Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. Boom. We had a huge day yesterday. Up nearly a percent and pretty broad based. I almost got the sense that everyone shrugged as Spain had their debt rating cut to one notch above speculative grade, it was almost a case of tell me something I don't know. In the first part of the session Italy managed to auction some government debt at not too bad a rate. More on that in a second. The real kicker later on in the day was a US weekly jobless claims number that came in much lower than anticipated, but the head scratching started immediately. It seems that one state, and perhaps a very big state (nobody said, but some suspect California) showed a drop in applications rather than a rise. Those readjustments would show up next week and everyone would be OK with the number then. It couldn't happen at a better time for Jack Welch, because he is going to say that he told you so. His record at GE is not very good, he was the master of "smoothing" earnings. Yeah, if anyone knows about manipulation, it is Jack.

Wow. OK, I have been reading quite a lot of subscription only content (sorry) that is less than flattering about ourselves. And of course I know that money managers make decisions a little more hastily than most, but sometimes the longer term money (the one that really stares through the haze) is a little more sticky than most. That money has made a multi-year call. For instance, you heard Mark Mobius say "Africa is a continent many investors bypass, but from my perspective as a long-term investor, I think that's a mistake. South Africa has faced some struggles recently, but I think they can be overcome, and a brighter future could be ahead there for its people.", in this piece titled: Will South Africa's Struggles Overshadow its Potential? Their South African connection recognizes all the problems and issues that we have as a country. So do we.

But as I often say, perception is reality. So don't look at the present strike action as an isolated incident. In South Africa we are aware that labour has a strong say, and this is for reasons related to the suppression of labour in the dark days when South Africa was a pariah state. So you can appreciate why the labour laws in this country exist. But I can remember when the headmaster, I mean the ex-governor of the Reserve Bank and ex minister of labour, Tito Mboweni once said something off the cuff at an MPC meeting that he wished he hadn't made labour laws so rigid. Dinkum, I remember that from way back then. So perhaps the labour laws gave away too much power in the hands of the employees and not enough power in the hands of the employer. But I understand that they needed to protect a worker that had been exploited for years. Decades. Centuries actually.

But, that perhaps is not going to change soon, not whilst the labour movement, or the main one anyhow, is a partner in the ruling alliance. For me that is possibly the biggest reason why we see paralysis at the upper echelons of government. I can't think of another political alliance in the world that has such divergent economic views. Can you? Communists and capitalists in the same alliance, no wonder it is difficult to make a decision. Notwithstanding that, I was reading that cabinet and government are serious on this issue: Cabinet grasps at crisis control. It seems unfortunately that the seriousness of the situation has once again come late to the attention of the leadership. Well, can you blame the senior leadership structures in South Africa? There is a party election in two months time, that is important too.

But let me get back to that point about perception being reality. Because in the publications that I read the news is littered with bad headlines for us. First from the FT, you know, the Financial Times of London (what-what) with headlines like: SA gold producers extend strike deadline from last evening and South Africa loses out on wall of money. The second story tells how we are losing out to our fellow African economies as people look for further growth prospects, and a more worrying sign from the outside (something we knew internally) is that the president is painted as a CEO who is only answerable to an ANC board. The president himself expresses this view anyhow. This FT article is from a week ago: S African unrest puts off foreign investors. I am not urging you to read all of them, just to be sure to note that international investors read the FT.

Another publication that folks in my industry read is of course the Wall Street Journal. This very long and in depth piece is something that I do urge you to read, published late in the "journal" last evening: South Africa Falters as Unrest Spreads. Sadly there is not too much that flatters us in there. Again, if you are sitting in Chicago, or Charlotte and you wake up this morning, and log in to the WSJ and read this story, how likely are you to draw a line through a possible investment in the country? Probably likely. BUT, and I think that this is possibly true of all of us, when you make a longer dated investment based on your destination, you have already factored in bad news like we have now. I am glad that government recognise their role in leadership finally, after having been "absent" for a while.

Italy, how bad is the debt?.

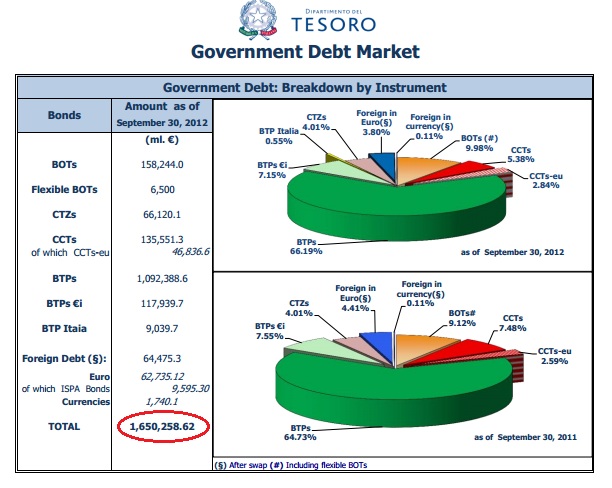

I thought to myself, what is the extent of the outstanding debt in Italy? They have been going sideways from an economy point of view for years, but their debt has actually been piling up. Check out this graphic that I found via the Italian Treasury website > Government Debt Market. This is total debt outstanding, a whopping 1.65 trillion Euros:

So the Italians might be very indebted as a nation, but on a per capita basis, they are actually richer than the Germans. Richer even than the Americans. Now you might be forgiven for falling off your chair, BUT, they have built up that wealth over the centuries. The Romans once ruled the world. Italy has some amazing history. That all adds up to something, right? Of course. Check this oldish piece out: Wealth levels in Italy, Germany and the US.

Wiki says that there are 60,813,326 people in Italy. The debt outstanding is 1,650,258.62 million Euros. Or 27136.45 Euros each, every man, woman and child. When you put it like that, it does not actually seem like such a big number. Taxes and others revenues are around 47 percent of GDP according to the CIA factbook website. The problem in Italy however, is that they are not that good at collecting taxes. And the underground economy is shady and HUGE!! There was a blog that I came across with all sorts of useful statistics: Italy's Well-Heeled Poor. See that!! "For a start, 42.4% of the 42,000 luxury boats in Italy are owned by people who say they earn less than 20,000 Euros a year!" Whoa!!

But it turns out that Mario Monti might just be the guy to solve the decades old issues that plague Italy. If you read this piece: Super-Commission to Combat Corruption in Italy, you can see that cost of corruption in Italy is as much as 60 billion Dollars a year. Over a decade that would wipe out 36 percent from the outstanding government debt. I think that if you spelt out the numbers for the human beings of Italy. Mario, time for some fireside chats with the people of Italy, to explain the seriousness of the situation. No time to start working on solving the problem like the present, and even the other day, the ex prime minister of Italy Silvio Berlusconi suggested that Mario Monti stay on in the pending elections. Each and every problem is solvable.

- Byron's beats

There has been a fair amount of negative press concerning Apple over the last few weeks. First there was the Apple map saga which required a formal apology from CEO Tim Cook. This would have had Steve Jobs rolling in his grave. And now there are talks of production concerns, a fall in demand for the iPhone 5 in the US and some issues with the iPhone 5 cover. This has caused the share price to pull back more than 14% from its recent highs.

I came across this article yesterday titled Apple $1000: Why it's time to buy which takes a detailed look at the fundamentals behind the Apple numbers and the share price. There are some interesting graphs which show how the average PE ratio has been on a constant decline even though the share price has been growing. Here is an extract which makes a compelling point.

"Meanwhile, Apple is busy selling every iPhone 5 it can make and has already suggested that it plans to sell 50-60 million iPhones this quarter which would drive EPS up to nearly $20.00 or 44.2% higher than the year-ago period. Yet, instead of breaking out above $700 a share in an effort to stay ahead of P/E compression that will surely hit the stock once Apple reports earnings, Apple has tumbled 12% off of its highs. Apple is setting up to repeat what happened in January 2012 and it seems a lot of people are just sitting there twittling their thumbs."

I am in full agreement. We have often commented on the endless possibilities for this company with their integrated approach and massive customer base. That is still to come however. At this stage the focus is on their current hardware business, namely the iPhone, iPad and Mac computers. According to the article Apple plan on delivering more iOS devices in the first 2 quarters of 2013 then they will the entire 2012. This should see a huge profit increase even though heavy capex has been pushed towards delivering so many goods so quickly.

We think it is absolutely ludicrous that a company like British American Tobacco can afford a higher rating than Apple. Not only is Apple defensive because of its brand domination but it is innovative, exciting and changing the world for the better. In the long term I believe this anomaly will change.

On this basis I would certainly be taking advantage of this pull back. If you have accounts with us in New York and have some cash from the constant dividend flow give us a call and we can add some Apple shares to your portfolio.

Crows nest. JP Morgan beat estimates and the shares are up in early trade. US markets sold off all through the session with the Dow Jones ending from top to bottom off more than 100 points. Oh, and if you needed someone to believe, Jamie Dimon said that housing had turned the corner. Excellent!

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment