Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. Welcome to Q4. Yip, it is that late in the year. If you felt that you did not get a chance to do what you wanted this year, then you had better get cracking soon. Because the 1st of October is 275 days into the year, for a leap year that is, which 2012 is. 90 days to go. Wow. And the first day of the fourth quarter resulting in huge gains for the equities market, in part because the European PMI data was better and then buoyed later in the session by a better than anticipated US PMI read. Locally we had a less encouraging PMI read, which lost a whole 4 percentage points for the month of September, indicating that manufacturing is in a poor spot right now.

Session end the all share, boosted by a monster two and three quarters of a percent jump in the resource index, closed up 1.43 percent to 36269 points. I am still amazed by how "hectic" the moves are, and how skittish all the folks on the screens are. How can you have the same conviction alongside the same high levels of gloom alternating weekly? The European debt crisis turns three this week, and the sometimes glacial pace of action is why Mr. Market is skittish. I understand that the Europeans are working closer to integration, and because of many different languages and cultures involved here, agreement isn't always something immediately forthcoming. It is taking a little longer than the super hyperactive market wants. But rather than offer short term measures, the Europeans are looking for a longer dated plan, and as Ben Bernanke pointed out last evening, this is to buy themselves time. More on that in the shorts.

An announcement from AngloGold Ashanti's chief yesterday, Mark Cutifani, was rather sobering, but was something that we had been talking about for some time. Job losses in the mining sector as a result of South African mining houses shutting less profitable operations is closer than you think. From the release, AngloGold Ashanti update on unprotected strike at SA mines: "Clearly for South Africa's gold sector, as for many others, there is a very clear trade-off between investing in the sustainability of our business and not putting employment at risk. If the current unprotected strike continues, it compounds the potential likelihood of a premature downsizing of AngloGold Ashanti's South African operations."

A premature downsizing means that AngloGold Ashanti was always going to be a smaller business locally. The key point for me I guess was the following: "In a country where roughly one in four people do not have work, it is incomprehensible that strikers are engaged in activities that threaten jobs in a cornerstone industry that is central to South Africa's growth aspirations, and where wage rates are highly competitive as compared to other labour intensive sectors in the country." Again we have explored the issues around skill-set versus remuneration in South Africa.

The business have made it clear to all concerned. And like we have always thought, this means only bad things for our country. Fewer jobs, less export revenue, less economic activity, that cannot be a good thing. And instead of being concerned about the issue, government is worried about the numbers of people in the ruling party branch structure and who is going to win at Mangaung. That seems where the focus is. I cannot blame either the incumbent, or the pretender, as well as their various factions. The job of a politician is firstly to make sure that they get re-elected. And right now, it is a bun fight of epic levels. How I wish Mangaung was tomorrow. It amazes me how everyone talks about the ANC National conference of 2012 as a place, Mangaung. Well, at least we are all on the same page with that one.

Meanwhile, if you missed it: Moody's cuts ratings on S.Africa's Eskom, Telkom as per the Reuters story yesterday. So I went along to the Moody's South Africa website and I was struck by the headlines in the top right hand corner. The Rating highlights of the rest of the continent. You might have to read them a few times to let it sink in properly. I took a screengrab:

What do you see there? Mauritius and Angola getting upgraded, that is what I see. Now, with all due respect to those countries, we should be heading in the same direction as them. But we are not. We should demand that in some way heads should roll. But we shrug our shoulders and shake our heads at the ratings agencies, blaming them for their ineptitude in the whole financial crisis.

You are going to have to sign up for a Moody's account to read the full release, this one is for the energy producer specifically: Moody's downgrades Eskom to Baa3 following sovereign action; outlook remains negative. It matters to all of us. Because what it means is that Eskom has to fund their expansion at higher rates, who is going to be expected to fit the bill for the unexpected difference? Go look in the mirror to answer that question.

- Byron's beats

When Richemont released their full year results in May this year they indicated that they were sitting on a about 1.6bn Euros in cash. Over the last two weeks we have seen two acquisition announcements from the company neither of which are big enough to have an effect on earnings but definitely worth noting, especially as an indicator of where the company is going and their confidence in the future.

The first announcement was the acquisition of US based, international luxury apparel business.

- "Founded in 2001, the Peter Millar line embraces timeless elegance using only the highest quality materials. With a studio and design centre in Raleigh, North Carolina as well as business operations in Durham, North Carolina, Peter Millar is one of today’s fastest growing and most sought after brands in the lifestyle apparel market. Global distribution includes North America, Europe, Asia, Australia and the South Pacific. For more information, please visit www.petermillar.com."

- "the acquisition by Richemont will position Peter Millar for its next stage of development and growth."

So I had a look at the website and the products look good, very much focused on an active, quality lifestyle. Especially golf which I know has and is still ballooning in Asia. Take a look yourself, maybe you will end up buying something! It looks like the kind of aspirational consumer product we like. Richemont are not as focused on clothing but through their Net-a-Porter online site there has been more focus on this business. We back management to pick out the right brands to fall under the very impressive Richemont umbrella.

And then just this morning the company announced the acquisition of a high end watch manufacturer called VVSA.

- "Based in Delemont since 1962, VVSA is a high-end manufacturer of stamped exterior components for watches, gold refiner and producer of semi-finished precious metal products destined for the watch and jewellery industry. A historical partner of Richemont's Maisons and Manufactures, VVSA and its 250 employees will reinforce the Group's industrial capabilities via their established technical know-how and state-of-the-art equipment."

This looks like a classic example of economies of scope, buying the manufacturer you normally outsource to in order to cut costs.

Most importantly these acquisitions remind us that the company is still happy to be investing and confident in the future demand of luxury goods. From looking at their past numbers throughout all the turmoil of the last four years it is hard not to trust this judgement.

Digest these links.

I was quite excited when I read this news: MTN commits to LTE rollout in 3 SA cities. Remember that you read just the other day that Vodacom plan to do the same, rolling out their 4G offering by the end of the year. Don't get confused, 4G and LTE (Long Term Evolution) are for all intents and purposes the same thing to us the consumers. And what does that mean for Telkom? Well, they are just going to have to lower their prices, or offer something more compelling on the speed front. And right now I cannot see that happening. Also, remember that Telkom had their debt rating downgraded yesterday by Moody's. The one thing that I cannot confirm is what handsets will be able to access these super speeds.

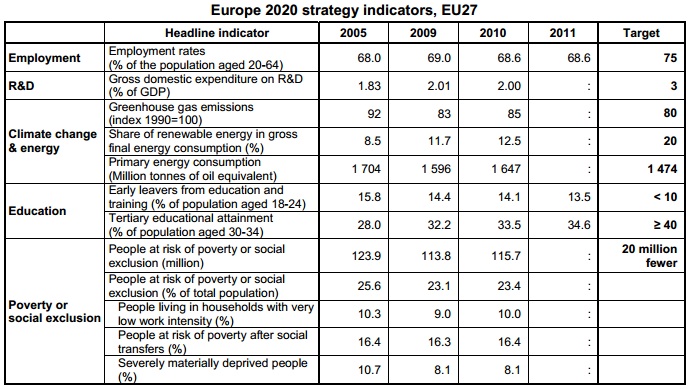

Yesterday I was struck with two releases from Euro Stats, firstly Euro area unemployment rate at 11.4%. That sounds awful, but it is stabilizing at that level. And then alongside the same release came another one that hit me even harder, because I had to have a little chuckle. Past trends and latest data for the headline indicators of the Europe 2020 strategy. I took the most important screengrab from the release, well the one that I thought was important anyhow:

See how in the Euro zone there are more people employed over the last twelve years, more people educated, less at risk from a poverty point of view and better absolute employment rates. 2012 will be a testing year, but without a doubt this leaves me believing that they are heading in the right direction here. And also important are those targets to improve further. Europe, struggling now, but making progress. This link however suggests that the uphill struggle is still exactly that: Why the Euro Crisis Is Nowhere Near Being Over. It might not be over, but it is closer to resolution. At least I think so. Oh, is Greece still in the Euro Zone?

You remember the Matt Taibbi article about comparing Goldman Sachs to Vampire squids. Remember? Here it is if you needed a reminder: The Great American Bubble Machine. I laughed yesterday when I came across pictures of the Not-so-Fearsome Vampire Squid via National Geographic. I reckon Taibbi should have used another creature. Not too sure which one, but the Vampire Squid looks cute(ish). I would not eat their diet though.

This is neither cute, nor is it good news. Black Monday in Iran: Free fall of the rial. It turns out that if the rest of the world does not like you, that could have serious implications, not immediately but it of course creeps up on you. And my only point is that when you hurt people in their pockets, they get more desperate. Ironically we could see another repeat of the protests that we saw in Iran several years ago. The New York Times has a similar article, longer: A New Sign of Distress as Iran's Currency Falls. Not good for ordinary people, inflation is the scourge of the poor.

New York, New York. 40o 43' 0" N, 74o 0' 0" W Stocks slipped away from their best levels, spoiling a good start for the bulls. A decent enough start to the rally, which was buoyed by better than anticipated PMI reads out of the European region. In particular people quite liked the fact that the Italian number was showing signs of improving, BUT perhaps the good news was that Spanish banks need less than originally thought. That almost always turns out to be the case, humans overshoot on both sides, their sentiment pendulum swings too far right or left depending on where the CURRENT sentiment sits. Psychology is definitely not my thing. And I cant tell the balance of the market how to respond to whatever situation, the market is the very best aggregator in the short term.

I was very pleased with the September 2012 Manufacturing ISM Report On Business, which was quite a wide beat. What was really amazing was the part "what respondents are saying". That was interesting to get an idea that the recovery is not broad based. And hence I guess that is why the Fed have decided to embark on more quantitative easing. More on that from Ben Bernanke last evening, who was very funny, at least I thought so: I'm a baseball fan, and I was excited to be invited to a recent batting practice of the playoff-bound Washington Nationals. I was introduced to one of the team's star players, but before I could press my questions on some fine points of baseball strategy, he asked, "So, what's the scoop on quantitative easing?" Remember at all time to ask your questions first.

Read the speech, because actually, loads of people liked it. Other than the references to Milton Friedman, but that was not actually in the speech but rather in the Q&A segment. Here: Five Questions about the Federal Reserve and Monetary Policy. Nice summary for all us sports fans!

Currencies and commodities corner. Dr. Copper is last at 376 US cents per pound, higher on the session. The gold price is slightly higher at 1779 Dollars per fine ounce. The platinum price is last at 1670 Dollars per fine ounce. The oil price is better at 92.64 Dollars per barrel. The Rand is slightly weaker. But we have started strongly again here.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment