Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. Globally the itchy feeling of US markets being closed was taking its toll on the liquidity in markets, although that does not really impact. There is that old Warren Buffett quote that goes something like this: "I never attempt to make money in the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years." This is strange, because as much as he never attempts to make money in the stock market, he is the person who has made the most for himself and his shareholders. The translation of one person that I saw suggests that you must confuse the ticker with the company. And another piece that attempted to decipher what the Oracle of Omaha is saying: "Only in the stock market can one acquire a piece of a company for a price that one would never ever be able to negotiate in a private transaction." True. But I think all that Buffett is trying to say is that you must be sure that you can own this company for five years and never be able to sell it. Seeing as technology moves so fast, that explains his reluctance to invest in businesses that can change dramatically in five years. Got it!

Our market locally added one third of a percent collectively, financial services sank a percent and a bit, gold miners lost half a percent, mining stocks added nearly half a percent, whilst banks added one quarter of a percent. Platinum miners lost three quarters of a percent, Anglo American Platinum was offering returning to work once off payments, as well as loyalty payments to those that worked through the wildcat strike and a borrowing facility for those who wanted it, repayable over six months. And still, there is tension in Rustenburg, police are still maintaining their presence there. People try and predict who will be the next in line at Anglo American, Chris Griffiths was one name that I heard, Mick Davis was another. Although the chairman, John Parker, said outright that he is too expensive, and there is no love lost between the two as I understand it. I asked the question, do we need a South African to run what is essentially a non South African business.

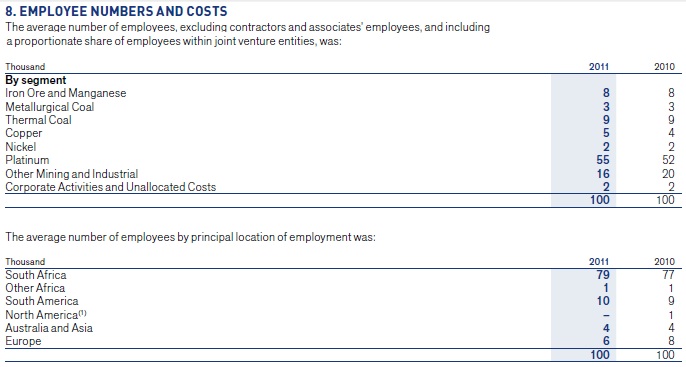

What do I mean by that? A non South African company? Well, I am referring to the part that politicians miss more than anything else, who the owners of the business are. Quite quickly, as per the 2011 Anglo American annual report, the platinum segment (including minorities) is 20 percent of group revenue, but is only 4.5 percent of group EBIDTA. But wait, this is the most important part I think, South Africa represents 44.5 percent of 2011 underlying group earnings. But more importantly, out of roughly every 100 people that Anglo employs, 79 are employed in this country. It is there in the annual report. This is important, I hacked an image to show you, this is taken from page 143.

I guess then it is easy for civil society and the employees to believe that the company is South African. But as you can see, 55 percent of the workforce is within a couple of hours drive from where we sit here. Check out the South Africa - Bushveld Complex map as per the Amplats website. I promise that this piece has a conclusion. When I said non South African business, I meant that the shareholders were not mostly South African.

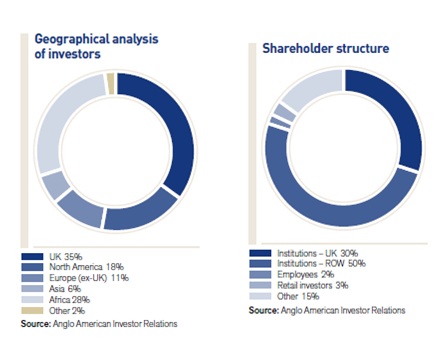

But that part is not as easy to find as I might have thought. On the Anglo American website, they list 5 shareholders as at Feb 2012 who own more than three percent of the company. BlackRock (an American investment company that operates globally) owns 5.97 percent of Anglo American. Black rock, as at 30 September, according to their website manages 3.67 trillion Dollars worth of assets globally. They are bound to own a little of all big companies. Legal and General Group Plc, a group which manages 388 billion Pounds worth of client assets as at 30 June 2012 (from their website) owned 4.03 percent of the company as at the end of Feb this year. Two entities, Tarl Investment holdings and Epoch Two Investment holdings hold 6.75 percent of the stock, but don't vote it. Why? Well, they are the entities that have bought back stock on behalf of the company. I also said, WHAT? The other significant shareholder is the PIC, which owns 5.86 percent. Add these five shareholders up and you get to 22.62 percent. Only one South African shareholder effectively? I finally got my old mate to find it, what a legend, he did. Drumroll:

See that!!! Nearly two thirds of Anglo American shareholders are either from the UK, North America and Europe. Those people actually own the business. As a business owner, you have a right to appoint the best person for the job. And if the best person happens to be South African, to take the business forward, then by all means, choose that person.

So, who should be the new CEO then? The rumour mills are already running at full steam. But as Ron Derby at BusinessDay points out: Platinum is the big problem for Carroll's successor. A note that I read this morning still suggested that the stock was expensive relative to their peers. In fact, the note said that the stock was a sell. These notes are always to be taken with a pinch of salt, but the suggestion is that the unbundling of Amplats is unlikely (too complicated really) and costs at Minas Rio are likely to be short of 7 billion Dollars and first ore shipped over two years behind schedule. As we have said many times, we prefer BHP Billiton.

Staying with platinum and problems (sorry, I mean challenges), Lonmin have announced a rights issue this morning. The details of which are not available just as of yet, the company said that they would follow in due course. This announcement comes along with a quarterly production report and a medium term plan to get to 800 thousand ounces of production by 2016. Download the results here: Fourth Quarter 2012 Production Report and Update on Lonmin's Future Strategy. I did a simple calc, Lonmin has a market cap of 964.5 million pounds, which translates to nearly 1.55 billion US Dollars. 13.4 billion Rands. And the rights issue? 800 million Dollars. It is a whopper. I only want to know one thing. Xstrata, who potentially will have to pony up 200 million Dollars as a nearly 25 percent shareholder, what do they think of this?

Listen in closely here. How do you listen to a newsletter? I suppose you can if you get the software. 203 million shares in issue. I did a quick search and came across a Guardian article that suggested that Xstrata have an average entry price of 19.79 Pounds, for 440 million Pounds apiece for the second tranche. That was for the 22.2 million shares to increase the Xstrata stake from 10.7 percent to 24.9 percent. That second tranche was announced on the first of October 2008. The initial purchase was announced 6 August 2008. On the same day, Xstrata proposed that Lonmin shareholders take cash of 33 pounds a share (in Joburg it topped 500 ZAR on that day) and they could own the whole company, check it out: PROPOSED CASH OFFER FOR LONMIN PLC ("LONMIN") OF £33.00 PER SHARE.

Imagine what a colossal mistake that would have been, and what a gigantic score that might have been for Lonmin. My word, I found an old Lonmin SENS release from 2 September 2008: "Therefore, the Board has no hesitation in rejecting Xstrata's entirely unsatisfactory approach which fails to reflect a proper value for the assets and prospects of Lonmin and the synergies from which Xstrata's rather than Lonmin's shareholders would benefit. We continue to explore all options to maximise value for our shareholders."

I don't want to nitpick, BUT on the Lonmin website, those releases ARE NOT linked. Not at all. The telling of Xstrata to get stuffed has been documented in a dumbed down way. Try and click on the 2008 - Press Releases from 7 August, 13 August and 2 September. Yeah, I would also forget about those. Xstrata's stake is worth less than a quarter of what they bought it for. They could have turned a small fortune into an even smaller one. The share price is responding favourably, with the debt "issues" being sorted for now. That is another story entirely. The stock is below five pounds a share if you wanted to know!!!!

- Byron's beats

Everyone is talking about African Bank, well in my world anyhow. Clients, along with ourselves have had to be very patient with this one. Yesterday the share price had another tough day falling to 2835c, touching on levels it reached during the financial crisis. We have written extensively about this one. If your memory sometimes eludes you or you just happened to miss your favourite daily read due to some extreme circumstances, click on the link below which will steer you towards a whole host of links. Share reports for African Bank.

So far this year we have written six articles about Abil and have referred to the company on many other occasions. I spoke about them when I covered the Capitec Numbers and just yesterday Sasha alluded to the micro lending environment whilst covering Nedbank. He had deciphered that the entire Micro lending market in South Africa was equivalent to 71.4% of Nedbank's book (the smallest of the big four banks). Just to put things into perspective of how small micro lending still is in SA.

Fundamentally the stock looks ridiculously cheap. According to Sharedata who have pooled 6 analyst estimates, 2012 should see earnings around 354c, 2013 of 422c and 2014 of 511c. That puts the stock on forward multiples of 8 (2012), 6.7 (2013) and 5.5 (2014). Historically the company has a strong dividend policy which should see yields above 8% in years to come.

So why has the stock crashed while the fundamentals look so good? Sentiment beyond 2012 has decreased, especially from foreign investors who are/were big holders of the stock. The market does not believe the company will meet analyst expectations. Beyond the strikes, their exit from the top 40 and foreigners exiting, the biggest dampener is talk of a micro lending ''bubble''.

African Bank is the biggest micro lender in the country and is entirely reliant on micro lending for its earnings. Ellerines only contributes 12.5% to income from operations. So whether there is a micro lending bubble or not is the biggest question that needs to be asked.

As Sasha pointed out yesterday comparing the entire micro lending market to Nedbank's book, people underestimate how small the base we are coming off actually is. Our economy is very unique, mostly due to our political past. We have a massive informal sector who cannot obtain credit any other way. Before the country was liberalised more than 80% of our nation struggled to obtain any credit at all. The demand for credit, especially amongst the recently liberalised is way beyond the supply. These factors along with the implementation of the national credit act meant that the micro lending environment was abnormally small.

The massive uptick we have seen in recent years was purely due to banks increasing the supply, seeking higher returns due to increased regulations on secured lending following the financial crisis. Keith McLachlan, the renowned small caps analyst, suggests in this article titled Brief look at Unsecured Lending, that this uptick was in fact required in order to reach a sustainable equilibrium for micro lending in our credit market.

People are worried that there is a bubble because of the unnatural growth we have seen. But in my opinion this is because micro lending levels were unnaturally low. Yes this growth will slow and yes we will see a rise in defaults. More loans means more default risk. But at the end of the day it is all about earnings and return. African Bank are more than prepared for what the micro lending environment has in stall. Trust me, they know more than anyone else about this world and even have to share advice with the regulators on a regular basis. The share price has priced in an explosion which I think is over exaggerated. I'm not saying a rerating will happen tomorrow but for the patient investor like ourselves this is a strong buy.

Digest these links.

Markets are closed again in New York for the day Tuesday, as the "Frakenstorm" passes over an enormous area on the East coast of the US. The size and scale of this storm is pretty mind blowing, I am a bit surprised that a storm came so late in the season, but then I checked Wiki and the suggestion was that storms can happen all the way through to the end of November. September is the most active month for the Atlantic hurricane season, May is the least active, reminder if you ever want to go to the Caribbean.

What I was surprised to hear was that this two day closure was the worst weather related close for the New York markets. In fact this is the first weather related close of the NYSE for 27 years. As far as I can tell from what I have read and seen, a blizzard back in 1885 stopped the financial centre for two days. Back then however, New York was not the financial capital of the known universe.

Name attributable to the late Mark Haines, who famously used to introduce the CNBC morning show, which starts half an hour before the bell as "Live, from the financial capital of the known universe" which was expanded on from "...financial capital of the world". I came across this piece from Forbes: 10 Memorable Events That Closed The NYSE. Last weather event, hurricane Gloria back in 1985. Don't tell anyone, but that is my mother in laws name. I never knew they named a hurricane after her.

The census is out! This was quick, by South African census standards. If you want to read the whole thing, yes, the whole thing, download it: Census 2011, statistical release. Eskom need to change their 49 million line, the total number is 51,770,560 folks. That is an 11 million jump since 1996, wow that is pretty big. And where do those people want to live? Gauteng province. Which now has 12,272,263 people. In 1996, Gauteng had 18.8 percent of the countries population, in 2011, it had 23.7 percent. That number is ticking up all the time. Urbanisation at work here folks, because Gauteng is small, according to "Percentage distribution of land area by province, 2011, Figure 2.1" Gauteng has only 1.4 percent of all the physical land area in South Africa. So, 23.7 percent of South Africans live in 1.4 percent of all the space in our beautiful country. Haha!! Yes, we are pretty nuts here.

Paul said that the outcomes, bar for the growth in number of orphans, which is a direct result of HIV, is very good, he feel proud to be a South African. And of course too many poor immigrants, which is not exactly highlighted in this report. Those are the two noticeable problems. Hey, but it feels good to be a Gautenger, even if the Currie Cup went to some part of the country where they can't remember when last they won it. As someone said: Breaking, all flights to Cape Town cancelled for a week as massive dust storm from opening the trophy cabinet for first time in a decade.

Crow's nest. Markets closed in New York again today. That sucks again. As Paul said however, expected spend on Halloween related paraphernalia is 8 billion Dollars. That takes place tomorrow.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment