"So three dissenting Fed members, rate hikes still on for the year i.e. December or an outside chance of November and the members of the FOMC downgraded the growth outlook. And stocks went up. The S&P 500 closed 1.09 percent better on the day, the Dow Industrials added nine-tenths of a percent and the nerds of NASDAQ racked up a little over a percent"

To market to market to buy a fat pig So three dissenting Fed members, rate hikes still on for the year i.e. December or an outside chance of November and the members of the FOMC downgraded the growth outlook. And stocks went up. The S&P 500 closed 1.09 percent better on the day, the Dow Industrials added nine-tenths of a percent and the nerds of NASDAQ racked up a little over a percent. Most of the action pre the Fed announcement was one of waiting and watching. If you are waiting for the Fed to do x or y or z, then I am afraid that you are doing it all wrong. The Federal Reserve in their official capacity meet every 45 days. Fed members are constantly giving speeches in public nowadays. If the only thing that you are concerned with in terms of your markets decision making process is around interest rates (I can understand if you are a fixed income person), then you are going to be confined to halls of tread carefully all of the time. You are never going to get it right.

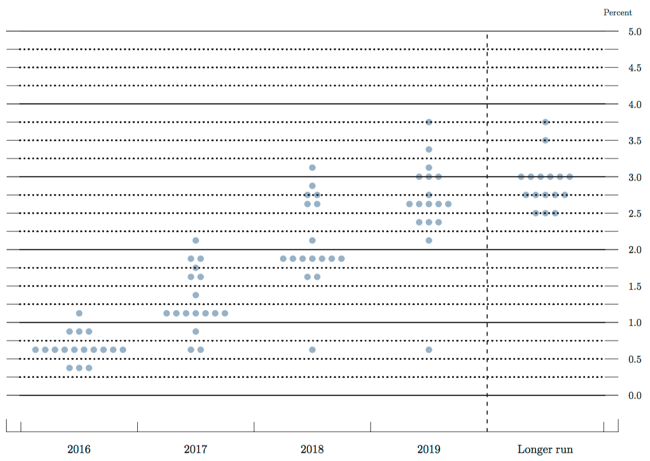

If you are looking for the new Fed "dot-plot" then the Business Insider has it for you here -> Here's the new Fed dot plot. This is taken from the document released with the Fed announcement titled: Economic projections of Federal Reserve Board members and Federal Reserve Bank presidents under their individual assessments of projected appropriate monetary policy, September 2016. Here is that "dot-plot":

I much preferred the real one, the meme that has been doing the rounds since this document was released with the individual projections of each and every member:

Of course only the first one must be taken seriously! The second one is spot on too, nobody knows. It certainly reaffirms the view, the dot-plot of the voting members, that the long term rates are likely to be at a lower level than historical levels. That is a result of inflation having been non-existent for the last four years. And remember from that Ben Carlson piece from a couple of days back, that the US is not Japan and likely to not end up like that. The ex chief of the Fed, I mean ex chair, weighed in yesterday with his own projections of where current Japanese economic policy is heading, that is of course if you are interested: The latest from the Bank of Japan. Sounds better than your average armchair critic, right?

Over in the single companies department, Fedex added nearly seven percent on the day as numbers absolutely crushed expectations, at least on the profits front. There was a marginal top line beat too. The stock is hardly cheap and perhaps fits outside of what we would like to own, nevertheless is an important indicator of the US economy. The more stuff being shipped around, the more economic activity. I guess it shouldn't be that surprising, we had a similar "trucking" index graph that was taken from the Daily shot, two newsletters back. The company also expects a record December. Yes, the US needs to be made great again, so that this pending record Christmas can somehow "go away".

Back on the local front there was both good and bad news. Inflation numbers came in below expectations, that is good news, meaning that another rate hike is possibly unlikely in the coming meetings of the MPC. The Rand is attracting some serious inflows, perhaps the yield searchers hell bent on looking for something across the globe. Some even suggested that there was a possibility of the flow of the SABMiller money (the funds that AB InBev would use to pay for the deal) into the country. Really? Perhaps, who really knows and to be honest, trying to predict which way the currency is likely to go next is like trying to predict which way a rugby ball is likely to bounce. Hard.

The upshot of course of the Rand strengthening is that the top end of the market, which is of course the Rand hedge segment, sells off. Dollar earnings are then cut, and as Dollar earnings are cut, Rand profits are slimmer. In large part the stronger Rand is very good for the country, it reduces imported inflation and sets rates lower. For the stock market, it isn't always a great thing. Led lower by Industrial shares, that index down nearly two percent, stocks as a collective were down 1.13 percent on the day. Eish.

There is a rates decision from the local Reserve Bank today. Recent ammunition, although suggesting that we should be in the rate hiking cycle, suggests that the Monetary Policy Committee may be able to pass here. Growth is next to nothing. Inflation more importantly is below the top end of the range. Consumers may breathe a sigh of relief, we have seen that furniture and household goods in South Africa was over 8 percent lower year on year. Yech. Edcon going to the wall essentially is a bad outcome. Mr. Price looking sloppy, perhaps as a result of weather conditions. As ever, we will come though these tough times. I am expecting the question at this afternoon's MPC meeting: "Was the decision unanimous?" As Michael said, you want that to happen, you want people to not always agree.

In Europe I noted with interest that the holding company for Zara, Inditex reported numbers that were ahead of expectations. They would not be growing sales by ten percent plus if the whole of the continent was finished. The flagship store network offers quality and a reasonable price, they are neither cheap nor are they expensive. The stores look clean in design and the clothes are also clean. They seem to have the right staffers everywhere. Great business, certainly worth a look at some level.

Linkfest, lap it up

More competition is always good for the consumer. The new network will have to prove their speed and reliability, the two key reasons that consumers are switching to fiber as fast as they can - WBS to roll out national LTE-A network

WTF, is my best response to this article. Saving is difficult who ever you are - Make Six Figures? There's a Decent Chance You've Got Almost Nothing in the Bank

This points to the consumer market gaining traction in China. Property markets are wild in China at the moment - China is in the middle of a new home buying boom

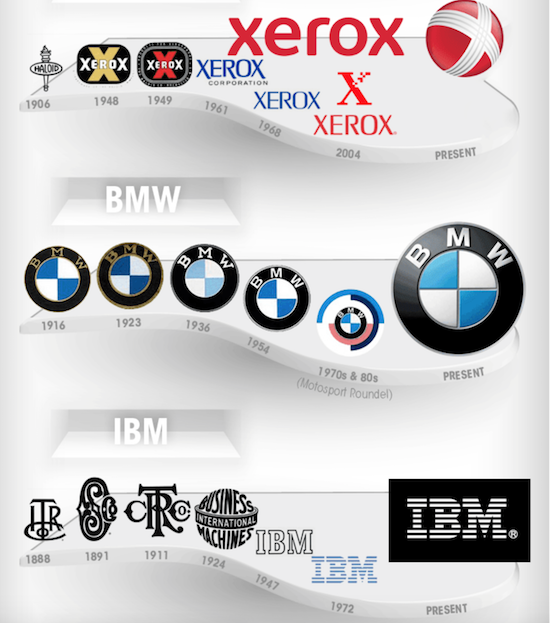

Another great image from Visual Capitalist - How the World's Most Iconic Logos Evolve Over Time

Home again, home again, jiggety-jog. Stocks across the globe are higher. Thanks to central bank decisions. It might not be your favourite thing, it is what it is however. And we are likely to have an interest rate pass here today, I wonder if that means that those searching for yield or growth will determine the flows? I can't tell. Stand by!

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment