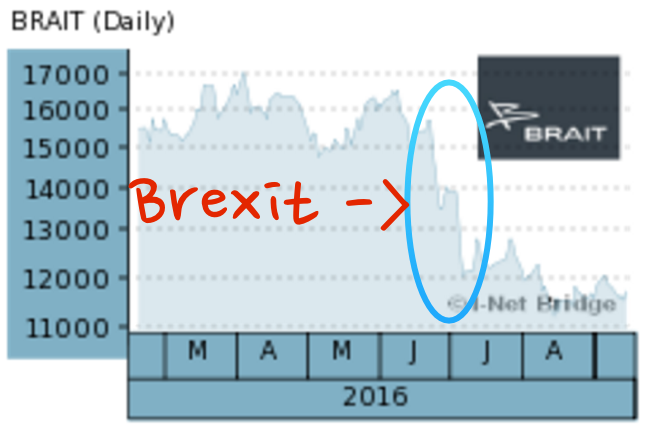

"Brait has been a stock that has sucked serious wind lately. And by lately, I mean in the last three months. Up until Brexit. And then basically everything changed from there, check out the share price taking a couple of legs down post the Brexit vote and the subsequent rerating of their UK assets."

To market to market to buy a fat pig My mother in law used to sometimes get surprised when we would have a conversation about the market and I didn't know the exact levels or what Mr. Market did exactly today, or yesterday. I do check, it doesn't make much of a difference for our clients whether the market is up this amount or down that amount. At the end of the day, and we will beat this drum for as long as we do this (which is hopefully forever, our forever), it matters what you own.

In other words, the index is made up of all sorts of businesses that come and go over the decades, the businesses that you hold, you hope have the distance and endurance to continue to be around. There are some prime examples in markets all around the world of new businesses that are far bigger than long existing names. Newer businesses with better near term prospects certainly generate investment excitement, equally a business with a long track record can generate the same amount of excitement, based on current business trends.

If you are only interested in finding the best possible businesses to own and your choices are amongst the 70 trillion odd Dollars of global stock markets, then you are in a lucky space. The length and breadth of global equity markets is more than enough, perhaps there are too many choices . There is of course this pesky thing called exchange controls here, we are not alone. More for historical reasons than anything else. Russia, Nigeria, Pakistan, Brazil, China, Libya, Iran, the list is actually too long of all the countries that participate in trying to fart against the proverbial thunder of global market forces by instituting exchange controls. Luckily for us, we have a free floating currency and a pretty large allowance, perhaps less so in Dollar terms.

Unfortunately the worst thing about government overreach is that it always stifles investment. Stifling investment always leads to those further down the rungs of financial freedom to suffer. Those who have capital for historical reasons (inherited, generational wealth) will be fine, they will adapt and evolve. Those equipped with the new skills will survive and thrive. Those without skills as a result of poor base education and nutrition, and worse, poor implementation of government services, will unfortunately struggle.

There is somehow this misconception that wealthy people in society are not receptive to many more joining the ranks. False. In true capitalism everyone is encouraged to follow their dreams and give it a real go. Rather than failing to try. We have the will here in Msanzi, the recent political machinations may get you down, they are part of the wheels of democracy. In other countries (some of those that implement exchange controls) the opposition is dealt with in a different manner. i.e. Not favourably. We will be fine here in the end, pending downgrades or not. We are in a very tight spot, with little or no wriggle room.

OK, off to the markets, less politics, philosophy and scenario planning, that is not our "thing". Stocks in Jozi, Jozi sank nearly two-thirds by the close yesterday. We slipped away in the afternoon part of the session, we should catch a bid today as stocks across the oceans and far away, in New York, New York, caught a bid all the way through to the closing bell. The broader market S&P 500 added just over a percent, the Dow Industrials was a whisker from adding a percent on the session.

The nerds of NASDAQ were powered by Apple (up 3.4 percent to 115 and a half USD) to a percent and a half (give or take) higher on the day. Wow. Apple have certainly captured the imagination ahead of the release today of the new version of the iPhone, which happens to coincide with a big competitor of theirs having to recall a certain model. You know what I am talking about. See this related story - Apple's 21% Rally Is Tough Pill for 295 Funds That Bailed. Oops.

Company corner

Brait has been a stock that has sucked serious wind lately. And by lately, I mean in the last three months. Up until Brexit. And then basically everything changed from there, check out the share price taking a couple of legs down post the Brexit vote and the subsequent rerating of their UK assets. Of course those Pounds are worth less Rands, a reverse Rand hedge if you will, as the hedge is NOT working in your favour:

In part the recent results have led the market to rerate the NAV again, which would probably fall further. And as such the price of Brait has given back some hard fought gains. Game over? Most certainly not, CEO John Gnodde has moved to London. With good reason, two days back the company announced their intention to list in London. First, they are going to shift business HQ to London. They give some background to the history of the business, in five years they have gone from a private equity business to a holding company:

"The Company raised ZAR8.6 billion through a ZAR6.4 billion rights issue and private placement on 4 July 2011, as well as a ZAR2.2 billion increase in its debt facilities. Since then, it has acquired significant stakes in a number of well-known South African and UK brands including Premier (in which it holds a 91.4 per cent. shareholding), Iceland Foods (57.1 per cent.), New Look (88.7 per cent.), Virgin Active (78.2 per cent.) and increased its shareholding in DGB (81.3 per cent.)."

DGB is Douglas Green Bellingham. The others you are familiar with, not so? If not, use the best library known to mankind, the inter-webs. Yet ..... Trivial Pursuit is still fun.

Why a London listing? The UK is their biggest market in terms of assets, that makes sense. It gives them flexibility (open market) to do deals quicker and of bigger size. It allows them to attract a multitude of new investors with more money, and that includes any further capital raising exercises. Inclusion into various high profile indices gives them the ability to raise money to execute deals at cheaper rates. Lower risk profile is synonymous with cheaper cost of capital. The way that the company views it from a tax point of view (as a result of where the assets are) is that it is tax neutral.

They are also teeing up shareholders for another capital raise, another rights issue, although it may not happen, this is all market dependant. There is no commitment, just be aware I think is what the company is saying. Timing? End of March next year. The common thread with Steinhoff and Mediclinic recently is that they externalise their business by acquiring assets offshore and then it makes more and more sense for them to list their businesses where it becomes cheaper to raise money.

It is better for Mediclinic/Steinhoff and now Brait to have access to capital in markets closer to their biggest assets. I have no idea why people in general feel like they are rushing away, we should rather celebrate these captains of industry. Well done. The shares are held here too, by South African pension funds and by extension large swathes of investors who have retirement savings. All three of these businesses have delivered market beating and superior returns to their stockholders and regardless of the currency, should continue with superior management skills and deal execution to be able to continue that trend. We endorse.

Linkfest, lap it up

If you want to change someones mind, agree with some of their points so that they are not forced to stand their ground and then lay bread crumbs for them to follow the view that you want them to see - A philosopher's 350-year-old trick to get people to change their minds is now backed up by psychologists

Thanks to the curiosity of human kind we are pushed forward - The boundaries of science. "And the rate of progress is accelerating: the number of scientific publications has doubled every nine years since the second world war."

We are all linked, even more so as the globe gets smaller. As emerging markets become wealthier, thanks to better economic policy, this has a ripple effect across the globe that has winners and losers - The Global Poor, the Great Enrichment, and the American Working Class

Home again, home again, jiggety-jog. Stocks are mixed to higher across the globe. Markets across Europe are touted to open lower, the leaders of the region are meeting in beautiful Slovakia, the capital Bratislava looks nice at this time of the year. Not so much for the UK, their central bank is still grappling with how to deal with the pending EU wilderness. We will see how it unfolds.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment