"Aspen results! Those were released mid afternoon here in Jozi, the stock reacted positively, notwithstanding being smashed last week when the trading statement revealed the BS they have to put up with in Venezuela."

To market to market to buy a fat pig Some measure of "normal" was restored to global markets, although is was marginally disappointing (for the bulls of course) that stocks slipped off their best levels in the New York session. Energy stocks slid as the oversupply issues percolate in the oil markets, at least with those interested in where the price will settle. Your best educated prediction is almost as good as anyone else.

Wells Fargo continued to take some heat, the behaviour of at least two percent of the workforce might not necessarily be reflective of the rest of the workforce, tell that to the folks on the streets, tell that to the regulators. I suppose when you have hundreds of thousands of employees, you are never going to keep them all on the straight and narrow, when 2 out of every 100 are engaging in unethical (and illegal) activities, you had better know about it. In fairness to the bank, they are the ones who uncovered the "ghost accounts" being created (and then shut quickly), perhaps a little credit should go to them. Wells fell another 0.94 percent to be trading at levels last seen in June. The stock trades on some pretty juicy fundamentals, a yield of three and one quarter, earnings are expected to be squeezed, the historical multiple is 11.5x, and about the same forward, indicating the market sees muted growth. The analyst community is mixed on the stock, most of the bias is still in the buy category.

OK, I had to chuckle as the Apple share price continued to march ahead, still comfortably off the highs from the first half of last year, the moves northwards since the numbers and product refresh still leaves you scratching your head. Scratching your head, why? Remember that they were ex-growth, losing their mojo from a product development point of view and another ten reasons I can think of. Suddenly it is like, they are innovators, they are delivering quality and so on. Sigh. Nothing changed except the chattering classes got on and off the merry-go-round.

The stock caught another bid, up over four percent at one stage, closing a smidgen over three and a half percent by the time the closing bell rang. This is about the best level for the stock this year, year to date the stock is up a little over 6 percent. Market cap is back over 600 billion Dollars, comfortably. Astonishing. Still looks cheap at 13x earnings and has a pre-tax yield of 2 percent, we are still buyers. Oh, and did we mention that the iPhone 7 Plus is sold out across the globe. No? Reuters reports this morning - Apple says initial quantities of iPhone 7 Plus sold out.

Back to the local scene, the city built and based on gold for centuries (and soon to have no bicycle lanes, not that they got used a lot), stocks were lower from start to finish. Financials and retailers had a poor showing, Mr. Price fell again after a conference call two evenings back didn't include questions from analysts. The stock lost another five and a half percent. Year to date the stock has lost one quarter of their market cap. Over five years the stock has still doubled, this is obviously rattling investors and management alike, they are quite frankly not used to this. I am cherry picking here, Mr. Price from their all time highs in April last year are down nearly 47 percent. The stock now trades on an ex growth multiple, less than 15x and the yield has now grown (with poor share price performance) to 4.44 percent. They will be fine in the end, a tough period here.

Some of the local retailers sank in sympathy, Woolies lost over four percent, ditto Truworths and about the same for The Foschini Group too. Ai shem, not feeling any of the love from the market, all these stocks look cheap, retail sales year on year grew at about the same pace as the overall economy, furniture and household goods (appliances) sank over 8 percent year-on-year. It certainly is VERY, very tough out there for Joe Consumer. Added to that, Richemont sucked wind after the less than encouraging short term outlook for them, we covered the five month sales update yesterday, the stock ended the session down four and a half percent. Eish.

Finally some good news for MTN share holders, although it doesn't feel like it at 120 odd Rand a share. Still, the stock up on the day after their debt issuance post their road show was well received. They are of course struggling to repatriate the big pot of money (over a billion Dollars) from Iran, the falling in a heap of the Nigerian Naira, now that it floats free and is buffered by market forces instead of unicorns and fairies and their ideas. Yes, pegged rates are dumb and eventually unwind. Let Mr. Market decide that the rate is likely to be and deal with the consequences. If it is overvalued or undervalued, eventually it will find the right level.

Company corner

Aspen results! Those were released mid afternoon here in Jozi, the stock reacted positively, notwithstanding being smashed last week when the trading statement revealed the BS they have to put up with in Venezuela. Stephen Saad said that when the Venezuelan Deputy President was here in Msanzi not so long ago, spewing garbage about their awesomeness (how can you tell I am not a fan?), there were assurances of being paid, and guess what? They didn't materialise! What a twist, socialists lying!!! In theory sharing is actually caring, when big purple dinosaurs tell you to do so with biscuits or crisps or plastic play things, when we grow up instinct kicks in. I am afraid whilst we can organise ourselves into some sort of working patterns in cities and in the workplace (and so on), the early instincts of oneupmanship still remain, it is hard coded to perform better than your peers. You can try and take that away, sorry, it doesn't work.

OK, enough about nut job Venezuelans, as usual the people suffer with dumb economic policies. And Aspen shareholders, amongst many other businesses globally. So let us deal with why headline earnings per share decreased 23 percent to 889 cents, ZA of course. It is almost all due to the company taking a decision to devalue their entire business in that country. Just above we were talking about unicorn exchange rates, in the context of Nigeria and MTN. Venezuela takes it to another whole level. Let us copy and paste the commentary from the company:

"The economic situation in Venezuela deteriorated over the year to 30 June 2016 and the Venezuelan authorities have increasingly limited authorisations to pay for pharmaceutical imports using the official DIPRO rate during this period of between Venezuelan Bolivar ("VEF") 6,30 and 10,00 per US Dollar ("USD"). As a consequence of the limited payment approvals and the uncertain economic and political situation in Venezuela, before reporting the interim results for the six months ended 31 December 2015, the Group has concluded that it would be more appropriate to apply the DICOM exchange rate (VEF628,34 per USD at 30 June 2016) to report the Venezuelan business' financial position, results of its operations and cash flows for the year ended 30 June 2016. This has resulted in a one-off currency devaluation loss on foreign denominated liabilities of R870 million."

On the parallel market (in the real world where people really transact) the Venezuelan Bolivar traded at 1022 to the US Dollar (source here - Parallel dollar weakens slightly, modification of exchange rate system is still widely expected). So in real life, the Venezuelan government were wanting Aspen to sell their drugs at one percent of the real rate. Of course you cannot operate in a market like that, in the very short term Aspen have made the right decision. It hurts, and it is what it is.

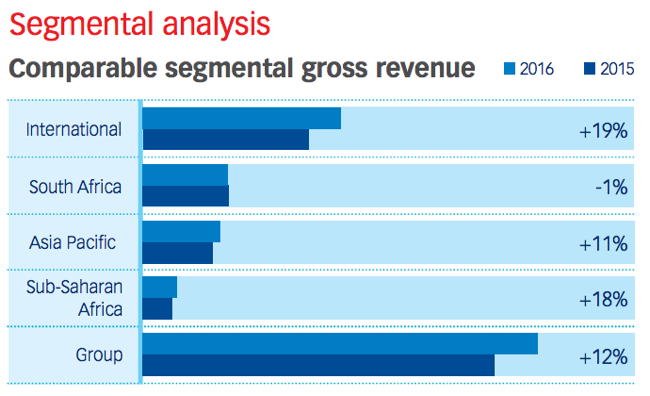

Normalised headline earnings grew ten percent to 1263.7 cents per share. The stock trades on 25x earnings. It is not cheap and the market is expecting BIG things. The South African business was the biggest issue outside of this. Herewith a segmental analysis of their territories:

Stephen Saad said in an interview on CNBC Africa that he was pleased in a sense that there were problems with their business in South Africa, he can fix them here. On the investor presentation, on the page about South Africa, there is an angry face.

What is up with these recent transactions? I suspect that Aspen have identified that there are likely to be more and more surgeries and hospital visits in the coming years, across all of their territories. People are living longer, they are likely to have many more surgeries than their parents. Their Thrombolytic portfolio now is second only to Sanofi (who are miles ahead), and ahead of Pfizer. When you competing against those businesses, you know that you have more than arrived. They have an effective 18 percent share in the anticoagulants (blood thinning) therapy.

Cast an eye to their anaesthetics portfolio (recently added), they are likely to have just over twenty percent, ex the USA. Of course Aspen are not going to be in that market (the USA) with the recently acquired therapies from AstraZeneca and GSK excluding that territory. Remember, we wrote about this a couple of days back - Aspen update on GSK deal. Aspen have 350 representatives selling the anaesthetics products in China, the management team here no doubt will expect big things, 50 percent of sales currently come from Asia Pacific.

Prospects? They look pretty good. The company and the drivers have done an incredible job in transforming this business from a second tier South African business to something that is now bordering on a second tier global operator. I am pretty sure, that by a country mile, Saad and Attridge are not finished. They want to still change the world, they still have the energy, they still make mistakes and then fix it. I back the team, I back the space that they operate in. The stock is priced for earnings growth of mid teens or more, I am pretty sure that they can deliver, we continue to accumulate the stock at what are likely to be favourable levels in the coming years.

Linkfest, lap it up

As a brand becomes more popular it also becomes more 'common' which is not a term you want to associate with a premium brand - Starbucks is spending millions of dollars to fix its 'basic' image problem. The Starbucks solution is to launch new higher end stores, with a more unique experience (and higher cost).

Remember Buffett's feud with the hedge fund industry? The S&P 500 has crushed the returns of the hedge fund industry, in part due to the large fee burden of hedge funds - Warren Buffett is (Actually) Losing His Hedge Fund Bet. Berkshire has another problem though when it comes to beating the index, the company is getting too large to outperform. Trying to find a place for all the billions in cash that the company generates can be a difficult job.

When doing research, very large amounts of data are generated, so when it comes to drawing your conclusion, cherry picking data points can produce basically any result that you are hoping to achieve - How Big Sugar Enlisted Harvard Scientists to Influence How We Eat - in 1965. In the food industry this is particularly prevalent, eating badly today doesn't have an immediate impact on my health coupled with exercise, stress, environment and DNA also having an impact on health. How do you determine that one food substance is bad for you when there are so many moving parts?

Home again, home again, jiggety-jog. European stocks are lower, US futures are higher and we have opened a little better at the get go. Nice. "Things" seem to have settled a little after a monster flurry.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment