"30 percent of all the shares in issue have been bought back since listing in March 2008, mark this down to around one-third once this current program is finished."

Attention: One of our sub-tenants is moving to Cape Town so we have some open offices to lease. There are 2 spaces available, one is 32 square meters, the other is 12 square meters. Fully serviced, in Melrose Arch. Please get in touch if you are interested.

To market to market to buy a fat pig So much company news, thank the heavens above for that, otherwise we would have to keep abreast of all the news on Trump this and that. Hanging up on the Aussie Prime minister, who knows. Things are certainly getting a shake up, perhaps politics needs it, perhaps statesman should not act in this manner. How am I to know what the unintended consequences are of it all? Let us deal with the stuff that we have no control over, the business of markets. Which were flat to mixed in New York, the broader market S&P 500 added just over a point and a quarter (0.06 percent), the Dow Jones Industrial Average closed the session off 0.03 percent, whilst the nerds of NASDAQ gave up just over one-tenth of a percent.

Locally, in Jozi, Jozi, stocks sank as a collective, down seven-tenths of a percent on the day. Some of the retailers took some heat, Spar and Clicks were both off by over three and a half percent on the session. The gold miners got a lift from the bullion price, that index was a clear winner, with Sibanye, AngloGold Ashanti and Harmony (with results and a dividend and big hoo-haa) all sharply higher on the day!

Company Corner

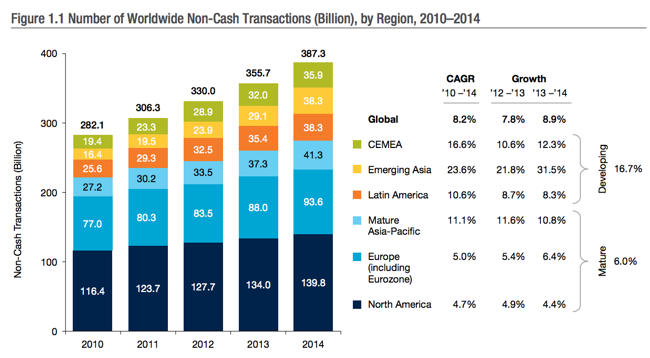

Visa takes you places. It is far easier than at any time to access your funds, no matter where you are. It is difficult to believe that the first ATM turns 50 this year, it is known that cash is still used amongst many, see the recent crisis in India with the notes removal from circulation to know how many people are completely reliant on the physical "stuff". I recall recently ABSA working with Visa to integrate fingerprint technologies on their ATMs (Visa testing biometric verification). Cash remains, electronic transactions and the associated technologies are on the rise, replacing the old methodologies. You will recall from the piece that was included in links the other day about "money" that cowries (the beautiful shell) used to be a means of currency in wide parts of our continent, see - Shell money.

Enough, that is history. Nowadays we use less cash than ever before, as you will see below. For the time being, let us deal with the business of Visa's First Quarter 2017 Results. Operating revenues rose by 25 percent to 4.5 billion Dollars, net income of 2.1 billion Dollars represented a 7 percent increase from this time last year. Remember that this is only the second quarter that includes the entire European business in Visa global.

Earnings per share rose 7 percent to 86 US cents. The company bought back 1.8 billion Dollars of shares in the quarter at an average price of 79.77 Dollars, 3.9 billion Dollars of the buyback is still authorised, around 2 percent of the current value of all shares in issue. As we said in the last report, around 30 percent of all the shares in issue have been bought back since listing in March 2008, mark this down to around one-third once this current program is finished. Remember that the accelerated buybacks are to minimise the dilution of the Visa Europe purchase. Cash on hand, 13.2 billion Dollars, loads left for small bolt on acquisitions of interesting new payment areas.

The new chief, Alfred F. Kelly (junior) sounds pretty upbeat, he has whizzed around the world in his first quarter as the head of the business and sounds confident in the team and the regulatory framework, as well as importantly, their customers. As he points out on the conference call (courtesy SeekingAlpha - Earnings Call Transcript), the entire network is 44 million merchants strong, connecting them to 16 thousand financial institutions. He also points out all the new innovations to keep them current, I think that it is very important for shareholders to understand that this business wants to be at the forefront.

It is also difficult to believe that in some countries cash still gets a fair usage, obviously the bigger payments of all sorts are done electronically, many smaller transactions (small grocery purchase etc.) are done in bills and cents. Here however is a sign that these payments are all slowly changing. I downloaded and read a report titled World Payments Report 2016. You'll have to register there, unfortunately, it takes a couple of minutes. Once done, you can download the report, and whilst the data is not fresh, you get the "trend" which is important.

I recall that in the Visa annual report, when we looked at this business the last time, that cash and checks in Europe represented 37 percent of all personal expenditure across the region, as Visa said at the time, this was a 3.3 trillion Dollar growth opportunity. Cash is still in the purse, pocket and wallet of hundreds of millions of people, a card is a foreign concept. India and China however are set to be huge markets for Visa, the brand is well recognised and the systems are seamless, something we take for granted. Governments want less cash in issue, more electronic trails. The growth story for Visa is simple and definitely intact. The stock always looks perpetually expensive, and whilst the stock trades 27 times forward 2017 guidance, it represents "good value". We continue to buy this stock, which should always represent a core part of your portfolio. A great, long term opportunity. The stock is set to open at an all time high, up 3.4 percent to 85.10 Dollars.

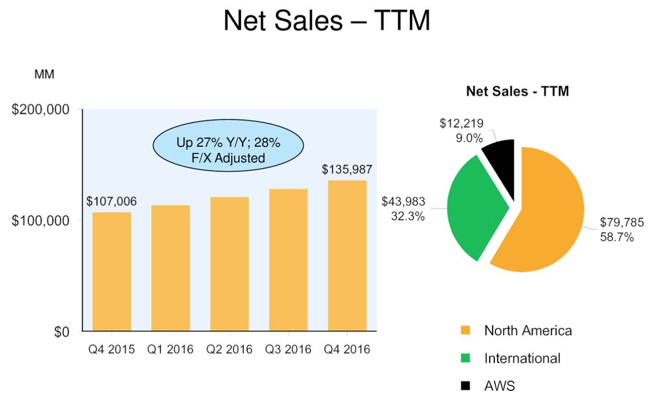

Amazon reported numbers after hours, this was for the "holiday" quarter - Fourth Quarter Sales up 22% to $43.7 Billion. The sales number fell short of expectations and guidance, as much as 1 billion Dollars or around 2 and a bit percent relative to what the market expected. The company reported profits ahead of consensus, that matters little when you are owning the stock for the sales growth. There is a major contributor over the last few years, that being AWS (Amazon Web ServiceS). In case you needed a refresher - Amazon AWS update.

Whilst AWS is a smaller contributor to total revenues, 12.2 billion Dollars relative to total group sales of nearly 136 billion Dollars, it is more reliable from a profitability point of view, representing 3.1 billion Dollars of the total of just shy of 4.2 billion Dollars of operating income for the group. AWS is growing at nearly 50 percent per annum, more and more businesses are moving their solutions to the cloud. The whole idea that you don't have to own the hardware is very appealing. AWS managed to migrate 18 thousand databases across to their hosting zones during the year. That is nearly 50 databases moving each and every day. Here you can see the breakdown of the businesses relative to one another:

Amazon North America is a profitable business, much more of the infrastructure has been rolled out, relative to the "international" part of the business, in the core "older" Amazon business. The introduction of the "prime" offering will continue to weigh, as the company continues to leak (at 99 Dollars per person, it is neither cheap nor expensive) in the startup costs, China is the newest "prime" membership area.

There were and always are many highlights for this company that innovates constantly. Amazon Air Prime is being piloted in the UK, a drone delivery service, their movies division (Amazon Studios) was nominated heavily (11 nominations at the Golden Globes, seven Academy Award nominations), and won best actor in a movie and best actor in a TV series drama at the recent Golden Globes. Alexa enabled devices (the Echo and others) were the top seller during the past quarter across all categories. As the company points out, they (and it is very cool that they keep track) launched 1017 significant services and features in 2016. That is basically 20 new services and features a week. Innovation will always be at the forefront of this business.

Guidance for the current quarter was not what the market was expecting either, and the stock sank heavily. Down over four percent pre market, near the 800 Dollar mark. We think that this represents a fabulous opportunity. We are expecting this business, on these revenue growth rates to top 200 billion in sales by the end of the next year, and whilst the multiple looks outlandish, know that the company is investing heavily in the future, building a retail convenience (and cloud business) giant second to none. We remain buyers of what is a wonderful opportunity.

Home again, home again, jiggety-jog. Don't forget that today is non-farm payrolls, there is also the small matter of Amgen results overnight, the market clearly "liked" those results, the stock is up over two percent. The futures market is flat, completely flat. Markets here have started mixed to lower. Watch NFP later! If not, then watch SNL tomorrow night.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment