"The pundits were left scratching their heads Friday, markets sold off aggressively and suddenly there needs to be a reason, as this is serious. Was it the statements from Fed officials that were interpreted as hawkish, i.e. rates are up sooner rather than later. Was it a roll over of the ECB not "doing enough"? Or was it one of the bond kings, Jeff Gundlach getting negative on treasuries? Or was it the Oros man from the not so democratic republic of North Korea and the fifth nuclear device that they detonated in their history? Perhaps it was a combination of all of these things."

To market to market to buy a fat pig The pundits were left scratching their heads Friday, markets sold off aggressively and suddenly there needs to be a reason, as this is serious. Was it the statements from Fed officials that were interpreted as hawkish, i.e. rates are up sooner rather than later. Was it a roll over of the ECB not "doing enough"? Or was it one of the bond kings, Jeff Gundlach getting negative on treasuries? Or was it the Oros man from the not so democratic republic of North Korea and the fifth nuclear device that they detonated in their history? Perhaps it was a combination of all of these things. The good news is that in a month's time we will be talking about earnings. The Fed may or may not raise rates now, or later or only once in December, you can bet that Apple will sell their new phone with great gusto, Nike will still sell amazing shoes, Starbucks will still sell multiple hazelnut flavoured soy lattes.

Risk and the measure thereof, making sure that in the equities market you are taking a measured approach relative to the risk free rate, the good old talk of bonds and stocks, or bonds or stocks. Volatility jumped an amazing 40 percent, volumes on stocks were up sharply, and the 52 day streak of stocks not being down 1 percent was broken. Stocks sank heavily, the broader market S&P 500 sold off nearly two and a half percent, the nerds of NASDAQ did sell off over two and a half percent, whilst the Dow Jones sank a little over two percent. Oil prices were sold off. Materials and energy stocks sank over 3 percent, financials (more likely to benefit from marginally higher rates) were "less bad" selling off only 1.8 percent by the close. A tough old day for stocks, a tough old day for bonds, pretty much everything if you were long. Other than volatility of course. That has been a slow grind for traders.

Over to local, which was also a mixed bag on Friday, stocks rose marginally. Resources were higher by nearly a percent, financials sank around one quarter. Gold mining stocks were looking a little worse for wear on the day, they have had a spectacular year. As ever, with almost everything, it depends where you draw your line in the sand. I would not want to own a company in which I do not understand the demand and supply dynamics for the end product, and as much as I try and understand the gold market, I cannot. Too much emotion, too much historical connection to an age gone by, the inability to think that humans can create wealth through building and creating. I place it in the drawer of "don't understand, don't invest".

Company corner

Mediclinic produced a trading update at the get go on Friday that the market received favourably, the stock was up two and a half percent. Remembering however that the stock took some heat on Thursday, during that session the share price sank five percent. Hmmm .... if the market knew this was coming it could have been some positioning of some sort, call me a sceptic on share prices moving heavily on larger volumes ahead of an announcement. The trading update is titled Trading update and Middle East integration.

The company has been able to save more money than they initially thought in the integration process with their facilities and those of Al Noor. There have however been some issues in Abu Dhabi, a loss of quality staff before the integration and the inability to source quality in the region is understandable. The lead health insurer (Daman) in the region has no doubt been under some pressure, a certain membership of the scheme has been forced to implement a 20 percent co-payment when using private healthcare in the UAE, which as Mediclinic says "is likely to have an impact on patient mix and volumes."

Lastly, and again understandably so with the deal pending, there is a delay in a 40 bed facility in Al Ain (Southern Abu Dhabi, the 4th largest city in the Emirates), which will be commissioned in October this year. With all these issues swirling around, Mediclinic Middle East (the expanded company) is expected to deliver "low to mid-single digit revenue growth and underlying EBITDA margins of mid to high teens with performance being materially second half weighted."

For their other two businesses, trading remains inline with expectations, i.e. in Switzerland and South Africa, all is good in the hood. Whilst this is an early look into the first six months as a UK listed entity, the half year only ends at the close of this month. Results themselves are only expected 10 November and another trading update will provide more clarity in due course, we should expect that in the last week of November.

Why do we not like change as human beings? Not all of us, the vast majority prefer the status quo, prefer not to upset the apple cart. I would assume that upsetting the apple cart 300 years ago would result in many apples becoming dirty and "running away" from you. We are resistant to ideas of change, perhaps as it requires mental strength to think that something should be different, it would be easier that way. Tesla is a business that can change your product overnight, whilst you are catching some z's. The software update on the Tesla autopilot will take place over the next couple of weeks. It may not work for "seeing" deer when the system switches to radar (fluffy animals apparently to Elon Musk) in snow, fog and dust.

Plus, the new software will engage in emergency braking when you are in "control" of the vehicle. I am not too sure about what you think, I trust millions of hours of collective driving and by extension learning over a teenager who has 50 hours of driving experience. Or bad habits built through decades of driving in changing technology. In the press release yesterday - Upgrading Autopilot: Seeing the World in Radar, the same cheeky Tesla style remains:

"The net effect of this, combined with the fact that radar sees through most visual obscuration, is that the car should almost always hit the brakes correctly even if a UFO were to land on the freeway in zero visibility conditions.

Taking this one step further, a Tesla will also be able to bounce the radar signal under a vehicle in front - using the radar pulse signature and photon time of flight to distinguish the signal - and still brake even when trailing a car that is opaque to both vision and radar. The car in front might hit the UFO in dense fog, but the Tesla will not."

The company may solve transportation issues globally and it may take a long, long time for driverless fleets of vehicles to be mainstream, I for one am very ready for the machines to take control. They never tire, they never lose concentration, they do not drink alcohol, they are more reliable than us. They will greatly reduce the death rates on the roads, the World Health Organisation suggests that there are around one and one-quarter of a million deaths on roads globally. Around half a million in India and China alone! It may take us decades before we all adopt this technology, our great grand children will look at these as all preventable, perhaps in the same way we look at common infections and the common colds nowadays relative to 100 years ago. Another big moment for Tesla, the release of their version 8 of the software, pushing boundaries and continuing to innovate.

MTN has released the much anticipated Prospectus for MTN Zakhele Futhi (the new BEE scheme that will replace MTN Zakhele when it unwinds on 24 November 2016).The purpose of the MTN Zakhele Futhi Offer is to provide the Black Public with an opportunity to participate in the ownership of the MTN Group, either through the MTN Zakhele Futhi Public Offer or by continuing to participate therein through the MTN Zakhele Re-investment Offer. The MTN Zakhele Futhi offer is a part of the 2016 MTN BEE Transaction, which is sized to be approximately 4.0% of MTN's issued share capital on a Fully Diluted Basis.

Black People and Black Groups are invited to subscribe for up to 123 416 819 ordinary shares in MTN Zakhele Futhi at R20.00 per MTN Zakhele Futhi Share. The total MTN Zakhele Futhi Offer size is up to R2 468.3 million. The minimum subscription required for participation by a Cash Applicant in the MTN Zakhele Futhi Offer is 100 MTN Zakhele Futhi Shares, which amounts to a minimum subscription payment of R2 000.00.

For Cash Applicants that have applied and paid for more MTN Zakhele Futhi Shares than are eventually issued to you, MTN Zakhele Futhi will refund to you the excess amount plus interest by EFT.

If you are a Re-investment Applicant and have applied for more MTN Zakhele Futhi Shares than are eventually transferred to you, then the relevant portion of your MTN Zakhele Scheme Consideration which was not settled in MTN Zakhele Futhi Shares will remain with you and be settled to you as part of the MTN Zakhele Unwinding Scheme. As you have not paid any monies, no interest will apply to you.

The 2016 MTN BEE Transaction will be funded through a combination of:

1) Money raised from the Black Public under the MTN Zakhele Futhi Public Offer;

2) Re-investment value received from MTN Zakhele under the MTN Zakhele Re-investment, if any;

3) Notional Vendor Finance from MTN;

4) An upfront effective 20% discount being provided by MTN to the price payable by MTN Zakhele Futhi for the MTN Shares acquired by it; and

5) Third party bank funding.

Each MTN Zakhele Futhi Share has an underlying value, as at the Last Practicable Date of approximately R33.50. The market price of the MTN Shares is the most important factor affecting the value of an MTN Zakhele Futhi Share although such value is also significantly impacted by the financing obligations.

For every R2 000 you invest, MTN Zakhele Futhi will be able to make an investment into MTN Shares of about R8 000, facilitated by way of the 20% discount provided by MTN, and the funding raised by MTN Zakhele Futhi from MTN and the third party funders. This will give you exposure to a significant investment into the MTN Group and its future, for a relatively small (25%) contribution. For every R100.00 you put in, MTN and the funders will effectively put in about R301.60.

The Empowerment Period for MTN Zakhele Futhi is eight years after the date on which the MTN Zakhele Futhi Shares are issued to the Black Public, which is expected to be 23 November 2016.

You cannot sell or otherwise dispose of your MTN Zakhele Futhi Shares during the first three years of the Empowerment Period (i.e. the Minimum Investment Period). Restricted trading will be allowed during the fourth to eighth years, where you can only sell or Dispose of your MTN Zakhele Futhi Shares to eligible MTN Zakhele Futhi Shareholders. All sales and Disposals during the fourth to eighth years are subject, amongst others, to approval and BEE verification processes. You cannot Encumber (e.g. use for security) your MTN Zakhele Futhi Shares during the Empowerment Period (i.e. 8 years).

During the Minimum Investment Period, MTN Zakhele Shareholders will generally not receive a dividend. From year four onwards, while the MTN Zakhele Futhi Pref Shares remain outstanding, the dividend income earned on the MTN Shares held by MTN Zakhele Futhi in the ordinary course will be used firstly to pay or provide for permitted operational fees, costs and expenses and tax liabilities of MTN Zakhele Futhi and then a portion will be used to pay dividends and to provide a specified minimum amount per annum for settlement of the third party funding of MTN Zakhele Futhi. If funds remain, the MTN Zakhele Futhi Board has a discretion to pay up to 20% of the total dividend received from MTN as a dividend to MTN Zakhele Futhi Shareholders, subject to MTN's discretion.

The MTN Zakhele Futhi Offer opens at 09:00 on Monday, 12 September 2016 and closes at 16:00 on Friday, 21 October 2016. (Hit reply to this email if you want more information)

Linkfest, lap it up

Having access to healthcare and particularly to specialists increases as your wealth increases. I don't understand why Monaco has more than 4 times the psychiatrists than Australia does though - On The Couch: The Most Psychiatrists Per Capita.

You will find more statistics at Statista

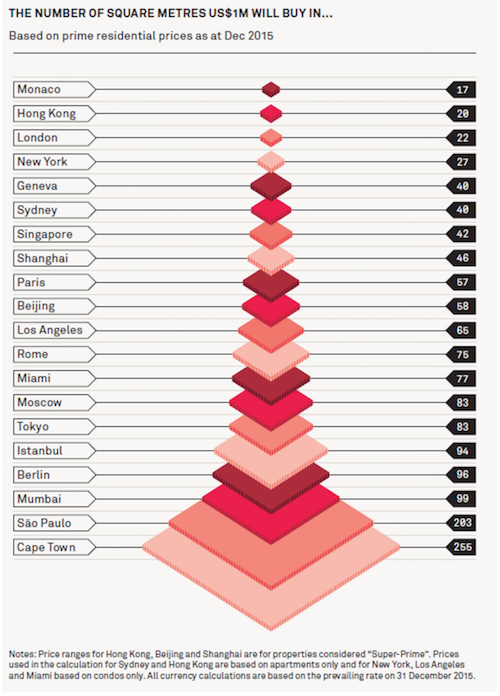

Maybe it is due to how little $1 million will buy you in the city - What $1 million buys you in global real estate. Note how cheap Cape Town is by global standards, as the globe gets smaller and as populations increase, the best property locations in the world will continue to see value increases.

Improving peoples reading speeds and comprehension will have far reaching positive economic and social impacts - This article has been perfectly formatted for maximum reading comprehension. Read the article and see if it is easier to read, I found it "smoother" than ordinary formatting.

Home again, home again, jiggety-jog. Stocks are lower, both Shanghai and Hong Kong are down over two percent, Japan nearly three. Where were you when the planes hit the world trade centre? I was at the old JSE building, downtown Joburg, 17 Diagonal Street, we were in the dealing room watching an old tube TV (those things weighed a ton), watching CNBC. The second plane hit and the gasps were noticeable, mostly from the more experienced folks. I remember standing next to an old timer, he had decades of experience in the equities markets (I am sure I tell this story every few years) and I asked him what this meant, his answer was simple, "very, very, very bad" he said, with his trademark unlit cigarette hanging from the corner of his mouth. He was right, the world as we know it has changed. We will overcome the current threats, humanity is too powerful as a collective to fall back into the dark ages. There is too much good in the world for that, I am grateful that it is 2016 and not 500 AD.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment