Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. We were driven higher yesterday by the broader resources sector, there was a giant jump in a second tier platinum producer, RB Plats, but that was right at the end of the day, the last trade! But it was for half of the volume of the day, a strange and rare occurrence. I can't say that I read anything untoward, perhaps the price will adjust back today. It has in fact, down 12 odd percent today. Over in the US there were company results again, this time marginally better than folks anticipated. Heavyweights Boeing crushed expectations, AT&T had a marginal beat, Kimberly-Clark was a slight miss.

Tupperware was a miss, or so the Bloomberg earnings calendar told me, that must mean that less people are taking lunch to work, they must be eating out! Ha-ha, that sounds like strange logic, or at least that was what I thought. Then I checked the conference call and they seemed to come out above the top end of the given range. Confused. And then I thought, well, I don't really care that much for Tupperware other than that I use the product, we have no investments there, explore no further. There was a slew of PMI data out of Europe, none of which I can say, bar for a French Services PMI read that beat expectations. As such the mood across the European financial journalists was a little glum.

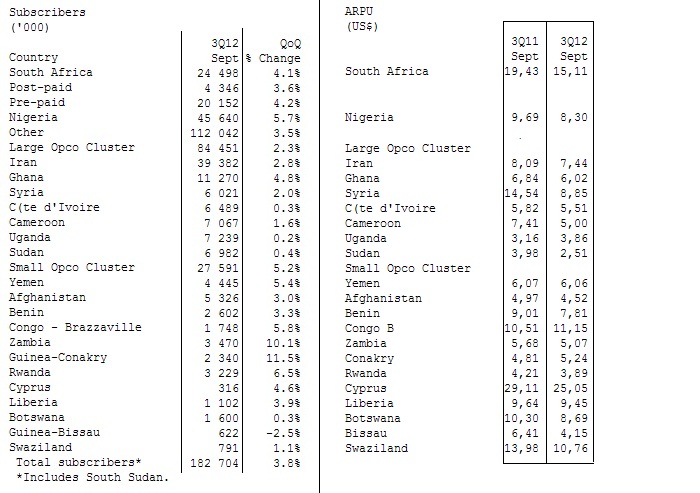

MTN released their quarterly subscriber numbers this morning, and they managed to increase subscribers by 3.8 percent quarter on quarter to 182.7 million folks. Due to a more solid than expected last quarter, the company has raised their subscriber guidance for the full year by nearly two and a half million subscribers to 23.7 million additions. A rather bland looking Official Announcement- Thursday, 25 October 2012, MTN quarterly update is available via their website. But I am a glass half full guy, rather some information than none at all, not so? Yes. I hacked the release and have posted this table, which I think provides you with all the information that you need:

The ARPU's continue to fall in Dollar terms, in Syria the impact of the civil war has had a monster negative impact, but strangely they still managed to add subscribers there. It feels just plain weird to talk about the impact of a civil war on a business, but this has always been the reality of investing in this company. Many of the places they operate are not places high up on your holiday destinations list. But, they are places that the company does business in. I have this long standing debate with my uncle on Facebook about MTN operating in Iran. My argument is that if it is emancipation that he wants, communication is the best way to bring about long lasting change. He says be careful, the company is going to feel the brunt of the US. What does help him making up his mind is that he is American you see, but I certainly hear his point of view.

That being said, I am guessing that the Dollar ARPU's presented to us by MTN are at the official exchange rate and not at the deflated rate. Nigeria, Iran and then South Africa is how the pecking order goes, as far as subscribers are concerned. There is only one other country with over ten million subscribers and that is Ghana, with 11.270 million subscribers. Amazing. But that (in Ghana) is out of a total population of 24.3 million, so you can quite quickly see that MTN has a position of dominance in that geography, possibly one of the most exciting countries on our continent. Political law and order, property rights and upholding the constitution has meant that by most global measures Ghana has made more progress than any of their African peers, bar for Mauritius. Arguably, you could say on the "mainland". More recently oil reserves, which are amongst the largest on the continent (fifth in fact) have been managed properly. Bright future I think for that country, still poor by global standards, which means that there are still many possibilities.

In their biggest geography, in terms of subscribers, Nigeria, MTN was able to maintain their market share whilst it seems like there is an aggressive pricing from all parties, most through promotions. Billable minutes, just for the month of September increased by 24 percent against the prior months. So what is happening here? More people are talking more at cheaper rates as the competition hots up. Data continues to grow, but feel for the mobile users up there, they still have to use 2G networks, which as MTN say are congested as a result of more folks making calls. MTN continues to improve and upgrade their existing infrastructure up there, imagine when the internet starved get real speeds and better handsets. We still maintain that data has a long way to go on our continent, and in MTN's territories.

We continue to buy the stock. The Iranian standoff with basically the rest of the developed world and their hostility towards many others does place MTN in more than just a little bit of a pickle. It is a very serious situation. I did read however that Iran was again ready to talk about their nuclear ambitions. This remains the only sore spot on what is a very bright future for this company still. I like them a lot and with Sub-Saharan African growth to top global growth for the foreseeable future, this is a luxury item spend in many emerging markets. Cheaper smartphones are already making their way into this market.

Today is the medium term budget speech that will be presented by the minister of finance a little later today. You will be able to find it later on the Treasury website, not yet uploaded, but at this web destination: Medium Term Budget Policy Statements. I am pretty sure that your favourite stations will carry the broadcast. From what I have read, "investors" are looking for the same old prudence that the ministry has been hailed for, and guidance in reducing the budget deficit over the coming years. Both of these critical issues will be difficult to address, in light of a deteriorating economy locally and also that of our major trading partners. So, this is not going to be easy by any stretch. Secondly, there is pressure on government to ramp up social spend, I am all for that, the problem however is the resources to go around are scarce.

- Byron's beats

This morning Anglo American released their production report for the third quarter ended 30 September 2012. I promise I am not being lazy here but the overview from the release really does summarize it all very well so I will do a copy paste and then we can analyze it in more detail.

"Overview

Solid operational performance with production increases across five of the seven commodities

Kumba Iron Ore production increased by 14% to a record 12.5 million tonnes, driven by fasterthan planned ramp up of Kolomela mine. Kolomela is expected to produce at least

7 million tonnes in 2012

Export metallurgical coal production increased by 12% to 4.5 million tonnes

Export thermal coal production from South Africa increased by 10% to 4.6 million tonnes

Copper production increased by 12% to 157,300 tonnes, reflecting the full ramp up of the Los Bronces expansion project

Nickel production increased by 38% to 9,000 tonnes, with production from Barro Alto offsetting the lack of production from Loma de Níquel in Venezuela

Refined platinum production of 649,000 ounces was flat, while equivalent refined platinum production decreased by 6% to 626,300 ounces. Production and costs were adversely impacted by illegal industrial action which caused production loss of 42,000 ounces of equivalent refined platinum in the quarter

Diamond production decreased by 31% to 6.4 million carats, largely in response to market conditions and the Jwaneng slope failure

On 16 August 2012, Anglo American completed the acquisition of a 40% shareholding in De Beers from CHL Holdings Limited for a cash consideration of $5.2 billion

On 24 August 2012, Anglo American completed the sale of a 25.4% shareholding in Anglo American Sur to a Codelco and Mitsui joint venture company for a cash consideration of $2.0 billion

During the quarter, Anglo American issued corporate bonds with a US dollar equivalent value of $2.3 billion in the US and European markets"

In the latest results release the company made 50% of its profits from Iron Ore so let’s look at that one first. 14% is a solid increase bringing in 12.5 Million tonnes. Again the faster ramp up of Kumba’s Kolomela mine having a positive impact. In Fact Sishen production decreased 7% due to quality constraints which means Kolomela was vital in this growth. The strikes took place after the quarter end so we will see the 2.2Mt of lost production reflect in the next quarter. That is much bigger than I thought.

Minas Rio is still sucking cash. They say that production could begin in the second half of 2014 but the expected capex of $5.8bn is being revised for a further increase. Some analysts reckon the number could be close to $8bn. Ouch.

The better quality higher margin metallurgical coal grew 12% from this quarter last year. The Brownfield project in Queensland Australia is making good progress.

Copper which was responsible for 26% of profits in the first half showed some decent growth (12%) thanks to Los Broncos growing 84% off a low base.

Platinum decreased 6% to 626 thousand ounces which already saw the affects of the strike action which started on the 18th of September. Expect the numbers to be heavily hit in the next quarter. The company states that 96,300 ounces lost production is the figure for the next quarter. They also state that due to the strikes there will be an 8% increase in unit costs just for this quarter. It will probably be worse in the fourth.

The big dive in Diamond production is obviously not good, especially when they cite demand as one of the main reasons now and going forward. They have just forked out $5.2bn to buy the rest of De Beers.

This production report again reminds me why we buy BHP Billiton. There are so many issues here. Especially with the iron ore asset in Brazil. They have long ago reached a point of no return there while it keeps on sucking money. Not to mention the strike issues in SA, a forced sale of a very good copper asset in Chile and no exposure to energy (other than coal). In a world of choices we will stick with BHP.

Ben Bernanke and his merry band set about telling us the same stuff that we knew already in the FOMC statement yesterday, 2012 Monetary Policy Releases, October 24, 2012. Two lines to pick out immediately from the release: "economic activity has continued to expand at a moderate pace in recent months" and "the housing sector has shown some further signs of improvement, albeit from a depressed level" are encouraging. Inflation however recently has picked up, but long term inflation expectations remain stable. OK, so employment is not expanding at the rate that the Fed, or anyone for that matter would like either.

The Fed are going to continue their ultra low rates through to mid 2015 and continue their MBS buying programme, you know, the 40 billion Dollars per month in order to keep rates low for households, who can then refinance and have more spending money in their pockets. As they say, don't fight the Fed. I shan't. And you shouldn't either.

I keep making the point that when top line growth resumes, then companies will possibly be in the best financial shape that they have ever been. Ever? Well yes, back after the US second quarter company profits had hit an all time high, on the best margins that companies had reported post world war two! BUT, wages as a percentage of the overall economy in the US had hit an all time low. All time means since world war two ended, that is since the measurement ended. As at the end of the June quarter, companies globally had nearly 5 trillion Dollars on their balance sheets. From this piece: What to do with all that cash? Nothing I am guessing that number continues to rise each and every quarter.

What also perked my ears up was that the state, the individual and federal government debt had fallen significantly. By ten percent since 2006. The numbers are eye popping, but the debt reduction overall has been nothing short of amazing. Check it out: Total US Debt at a Six-Year Low. So, whilst the central government continues to rack up debt, individuals and at a local government level and businesses de-lever. I still think that like Warren Buffett, on a five to ten year basis that there will be a stronger than anticipated recovery.

Crow's nest. We are higher again here, having crushed it through 37 thousand points again. Locally, we know what to watch, from 2 to 4 pm. Across the globe, the results continue, none bigger than Apple. Apple reports after the market tonight, these are important results for the company that recently seems to have lost their mojo a little. And there is also the small matter of a US durable goods report.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment