"Before the market opened yesterday, Famous Brands announced that they are expanding their operations in the UK. They are paying 120 million Pounds for Gourmet Burger Kitchen" or "GBK", a 75 store premium burger restaurant."

To market to market to buy a fat pig Space X, the company striving to get humans to Mars in the near future had an explosion on their launch pad yesterday, Falcon 9 explosion. Part of the cargo damaged in the explosion was a satellite from Facebook, part of their Internet.org initiative. You will remember that the initiative is based around making internet free for accessing certain webpages, Free Basics by Facebook. The explosion yesterday is a setback to both Mark Zuckerberg and Elon Musks respective dreams, one dreams for this planet and the other dreams for Mars.

Moving to the markets, yesterday was another tough day out for the MR Price share price, down another 8.6%. The share closed at R168.50, higher than the R150 level it was at in Jan this year but well below the R270 levels that it reached in April last year. Share prices today are the collectives expectations about the future, when expectations are high a small change in the current periods earnings has a compounding negative impact on the future expectations for the company. The rerating of the stock has taken its earnings multiple from being in the low 20s to the mid teens, which can still be considered expensive for a company whose earnings will contract in the next period. The space also has added pressure from international brands, H&M and Cotton On are both brands who operate in a similar price bracket, they have the added advantage of an international allure that South Africans are drawn to.

The ALSI bounced between red and green yesterday with the bears winning it in the end, the index closed down 0.2%. For the US market, we have been speaking about the very low volatility of the S&P 500, yesterday epitomised that low volatility with the S&P 500 being neither up nor down but flat with a 0.0% move. The other 2 major indexes were in the green, The Dow up 0.1% and The Nasdaq up 0.3%.

Company corner

Before the market opened yesterday, Famous Brands announced that they are expanding their operations in the UK. They are paying 120 million Pounds for Gourmet Burger Kitchen or "GBK", a 75 store premium burger restaurant. These 75 stores will add to the current 83 Famous Brand stores already in the UK. In terms of value for money, GBK had an EBITDA of around 9.6 million pounds for the 12 months ending June 2016, so not cheap but not overly expensive. The question that we were asking in the office, "What exchange rate did they get?". The company locked in an exchange rate of GBP/R 17.54, getting near the strongest levels of the post Brexit Pound crash. On that exchange rate it will cost them around R2.1 billion, Kevin Hedderwick on TV yesterday said Brexit saved them around R800 million, compared to the price they were first looking at paying.

This means that we will have another burger shop on the block in South Africa. If it is in the same league as Rocco Mamma's it should do well (assuming the gourmet burger trend continues). I think that this is a good move from the company, they are becoming more global with a move into a country where they already have experience, logistical systems and partnerships in place. The Famous Brands market cap is currently R15.1 billion (including the 25% spike when the market got a whiff of this deal), so the R2.1 billion acquisition is roughly 14% of their market cap. Remember that Famous Brands has no debt on their balance sheet at the moment, so this deal will bring with it some leverage which can be a good thing.

Linkfest, lap it up

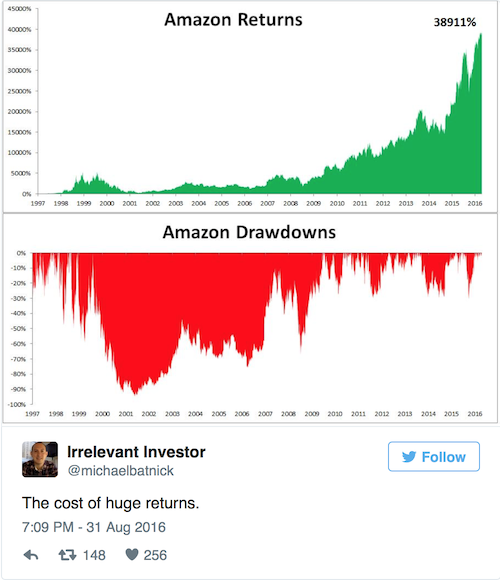

This blog post highlights why it is important to know your game plan when it comes to markets. Having a game plan means that your emotions are under control when the headwinds of volatility strike markets - Why I Invest in Stocks. . .Why Do You?. I like the line where the blogger says he doesn't just want to beat the market returns but to trounce them. To do that you only need to pick one or two winners and avoid the stocks that blow up. Note that buying and holding doesn't work if you are holding stocks in terminal decline.

Management remuneration is a topic that is coming up more often, where the question being asked is; "How much do you need to pay to attract top management talent?" - UK firms should adopt Sweden-like shareholder committees to curb top executives' pay. Having shareholders and employees taking a more direct role in the remuneration of top management is one proposal.

IF you ever wondered how the tax structures of some big companies work, here is a diagram showing the money flows - How Apple and the rest of silicon valley avoid the tax man. These type of loop hole structures are getting harder to implement but as long as there is money to be saved people will find these legal ways of paying less tax.

Becoming 100% carbon neutral is within grasp for large companies, it may still be many years off before that tag can be used but laying the ground now is important - Apple Becomes a Green Energy Supplier. Apple is also building large solar farms in China to power parts of their manufacturing activity there.

Home again, home again, jiggety-jog. Our market is nicely in the green this morning, currently up 0.7%. Mr Price is continuing its downward streak, down another 2% today (which given the pain of the last 2 days doesn't sound like much). Today is jobs day in the US, another one of those "most important" data points until the next one. Depending what the job market looks like and more importantly, how will the numbers compare to expectations, we will see some market movement.

Sent to you by Sasha, Michael and Byron on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment