Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. It was another mixed bag on Friday, with industrials and financials ending the session in the green, with resources dragging the overall index lower by 0.16 percent. The good news was that the truck drivers strike was over, the bad news was that there is a municipal strike pending. And then another piece of bad news was that we lost a plus. A what? We lost a plus as Standard & Poor's dropped our Foreign Long Term rating to BBB from BBB+ and put us on a negative outlook. More on that in a second.

In the meantime we continue to see the same problems in Europe met with solutions from the authorities AND we head closer and closer to US elections. As important as that event is, cast your mind back over the years and tell me how they panned out? Tell me, did the Bush or Clinton economic policies lead us to this point, or was it Greenspan, or collectively just people? What were the Clinton economic policies and how did he debate? Someone told me over the weekend (and he remembers, because he was living in the States at the time) that Clinton was not the FIRST choice for the Democrats. They thought that he might lose to the incumbent, Bush Senior. Because Ross Perot won an enormous amount of the vote as an independent. Nearly 19 percent. So, as important as the US elections are, the needle is just a few points from centre.

OK, what do we often say around here? Perception is reality. Think about it, if you live in Germany, what is your perception of the Greeks, right now? And think about it, what is the Greek perception of the Germans? Think about the sweeping generalisations that people make about other nations and other ethnic groupings that are not your own. They are based on your own assumptions that are formed as a result of generalisations. Because my overwhelming sense is that many people are attracted to the idea of a certain grouping of people acting in that manner. The most recent visible and high profile country bashing was the Borat movie, which immediately displayed Kazakhstan as a backwards looking place. Not that one should use the Olympics, but they finished pretty high up the medals table in London. In fact 12th on the list!

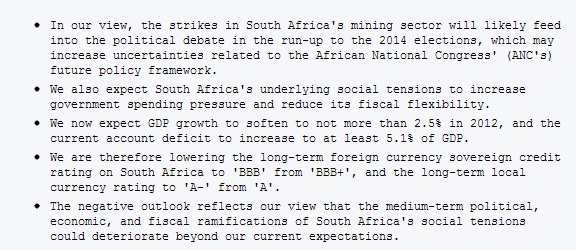

So where am I going with this? Well, and you are going to have to sign up for this, but it is free from Standard & Poor's: South Africa FC Long-Term Rating Lowered To 'BBB'; LC Ratings Lowered To 'A-/A-2'; Outlook Remains Negative. Not only does the rating change down a notch, but the outlook is negative. Here are the key points:

Those are the main points which are all fleshed out in the message. The main "fleshiness" we have talked about often in this message. The problems that the tripartite alliance has, trying to please everyone both left and right, and centre. And unfortunately you cannot carry on doing that forever. SO, you have to at some point pick a path. And the way that Standard & Poor's see it:

- "We see an increased likelihood that the ANC will take on board more populist elements for its policy framework in the lead-up to the 2014 presidential elections. In our view, it may try to counter the perceived loss in legitimacy of South Africa's political and social institutions, as well as ensure the continued support of the trade unions."

As ever, political persuasions of the ordinary South African are very difficult to gauge. Who, after all is an ordinary South African? Is it a new middle class entrant in the urban areas who works for local or national government? Or is it jobs created in the private sector? My only observation is that people change their political persuasions when it hurts them in their bank balance. That is the way I see it. How do you think that massive political change came about in Europe over the last few years? It was because circumstances changed, ordinary people started getting less benefits. Less benefits equals less votes. Let us try someone new! You could argue that the populist vote and economic path is bad for the economy, now how does that explain Hugo Chavez getting 55 odd percent of the vote? Particularly when the opposition candidate conceded, he did not contest the results. So surely the greater population's lives are much better under Chavez, but not everyone agrees with his economic policies and in particular, those that have money.

This downgrade represents the outside worlds view on ourselves, because if you read the main analysts, one is in Frankfurt and the other is London. They will advise their clients there. And if perception is negative, that leads to reality. Either people who pull their funding, or people who do not invest, who might have invested anyhow. I am as ever hopeful, that the recent warnings given by the folks who give the advice to the upper echelons of government, who are in the "inner circle" might well make those folks take more than just a passing interest. Although, the Finance Minister, Pravin Gordhan did say that this current downgrade was a surprise. Well, the more we see a paralysis in leadership, expect more of the same.

Digest these links..

Baron's cover story, Almost There is not one of the songs from Disney's Princess and the Frog (I have two daughters, I have to watch these movies), but rather about how the Dow Jones Industrial is closer than you think to the all time highs. In fact, only 6 percent away. All time highs or not, what was most interesting for me was the valuations. The article points out that currently the Dow Jones trades on a current earnings multiple of 12.6 times, back then (October 2007) the multiple was closer to 18 times. So what we have here is (not a failure to communicate, as in Cool Hand Luke the movie and the Guns 'n Roses song, Civil War) PE compression versus PE expansion last time around. Last time around, at much higher valuations, MR. Market was too optimistic. I suspect that the opposite is true now. Mr. Market is way pessimistic. And the problem with all those guys sitting in cash, is that they are waiting for a 2008 event again, to see the markets print another March 2009 low event. But stocks now are cheap, and even if they get much cheaper than now, I doubt they would go back to those levels. According to the analyst consensus on Bloomberg (via the Baron's cover story), the Dow Jones Industrial Average is trading on 11.6 times forward. Oh, and in case you missed it: Consumer Sentiment Graph. At the highest point since 2007. Hmmm.... makes you think doesn't it!

Often you hear the twin deficit problem that should keep the Dollar on a weakening trend for a long time, but also keep the gold price high. One of the reasons is in large part the US's size, and their reliance on big motor vehicles, and their oil consumption. Well there is some good news on that score, good news for Americans that is, as you can read in this article: America's energy bonanza: U.S. crude oil production reaches 17-year high in October, net oil imports are lowest in 20 years. Lowest oil imports, and highest oil production! That should start to make a dent on what is a very serious problem. Check out: Budget Deficit Again Tops $1 Trillion.

Conflicting messages, I read this from the Mirror in Germany: German Finance Minister Rules Out Greek Euro Exit and then I read this from Anders Borg over the weekend: Greece Will Probably Leave Euro Within Six Months, Borg Says. And then Christine Lagarde has softened her stance on the Greeks: IMF's Christine Lagarde backs more time for Greece. Huh? She is the person who incurred the wrath of the Greeks when she said that she cared more about babies in Niger than the people in Greece. We knew what she meant, she meant that the IMF has poor people problems and rich people problems.

- Byron's beats

Last year Sasol bought a 50% stake in Montney shale holdings from Talisman Energy for $2bn. The timing wasn't great. The gas price fell dramatically soon after the acquisition following a huge surge in production thanks to improvements in technology. This forced Sasol to take a big write down worth CAD120 million and depreciation worth CAD 171 million of these particular assets which obviously had a negative impact on earnings.

This is a catch 22 situation for Sasol however because at this stage they own an asset in a JV which produces gas but the long term idea is to take this asset as a supply chain for a gas to liquids production plant. For this process, the cheaper gas is in relation to the oil price the better the profits. This article titled Sasol closer to building multibillion dollar gas to diesel plant from Moneyweb has shed some more light on Sasol's plans in Canada.

The article says that Sasol have now secured a site in Alberta where the plant can be built. The plant is estimated to cost a whopping CAD10 billion and could only be ready by 2020. This is why I would imagine Sasol affords such a low valuation relative to its earnings. Even though they have access to this extremely exciting and potentially game changing technology the Gas to Liquids plants take a long time to build and are very expensive.

With time comes uncertainty. What will the gas to oil price be in 2020? Will oil even be such a sought after product in 7 years time? In the interim however the asset is still producing gas which is an energy source I believe has a lot of potential for future energy supply. And since Sasol took that huge write down the gas price has increased significantly. This could be earnings enhancing in the next reporting period.

Whether Sasol take the huge decision to build the plant falls to the highly regarded management. They certainly aren't rushing into anything and are still only in the feasibility stage. I would still expect oil to be a very important product in the next few decades and with the vast amounts of gas around the world and the ever improving technology I wouldn't expect the gas price to spiral out of control even if it does increase as an energy source. I fully endorse this strategy as Sasol continues to innovate and take advantage of its unique technological expertise.

Crows nest. This is a crazy busy week. As is every week I am told for the trader types! Some fellow I saw had six straight longs go against him, and then he said he was back to cash. It was a widely read post. The life and excitement of a trader, too much for me. We are higher here, driven mostly by the Rand hedge stocks. The currency has taken another leg down, thanks to Standard & Poor's.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment