"Aspen released an update that had several parts to it. This is all ahead of their results which are tomorrow, with the presentation of said results on Thursday, Michael is heading off to the results. I hope he sleeps on Wednesday night and isn't too excited"

To market to market to buy a fat pig What the {insert expletive of your choice}? How is it possible that the markets were completely battered and bruised Friday on fears that the Fed were going to raise rates soon. This FT article from the weekend - Federal Reserve risks markets shock with September move and then this morning - Asian stocks regain poise after dovish Fed remarks. So Mr. Market and the collective in their infinite wisdom interpreted comments from Fed officials Friday as Hawkish and yesterday as Dovish, i.e. we went from a point of heightened risk off as a result of pending rates increases to happy days, no rate increase. Won't they just hike already? My goodness, there are two year old people who have less intense mood swings. There are three year olds with more concentration and staying the course.

Not that I am complaining, I just think that it is dumb. Dumb, dumb, dumb. What can I do about the collective flipping and flopping? Nothing. Yesterday morning when I walked into the office, stocks were indicated off (the futures market) by around two-thirds to three-quarters of a percent in the US. By the time Wall Street wrapped up proceedings, stocks across the board had enjoyed a strong day of gains, the Dow Jones up a percent and one-third, the broader market S&P 500 managed to add nearly a percent and a half, whilst the nerds of NASDAQ added just over one and two-thirds of a percent. The WSJ suggests that Divided Federal Reserve Is Inclined to Stand Pat. Sorry, all these links are subscription based, you get the general gist of it all, big down followed by big up. The upshot of the sharp moves are that the S&P is down just under a percent over the last five trading sessions. The session yesterday was the single biggest up day since July for stocks. Sigh.

Back to local, stocks rallied around 500 points, or just under a percent off their worst levels of the day which was mid morning, ending the session off just over a percent as a collective for the Jozi all share. It was a horrible no good day pretty much all around, resource stocks slipped nearly two percent, financials sank over a percent and a half. There was pretty much nowhere to hide on a poor day for equities. If it was not for the better start for US markets, we wouldn't have pared losses by half. I did notice that Truworths hit a 12 month low, does the outlook look that bad? Not too sure. Over the last twelve months the stock is down nearly 19 percent. The market has the stock forward on 9 times earnings. Earnings growth looks stodgy, the yield of around 7 percent before tax (forward) looks attractive, Mr. Market is telling you to brace for something worse though. All retail stocks look cheaper, sometimes cheap for a reason! Results and updates from a whole host of businesses, we can deal with them one by one below.

Company corner

Aspen released an update that had several parts to it. This is all ahead of their results which are tomorrow, with the presentation of said results on Thursday, Michael is heading off to the results. I hope he sleeps on Wednesday night and isn't too excited. You can find the release from yesterday here - Aspen GSK Announcement. The first part of the release deals with a transaction in which Aspen Global Incorporated (AGI) will acquire from GlaxoSmithKline (GSK) a series of five established medicines, one general anaesthetic (Ultiva) and then four muscle relaxants (Nimbex, Mivacron, Tracrium and Anectine). According to the Ultiva website, the drug is rapid response and has an equally rapid recovery. Used for spine, orthopaedic, Ear Nose and Throat (ENT), cardiac and other procedures. Wikipedia suggests that the active ingredient in Ultiva, Remifentanil, is 100 to 200 times as potent as morphine. Whoa!

Nimbex is used in conjunction with anaesthetics is a neuromuscular blocking drug to relax skeletal muscles. Mivacron performs a similar function, ditto Tracrium. The active ingredient in Anectine is known as suxamethonium, and it is used in order to administer flexible pipes into the trachea, a process known as tracheal intubation. Sorry, did I make you gag, didn't mean to. There you go, lesson over for now. Aspen (AGI) will pay 180 million Pounds (nearly 240 million Dollars) and then "milestone" payments over three years of up to 100 million Pounds (133 million Dollars) depending on the "results of the portfolio". The portfolio of five drugs are sold across 100 countries, and exclude North America, where GSK will continue to have that spot. Aspen mentions Japan, Brazil, Korea (I presume South), Germany and Italy as countries that this drug sells in. Funded from debt and expected to close in the 3rd quarter of their 2017 financial year. Annual revenues from these therapies is around 70 million Pounds, or 1.336 billion Rand.

Why do they want these drugs? As they say, they see "anaesthetic as a key element of its expansion strategy into niche therapeutic categories that complement its existing operations." Remembering that they recently bought AstraZeneca's portfolio of anaesthetics for 520 million Dollars (and then 250 million Dollars based on sales over the next 24 months, from then), remember we wrote about it back in June - Aspen debt raise & deal with AstraZeneca. In the last 4 months Aspen is shelling out 760 million Dollars, and then over 24 to 36 months another 383 million Dollars. That is over 16 billion Rand, or just over ten and a half percent of their current market capitalisation at current exchange rates and share price levels. Wow, these deals are sizeable when you add them all up.

The second leg of the announcement relates to a previous transaction that Aspen Global Incorporated (AGI) had done with GlaxoSmithKline (GSK), in which AGI had an option to acquire thrombolytic products Fraxiparine and Arixtra in various other territories, you will recall the deal closed back at the end of 2013, having been first announced at the end of September 2013 - 30 September 2013 - Acquisition Of GSK Brands And Manufacturing Site In France. Under the original deal, which excluded China (Hong Kong and Macau too) as well as India and Pakistan, Aspen paid 600 million Pounds (only 9.798 billion Rand back then) to acquire the manufacturing facility, with the inventory and stock at a site in France, Notre Dame de Bondeville. The town is a small light industrial town (according to Wiki) near the French town of Rouen, which actually sits on the River Seine in Normandy. Got it? For the rest of the portfolio distribution into those heavily populated countries, Aspen will pay GSK 45 million Pounds (nearly 60 million Dollars), an amount of nearly 860 million Rand.

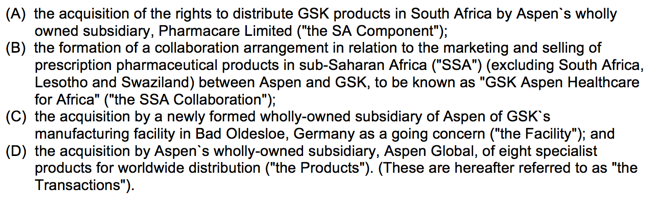

Add the two together and then you get to nearly 2.2 billion Rand of revenue, or around 6.1 percent of full year revenue last year, remembering that full year numbers are tomorrow, we have a clearer idea of what is likely to unfold there. As those TV adverts say though, but wait there is more. Cast your mind back to a huge transaction where Aspen issued 68.5 million shares to GSK in May 2009, for 3.47 billion Rand. The deal had four legs to it, here is a screen grab of the parts of the announcement below, the four legs of that deal:

That B leg of the deal is now set to be cancelled under the announcement yesterday. Aspen and GSK have agreed to discontinue this rights to collaborate, revenues last for Sub Saharan Africa (SSA) were 2.1 billion Rand. GSK will pay Aspen 45 million Pounds, or 860 million Rand, exactly the same amount that Aspen pays GSK for the rest of the thrombolytic product territories. As you can see, what Aspen are buying and what Aspen is ending (in the Sub Saharan Africa agreement with GSK) is roughly the same Rand amount, from a revenue point of view. What is important to note however is that SSA was 9 percent of Aspen sales, this is set to decrease significantly, and Asia Pacific is set to be boosted by this announcement. That tells you what you need to know, as far as they are concerned it is more strategic to have more Asian business and less African business, due to the big base here in South Africa. Aspen rose around a percent and one third as the market fell, and up another 1.7 percent as the market opened today. Waiting for results tomorrow!

Linkfest, lap it up

One way to make a road safer after rain is to have the road adsorb the water really really quickly - This 'thirsty' concrete absorbs 880 gallons of water a minute.

Sasha found this article about a second hand book seller in JHB. It is an interesting read about how he goes about his day trying to source books for his customers and run his sidewalk bookshop - From a bridge in South Africa, sidewalk bookseller believes in the power to change lives.

I haven't seen the statistic for digital camera sales before, it makes sense though that they are dropping due to the introduction of smartphones and photo apps, Nikon's compact-camera sales have dropped by 45% in the last quarter - With the iPhone 7, Apple changed the camera industry forever. The article also points out that due to the vast number of smartphones sold, Apple and the likes can afford to spend huge amounts on R&D. The digital camera makers who have dropping sales will struggle to match the R&D spend to keep up.

Home again, home again, jiggety-jog. Stocks are trading better here in Jozi, stocks are trading better across the globe. What to say other than it is what it is.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment