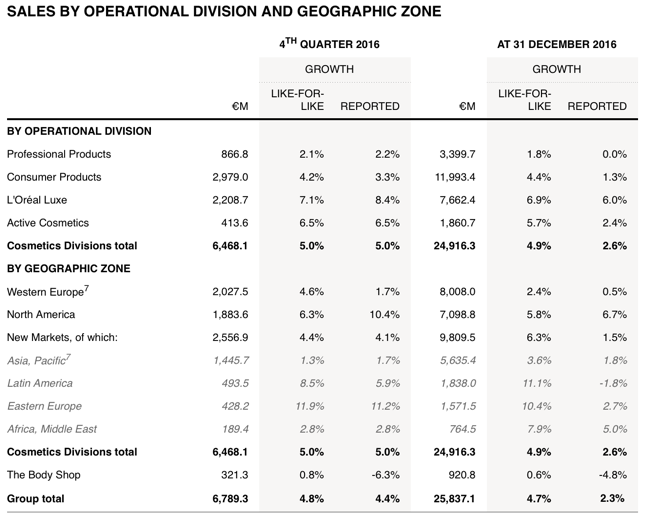

L'Oreal reported numbers for their full year last evening, after the market had closed in Paris. The company continues to attract market share across all territories, sales grew 4.7 percent like for like to 25.84 billion Euros, earnings per share increased by 4.6 percent to 6.46 Euros per share. For the purposes of this exercise, when talking about valuations, we will reference the Paris price, which is 174 Euros a share. The stock trades at a pretty lofty 26x earnings, which is not cheap at all, the company has delivered in what has been a pretty tough operating environment. The company has four major operating divisions, you can see the breakdown via a previous message on the business - L'Oreal 3Q numbers - steady growth. The dividend has been jacked up by 6.45 percent to 3.30 Euros, maintaining the nearly just under 2 times dividend cover.

In terms of profits geographically, Western Europe is their strongest market in terms of profits relative to sales. The company always has the most fabulous revenue by geography and revenues by segments. All the divisions are of a similar operating profit as a percentage relative to sales, around 20 percent. It is a key metric of theirs. The company spends a large slice of sales on telling you how amazing the products are, I guess that it is a very competitive market.

The company is looking to sell the Body Shop, this is not new news. They are looking to fetch around 1 billion Dollars, it is going to be hard to find a buyer for that business, as a recent Bloomberg Gadfly article pointed out, it is neither hipster nor is it new, and it is definitely not premium - Making The Body Shop Great Again.

The investment thesis is pretty simple, the company is the leader (around 28-29 percent cosmetics) in a growing market globally, around 3.5 percent. The cosmetics market is growing at a faster click than global growth, there are many more woman enjoying soft luxury than at any other time in history. The company continues to expand their presence across all the social media platforms, they have multiple platforms across Instagram and Facebook, as well as Twitter. Simple things, such as tutorials for applying makeup, new products and product range. The company now has around 1000 people working on these platforms, they certainly take it really seriously, it is a great feedback loop.

This is a deeply loyal product for many people, once you trust and apply the product, or use the shampoo and associated hair care, you are likely to stick with it for years and years. The share price performance has been pretty pedestrian, keeping pace with a weakening Euro to the US Dollar. We hold the unsponsored ADR. To illustrate the point, the share price performance in Euros over five years has increased 114 percent, whilst the Dollar based price is up "only" 73.9 percent. I will take that Dollar return any day of the week. A currency unwind, should we say, would be helpful for our Dollar investments in a European currency denominated company.

This is a great defensive and growth business, their products are always going to be used. The company will continue to grow as global GDP rates grow, and remains a key pick in our consumer based investment theme. We continue to accumulate.

Linkfest, lap it up

I really didn't know what to make of this, whether to be amazed or whether it was going to be the "rise of the machines" (as per the posters on the walls), or whether to think this chap was completely crazy. Either way, they are not the first and they won't be the last - Silicon Valley Hedge Fund Takes On Wall Street With AI Trader. What is most interesting is that this guy has a connection to the development of Siri and also has little finance experience up to this point.

When I had finished this article I wasn't sure what to make of Jimmy Iovine. What I was sure of was his passion and his ability to really think (and act) differently. One thing is for sure, streaming music has changed the way we all consume music and no doubt Apple will keep up to date with the trends. How Jimmy Iovine Plans to Take Apple Music to New Heights.

Home again, home again, jiggety-jog. Stocks have started better on this side, the Japanese market flew today! We live in interesting times my friends.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment