"The group never stands still. Recently there has been the acquisition of Poundland in the United Kingdom, Mattress Firm in the US, the intention is there to close that deal and make the company the largest mattress distributor in the world, and of course closer to home, Tekkie Town."

To market to market to buy a fat pig It was a busy day on the local front, results pouring in, Sanlam, African Rainbow Minerals, FirstRand and Spur all releasing their results. Spur isn't really in the same category as those others, it is recognisable as one of South Africa's most well known eateries. Aspen shares sank after the trading statement the session prior, ending comfortably off their worst levels however. Banks seemed to catch a bid collectively, the FirstRand numbers perhaps revealing that whilst it is not comfortable sitting in that banking sector chair, it ain't that bad either. Wesbank delivered, if you drill down segmentally into the FirstRand results, a pretty decent set of numbers under the circumstances.

The market is taking a serious watch and wait stance on global credit ratings agency's views on Msanzi and subsequently banks valuations, the discount that they trade at (relative to the market) represents the risk that they may have to raise more money. Worst case scenario, if we get a ratings downgrade. Banks hold South African paper and will need higher levels of collateral, I think I have tried to explain that as simply as possible. High single digit and low double digit multiples are not exactly pricing in anything terrible, and with a collective yield underpin of around five percent, Mr Market is erring on the side of extreme caution. Let us just say that in the last year there have been enough political dramas to keep a lid on any upside, I am guessing that collectively the stocks are a hold at best. Great businesses banks are, that is for sure, loads of customers and a captive audience. Not for everyone as an investment.

Stocks as a collective closed the session down nearly four-tenths of a percent, losers and winners in the top 40 were about even. Steinhoff bounced back after the sell off after their results, we will look at those below. Aspen as we said had a stinker, Mediclinic had a pretty poor session too, I struggled to find any specific reasons why. No big broker downgrades, no big healthcare announcements. Perhaps a big investor getting out. Part the currency I guess. A weaker Pound is better for them, a weaker Rand is better for them. Both of those metrics haven't been favourable recently. (Trading update out this morning after this was written, we will cover that on Monday.)

Across the seas and far away in New York, New York where Labor Day has announced Fall (Autumn to you and I, Labour to you and I) and a return to desks for traders and wealth managers alike, the mood seems to be first gear is good enough. We are currently stuck in traffic, volatility is low, so low in fact that many trader types are currently shorting volatility. The good news as old Eddy Elfenbein pointed out in his weekly piece this morning is that Q3 earnings should knock the socks off. Mostly healthcare and technology earnings are set to carry the S&P 500 earnings collective for the quarter to a record. That is good to see, and a long way from when financials and banks dominated the same said earnings a decade ago.

By the close the Dow and the S&P had lost around one-quarter of a percent, the nerds of NASDAQ were lower by nearly half a percent. The Apple release I thought was top notch, the watch is going to be big. The new phone is a thing of beauty. The big phone might attract serious photographers and Instagrammers. Or just grammers, right? Help me out young people! Apple ended up losing over two and a half percent. Sell on fact I guess, the stock certainly looks cheaper than most. The other tech related news was the announcement that Google (sorry, I mean Alphabet) was shelling out around 625 million Dollars to buy a business that we struggled to figure out exactly what they did or do. Apigee, heard of them? Thought not. It is that small that it didn't make the news segment on the investor relations site.

In other company related news, Wells Fargo has fired two percent of their workforce (over a number of years) for engaging in dodgy practices at the expense of their clients, opening many unauthorised accounts and then subsequently charging those accounts higher rates. By doing that, internally they met targets. At the expense of their clients of course, sis. The good news is that this was discovered internally and dealt with, the bad news is that it does very little to quell the fears of Joe Public over the practices internally. Wells has been dished a hefty fine by the regulators and will refund their customers who didn't know that they had these ghost accounts. Fail, big fail.

Company corner

OK, it is time that we review those Steinhoff results. Firstly, it is important to recognise the massive transformation of this business over the last half a decade, from Conforama in Europe to Pepkor across the globe, the company has been ambitious and has definitely pushed the envelope. Should that worry you? I guess that if one of the richest South Africans has basically thrown in his biggest asset in here and is the biggest shareholder, then he has done his due diligence. I am of course talking about Christo Wiese, who in his mid seventies has decades of retail experience. He has thrown in his lot with Steinhoff, Brait and of course various others that include Shoprite (of course), Invicta and Pallinghurst. To mention a few, there are more, that Wiese fellow is a warrior.

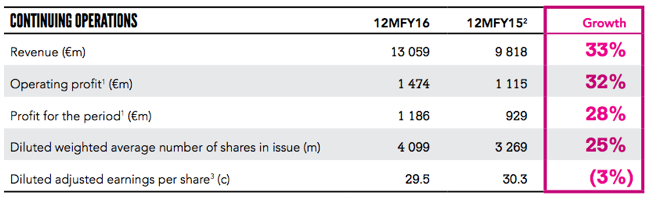

Straight into the numbers, from the booklet:

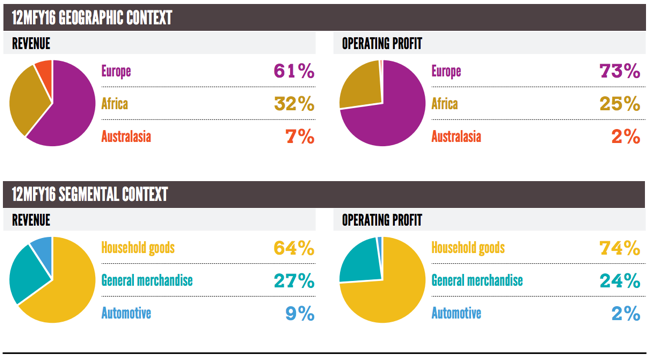

See that the shares in issue increased substantially, diluting earnings per sharer, which actually went backwards. The purchase of Pepkor is the share issuance (and dilution for you) and then the 17 percent devaluation in the South African Rand. Here is the geographical breakdown by territory and segment. It is fair to say that this is more a European business that sells household goods. And is most profitable in that geography and that business. Automotive, not good, 91 dealerships and 48 rental outlets, that is all.

Conforama sells mostly furniture and white goods (72 percent) in France (67 percent of sales). South Africa has the biggest store footprint in household goods, there are 945 (there have been aggressive closures this last year, 123 in total in Mzansi) Bradlows, Rochester, Russells, Sleepmasters, Incredible Connection and HiFi Corp. Conforama in France has 204 outlets with 738 thousand square metres of space. Phew, there are a lot of Pep stores in Southern Africa, nearly 2000. Yowsers.

The group never stands still. Recently there has been the acquisition of Poundland in the United Kingdom, Mattress Firm in the US, the intention is there to close that deal and make the company the largest mattress distributor in the world, and of course closer to home, Tekkie Town. Why so many deals? I suspect that they want to build something huge, borrow heavily whilst rates are low and acquire cheap assets in a time when prices are suppressed historically. We continue to own this business for the long run, management are hard running, the giant share holding by Wiese is a huge plus in my books. Checks and balances on the hard running management and the ability to tap a wealth of experience at the same time. Expect them to continue to buy and accumulate over time, as should you on weakness.

Linkfest, lap it up

The Hamilton project does some great research, here is a report they compiled on immigration given its centrality to politics at the moment. The basic conclusion is that immigration is good for the receiving nation partly due to increased consumer demand - Ten Economic Facts about Immigration. The data is based on the US but there are still points that are true across other nations.

It is great to see the creative ways that people come up with ways to recycle and lower pollution - Converting Air Pollution into Inks and Pigments for Artists.

It seems that holding a book and having the smell of paper trumps e-books - E-Books Are No Match for Printed Books (Yet). I think that the 65% of people who prefer books haven't read a book on a Kindle yet.

You will find more statistics at Statista.

Home again, home again, jiggety-jog. Those idiots in One-haircuts-ville have let off another nuclear bomb. And have even irked the Chinese. The Chinese need the North Koreans to behave, if integration happens, then remember that the "free" world would be on their border. Think about it, friends of the US on their border. It means that the Oros man with the bad "potty" haircut, a love for fine things and ruthlessness for his enemies is more than a "problem" for the Chinese. The biggest advancement of the idea of capitalism is the horrible socialist experiment wrecking peoples lives in the North and the capitalist South. Whilst the pressures of society in the South lead to high suicide rates (8 times that of Greece, double New Zealand) as a result of having to perform at such a high level, the freedoms afforded to people mean that they have choices.

Choices my friends means we can write what we like and say what we want. Choices means that we will be wrong a lot too, that helps us learn and evolve. If you cannot takes risks as a result of living in a country that has dog-show (some dog-shows are civilised matters) policies, you will never evolve. Capital has and makes choices that last a long, long time and have implications for all and sundry. Capital makes decisions for decades. If capital decides to go somewhere else, it quite simply does. The end. And there is nothing that anyone can do to prevent that.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment