Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. Eventually there had to come a time where the recent hot rally would fade a little. Reasons? Well, worries, the same old ones, they are not really going away, they (the Europeans) are just grappling to get to a quick enough consensus. The European leaders and finance ministers are meeting in Brussels. In the wee hours of this morning, the FT reported that EU leaders strike deal on bank oversight. Which basically means that 6000 odd European Banks will report to a single regulator in the coming year. Months, something like that, by 2013. Not sure about you, but that sounds like more consolidation to me and moving in the right direction.

But yesterday stocks fell, some commodity prices felt the brunt of the sellers, the gold stocks sank heavily down nearly three and a half percent, platinum stocks fell over two percent, the sector as a whole, the Resources 10, they only fell four tenths of a percent. Banks sank a percent. We still of course have the strikes, suggestions from lefties on what economic paths should be followed leave me (with my capitalist tendencies) rolling my eyes. Meanwhile, the rest of the world is reading about us in The Economist publications main story for this week: Cry, the beloved country.

Alan Paton would be wincing now, using his book as the headline and the liberators being compared to old African regimes. Hopefully for all of us the story turns out with the title of Paton's last book: "Ah, But Your Land Is Beautiful". Anyone read that? I have already read (from their detractors) that the Economist is biased and bearish to anything that is not Anglo Saxon, by their own admission they got the future of Africa wrong, see in the same article. But sports lovers, unfortunately people reading the publication think something else, I can't change their mind. I can't change what the Economist writes about us. We can either continue to be combative or actually recognise that we have a problem, sorry ahem, a "challenge". I guess all quarters are talking. Well, some at least, I am sure on the Christmas card (if there is still such a thing) swapping lists Russell Loubser and Julius Malema won't find a one for one.

According to the ANCYL, "Mr Loubser is an uninformed and reckless loudhailer of the interests of white monopoly capital." Maybe. But perhaps that is not the truth. The PIC's largest client is the Government Employees Pension Fund, the GEPF. Who are, according to their website: "Africa's largest pension fund. We have more than 1.2 million active members, in excess of 300 000 pensioners and beneficiaries, and assets worth more than R1 trillion.". Whoa! So I suspect that many government employees contributing towards their respective pension funds have a large portion of equities exposure. Including many companies that the ANCYL is calling for the nationalisation of, Sasol, all the mining companies out there. So, what I am trying to say in a very convoluted way is that when you mess with peoples savings, the thinking is done with their heads. But often people do not know that they are affected by the negative sentiment until they are told that is the case.

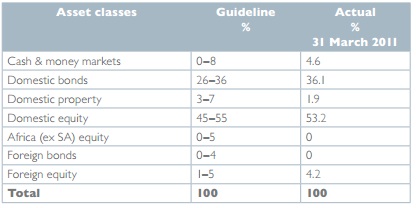

If you download the Government Employee Pension Fund | Annual Report 2010-2011, you will see the following table of page 73:

The next page tells you how many folks are reliant on Africa's largest fund: "The GEPF membership as at 31 March 2011 consisted of 1 242 258 (March 2010: 1 212 550) government and parastatal employees, as well as 345 492 (March 2010: 336 586) pensioners receiving monthly annuity benefits." Gee, I don't know about you, but if I worked for government and saw that most of my life savings were in local bonds and stocks it would matter to me how everyone perceived the place as an investment destination. I think that many people however would not connect the dots.

Because in the world of investing, the one that we are so interested in, we are a minority, a crazy bunch of people who eat and breathe this "stuff" as many might call us. But yet, yet, it impacts on all of us. So whilst some in government might not think that the negative perception towards South Africa might not impact on them, think again when you get your quarterly (or is it yearly?) pension review. Oh, why did it go down? The PIC owns 13 percent of Impala Platinum, which is down 9.18 percent YTD. The Government Employees Pension Fund owns just over six percent of Amplats, which is down 26 percent year to date. Of course many stocks have done exceptionally well too, we would not be at record highs if that was not the case. So, I am pretty darn sure that the PIC has done well for their clients, but you get what I am trying to say. We are all impacted by negative sentiment.

The only thing that I want, the ONLY thing is for everyone to have an equal opportunity. I want to see more entrepreneurs. Very often all people need is confidence and funding. The second part is more difficult than you might think. The fact that we are reading this means that we have better means than most of our fellow South Africans to implement our business ideas. Economic empowerment is hard, it starts with an equal education. Put me in charge for a day and I would trumpet education as the key to changing all of our fortunes. Sadly we are not exactly making fast enough progress in this regard.

- Byron's beats

Yesterday we received a trading update from SABMiller which are always very informative. Organic Lager volumes for the six month period grew 4% from the prior period last year. This was slightly below expectations of 4.4%. If you include acquisitions and disposals, volumes grew 9%. Organic revenue grew 8% thanks to price increases and an improved brand mix.

It's always interesting to see how these numbers look per region to get a feel for alcohol consumption growth around the world. Latin America came in line with the group, growing volumes by 4%. Europe grew volumes by 9%, maybe people there are drowning their sorrows? The Euro 2012 helped volumes along with strong growth from Eastern Europe. Volumes in the US declined by 1.9% but I think that might be a brand issue. I am told it is a very hard market to crack with huge competition from the micro brewers.

Africa grew volumes by 6% as the continent gets richer. South Africa which is reported separately from the rest of Africa only grew 1%. This was off a high base and was in line with expectations. Asia Pacific grew 5% organically, 17% if you include the Fosters acquisition. India was strong (23%), China was in line with the group (4%) while Australia declined (8%) but that is due to some once offs.

All in all the company is showing decent growth in a tough market but is it a good investment? Analysts expect earnings of 1890c for year end March 2013. That is not very far away, time is flying. The stock trades at R362.11 and a forward PE of 19. It would be hypocritical to call this one expensive if I rate Coke who are trading at a similar rating, has similar growth prospects, targeting a similar client, a buy.

But that is my point. We feel Coke is a much better alternative. Similar fundamentals but without the shadow of government regulation looming. Healthcare spend is increasing around the world but governments are not going to accept equal treatment of people who destroy their bodies drinking. Sin taxes, in our opinion, are only going to get higher. It is great way for governments to raise money while at the same time alleviating negative social behaviour. I wouldn't call the stock a sell and believe it will maintain this growth going forward, I just feel there are better options out there with less risks.

Digest these links..

The headline says it all: Jack Bogle: Forget trading, start investing. This is of course talking Jack's book, he was the founder of the low cost model for retail clients, the ETF. I agree with Jack, if you are not 100 percent interested in the equities market and must own stocks, then go the low cost model. In Joburg I always say to folks who are not looking to own stocks that they must go the Satrix route, forget managed funds. Satrix still attracts a fee, but it is much less than mutual funds. And lest you forget, mutual funds are trying to beat the index. So, you are owning the very thing that active guys with higher fees are trying to beat, why do many people still own mutual funds? And trade like crazy? It is one of those unanswered questions, like, why do people use Microsoft Windows instead of Linux, which is free? Because it is there, in your face. Jack's thesis lends itself well to our model, low cost and staying long the quality.

You remember that local guy who worked for Goldman Sachs? Greg Smith? I think that a couple of people around actually know the guy. Greg Smith Quit Goldman After 'Unrealistic' Pitch for $1M. Turns out that Greg was just like the rest of us, wanting more of course, because he thinks that he deserves it. Well, perhaps he will make that up in a few days time when he releases his book (this is often only natural) in a few days time, the 22nd of October. I for one have better books to get to, I shall give this a wide miss.

We continue to watch the trends: This Is The Biggest Economic Story In The World. All of the right metrics moving in the right direction, including loads of charts, thanks Joe, keep up the awesome work, he really has made a name for himself by doing what? Working hard, networking, staying ahead and just generally being out there. None of Joe Weisenthal's high profile comes through the work of others, it is all engineered by himself. The platform might have been there, but he used it. So much so that he was able to infuriate "the Nouriel" once upon a time. Nouriel who used to follow nobody on twitter, that has changed now of course.

Whilst Joe is a born optimist, and perhaps we wasn't spanked as a child as maybe "the man who predicted the financial crisis but did not quite monetise it" there are still signs that growth is going to be subdued. The massive drop in claims last week was met with Weekly Initial Unemployment Claims increasing sharply to 388,000. I think the important paragraph there is: "Mostly moving sideways this year, but near the cycle bottom. The large swings over the last two weeks were related to timing and technical factors, and is a reason to use the 4-week average."

I wasn't around in the markets back then, in 1987, I was at junior school, finishing up. Paul was at university, nearing an end of his undergrad degree and Byron was still wearing nappies, perhaps not even walking yet. We are talking about the crash of 19 October 1987, perhaps the last real crash. I came across this great piece from a Dash of Insight blog that does a really good job of both explaining and looking for LESSONS FROM THE CRASH OF '87. Great job Jeff Miller.

Google Inc. 1600 Amphitheatre Parkway, Mountain View, California That was plain embarrassing. From the company that is the king of search this is just downright wrong. On their website, Google says that their "...mission is to organize the world's information and make it universally accessible and useful." I guess that there is nothing about a timeous and orderly release thereof! It turns out that it might not have been their fault, but rather their filing agent released the results earlier than anticipated. That normally is not too big a deal, if the results are inline with Mr. Market's expectations, but these were a big miss. The early release saw a wild selling scramble and the stock was halted. The horror of it all. An embarrassment for one of the kings of tech.

The actual results themselves can be viewed via their investor relations page: Google Inc. Announces Third Quarter 2012 Results. They still have an enormous amount of cash, upwards of 45 billion Dollars, that still translates to 19.8 percent of their market cap, or roughly 138 Dollars of their 695 Dollar closing price yesterday. When the stock reopened for trade, with around 40 minutes of the session left the damage had already been done. At 12:30 the results were prematurely released, the stock was around 755 Dollars a share. 8 minutes later it was at 689 bucks a share. The trading halt was called just after ten to one local time. When the stock re-opened, the buyers stepped in and now, after the dust has settled the stock is back above 700 Dollars in the post market. Pre market. Whatever you want to call it, perhaps just the outside of normal hours market, sounds like a better explanation.

So what happened? I don't care about the release timing, why did everyone get their knickers in a knot about the results? Why did they miss by quite some margin? It is the issue that is plaguing all of the advertising industry, how to monetize the move to mobile! And it was not that people are not advertising online, the average price paid per click fell 15 percent in the last quarter, that was the main issue. Ad sales actually increased. This was a nice summary with a whole lot of videos, if you are interested: Google Under Pressure to Wring Sales From Mobile Users.

I found possibly the best analysis of everything Google, from the WSJ, Live: the Google Earnings Disaster. Not too sure that I agree with the headline. But don't get your knickers in a knot. On the conference call Larry Page said the following: "We have a policy of not talking about the future. I tend to be very impatient. I think that we're positioned very well and uniquely well because we have a significant fraction on mobile. That's a great start. We're working on changes, we've been investing in the space for a long time, our mobile monetization isn't zero. We've got a good base there and I don't think the things we need to do are that huge to get us in a very good spot. I think we have an opportunity to be higher monetization than where we are now with some innovation, which we're good at doing."

I think that Google are one of the few companies that can actually change the world. And that have changed the world. You need to search on something specifically, boom, you have that search device enabled either by them or a competitor in your pocket. No more do you have to argue about something at a restaurant table, you have the answers fully available in your pocket. Driverless cars is my recent favourite. Google have more than 8 million patents on the USPTO database. How cool is Google street view? Monetization of the internet is something that many people grapple with. I think that Google is going to continue to change the world. Think about it, PSY's Gangnam Style is about to go through 500 million views. I agree with this article: Opportunity in Google's Fat Finger. We think that this is a buying opportunity. Nobody even talks about the future advertising revenue via YouTube, which I use a whole lot more than many other people.

Crows nest. A few misses by some high profile tech companies this week, Intel, IBM, Google and now Microsoft. We have GE and McDonald's today. Byron pointed out that Eddy Elfenbein blog from today shows that beats outnumber misses in Q3 earnings by 3 to 1 so far. And we are just a little over one fifth of the way there. What?! Earnings beating expectations?

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment