"I will go buy it. I think that the business understands psychology of the human being well, the rewards system and the look-at-me points system is designed to pit yourself against yourself. And of course against your mates. There are real cash reward benefits for both the policy holders and more importantly the company over time."

To market to market to buy a fat pig The weakest US services PMI read for an absolute age, and whilst the number showed 79 straight months of continued expansion, it was the lowest for six years. Normally nobody would blink too much here, we are however in a rates holding pattern. Mr. Market suggested that a rates rise in September is now solidly off the table alongside the tepid jobs number last week Friday, and the expectations for one and done for a while now shift to December. This results in a weaker Dollar, stronger metal prices and an OK time for stocks.

Earnings are what matter for stocks ultimately, not Fed watching, even if the TV screens tell you something else. Those people can't remember what they said last month. OK, sis, I am being mean, their time frames and livelihoods are very different to ours. Without the solid hustling that is afforded to people who operate in capitalism societies, the financial engineering ideas that we have become used to today wouldn't exist. i.e. If someone questioned something and said, what happens if I did this and or the same thing that way (obviously having an incentive for them), and everyone benefitted, then efficiencies almost always equals improvements. That can only happen where true markets exist.

So whilst I think it is crazy to have fixations on numbers and trading opportunities, and those get the short term attention, the luxury of having instant liquidity is very important. Even though that (older) fellow from Omaha, Warren Buffett, suggests that if you buy something today, you should be comfortable to hold it for five years without the liquidity. I guess that means that his minimum time frame to transact is at least half a decade. Also, for him to sell 10 percent of Wells Fargo is a lot harder than for most people, even if it is 15 percent of their portfolios.

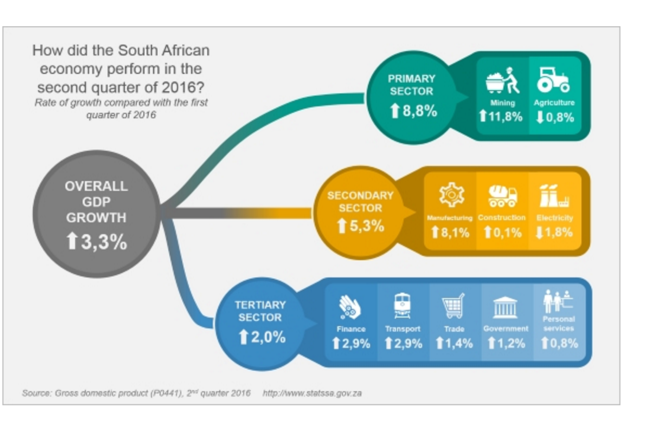

Quick scoreboard check of the US markets from last evening, stocks in New York, New York finished the session up one-quarter of a percent for the blue chip Dow Jones Industrial Average, nearly one-third of a percent better for the S&P 500 and half a percent to the good for the broader market S&P 500. Locally, where the weather is 'lekker' and the rainfall is desperately needed (apparently 40 percent of the water usage in Gauteng is used in residential gardens - dinkum), stocks rose a smidgen. There was a decent enough GDP read, Byron sent through a nice infographic (see why these are important in the links segment). The Rand was stronger as a result of a weak US economic read and the decent GDP read. Next quarter is going to have to be a blockbuster.

We used less electricity, thanks to lower consumption patterns and a warmer winter (that kicked Mr. Price in the kidneys too). Lower inflation on the horizon perhaps means for banks and financials, coupled with the finance sector looking better than anticipated. Make no mistake, it is really tough out there. I can tell from our clients locally, and their savings patterns that it hasn't been easy for local consumers, and these are the richer ones. So next quarter is going to be a tough comparable, the yearly growth is still muted and pretty pathetic, at least we are not Brazil! They are experiencing the worst the drawdown in Brazilian economic contraction since the great depression, and that was a LONG time ago. As they say in the classics, "let's watch it".

Company corner

The first read through of the Discovery annual results revealed that the business is very definitely a growth oriented one. Different businesses in the core market, South Africa, continue to take market share and reinvent short term (and life) insurance, investments and bed down their core business, health insurance. There is a big gap between those that are lucky enough to afford private healthcare in South Africa and those who have to use the public health system, most will agree that the spend to outcomes ratio is not the best, to put it mildly. The Vitality program has undoubtably been a success and I think that we are only starting to scratch the surface. The potential of the existing partnerships in countries like China, with Ping An Insurance and more recently in Canada and the US (John Hancock), as well as some of the bigger economies of Europe represent exciting white labelling of the Vitality product.

One of the mums at the school asked me, why do you work to get the points, if I want a smoothie I will go buy it. I think that the business understands psychology of the human being well, the rewards system and the look-at-me points system is designed to pit yourself against yourself. And of course against your mates. There are real cash reward benefits for both the policy holders and more importantly the company over time. The better shape their policy holders are, be it life, health or short term, or a combination of all three, the less likely they are to claim. The bait of the rewards tussling with the tiger fish competitive nature of their core client is showing through in the Vitality Watch program.

The whole piece about the product launch is worth mentioning in full:

"The success of Vitality Active Rewards with Apple Watch in changing wellness behaviour and segmenting insurance risk in South Africa and the United States has advanced the science underpinning the Vitality Shared-Value Insurance model. Results over the first six months of the Vitality Active Rewards benefit showed dramatic and sustained behaviour change, with a 20% increase in physical activity for those who engaged in the benefit, and 81% for those who also took the Apple Watch. This is the most successful benefit to date, as measured by take-up and engagement, and shows strong initial insurance applications, with engaged members demonstrating significantly lower morbidity and mortality experience than other Vitality members."

Simply by undertaking to get the Apple Watch and maintain a certain fitness level, the Vitality users have gotten far healthier. There are tangible results for the business and the product is in its infancy. A significant amount of data is already being collected no doubt around the user patterns. Steps, heart rate (resting and exercising), flights climbed, and so on. The measure is not perfect, for example, my wife has a very low resting heart rate, in the forties and physically struggles to get her heart rate up. So obviously the loose calculations of 70 and then 80 percent of maximum heart rate doesn't work for all and sundry. It is no doubt work in progress.

By offering compelling and premium products that disrupt the norm, as we know it, the company has been able to grow from a standing start at the dawn of a democratic South Africa, to the dominant operator in some of their businesses. Of course the banking ramp up (branchless I guess) and roll out is going to cost a lot of money, and that is why the share price didn't react positively to the good results. At face value, like I said in the introduction, the results looked good. The spend and roll out of existing businesses will suck capital, you must know as a shareholder that the business is definitely a growth one, and not going to be priced in the same way as traditional insurers or financials. What sets the company apart is that they have a compelling product that they are able to white label globally. We maintain our buy rating and will continue to roll out some commentary in the coming days, including observations of ours.

Linkfest, lap it up

This is of course an infographic (what else, as Gorge Clooney would say) - 13 Scientific Reasons Explaining Why You Crave Infographics. I like points 5 and 6, we receive 5 times as much information today as we did in 1986 and we consume (outside of work) 100,500 words a day. How much do we remember? Turns out more if it is a picture! So if a picture was a 1000 words, you would only need to see 100 a day outside of work then?

Snapchat is growing like gangbusters. Advertising Revenues reported in 2015 were around 60 million Dollars, expectations are for 1.76 billion Dollars in 2018. Phenomenal. It is a pretty cool platform, perhaps the valuations are still too aggressive though. Decide yourself, either way, well done to the owners of the platform for not selling - Snapchat Ad Revenue to Reach $935 Million in 2017.

Are there going to be more of doing this in the future? - Life at the Nowhere Office What does it mean for office space, what does it mean for expectations from employers, what does it mean for formal workflow? Some businesses need everyone to be together, increasingly there are businesses where that doesn't need to happen. Would you, or do you work better on the run?

Home again, home again, jiggety-jog. Stocks globally are mixed. Of course the most exciting thing to happen today will be the Apple event, that takes place after market this side. Expectations are for a new phone and no cord for your earphones, we are going cordless people. Beats already makes tons of cordless headsets, they are far more expensive than the ones with cords. Let us wait and not speculate about what they are likely to be, or not, and whether there are new Macs or tablets or new Apple watch.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment