Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. The Rand caught a bid in a serious way yesterday. The currency that had been so talked about over the last few sessions and the weakening thereof found that the cycle had turned and the buyers presented themselves. I guess all of those that cried foul (fowl – yum) had jumped the gun a little. Although the reality is that we are nowhere near where we were at the beginning of September. Which is sad. The inflationary impact does not go away. The index movements were all bust yesterday, the JSE was having some or other problems, the short termers were having problems of their own not quite knowing where the levels were on a second by second basis. Round here, that did not really matter that much. The Rand hedges that had cracked on the pace in recent days turned tail and were sent packing. I guess one should be pleased, and I am.

Globally the mood seems to be souring a little, the same old questions asked about the European problems and solutions, the IMF global growth downgrade was certainly met with despair, but I suspect that we should not take the report: IMF Sees Heightened Risks Sapping Slower Global Recovery as seriously as others do. I mean, I know that they know what they are doing, but are they not often reactionary like the rest of us? I often see outlooks downgraded near the bottom and upgrades near the top, that is just human nature. Anyhow, like I said yesterday, I would prefer to listen to Jim O'Neill who is responsible for managing real money and making decisions on the future. And he reckons that people underestimate the recovery. Thanks Jim. I am with you. Or as they say in tall blue people language, people that live in trees, "I see you".

Meanwhile, just this morning I saw a tweet suggest that the economic outlook in South Africa is deteriorating. Who said it? Well, the suggestion from this fellow on twitter is that it was none other than our own Reserve Bank Governor:

And then shortly thereafter, "Steve", perhaps from *expletive* bank had this to say:

So perhaps the Rand will continue on the weakening trend just after the recent snapback in the last few days. I tried everywhere to find the news, but failed. Proving once again that twitter was better with the news, and quicker than everyone else, unless you paid top Dollar. Twitter is for free. For the moment I guess.

Iron ore prices have been volatile over the last 6 months. No. Let me rephrase that. They have been awful for the producers. Here is a very sad and short table:

That is about the worst of it though, Iron Ore prices have rebounded strongly from the worst levels reached at the beginning of September, up 35 percent to reach 117 USD a tonne. Read this -> Iron ore market may be closer to sweet spot. Both BHP Billiton and Rio Tinto are using this opportunity to lay off some of their highly paid (but not necessarily highly skilled) workforce.

Would you like to live in Newman? Check Google maps and let me know -> Newman, Pilbara, Western Australia. As per the Wiki entry, Newman holds a world record: "A privately-owned railway, the Mount Newman railway, was constructed linking it to Port Hedland which itself was upgraded to handle shipment of the ore to the world market. On 21 June 2001 a train 7.353 km (4.569 mi) long, comprising 682 ore cars and eight locomotives made the Newman—Port Hedland trip and is listed as the world's longest ever train"

We are deviating off the track here, a school and varsity friend of mine, let us call him by his common name, James and I were discussing Iron Ore prices yesterday. He works and lives in Brazil and is in the industry. I snarkily said to him that I thought Iron Ore prices were volatile. He then gave me a very long answer, which is worth a reprint:

- Quite predictable Sasha - they are restocking in China, they purposefully slowed their economy I think 5-6 times to prevent property speculation and everything that goes up and doesn't come down for a bit you have to be worried about - they are way smarter than the west who are propping up property, with ridiculous cheap money, which should all drop another 20%-30% to clean out the system with much higher interest rates. China is a long term investment and internal consumption play, as is Brazil.

40% of the high price margin Chinese iron producers are now unprofitable and in future they will be mining 15% Fe at US$140 per ton, many mines closing, how sustainable the price is over the very long term is the only issue. Iron ore demand still 4-5% per annum off a very high base. Takes a very long time to get into production and so many issues to attend to never mind capital and skills and labour and every other issue under the sun and then you often still have to worry about governments even in Australia nevermind Africa. Price US$110-US$130 medium term. Long term US$80-85 for 62% Ozzie ore into China.

Focus on the very high quality, low cost Brazilian iron ore where you have steel mills and pig iron producers close by too and a fast growing local industrial base, lowering logistics prices and costs and electricity charges and all supported by the extreme necessity for long term infrastructure with a rising middle class and a democratic government that has no option but to support big business which provides all the revenue for them in royalties and all the jobs for both the private and public sector and who understands this to some degree. The Infrastructure play in rising middle classes and replacing existing in the west (when they recover or which might make them recover) is still the most needed for the world regardless of what happens anywhere. If the price goes down buy, if the price goes up and it is still below its all time high, buy on caution.

I just answered him that I thought that he was right, the Chinese iron ore grades were horrible, and we would continue to buy the BHP Billiton story. I also said that recently Goldman had suggested that the Chinese were moving towards higher quality growth, consumption over infrastructural growth. I thought that was the end of that, but in typical fashion, this guy has more energy than most folks I know, always smiling, ALWAYS having a good time, he sent me another detailed answer:

- Spot on too, Sasha. I don't know how you keep ahead with so much information to digest. It is becoming a real art these days. China is definitely moving to a consumption based economy but like all great things this takes a long time especially when something like 350-400 million are still to move into cities and will need a house and a road first, to the house. Once they have the house, then they can think about the car and microwave and fridge etc. And before that they need a train to get them from the countryside to the new house!

Also depends what you define as investment and consumption, I guess too. Brazil is interesting as it's a consumption play already that is trying to be an investment play which will limit growth but has fewer risks than China (I think I am alone here in this thinking) and I think has a lot more opportunity but am on the ground and very biased as I see this every day. And China is an investment play trying to be a consumption play. Both need huge investments in infrastructure and both governments have reserves so you can spot what will likely happen - more government focused or incentive investments in water, roads, railway, ports, airports etc etc.

Industrialization in China will peak in about 2025 only, I think there will be a major crisis before then (war, real crash, possible new reserve special drawing rights or other currency etc) which could delay this to 2030 or longer. FMCG has too much debt and are too high on the cost curve for paying for their infrastructure. Look at others that are using their infrastructure or third party infrastructure and who are smart looking at Brazil now which is grossly underdeveloped and has 100 times more opportunities on a cloudy day and its mostly sunny here.

BHP is a safe long term bet. You make money by betting on the small ones that are thinking ahead of the mature majors. The next major mines, in my opinion, will be found by the hard working and well-funded juniors and this is where the real opportunities lie. Look at agriculture too - all those people have to eat and rising demand with less farmers, less arable land and more intensive meat based diets needing more hectares of dwindling land means prices will rise (some are still at all-time lows) and a focus on fertilizer, machinery associated, water management and supply companies all have a very bright future. Phew, now I need a strong Brazilian coffee! A good place to invest too!

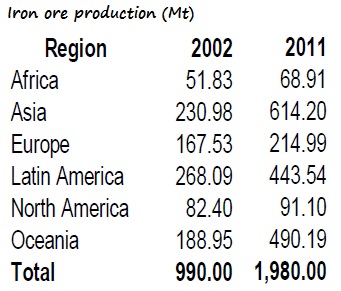

Whoa! I got so much more than I bargained for! But it was something that I was desperate to cover, the fall in the iron ore prices, and James who mines the stuff gave me his views as a smaller supplier. And he also gave his views on the future, which is always useful. Thanks! To end the conversation, here goes: China's Golden Retail, Tarnished Growth from the WSJ. Higher wages = greater consumption. In closing off, I think that it is very important to note one thing specifically, and that is how Iron Ore production has increased significantly over the last decade. No, it has exploded. This hacked table was sent to me by a friend:

And there somehow we have folks thinking that it was them doing something right! I often say that the whole DME/Imperial Crown Trading/Sishen/Kumba Iron ore/Arcelor Mittal thing would not have happened if the iron ore prices had stayed in the dumpsters, as it was for many decades. As ever we watch these things closely for further developments in the iron ore markets.

Digest these links.

With the European finance ministers giving the thumbs up to the ESM, the question around funding thereof still remains. I found this article, from a bearish (in my opinion) writer that I follow. No, he is an economist. This is very interesting: Will the European Stability Mechanism create stability or yet more instability? See those critical parts about the contributions from the countries. You might well ask, well how are Greece going to afford their contributions? Well, as Paul pointed out, that is how restructuring works, you borrow at better than before rates to pay your obligations. They would still owe the money back. Seems rather circular, but as we have often said, it is better to be in the Euro zone than out. Even though Angela Merkel received a two sided reception yesterday in Athens, welcoming from the officials and protests from the unions, just outside parliament.

Jack Welch has been taken to task about this tweet last Friday. So much so that he was obviously upset with the commentary from Fortune contributors that he decided to stop contributing there himself! I then stumbled across this article: How Much Trust Should We Have in Economic Data? As the article ends off: "There are some countries where economic data that comes from the government should be viewed with considerable suspicion. But in the U.S., there are too many people involved in the data collection and processing effort, and too many checks and balances, for this to be a worry." Quite right! This next piece from the Time business blogs points to Jack's own fudging, and why you SHOULD trust the data: Is the Obama Administration Juicing the Unemployment Stats?

Here Are Some Very Convincing Photos of the iPad Mini. I guess all the pictures tell you what you need to know, it is coming to compete with the smaller Nexus 7 as well as the smaller Samsung "phablets". Of course the margins won't be as good as the bigger tablet, the iPad, but perhaps that will attract a whole new bunch of new Apple fangirls/fanboys. This is concerning, but at first glance seems to be a good problem: IPhone 5 Shortage Spooks Apple Investors. As you can see, everyone is still talking about it, the iPhone 5 and not yet talking about the iPad mini!

Staying with US housing and the recovery, comes this from an RSS feed that I subscribe to: Consumer Attitudes on Housing Continue Summer Season's Gradual Upward Trend. There is a massive swing, in just one month: "With regard to the economy overall, 41 percent of consumers now believe the economy is on the right track, up from 33 percent last month, while 53 percent believe the economy is on the wrong track, compared with 60 percent the prior month. Both the right track and wrong track figures mark the highest and the lowest readings, respectively, since the survey began in June 2010." And as we often say around here, perception is reality. And if consumers are feeling better about the US economy, that bodes well for the rest of us. Pleasing, and again this is another sign that the US housing market continues to improve.

- Byron's beats is back. He enjoyed Cape Town. But said the weather here is better. Yip, you have the natural beauty, we have the naturally beautiful weather. Here goes:

Yesterday we had some good numbers come out from Yum! Brands for the 3rd quarter of 2012. In case you were unaware these are the guys who franchise brands such as KFC, Pizza Hut and Taco Bell (which is very prominent in the US and a big part of their growth plans). I have recently written about Famous Brands, a local operator with a similar business model so you should already know I like the theme of fast food restaurants.

Yum! have also been one of the more aggressive companies when it comes to infiltrating China. This has been very successful so far with up to 20% quarterly growth on a consistent basis and because of the higher margins in the region, up to half the profits have come from China in the past. Yum has about 18000 restaurants in the US compared to 4950 in China so you can imagine the growth coming from that region to have such an impact on overall numbers.

As expected same store sales in China have slowed to 6% but thanks to really good numbers from the US which also came in at 6% the company beat the street. Per share the company made 99c compared to consensus of 97c. This was up 19% compared to this quarter last year. Interestingly margins were increased by 1.9% even though costs have been rising globally. Analysts expect earnings of $3.27 for the full year. The stock trades at $66 and a forward PE of just above 20.

Why so expensive? This extract from their CEO David Novak should give some clarity.

- "When you add it all up for Yum!, we will open at least 1,750 new restaurants outside the U.S., further strengthening our leadership position in emerging markets. At the same time, our heightened operations focus and product innovation has driven much better performance in the U.S., with all three brands growing sales, margin and profit. We expect 2012 to be our eleventh consecutive year of delivering at least 13% EPS growth, prior to Special Items. Our consistent track record is evidence that Yum! Brands is capable of delivering strong double-digit growth even in the most challenging economic times. We expect this to continue as we build on our track record of at least 10% EPS growth in 2013 and well into the future."

I like the theme and I like the Brands. I especially like their huge focus on the developing market consumer. We are still happy to add to this stock at these levels although we do prefer McDonalds who are looking slightly cheaper at current levels.

Currencies and commodities corner. Dr. Copper is last at 368 US cents per pound, I guess the weaker Chinese news continues to weigh heavily on commodity prices. The gold price is slightly lower at 1761 Dollars per fine ounce, whilst the platinum price has dropped to 1662 Dollars per fine ounce. The oil price is lower at 91.66 Dollars per barrel. The Rand is flat, 8.72 to the US Dollar. We are about flat here. Not bad, not good.

Sasha Naryshkine

Follow Sasha on Twitter

011 022 5440

No comments:

Post a Comment