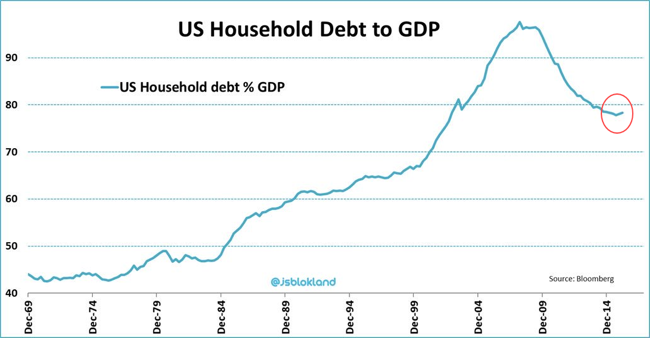

"Last graph. It seems that there are early signs that US households are starting to borrow again, leveraging up. Contrary to popular belief, household debt to GDP has been going lower for the last 7-8 years since the financial crisis."

To market to market to buy a fat pig Stocks across the oceans and far away, in New York, New York, started better and were trading higher immediately and then someone remembered that the Fed were meeting and delivering their state of the economy mid-week. Seriously? Seriously .... There is a Barron's article that reads: Dow Gives Up Gains Because Who Wants to Be Long Before the Fed? It sounds a little like two five year old buddies not wanting to be friends anymore "I am not your friend" as a result of a lack of sharing of the plastic firetruck. Who wants to be in the business of trying to second guess the next Fed move anyhow? Not me, not us, around these parts if you "trade" and "position" yourself based on what the Fed is likely to do or say, then you are doing it all wrong.

Like all central banks, the US Federal Reserve have their specific mandate to stick to and will adjust that accordingly relative to the incoming data. They are no soothsayers either. The "dots" as that article above links to are the projections from the members themselves on where they see rates in the short term and where they see rates in the long term. What has happened is that the "Fed dot plot" has consistently been lowered over time. i.e. The action taken to raise interest rates has gotten further and further apart, not a raise now and then next meeting, and see how it goes with the incoming data from there. The suggestion is that rates are so low, thanks to the splurging in the last economic cycle and the subsequent re-adjustments of the global central banks, that raising rates too quickly could be a problem. Besides, inflation is low, the various programs that the Fed used to stimulate the economy came to an end two December's ago, more or less, remember the taper tantrum? Of course you do or don't.

In short, the smartest central bankers on the planet, handpicked and chosen by their peers and endorsed by politicians (is that a good thing?) will do whatever they have to do, in order to fulfil their mandate, the job of an investor is to see through business cycles and to pick quality stocks for the long run. And by long run, all people have their different respective time frames, two weeks is not a proper time frame, OK? Neither is two years to be honest, ten years is an acceptable time frame. Think of investing in the same way that you would living in a house. There is no way that you would chop and change houses every two weeks, or every two years. The cost and the upliftment associated with moving house, and the attached stress, is bad news for all involved. Taxes and fees are too many.

At the bell in the city built originally around the trading of animal pelts, stocks closed off their best and in the red. The broader market S&P 500 nearly managed (I think I can, I think I can), falling 0.04 points (unmoved to two decimal places in percentage terms), whilst the blue chip Dow Jones Industrial Average lost 0.02 percent at the close. Apple weighed down the nerds of NASDAQ, that index down nearly one-fifth of a percent by the close. GoPro had a product release that even I was looking forward to at some level, it included the release of a drone and a new camera. Hero5 cameras and something called the Karma drone, which folds up and fits in your backpack. It has a "console like" device that you use to control it. It looks a bit weird and will take some getting used to, I suspect that the refresh may encourage new fans to join the GoPro movement - This is GoPro's $799, foldable Karma drone. About those FAA laws ..... FAA being the Federal Aviation Authorities....

What is that you say? You want your groceries delivered by drone? Before you think that the idea is a ludicrous one and is something out of science fiction, Amazon has distribution facilities within 20 miles of 44 percent of the US population. Think about that. Around 150 million people in the US are within 20 miles from an Amazon facility that could deliver them everything from fridges to veggies. And I am guessing that Jeff Bezos, the founder of the business, wants to do it with as little human intervention as possible. The robotics age is upon us, we are close and as it evolves each day at a time, driverless cars, connected devices that can interact with us. Amazon Alexa powered through Echo, your Apple ecosystem powered by Siri. It is always a little more mind-blowing when you take a step or two back.

Back to local, which is lekker. Except we are still reeling from the loss of a music legend in a South African sense, gone too soon Mandoza. Eish. Unfortunately for the family of the departed, life just goes on as normal, it simply just rolls on and has to be that way. Stocks as a collective in Jozi rose just over one-quarter of a percent on the session, industrials slipped by one-quarter of a percent while financials added nearly a percent and one-third. SABMiller slipped as the Pound continued to weaken, as did Hammerson (a new entrant to the ALSI 40), Intu and Bidcorp, all with businesses in the UK. Call this the second round of Brexit, in which Bank of England governor (a Canadian) hopes this won't be a series of cricket test matches. And as Paul said, for a Canadian or any outsider to compare a process to test cricket, it means that it must be VERY long. In the winners column was Shoprite, which roared ahead by four and some more percent. Stronger Rand = lower inflation projections = better outlook. Make no mistake, it is still tough out there for all and sundry.

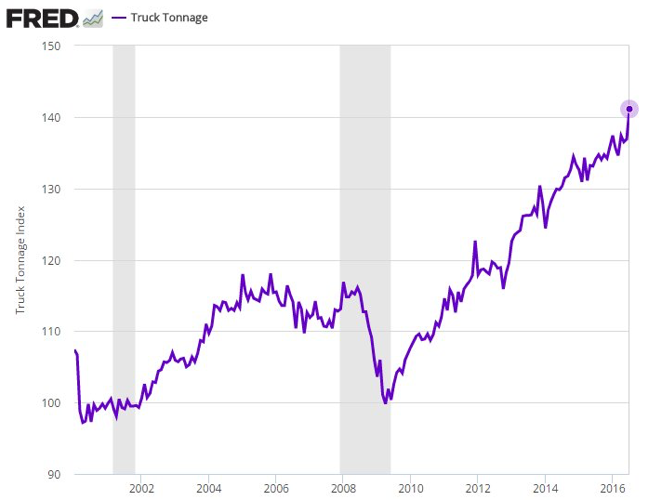

I want to take a few graphs from a magnificent daily email that I get called the Daily Shot. It is a series of graphs showing right now relative to historical. Some good, some bad as in Russian retail sales that have fallen for a couple of years now, almost every single month. There were and are a couple of graphs about the state of the US economy that I think are worth pointing out. The Daily shot is so impressive that the editor yesterday said that they were moving into the Wall Street Journal subscription area. Firstly, US truck tonnage is at an all time high.

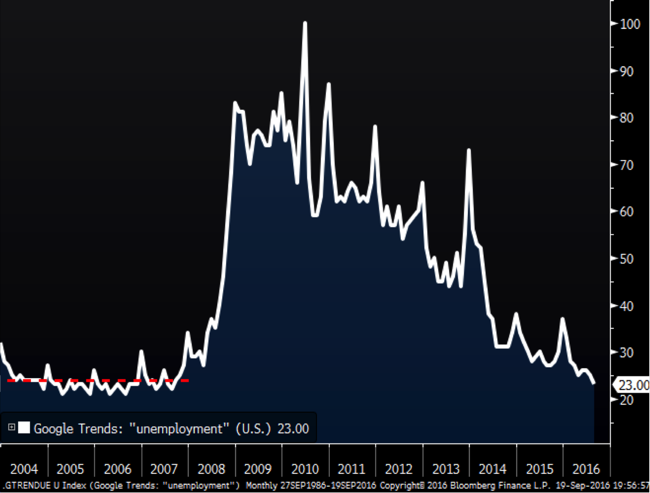

Now correct me if I am wrong, people would not move stuff around by truck across the lengths and breadths of the US if they were feeling very bleak about the state of the US economy, right? Unless of course the railway system and the planes transporting stuff were all broken too, and I certainly have not heard anything about that, have you? The next is the Google trends graph of the search for the keyword "unemployment" inside the USA. Now, again, correct me if I was wrong, more people are likely to search for the word if someone close to them is unemployed, they are unemployed themselves or they are worried about too many unemployed people, right?

Last graph. It seems that there are early signs that US households are starting to borrow again, leveraging up. Contrary to popular belief, household debt to GDP has been going lower for the last 7-8 years since the financial crisis. There seems to be a wagging tail emerging at the end of the graph there, suggesting as the question from the Daily Shot asks "Is the US household deleveraging trend ending?"

So why would this be seen as good news? It indicates that consumers are feeling more positive by taking on more debt and it suggests that the dual mandate that the US Federal Reserve has, is eventually starting to work at some level. Draw your own conclusion, maybe I am cherry picking from the data that looks good to me, it clearly indicates that not only is the timing nearly right for the Fed, it indicates that they have done a far better job than the armchair critics dish out so easily. Like the Springbok players needing to keep their phones in their pockets and check in on the suggestions from Twitter every two seconds, the Fed needs to do the same. Thank goodness that neither party actually does that.

Linkfest, lap it up

Another great blog piece from Ben Carlson. He is talking about the investment lessons from Japan since the 70s. Most people were not following stock markets in the late 80's so don't remember the circumstances around the Japanese crash - The Greatest Bubble of All-Time?. If you thought that stocks were over valued in the mid 70's, did you just sit around watching stocks climb higher for the next 15 years?

Twitter launched their rework of the 140 character limit yesterday, so the limit is still in place but things like twitter handles and images don't count towards the limit - Coming very soon to Twitter: longer tweets

Sticking with Twitter, last week was the first time that they broadcasted a sports match live on the website - The NFL on Twitter. This is just an experiment at the moment but I expect to see more live sport matches in the future.

Still more Twitter news, the headline is fairly self explanatory - Twitter Sued by Investor for Failing to Deliver on User Growth. This sounds like a giant waste of time and money from a grumpy investor, buying equity means that you are taking on risk that the future might not look like you predict it to look.

Home again, home again, jiggety-jog. Stocks across Asia are mixed to lower, both the Shanghai composite and the Hang Seng in Hong Kong is lower on the day, only just though. The Nikkei in Japan is open again after celebrating "Respect for the Aged day" yesterday. There are 65,692 people in Japan who are 100 years or older as at the beginning of September, nearly 9 out of every ten are woman (87.6 percent to be exact). As Quartz reported yesterday: Charted: As Japan celebrates "Respect for the Aged Day," it has more seniors to honor than ever before, there are 10.5 million octogenarians (people between 80 and 89), which is more than entire population of Sweden or Portugal. About that robotics age and helping humans???? Quickly, advance humanity, advance!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment