Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. We managed to turn out gains for the day, banks were strong on the day, resources were not, the Rand remained steady which I guess was a bit of a relief. Industrials beat the overall market which ended with one quarter of a percent gains on the day. The finance minister, Pravin Gordhan (middle name Jamnadas), suggested that the currency will get strong again. PJG is in Tokyo, attending the IMF and World Bank meetings, which China have snubbed. Byron said, but I thought that we wanted a weaker currency to help our exports and to some extent protect us from cheaper imports, the minister is clearly worried. And as we pointed out yesterday, SARB governor Gill Marcus was in Grahamstown (my old town) speaking to students about the risks of strikes on the economy. Bad for job creation and bad for the economy. Both our finance in chiefs quite publically letting all related parties know that they are concerned. Everyone is concerned. I do not blame them, there are unintended consequences to everything.

This is related. I am on the mailing list for the monthly Adcorp employment index, the latest one I received in my inbox yesterday: Adcorp Employment Index, September 2012. At face value this looks very good. Adding jobs, woo-hoo, even if the pace is not that quick. "Employment increased in September, growing at an annualized rate of 1.61%. During the month the economy added 25,855 jobs, partly reversing the decline of 82,431 jobs observed in the four-month period of May, June, July and August."

But then you start getting into the nitty gritty of it all and find that jobs are being shed in the unskilled sector, but grown in the skilled sector. I suppose that is good news for the economy, but not so good for the have-nots in South Africa. I am going to try and pick up the pace here, I have started this segment weakly. The analysis segment, which is specifically focused on the recent events in the mining sector. That is the juiciest part of the message, because some of the statistics are really telling. I picked out some parts that I found interesting (for me) and posted them on Twitter. I can flesh them out more here, because we do not need 140 characters, we can do more!

- "To the student of history, nothing comes as a complete surprise. In this view, recent events at Marikana are not an occasional mayhem: they are just the most recent and suggestive symptom of an old and familiar rot.

Over the past year, wages including bonuses and overtime in the mining sector increased by 13.8%. By contrast labour productivity in the mining sector fell by 11.4%. The absolute gap between labour costs and labour's contribution is now 25.2%, the highest gap in recorded history.

South Africa's mines are responding rationally, by reducing their dependence on labour. Since the peak in 1986, employment in the mining sector has declined from 839 000 to 523 000, a decline of 37.7%. (Production levels were roughly flat.) Over the same period, mines' annual capital expenditures increased by 124.7% to R72 billion. The ratio of capital to labour – a measure of mines' capital intensity of production - has increased by 959% since the mid-1960s."

There are some important points in there. Capital responds rationally to increased costs. Mechanisation and shedding of humans is a reality. The productivity measure always sees the labour union rebut this observation from Adcorp. But their points are well made, mines have been investing heavily in the South African economy (somehow the socialists overlook that point) and not exactly extracting top rewards for those investments. To a large extent some miners have had the blows cushioned by a weakening currency and rising underlying metal prices. That has not really helped their shareholders out though. And as patient as shareholders are, this does not continue forever. Back to some of the other points though:

- "Trade unions are the most significant losers in this equation. Applying an average unionization rate in the mining sector of 80.3%, the loss of 316 000 jobs over the past 25 years represents lost union membership dues of R193.9 million in today's money. If the future is anything like the past, trade unions could lose 200 000 jobs in the mining sector over the coming decade.

Given these sorts of losses, competition between unions has become commonplace. Unions like the National Union of Mineworkers (NUM) have grown complacent under laws that heavily favour large trade unions and the miscellaneous distractions of the tripartite alliance."

So I guess what Adcorp are saying is that the dominant union has become complacent, but more importantly as a result of companies making cost savings in the form of labour, Adcorp expects the unions mining memberships to continue to shrink. That is the sad truth. And still I see that government continues to be combative to the sector. Uncertainty does NOT lead to further investment. Higher wages = less profitable companies, that equals less government revenue, directly anyhow. Indirectly the employees would be contributing to the fiscus of course, and if their wages were high enough (which it definitely looks like it), the employees would be direct tax payers.

But you must take a look at the interview done yesterday on CNBC Africa, September Employment Numbers in South Africa with Loane Sharpe from Adcorp. He makes some telling points, business is rushing to mechanisation across the economy. As Loane points out, in 1960 the mines employed 1.4 million folks, that has fallen to 500 thousand people. Plus also, if government wanted to meet that 5 million jobs target, they would have to see the economy adding 100 thousand jobs a month. Just to pick up the folks exiting schools and tertiary education, we would have to be adding 40 thousand jobs a month, we are still well below that.

And in their business, Adcorp? Well, as evil as labour brokers are perceived to be their order books have never been so full. Companies are hiring temporary staffers with fewer obligations and looking to head around the regulatory environment. Until that changes, until labour laws are less rigid, business will continue to disappoint the combative rhetoric from government and their alliances.

Digest these links.

At first it seems like a fairly innocuous story, right, unless you are a shareholder of General Electric? GE Starts Australia's Biggest Solar Farm to Power Seawater Plant. But then I thought to myself, the similarities between the Western Cape climate and Western Australia are many. Both get loads of sunshine, are pretty dry and could do with more water. And then I thought, well, if the biggest problem in the Karoo fracking debate is around water, then I have a simple solution. Why not obligate the companies inside of the first five years of production to build both desalination plants powered by both wind and solar energy to be pumped inshore? And to make sure that water, possibly be used for local agriculture, where the Karoo is strong already. What do you think of that idea?

I remember the haters! Yo! That was my lame attempt at being hip, my cool jeans that I wore to work yesterday elicited sniggers from my colleagues who perhaps believe that I am on the cusp, age wise, of pulling that "look" off. This next piece from the BusinessInsider has something to do with that, the haters and the coolness: CHART OF THE DAY: Instagram's Runaway Growth. Everyone was outraged that Facebook bought fresh air for a monster sum. Hey, they might not have got the mobile advertising "stuff" right just yet, but they certainly knew that people wanted to take more photos and post them. Byron often says that Facebook is a gloating place. But there you go, well done Facebook.

Not so well done Facebook, in fact the reason why the shareprice has taken a beaten over the last two sessions is this: Facebook Fought SEC to Keep Mobile Risks Hidden Before IPO. Look, all I can say is that all is well that ends well, but perhaps the early investors in Facebook will still feel horribly aggrieved that the secrecy issues that the company guarded so much, should have been a WHOLE LOT more transparent. Thank goodness for the regulators, another egg on the face of (the book) companies management: The Little Lies Facebook Almost Put In Its IPO Filing. I am going to say it over again, I still believe the company is going to change the world. Will they monetise that? Time will tell.

Ok, this is a short paragraph, but this article struck me yesterday: Beyond Our Means: Why America Spends While the World Saves. As we pointed out though last week, this is changing subtly, younger people are saving more and paying down debt more. You have seen that recently with regards to the refinancing numbers suggesting that people are not using their homes as an ATM machine, BUT refinancing to pay down their debt quicker. This is another reminder of how a crisis can impact on a generation, who might just return to their grandparents frugal ways. I even came across an article that suggested that being thrifty was the new cool. I suspect that we are somewhere in the middle of this.

Sometimes the news comes after the event. A couple of days ago I noticed that tobacco stocks had taken a bit of tap, I knew there must have been some government somewhere "doing" something, more regulation. Because governments apparently know best. But then I came across this story yesterday that made me say, aha, that is why: Health Ministry Seeks Tobacco Price Hike. Russia? Who cares? Well, my forefathers are from there, so I have some vested interests, although I am as Russian as Barack Obama is Kenyan. I doubt he speaks Swahili, I speak no Russian.

Losing ourselves here, sorry. The higher taxation has had a marked impact on tobacco consumption. And we will watch this closely, because if you thought this wasn't important, think again, Russia is the second biggest smoking country in the world. And it seems, according to this old(ish) piece that Russians have the cheapest cigarettes in the world: Tobacco Taxes in Russia. And I know that we have been very wrong about the industry as an investment over the last three years, but all the evidence is starting to stack up. I suspect it might take as much as five years for anything to make a dent.

More Signs of Strength in Housing: Does Bernanke Get the Credit? And who would have thought that people would have been using this as an opportunity to pay off their houses quicker? What a twist. Not those same folks who are famous for making mistakes associated with human behaviour. More good news: Ben Bernanke's Mortgage-Refi Nation. See, we referred to that earlier. Less ATM behaviour and more, let us crush this debt behaviour. All good signs for a longer dated structural recovery.

I chastised someone for being late yesterday with some news, because it was a "known" story that had been out there for a while. This story is "old" but of course relevant: CHINESE COMPANIES FREE TO EXPLOIT WORKERS IN ZIMBABWE. Old yes, from September. But sometimes I get the sense that we have this mentality that the Chinese would be more than happy to save the mining industry, if worst case scenario transpired. Last I checked the Chinese had around 27 people for each one of our own. And as this article above shows, the swopping only happens when worst case transpires, which leads me to believe that every nation has their bread buttered on THEIR preferred side. And the Chinese tolerance of a disorderly environment seems to suit them just well.

- Byron's beats

Earlier in the week we had half year results from a retail company called Holdsport. They own Sportsmans Warehouse (34 outlets), Outdoor Warehouse (18 outlets) and two performance brands, namely First Ascent and Capestorm which they wholesale across the country.

The company has only been listed since July last year after being offloaded by a private equity group. Since then the share price, like most retailers over that period, has performed well. After opening at R31 on the 18th of July 2011 the stock peaked at R50.50 in September this year before pulling back with the rest of the retailers now trading at 43.20. That is growth of 42% since listing.

Overall sales grew 9.9%. 10.3% growth from Sportsmans Warehouse, 6% from Outdoor Warehouse and 25.7% from the performance brands. Operating profit only increased 1.2% however because of some big currency adjustments and the influence of the Rugby and Soccer World Cups in the last reporting period.

Headline earnings per share came in at 143c for the 6 months but remember that the next period which includes the festive season is much bigger. In fact last year it was 50% bigger. Let's assume they manage to grow earnings by 5% considering that the rugby world cup at the end of last year raised the bar. That would mean earnings of 372c. The analyst community expects much more, around 440c. Trading at R43 the stock looks very cheap for an exciting retailer. PE's varying between 9.7 and 11.5.

Big sporting events come and go which may make earnings volatile. One thing for sure though is that they will always consistently happen. That is not where I see the growth coming from. The two performance brands are making big headway in South Africa. They are good quality value for money products. Internationally we have seen Nike, lululemon athletica and Under Armour take off, especially in the developing markets. It is a fast growing industry.

I also like the big concept retailer brands of Outdoor Warehouse and Sportsmans. It is a theme I really believe in. People want to be healthy and active. Heart disease is a huge killer and more and more awareness to be active and healthy is being created. It's a government priority while companies like Discovery also promote it. South Africa has a fantastic climate with many mountain ranges, forests, rivers and nature reserves. Not to mention our sports mad culture. We have a growing middle class where more and more people are entering the earnings bracket where spending on activities almost becomes a priority.

Risks include a weak currency (one of the reasons the share price has been taking strain), a weak SA economy and strong competition from the likes of Mr Price, Massmart and Foschini. Considering all these factors I would be adding at these levels.

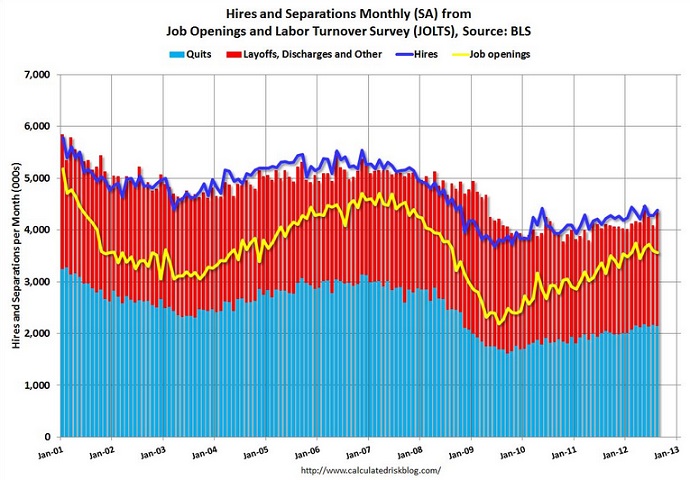

We have heard a lot about the US unemployment figure from last week. About that drop in unemployment, the sudden drop. There have been several explanations, but partly because the second survey, the unemployment number is a household survey. I quite liked this Ezra Klein piece: How worrisome is the rise of involuntary part-time workers? So they kind of figured that part time job workers are being hired for between 30 to 34 hours a week. I then stumbled across this Calculated Risk Blog piece: BLS: Job Openings "essentially unchanged" in August, Up year-over-year. His conclusion is the same as almost everyone that I read. Almost. I quite liked that chart of his, courtesy Calculated Risk:

The gradual improving trend continues. Despite all the pending rules and regulations that stand in the way of American businesses, or the perception thereof. Some folks are turning their labour force into temporary workers, so as to cut back their benefits. Huh? Well, because employers need to pay more medical benefits for their employees. Surely then you would just make sure that your employees are healthier when you hire them? Yes. Anyhow, slightly off the point, when I said that not everyone, this fellow is a staunch Republican, and free market type: The unemployment rate has dropped by 0.3% or more nine times since 1990. But none of them looked anything like last month's decline.

I like James (the blogger), but sometimes feel that he is a little combative. And I almost always say that when comparing the present with the past, bear in mind that technology has improved peoples efficiencies. The iPhone, the Samsung Galaxy, both companies tablets did not exist six or seven years ago. More productive employees means that you can have a smaller workforce. So at each and every juncture, the recovery or downturn is very different from last time. That is my view and I am sticking to it! I shall leave the conclusion to James New government report casts even more doubt on the September jobs data. He is going to continue on that line. I just hope that he does not tear his hair out when the incumbent (like I expect) wins the elections.

Crows nest. Spain has been downgraded, their debt, luckily for the citizens not their football team. Markets are again catching a bid, as in the Rand. Metal prices are improving. Globally the US futures are much improved after two days of bloodletting.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment