"More people use more data as their phone advances in technology. Watching YouTube (which didn't exist back then) clips on the Nokia 3210, no ways! WhatsApp, what is that? You were sending 2 Rand a pop sms' and if memory serves, you were confined to a certain number of characters. Otherwise it rolled over to another sms which then became a second charge."

To market to market to buy a fat pig Another day focussed on central banks, this time the aftermath of the Fed decision and the fact that global equity markets cheered the decision. The Rand rallied hard as the Dollar lost some allure, the general consensus around the marketplace, whether ill informed or not, was that there were some company flows inwards to pay for the SABMiller stake. In other words, when AB InBev take SABMiller out, the cash has to be here already. I suppose the timing is what it is.

The Monetary Policy Committee also released their forecasts for growth and inflation, growth is expected to be muted in the short term and inflation is expected to stay inside of the 3-6 percent band, admittedly at the top end of that range. If you are interested, then follow the link - Selected forecast results: MPC meeting September 2016. Inflation through next year is set to average 5.8 percent, and the year after that inflation is set to be lower to 5.5 percent.

Those of course are predictions. Remember that at the beginning of this year, Deputy Fed governor Stanley Fischer suggested that the Fed would be on course for four hikes this year. We are yet to see one. Even the best predictions by the best predictors are still predictions. The Statement of the Monetary Policy Committee points out that food prices are somewhat of a problem for consumers, no thanks to the drought. Any rain on the horizon? Hopefully. Expect food prices to peak in the last quarter, according to them.

The statement delivered by Reserve Bank governor Lesetja Kganyago suggested that "(t)he marked appreciation of the rand during the past few days appears to be driven by expectations of unchanged US monetary policy, as well as to speculation regarding possible purchases of rand related to a major M&A transaction. See? They think that too. The upshot of it all is that rates are on hold, and the MPC is concerned about inflation. What is interesting is this line, it seems to be a classic on the one hand: "The MPC is of the view that should current forecasts transpire, we may be close to the end of the tightening cycle. The committee is aware that a number of the favourable factors that have contributed to the improved outlook can change very quickly resulting in a reassessment of this view. The bar for monetary accommodation, by contrast, remains high, as the MPC would need to see a more significant and sustained decline of the inflation trajectory to within the inflation target range"

So we could be at the end of the current rates cycle, we may however not be, one could never say for sure though? The Rand weakened through the session, perhaps the M&A related Rand buying had passed and the prospects of ZA yields staying at these levels saw some retreat. It was good for stocks as a collective, with the Jozi all share index rallying nearly two and one-quarter of a percent. Resources were up an incredible three and a half percent on the day, financials added about as much as Mr. Market, and industrials were not too far off being up 2 percent. Glencore, BHP and AngloGold Ashanti dominated the winners column, there was a single stock lower in the top 40, and it was Aspen, down one quarter of a percent.

Over the seas and far away, in New York, New York, stocks finished better again, the afterglow of the Fed statement Wednesday. The broader market S&P 500 closed two-thirds (nearly) of a percent higher, whilst the Dow Jones Industrial Average added 0.54 percent. The headlines belonged to the nerds of NASDAQ, the index closed at a record high and set another intraday high too. Pencil in 5339.52 as your new all time high. Why I am not a fan of graphs and selective data picking is because of the following "drawing of lines in the sand". Since the financial crisis ended and the market bottomed in March 2009, the NASDAQ is up 312 percent. Sell it! Since the tech bubble burst, track the top of markets back to the middle of March in the year 2000, the NASDAQ is up less than 6 percent. Buy it all! And since the index bottomed in October 2002, in the great tech washout, the nerds of NASDAQ is up nearly 350 percent as a collective.

Be careful where you select your starting point. Even at that point, October 2002 to present day, "things" and constituents of the NASDAQ are VERY different. No Google/Alphabet, it wasn't listed, Apple was a mere twinkle in the eye. Although listed, it was a fraction of the price it is now. And Facebook didn't exist yet. Amazon is up 4630 percent since then (October 2002), the stock was only trading at around 17 Dollars back then, the market cap is now 386 billion Dollars. Microsoft is up, since October 2002, a more "reasonable" 155 percent.

So forgive me for once again pointing out that no two times in history are remotely the same. If people tell you about the Tech Bubble meltdown and compare it today, just remind them that Facebook didn't exist and by extension had zero users (there are 1.71 billion monthly active users now), the iPhone didn't exist (since then Apple have sold over one billion units), Amazon had sales of less than 4 billion Dollars back then, consensus for this year is for revenues of around 136 billion Dollars. See? This time is the same-same, yet completely different.

This whole idea that "stuff" must get cheaper, yet you want to be paid more makes me scratch my head. Data for one is expensive in South Africa as a direct result of government, their reluctance to encourage competition has meant that the only providers can keep rates at the goldilocks rate, or just above it. No network provider is out there to screw you over, they have to recoup the costs of the development of a very expensive above ground network. Make no mistake, their margins are pretty spectacular, the service is pretty darn good on balance, you would say.

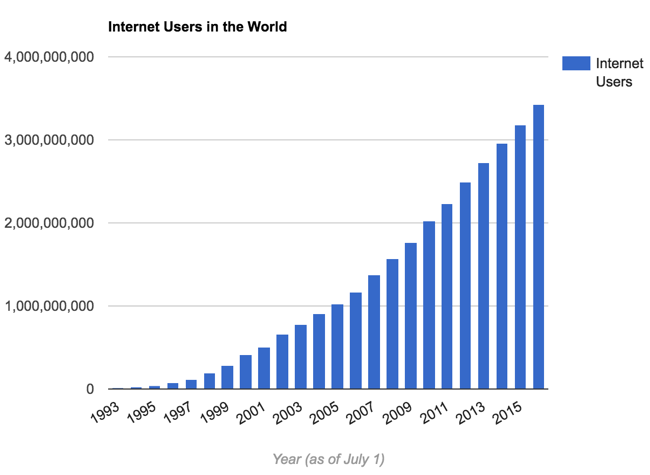

Vodacom and MTN have spent tens of billions of Rands so that your swankiest and newest smartphone can consume all the data that you want and need. High speed internet is a thing for only rich people in this country. The internet as we know it is less than a generation old. I for one am glad that the internet has changed so many lives and will change so many more. Check out this graph from Internet Live Stats:

Additions to internet users around the world is slowing, growing at a slower pace, only around 7.5 percent as the base has now swelled to 3.4 billion folks. Sadly this still only represents 46 percent of the global population. Think about that for a second. Less than half of the world get to use the awesomeness of the internet. Something we take completely for granted. Ten years ago it was only 17.6 percent. In 2000 it was only 6.8 percent. Hey, I was using the internet before that, I think my first experience with the "web" was in 1996, around 20 years back. It was hardly earth shattering, Netscape and the like, Ask Jeeves, and remember that search engine Aardvark? Ha-ha. How times have changed.

Remember your first mobile phone? I was "late" to getting one, I had an email address (hotmail) long before a cell phone. If someone wanted me, they could reach me at work or home. Otherwise, there was nothing else needed, right? No, I had to get one, a Nokia 3210, brand spanking new in 1999. It had predictive text, I think? The 3210 sold a massive 150 million units. And the reason why it had a good battery life is that you only made two calls a day, sent perhaps three sms' here and there. And that was possibly 20-30 Rand worth of usage. Nowadays, calls are limited. WhatsApp, even making data calls are a very common occurrence.

More people use more data as their phone advances in technology. Watching YouTube (which didn't exist back then) clips on the Nokia 3210, no ways! WhatsApp, what is that? You were sending 2 Rand a pop sms' and if memory serves, you were confined to a certain number of characters. Otherwise it rolled over to another sms which then became a second charge. So. Let me tell you something Johnny come lately data must fall people. Your life with regards to internet access and ability to do many things on the go has improved immeasurably, thanks to Android (thanks Google/Alphabet), Samsung, Apple and the like. If you don't like the price of data, use the alternative. Oh, no, I forgot, that is expensive too. And the rollout has been stifled. Suddenly now we are asking for cheaper prices. They have rocketed down as a result of more users, that will continue to be the case.

If government intervenes and puts a cap on prices, expect the quality to fall away as well as any potential competition. And who knew, competition means lower prices! When you are using your Apple iPhone 12 (or some other such model) and there is only a 4G LTE connection (and you can't do anything with the phone) remember the time that you wanted something for nothing. Of course this isn't the common perception that exists, somehow the private service providers are out there to fleece you (nobody forces you to use them), whilst government are always trying to do you a favour. In fact, the opposite always ends up happening, the more government "do", the worse for the consumer in the end. So let the process take course, data will get cheaper and cheaper as you use more and more.

Linkfest, lap it up

This study doesn't sound all that scientific, it is interesting none the less - 'Trust Your Gut' Might Actually Be Profitable Advice on Wall Street, Study Says. Trading is not the only profession where people talk about trusting your gut, research seems to point to a part of the brain that is processing information that you are not even aware of.

I'm not sure how this would be regulated ? Cutting methane emissions will go a long way to slowing the increase in the globes temperature. I wonder if this will result in taxes on beef, lowering cattle count is the easiest way to reduce the methane they produce - Cow farts can now be regulated in California

Using GDP as a measure for how well a society is doing is a flawed metric. Thanks to the digital age, our living standards have improved by spending less money - Recorded music sales by format from 1973-2015, and what that might tell us about the limitations of GDP accounting

Home again, home again, jiggety-jog. Markets across Asia are lower. US futures are marginally lower. I for one am pleased that earnings season starts in a few weeks time in the US. Amazon is now the fourth biggest company in the US. Wow. Who would have thought? And on other matters of who would have thought, is it really the case that John Stumpf of Wells Fargo could walk away with 200 million Dollars in compensation? That is likely to make senator Warren seething mad.

Lastly, what is your heritage? Let me give you some insight to mine. Born in Zimbabwe and lived there for the first 7 years of my life, lived in South Africa (the most now), Lesotho and Mozambique. My grandfathers were born in Russia and France. My grandmothers were born in the Ukraine and Namibia, of Russian and German descent. My great grandfather was born in Corsica, does that make me sort of Italian? So that begs the question, what am I? I will tell you, a citizen of planet earth that embraces all cultures!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment