"What? Who would have thought that one of the best design teams in the world would delivered great products? I am talking about Apple. I am seeing bloggers complain about x and y, they have probably only seen the product from a distance."

To market to market to buy a fat pig Ah yes, welcome back our old friend volatility. Three huge sessions with wild swings, after a Northern Hemisphere summer of relative calm, have greeted the financial fraternity. Doves this and Hawks that, it seems like a mismatch almost all of the time in equity markets, the sounds emanating from that quarter of the market are always stronger than usual. Bears apparently do not roar or growl, they make bear-like noises. If they are bears, then how are they "bear-like"? Like most perma-bears there is always a focus on bad news.

Being an optimist, I do tend to focus on the good news stories. Such as the best jump in US income in more than a while, Quartz says The middle-class American family saw the largest income boost on record last year. It is, as you can see from the graph, nowhere near the mid nineties era of American middle class prosperity, moving in the right direction is important however.

Those in the 25 to 44 year old brackets experienced the biggest changes in their rise in real median income. And across all ethnic groups too. That counts as good news in my book. The BusinessInsider also has a great summary (as usual) - Median household incomes just surged in the largest increase on record. Nice.

Mr. Market and the multiple participants were however concerned with other matters. Stocks fell heavily, bond yields spiked again and oil prices fell in a heap after the International Energy Agency warned of an oil glut all the way through to the second half of next year. I have noticed along with everyone else of course, that oil rig counts continue to rise in the US. Which translates to more supply. And whilst all the big producing countries that are completely reliant on oil for driving their economies talk a tough game on making markets tighter, nobody does anything about it. Talk heavy, do nothing.

The main reasons (or so we are told) for the market falling yesterday is the falling oil price. Huh? I thought that would be good for inflation, more money in the hands of consumers and by extension good for almost everyone across the board? Not so, it seems. This leg down in crude coincided with the "risk off" trade back on, volatility spiking again. Sorry, I feel really dirty even spewing that nonsense, it is what it is. Across the seas and far away stocks sank on Wall Street, the Dow Jones Industrial Average gave back over 250 points or 1.4 percent, the broader market S&P 500 sank nearly a percent and a half, the nerds of NASDAQ lost nearly 1.1 percent, in part weathering the storm better due to good news from Apple, see in the commentary lower.

On the local front we were unfortunately entertained by people who speak for a living, politicians, who once again were at each other in the mother city. At some level it is cringeworthy, at another it is about looking for better and accountability. Again, it is what it is, you and I are lucky enough to live in a place where democracy means that people (opposition or not) can say what they want, within reason. Sigh. It is better than watching five hundred people dressed in military uniforms with expressionless faces clapping the awesomeness of their great leader. As we pointed out the other day, Communism (which is supposed to be the great equaliser) has killed more people (tens of millions) than capitalism. Capitalism ironically is the great equaliser, those are the people who can come from anywhere and go anywhere.

Stocks closed the session completely flat, there were results from Clover that looked ok at face value. They are bigger than you think, their sales are around three-quarters of that of AVI, the branded business that themselves had decent enough results a couple of trading sessions back. Stocks as a collective closed a whole 4 points to the good. Financials had a good day, word on the street is that ex Barclays chief Bob Diamond is speaking to Barclays Plc. about buying some of that stock in Barclays Africa, those talks have "stalled".

Resources were on the back foot, unfortunately Kumba Iron Ore are again the focus of SARS investigations, with revenue services suggesting that there is more to pay. See David McKay's article in MiningMx - SARS takes Kumba tax claim to R6.5bn after 2011 review. Coupled with iron ore prices at an 8 week low, it was a tough day out. Parent company Anglo American lost nearly four percent, Kumba sank nearly five and a half percent. African Rainbow Minerals were also having a tough day at the office, that is how you could tell that it wasn't all related to the SARS SENS release.

Company corner

What? Who would have thought that one of the best design teams in the world would delivered great products? I am talking about Apple. I am seeing bloggers complain about x and y, they have probably only seen the product from a distance. I see a WSJ preview of the AirPods - Apple's New AirPods May Look Weird, but They Work Great, in which the author (Geoff Fowler) says: "I initially worried about them falling out, but have been pleasantly surprised they don't."

Ahhhh, who would have thought! He liked them, loved that they were wireless and that they looked just fine. See, they didn't fall out, looked just fine and worked great. Also see - Tim Cook says even when he dances, AirPods don't fall out. Ha ha, he dances?

Another review from Brian Chen from the NYT found that he wasn't the biggest fan of the same wireless AirPods in this article - IPhone 7 Review: Though Not Perfect, New iPhones Keep Apple's Promises, he did say this: "The bottom line: Those who have been waiting years to buy a new phone are in store for a major upgrade with the iPhone 7."

Another review from CNet's Scott Stein - Apple iPhone 7 review: Everything you need in a phone, except the headphone jack, Scott clearly misses the headphone jack. The button, the home button that is, will take some getting used to.

And Apple fans are queuing already, in fact since two days ago there are professional line queuers - Yes, people are already lining up for iPhone 7.

Most importantly, as per this SeekingAlpha article from yesterday (you may need to sign up for free, it is worth it however) titled Apple +3%; carrier iPhone 7 pre-orders encouraging, the Sprint and T-Mobile orders have been strong. And the timing, as the author points out is pretty good, competitor Samsung is having some serious problems of their own.

T-Mobile said via this statement - iPhone 7 and iPhone 7 Plus Shatter Records at T-Mobile that "pre-orders from Friday through Monday were up nearly 4x compared to the next most popular iPhone - and Friday set a single day sales record for any smartphone ever in T-Mobile US history."

Sprint, in their statement from yesterday titled Sprint Pre-orders of iPhone 7 and iPhone 7 Plus Increase Nearly Four Times said "Pre-orders of iPhone 7 and iPhone 7 Plus at Sprint are up more than 375 percent in the first three days over last year."

Granted that these are measuring against the iPhone 6s upgrade, this is still pretty special for Apple. In a market that was completely smashed (again), the stock rose over two and a half percent to just above 108 Dollars a share, there is still some very heavy lifting to do. Year to date the stock is up a little over two and a half percent. Since the May 2015 highs of above 132 Dollars a share the faith has waned a little. The product talks for itself and the consumer has voted with their feet. Again. We continue to buy and own this quality business!

There is very little that Richemont can do about a crackdown on graft and gifting in China, there is even less that the company can do about terrorism and people delaying travel to Europe. On those said trips, often people buy the expensive products that they produce. The company will continue to produce their quality products, which are timeless in themselves. In fact, as we often say around these parts, the longer they own the timeless and obviously quality brands, the more valuable the name and brand becomes. I look at LV bags and can't see the attraction, mind you, what the hell do I know about bags! The brands are what they are, old, quality and pretty much timeless.

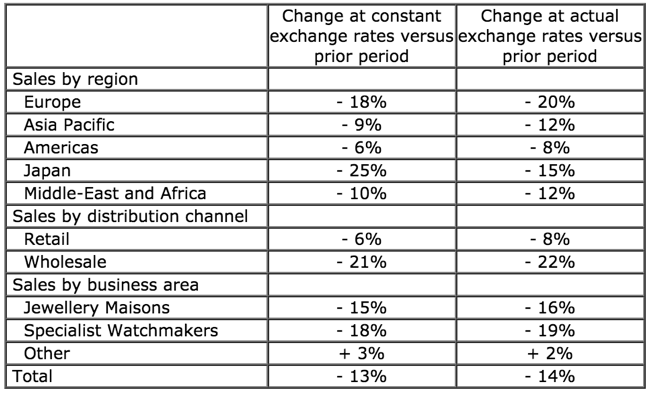

The luxury goods business has their AGM today and have released a five months trading update as is customary - Richemont Annual General Meeting 2016. And I can say that it looks pretty ugly, far worse than most would have expected. As they say: "sales were down, particularly in France, due to a significantly lower level of tourist activity." The only positives, and we have seen this for a while now, is that mainland China is growing. As the company points out however: "growth in mainland China and Korea was more than offset by the continuing weakness of the Hong Kong and Macau markets." Here is the sad looking comparison table:

The share price has reflected some of these weaknesses and will continue to trade softer is my sense, the outlook points to a much weaker six months: "We consider that the difficult trading conditions are likely to continue during September. Operating profit for the six months ending 30 September 2016 is therefore expected to be approximately 45% below the prior year's level, reflecting the effect of one-off restructuring charges of approximately EUR65 million, and the additional effect of the product buy-backs."

The medium term outlook suggests that not much is going to change. The group reckons that not much is going to change in the short term. They do continue to state the obvious "we remain convinced of the long-term prospects for luxury goods globally, and in particular for watches and jewellery. Richemont is well positioned, with a strong balance sheet and a portfolio of long-established Maisons."

The share price in Rand terms, as horrible as it has been, has been protected somewhat from a currency weakening relative to the Swiss Franc. Over the last year in Swiss Francs that price is down nearly 16 percent, more I am guessing after this worse than anticipated sales update. The stock in Swiss Franc terms is down 36 percent from the highs reached in late May 2014, it has been more than a little tough out there. The best thing to do as multi year holders of quality businesses is to hold here, even to add on weakness. The corner may be a way off, people may well spend heavily on experiences (more travel), they will continue to want timeless and valuable jewellery. To that end, Richemont is not just in the premier league, they are arguably the owner of some of the best brands known to consumers. Hold the line whilst it is tough out there!

Linkfest, lap it up

Do you like Michael Lewis? I do. His new book, which is no doubt a summary of "Thinking Fast and Thinking Slow" is available for pre-order on Amazon in hard copy format, I am afraid that you will have to wait quite some time for the title The Undoing Project: A Friendship That Changed Our Minds. Seeing as it is set for release just before Christmas, reserve yourself the present now!

As smartphones become better, they are not only killing the digital camera market (as discussed yesterday) they are killing the desktop and tablet markets too - Three charts that show how utterly addicted Americans still are to their smartphone apps.

Who doesn't want to think that they are an athlete and need a high intake of protein, coupled with the current trend of cutting down on carbs - Wildly effective marketing has led Americans to eat way more protein than they actually need

My only personal exposure to drones was at a wedding where one was used by the photographer. I was amazed at how stable the drone was and the amazing pictures that it was able to take -The Industries Where Drones Could Really Take Off. The big saving in infrastructure is due to the time and money saved with inspecting hard to get to parts of structures.

You will find more statistics at Statista

If you have an iPhone 4 it is now officially old. Why? The new iOS (which is available for download folks), version 10, is supported from iPhone 5 onwards - How Long Does Apple Support Older iPhone Models?

You will find more statistics at Statista

Home again, home again, jiggety-jog. Stocks are called higher across Europe, Richemont is not!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment