"I for one am most excited about the David Jones strategy in Australia. Fewer outhouse brands, the roll out of the in-store brands and most importantly (for me), a premium food offering for Australians."

To market to market to buy a fat pig Stocks in Jozi slipped Friday, again, a stronger Rand held us back a fraction. Financials were down over a percent, resource stocks sank, it was pretty much a broad based sell off. Whilst stocks as a collective have started the year better than before, the going has been tough over the last month, mostly as a result of the firming Rand. In the stocks up and down department, Amplats surged over four and a half percent, post their recent results. Aspen, ahead of a trading update (it should come this week or the next), had a couple of really poor days, both Thursday and Friday. Like I said, the only two pieces of information that I could find, were one, a downgrade from Zacks and two, Spanish authorities were investigating Aspen and a few of their peers. Anyhows, let us wait for the trading update. That will reveal all.

There were double the losers than winners, with no real clear indication that it was this sector or that leading or lagging. We are going to get into the guts of earnings season soon, this week and the next being a particularly busy one for our stocks. Discovery, Bidcorp, MTN and Aspen would have all reported by next Friday. All through the weeks and next month we will keep you up to speed on the ones that you need to know about.

Across the seas, stocks in New York, New York, closed better on the day, if only just for blue chips. The Dow Jones Industrial Average added 0.02 percent on the session, the broader market S&P 500 added nearly one-fifth of a percent, whilst the nerds of NASDAQ added just over four-tenths of a percent. Apparently Mr. Market is waiting for tax reforms and a little more clarity, that may be why Asian markets are selling off. Poor Swedes are under attack, I saw that on Fox. Oh no, that wasn't me - Sweden has no idea what Trump meant when he said, 'You look at what's happening ... in Sweden'

The biggest news of the day was that Kraft-Heinz was making a move for Unilever. Such massive companies looking to "promote synergies". All you have to know is that by Sunday, the folks at Kraft-Heinz (remembering the 3G "Brazilian guys" and the Buffett connection) and Unilever put out a joint statement that is so short that we can copy and paste it:

"Unilever and Kraft Heinz hereby announce that Kraft Heinz has amicably agreed to withdraw its proposal for a combination of the two companies.

Unilever and Kraft Heinz hold each other in high regard. Kraft Heinz has the utmost respect for the culture, strategy and leadership of Unilever."

That is it. Over the years we have always let news items "settle" first before taking any sort of view, one way or another. I can imagine the reams and reams of pages written on what this would mean, what it would likely be if the competitions authorities looked at the deal, etc. And in the end, the Kraft-Heinz folks took a hard look (and possibly invested many, many hours in this), only to have what looks like a cheeky opportunity disappear. Nothing ventured, nothing gained I suppose. Both stocks rallied hard on Friday, Kraft-Heinz ended the US session up 10.74 percent, the Unilever ADR in New York (Dollar price) was up 14 percent. I suspect that both of them will give some of that back, Mr. Market will be mindful that there is "always a chance".

Company corner

Woolworths reported 26 week numbers to end 25 December 2016 on Thursday, Ian Moir the CEO put on a brave face. There is no Boxing Day for Woolies in here, before you say, what is that about, the boxing day sale for David Jones in Australia is the single biggest shopping day for the business. Must be a "thing", like Black Friday. Country Road after a few rough years is starting to show "green shoots", the company has a new CEO, no prizes for guessing that it is a Scotsman, Scott Fyfe. What is interesting is that the Scott has a lot of experience in Marks & Spencer.

Let us face it, the consumer both in Australia and South Africa have been impacted by both consumer confidence having ratcheted (global and local politics putting a lid on "things") as well as lower economic growth. Seeing as both economies are reliant to a certain extent on commodities, the levelling off of China, and now subsequent return to growth in demand for commodities. The good news for both Australia and South Africa is that commodity prices have improved markedly from last year. Some prices may look top, who are all of us to know where they will end up. The company talks about consumer confidence in Australia being low, despite record low interest rates, mostly as a result of the change in the mix of the labour market, more part time jobs. In South Africa, consumer confidence continues to be under pressure, for obvious reasons I guess.

Better value for their customers in both food and clothes is what the company said. They invested heavily in their "customer". Woolworths food business is pretty incredible, they really have evolved and continue to grow ahead of the market. They had a "system change" in the middle of last year, chief Ian Moir reckons that this will help dramatically in the coming year. So I guess, as Ian Moir puts his best foot forward, the company is a little better poised than in years gone by. Of course, there needs to be renewed optimism and renewed economic growth in both their territories.

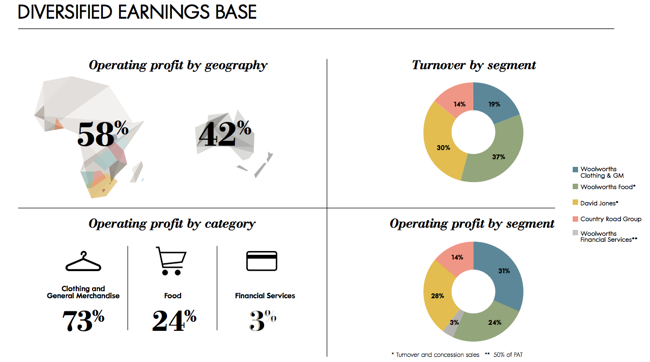

By geography and segment, the company has a *nice* slide at the analyst presentation, which I am going to share here:

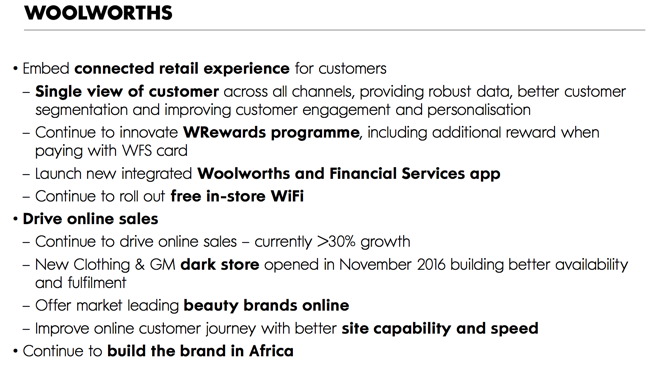

The company is going to continue to invest in their business heavily. They are also looking to take market share in the beauty product space. They are going to stock all of the leading brands, bar for L'Oreal, so there will be Chanel, Bobbi Brown, Clinique and Estee Lauder. I am wondering what this means for their competitors, most notably Edgars and Red Square. The company will also move some of their classic and premium merchandise and rebrand under the David Jones brand. There will also be a launch of a new private label brand. I suspect that the strategy is to improve the retail experience, including in store wifi and to encourage consumers to buy more general merchandise, soft luxury and their newer clothing labels (David Jones). This is a good slide for Woolworths (best known to us South Africans):

I for one am most excited about the David Jones strategy in Australia. Fewer outhouse brands, the roll out of the in-store brands and most importantly (for me), a premium food offering for Australians. There is little competition in that space, I suspect that the new Scottish signing (even though at Country Road) will have some input. Convenience, exclusivity and most importantly, quality, which trumps all. They are basically going to use the model that worked here, to implement that with David Jones. So you are going to have to give them a while. There is a food partnership with a fellow by the name of Neil Perry, I am afraid that I have not heard of him.

That is all very good and well, the truth is that the earnings and sales growth is positively anaemic. The dividend was unchanged at 133 cents for the first half. The stock price has acted accordingly, down since the results. The business trades on a less demanding multiple for obvious reasons. There is little to no growth, top line or bottom line, the stock deserves to trade on a mid to low teens multiple. The dividend underpin, as the business has traditionally always been generous, is likely to put a floor at some level. We continue to accumulate on weakness in what is a wonderful business, and whilst disappointed by the current performance, maintain that quality is important in this segment. The company will continue to innovate and continue to gain market share in all key segments. You have to own this one for the long run.

Nestle, one of the biggest food businesses in the world, certainly one who holds the gold standard for a large part of their offering, reported full year numbers recently. We recently did a deep dive at their nine month numbers, you will recall the message Nestle 9 month numbers - slow and steady. There we covered the company history in detail, which is important in terms of where to next, most especially in the new CEO era, the first non Nestle insider to run the business. Ulf Mark Schneider has been at the business since the beginning of the year, 45 odd days in, I am sure that he is getting his footing. What often happens with fresh blood is that they "feel" their way around and find a way to inject new energy into this business. Which it desperately needs.

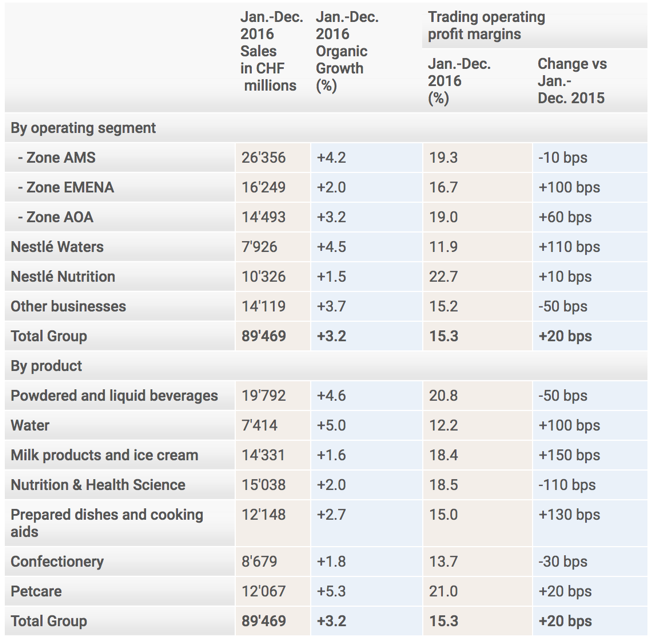

Group sales for the full year grew ever so modestly, only up 0.8 percent in Swiss Francs, experiencing serious currency headwinds of minus 1.6 percent. Still, at 89.5 billion Swiss Francs, this is a beast and a half. Developed markets still account for 52.1 billion Swiss Francs of that, the rest is emerging markets, which have far greater sized populations, many of which are finding their way through the maze of economic tiering. The company reported net profit of 8.5 billion Swiss Francs, reported earnings per share grew 4.8 percent to 2.76 Swiss Francs, whilst the underlying earnings per share grew by 3.4 percent.

They have a well diversified business as you can see below, from pet-care to water, confectionary to nutrition. Equally, the AMS zone is the Americas, Zone EMENA is Europe (East, West and Central), as well as the Middle East and North Africa. AOA is Sub-Saharan Africa, Asia and Oceana:

A well diversified business with some fantastic brands. It does have pedestrian growth and is unlikely to ever return 5 to 10 percent revenue growth. What may well happen is that the chief, the new fellow, may take the knife to the underperforming business units and look ahead to higher margin and higher growth businesses, the company spoke of selling their stake in L'Oreal, which I think is a win for both businesses. I suspect that we should give the chief a little more time, this is an incredible business that has superb brands. It may well be a case of having to hold for two to three years to see the giant ship change course, you may be well rewarded in the aftermath of slow sales growth between now and then.

Linkfest, lap it up

Finally. Good for Alphabet, not the best for the YouTube users, get used to it, as the article says. I suspect that the art of the 6 second advert is going to be in focus - YouTube to stop 30-second unskippable ads. Hey, who doesn't have 6 seconds to spare before a YouTube clip, if someone paid, watch it?

I have often thought about this - Why Social Commerce Isn't Exploding Yet. People trust their friends on social media. When it gets there however, it will be, "yeah, why didn't I do that before?" I suspect this is where Naspers is teeing themselves up at the moment.

This is bizarre, yet not unexpected. The elites of finance find themselves in the same place in the US, why not China then? China's Hedge Fund Elite Live in Their Own Private Village.

We might not be able to own Dropbox but we do own Google (Alphabet). The article demonstrates the value in having a seamless system, where all your apps work off of the same ecosystem and talk to each other without much effort on your behalf - I don't need Dropbox anymore, and it's all Google's fault. The only thing Google needs to do now is launch their Pixel phone in South Africa.

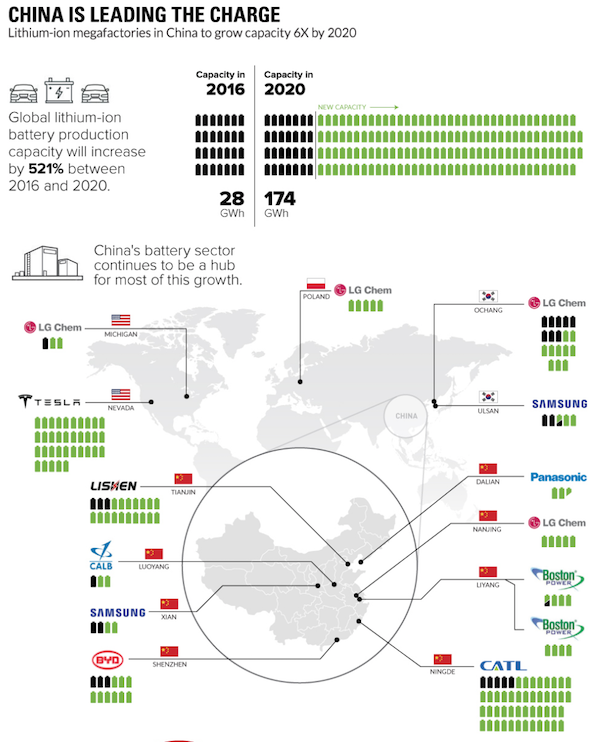

Renewable energy will probably be bigger, sooner than most people think. Mass production will bring down the cost of batteries, lower cost meaning that more people will use the technology - China Leading the Charge for Lithium-Ion Megafactories

This ties into a tweet that I saw last week about how the cost of solar is plummeting.

Home again, home again, jiggety-jog. US Holiday today. George Washington birthday, and all the presidents past, are celebrated. I suppose some of them did watch the news authority on all things factual. That real tax plan, the one that Mr. Market is waiting for, could not happen quick enough. I hope that it is tremendous, I know a lot of people (a lot, a huge number) who are waiting for this. Sweden? Can you believe Sweden? Talking of which, thank goodness for the internet and fact checking, CNN suggested that the Ukraine is a NATO member. They have a partnership, they are not a member.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment