Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. We added just over two fifths of a percent on the all share, resources were about in line with that, many of the Rand hedge stocks benefitted from a weakening currency. The "super Mario rally", or the "all the rage over Romney rally" or perhaps a combination of both was given the credit. The market perception that Mitt Romney won the presidential debate, and I think that is widely accepted was favourably perceived. My little theory on this is that Barack Obama is saving his gunpowder for later. He did not use the 47 percent gaffe, he never mentioned Bain, nor did he mention Romney's personal tax rate. He could have, and no doubt will if he feels compelled to. Fascinating watching a debate of that magnitude, where the stakes are very high.

The stakes are equally high over at the ECB, and yesterday Mario Draghi and the team were delivering their monetary policy announcement in Slovenia. In northern Slovenia. Look, the country is small, and has only 2 million inhabitants. But Slovenia itself is close itself to asking for a European bailout, they are creaking under the pressure of easy credit. I saw an interesting David Tweed piece, he is a Bloomberg TV journalist who travels around Europe. He made some good points about Slovenia. It is presently the first ex-communist state which is a fully integrated Euro Zone member. More recently Estonia and Slovakia were added. There was like in most places around the world a building binge and a credit party. One in three loans are thought to be dodgy. Ouch.

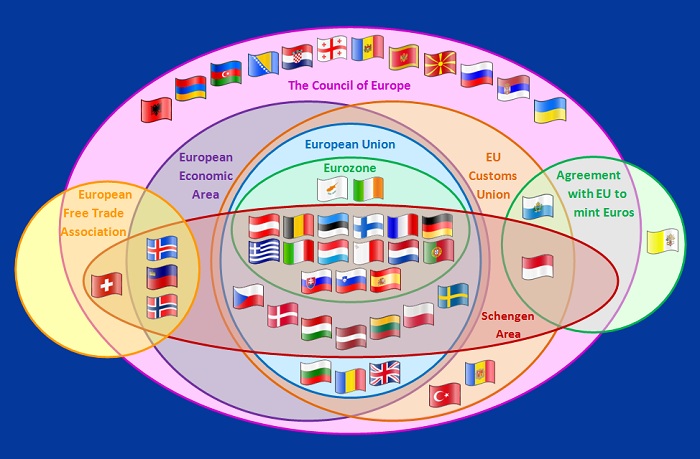

I know that there are many people who are still confused as to what fully fledged members are, who they are and who the zone members are who enjoy other benefits. And who the member states are who enjoy economic trade benefits. So I searched for a graphic representation, and came up with this one via Wiki: Europe explained in a picture.

This is of course if your flag recognition skills are up to scratch, as a kid all the flags fascinated me, so I was getting very excited when I saw this. Nerd. So what happened at the ECB conference yesterday? I followed it on the box, but in the aftermath was following the aforementioned David Tweed AND Silvia Wadhwa on Twitter. They are my favourites, you should follow them. Anyhow, this is what they had to say about the meeting yesterday:

First from David Tweed:

"#Portugal. Draghi said OMT only once full market access obtained. In Sept. he said available under existing programs when regaining access"

"IMF won't disburse its share of #Greek bailout if debt is not deemed sustainable or if others don't fill financing gap."

And then Sylvia:

"ECBs Draghi: decisions to embark on OMTs have helped to ease tensions"

"ECBs Draghi: gov council remains firmly committed to the singleness of monetary policy"

"ECBs Draghi: we are ready for OMTs as soon as all the conditions are in place"

That was during the ECB's Q&A session. There was a short interaction between the two of them, in which Sylvia said:

"Sometimes it feels as if they were making up the rules as they go along ... NOT very encouraging!"

And she is right. But I am sure that although it seems that way, the ECB is definitely not (in my opinion as someone who sits VERY far away from these things) as a crowd that is making it up as they go along. So what exactly did the ECB then say or do, because whilst these tweets give you a good idea of what they are capable of doing, did they actual do anything? The short answer is no. The long answer is yes, they are ready. And that means that the ball fall firmly in the courts of governments that need to stump up the money. And I suspect that all Mr. Market was looking for yesterday was confirmation that the ECB will act if needs be. And the conditions imposed on governments for accepting the funding? Those are not completely clear as of yet, but might be less harsh than originally thought.

In the meantime the Spanish finance minister has everyone's knickers in a knot as the suggestion comes from him that Spain does not need the money. Check this out: Spain Finance Minister's 'No Bailout' Remark Causes Laughter. Laughter, really? What happens if we have been led to believe that it is awful, but if in fact that Spain have done enough. What happens if he is right? What happens if this time next year yields on Spanish longer term debt are around 4.5 percent. And their interest payments are much lower. And the economy stabilizes? All I know is that the room of sniggering academics are going on their reading of the situation from what we have been fed on the screens. Surely if the politician is wrong then he deserves to be given the boot. I fear that I might be very naive, but something tells me that Draghi and his big stick waving might well be the finest central bank tactic we are likely to see. Be there. Wave your stick. We shall see.

Digest these links.

I found this link about one buck a day via Mark J Perry, an interesting business in New York. A phone away from home: Some NYC students pay private 'valets' a dollar a day. So, you hand in your phone, pay a buck, get a coupon and at the end of the day get your phone back. I thought nothing of it, entrepreneurial types, that is great for them to be able to make money and offer a service to high school students.

But when the article went on and said that they paid 180 dollars a year (for all the school days) I suddenly thought to myself, that is a lot of money to some people, one Dollar. How many people? This article sheds some light on the shocking truth: Dollar benchmark: The rise of the $1-a-day statistic. The statistical analysis suggests that there are far fewer people today who live on that amount than 20 years ago, but that is mainly due to the Chinese economic miracle. Sigh, if only government were quicker to liberalise economies rather than follow their ideological nonsense. We can get back to a billion a little later when we talk about Facebook, exciting!!

James Bond movies turn 50 today. 50. The first James Bond movie was Dr. No. Hands down for me Sean Connery is the coolest and most legendary James Bond of all of the 22 films, of which he acted in 6 of them. According to Wiki, only Roger Moore acted in more, 7 in total for him. So between the two they are represent more than half of the movies made. Over the last two decades there have been (including the latest one, premiering in just over two weeks) 7 films. In the first four years of James Bond, there was a movie every year. I suppose the franchise was fresh and the cold war was in full swing. Wiki says that box office total sales for the 22 films over the years has been upwards of 5 billion Dollars, with a budget of roughly one fifth of that. So clearly the franchise is very profitable. Profitable, {pause for a second or two} Very profitable. Austin Powers nailed it in that very un-PC line, "Men want to be him and woman want to be with him!"

Refi! Refi! Refi! The mainstream is starting to accept that the US housing recovery is in fact real. Which is important! Why? Because all that it means is that perception translates to reality. If you read in the mainstream news that the housing market is recovering, you are more likely to agree and act on the news accordingly. You might well refinance your own house and get the benefits of more cash in your pocket. Here are some more links to convince you, if you were not convinced before: LPS: Mortgage prepayment rates highest since 2005. And the improvement can in part be attributed to the Fed, thanks QE3 is already working, check it out: Mortgage rates sink to record lows.

"Things" in Iran are going from bad to worse for the economy. As this NY Times article: As Iran's Currency Keeps Tumbling, Anxiety Is Rising. Are they close to succumbing to the evil West? I have no idea, I do know that a stubborn bunch of any sort blames others. And rides the bad news for longer than you think. Evidence is everywhere.

New York, New York. 40o 43' 0" N, 74o 0' 0" W Today is going to be about non-farm payrolls (NFP). It suddenly struck me that whilst I despise the importance placed on this specific data release, I acknowledge its importance, both as an indicator of the health of the US economy, as well as future consumption, the poor fellows in Asia have very little to gain from NFP. Because whichever way it goes, traders out in that neck of the woods place their bets before the data. At least they get first dibs on it, come Monday morning. Of course they participate in the relevant futures and currencies markets, but the number is too far away. If you are a NFP junkie then expect around 110 thousand additions (consensus) and the unemployment rate to stay about the same, or rise to 8.2 percent.

Market rallied Thursday as the better than anticipated economic news started to pile up, making the recent run of disappointing data seem less relevant. I am not trying to sugar coat it, but again suggest that the US will be the leader in terms of the economic data. Factory orders were a slight beat, even though it hardly looked great, initial jobless claims were moving in the right direction. And the anticipation of a better jobs report after an ADP beat made Mr. Market feel better. The broader market S&P is now around 4 points away from a multiyear high, we are talking December 2007 levels. One third of a percent. Should the number today be a beat, it is likely to crack that mark. Like everyone, we partake in the excitement around the number, but we DO NOT trade it. Ever.

Some news from earlier in the session, just before the US markets opened was that there were One Billion People on Facebook. One billion users a month. If you follow the link lower down, then you will see the statistics, "Since Facebook launched, we've seen: Over 1.13 trillion likes since launch in February 2009, 140.3 billion friend connections, 219 billion photos uploaded" Wow. And then some interesting user statistics, "Characteristics of users joining the week Facebook hit 1B: The median age of the user is about 22; The top five countries where people connected from at the time we reached this milestone were Brazil, India, Indonesia, Mexico and the United States (NOTE: in alphabetical order); and Facebook now has 600M mobile users"

That is nice. One billion users, I am absolutely sure that every single business on the planet would love to know how many users they have. And I am guessing that in time, through platforms like Facebook, they will definitely know their customers better. If you think about it, Facebook knows more about you than any other advertising platform. More than the government knows about their citizens. So how much would you be willing to pay for all of that information? Well, 47 billion Dollars is the current market capitalisation. Or roughly 47 Dollars a user. That is what investors are paying. On a per revenue basis, with last years revenue of 3.7 billion, Facebook generates less than 4 Dollars per user in sales. And around 1 Dollar per user in profits, net income was a billion Dollars in the last financial year. You could argue that on that basis that the base is still very low, but at 44 times current years estimates and 35 times next years full year earnings, there is a LOT of work for the company still to do. The poor Zynga numbers post the market close are not a good outcome either, Facebook derives around one seventh of their revenue from Zynga. The initial excitement during the trading day turned to disappointment after hours with the Zynga numbers.

Facebook. Not for everybody as an investment, loads of issues with regards to monetizing their huge user base, loads of issues with regards to their mobile platform and a continued "free" service. You won't find pension funds holding these in any meaningful amounts just yet, and I say just yet because I believe their story and the prospects of the company look favourable. I believe that they will change the world, more than they have already. It is going to take a bit of time.

Currencies and commodities corner. The gold price took a dip this morning, but is still at elevated levels, last at 1790 Dollars per fine ounce. The platinum price is last at 1710 Dollars per fine ounce. The oil price is last at 91 Dollars a barrel, a massive session last evening. The Rand is getting a pasting. Well, not a big pasting, but the clearly poor news is lifting the Rand hedge stocks whilst the banks are getting all beat up here. The dust will settle, but I am not too sure at what level. We are up a percent here, testing the all time high levels again. Put your NFP goggles and flying caps on, it is going to be a fun afternoon. Byron is enjoying time off in the fairest Cape of them all, deservedly so! Except, the fairest Cape does not have the absolutely awesome weather that we are having here. Ok, that was a nasty sideswipe at Byron's weekend plans.

Sasha Naryshkine

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment