"58 billion Dollars worth of sales in 90 odd days is amazing, net profits of 13.6 billion for the quarter is even more amazing. That translates to 2.33 Dollars per share. Gross margin improved to 40.8 percent from the comparable quarter (Q2 2014) last year, where it clocked 39.3 percent. Forget the strong Dollar, which has been the flavour for the reporting season thus far, 69 percent of Apple's sales are beyond the US borders. Meaning that only 31 percent of their sales are mainland US. In fact, for the first time iPhone sales in China were bigger than that of the US"

To market, to market to buy a fat pig. Although I do not like holidays encroaching on work time, I do believe that yesterday, Freedom Day is a special day for our country. I think that every year I tell you my boring story of how there was no queue when I voted in the 1994 elections, I voted a day early at the embassy in Maputo. On the 26th. There were three or four people ahead of my parents and my sister, that was it. No excitement, singing or dancing. I must admit that I felt empowered in some strange way, I was a little nervous doing something that 19,533,498 other people did that day. That is according to the Wikipedia entry South African general election, 1994.

It is pretty amazing what can happen in that time, from one election to the other, the African National Congress ended up with 62.65 percent of the vote in 1994, the National Party (now defunct, dissolved in 1997) got 20.39 percent of the vote, whilst the Inkatha Freedom Party got 10.54 percent of the vote. Fast forward to May last year, the African National Congress got 62.15 percent of the vote, the DA got 22.23 percent of the vote, whilst the EFF came in third with 6.35 percent of the vote. The Inkatha Freedom Party is still around, although 2.4 percent of the vote now tells you that the support base has waned. According to the Wiki entry that sources the information from the IEC, 18,654,457 people voted (out of a possible 25,381,293) at the last elections.

I wonder why 26.5 percent of registered people do not vote? Why do they feel that their vote carries no weight? It is a question worth asking. You should take the time and effort to vote, it is something of a leveller and the right to vote was hard fought for. And more importantly won. If one of the minorities could win over 6 million odd people, it would make a HUGE difference to the political landscape here in South Africa. For all the parties concerned, even in the incumbent. In the case of the political landscape, it moves very slowly when there is economic stability. See the recent changes in Europe? Those have been as a result of ordinary citizens lives getting worse. Nobody changes the status quo when there is economic stability. Next year we have the government elections, we can see if anything changes, I suspect as usual, not too much.

Back to markets, away from the most important of South African days. What is happening out there? For one, the Greek negotiating team has been changed, or tweaked: Euro gains as Greece revamps bailout negotiating team. When the money runs out, the situation gets real. This boosted the Euro, the Dollar rally is seemingly running into a few headwinds with weaker than anticipated economic data giving the Fed more wriggle room. In other words, expect interest rates to stay lower for longer. Whilst we have seen a serious recovery in equity markets, many middle income households in the richer parts of the world have not felt it. And whilst the recovery has been good for asset prices and I suppose that most middle income people have savings, they perhaps do not have the same savings power as richer people.

The imbalance debate between the haves and the have nots, and what is the best way to address this is never going to be solved. I want everyone to be rich, it ultimately depends on a few things, first and foremost being born into a middle, upper middle class and rich family gives a you tremendous starting point. Better nutrition leads to better brain development. If your parents are hungry, the chances are that it will impact on your early brain development, giving you less of a chance later in life. If you have richer parents, the chances are that you will go to better schools, better tertiary education, and have a more stable environment in which to develop and nurture skills. The gap closes as soon as society as a whole gets richer. Enjoy the freedoms you have, be they earned or inherited, or both. The chances are that your life is much better than your grandparents and the chances are excellent that your grandchildren will have a much better life than yours.

US markets closed the session lower, down four-tenths of a percent for the Dow Jones, the nerds of NASDAQ, notwithstanding a strong result from Apple ahead of their earnings (see below), were lower on the session. Courtesy mostly of the biotechnology companies, there were some big names that were sold off heavily. Cast your mind back to Friday here locally, we reached another set of records for the overall market, up nearly a percent to close above 55 thousand points. Resource companies were driven higher by increasing iron ore prices, BHP Billiton indicating that they would perhaps defer some production. That is the first of the majors to give guidance on that. The stock, BHP Billiton is trading close to a monthly high in Aussie and in London, off a little for starters today.

Company corner

Apple. Just wow. Their last quarter once again blew estimates away. In truth there is only one risk to their business and that quite simply is a superior product. A superior product to theirs that is adopted with the same uptake of their flagship product, the iPhone. Out there, there could and might be a better product. What it lacks is the adoption and more importantly, the ecosystem. What I mean by that is pretty simple, the ecosystem of Apple draws you in. It is evident in the company numbers, away from the iPhone itself. Mac Sales, a device on which I am writing this message, are set to grow 10 percent this year and continue to take market share away from their peers. Sales in China of Mac units grew 31 percent in the last quarter, when the rest of the PC market went backwards! In total, the company sold 4.56 million Macs, their old flagship product.

You don't really want to know about that. You want to know about the iPhone, the new 6 and 6 Plus. I have one, I have recently upgraded to a 6. And whilst I read articles that bemoan the fever pitch excitement as unnecessary, in terms of getting a new phone every two years, the design features and improvement on my last phone, the iPhone 5, is something to behold. The speed, the clarity, the size, the response times, just when you think it cannot get MUCH better, the design team at Apple, led by Jony Ive (sorry, Sir Jonathan Ive), releases another incredible product. I guess they are always under incredible pressure to trump the last version. The leap from 3 to 4 was huge, from 4 to 5, not so much other than screen size, the leap from 5 to 6 feels the same as 3 to 4. Those of you who have the phone know what I am talking about.

Let us have a look at sales units and numbers. 58 billion Dollars worth of sales in 90 odd days is amazing, net profits of 13.6 billion for the quarter is even more amazing. That translates to 2.33 Dollars per share of earnings. Gross margin improved to 40.8 percent from the comparable quarter (Q2 2014) last year, where it clocked 39.3 percent. Forget the strong Dollar, which has been the flavour for the reporting season thus far, 69 percent of Apple's sales are beyond the US borders. Meaning that only 31 percent of their sales are mainland US. In fact, for the first time iPhone sales in China were bigger than that of the US, unit sales grew 72 percent, revenues grew 71 percent to 16.8 billion Dollars of the group total of 58 billion. Tim Cook, the Apple CEO had indicated a few quarters ago that China was going to be huge. And now it is.

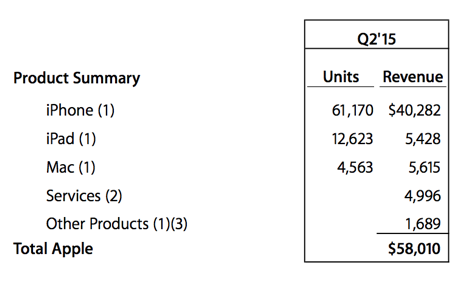

Total product sales are as follows, including revenues generated from those:

Services. Check that out, nearly 5 billion Dollars worth of sales, for the quarter alone. As they point out, services is as follows: Includes revenue from the iTunes Store, App Store, Mac App Store, iBooks Store, AppleCare, Apple Pay, licensing and other services. And then other products, which includes sales of iPod, Apple TV, Beats Electronics and Apple-branded and third-party accessories. I wonder where the watch is? Or where it will be in the future, a separate line?

If you were wondering about the take up of the watch with watered down and muted response, you are wrong. The watch take up was the most successful first day sales of any product ever for Apple. So there. Perhaps pre order data might have been in there (the "other products") segment, I suspect if so it is negligible. What you can see is that for the first time since the release of the iPad, Mac revenues have surpassed tablets. Which means that the bigger screen phones have definitely started to cannibalise iPad sales. The clearer and crisper screen enable users to ditch the tablet. Equally the greater adoption of the Mac means that Apple closes the loop, in terms of the ecosystem.

The company has also announced that they are boosting their buyback program by 50 billion Dollars, from 90 to 140 billion and have also boosted the quarterly dividend by 11 percent, from 47 to 52 cents per quarter. That amounts to 208 cents a year, on an after market share price of 134.42 Dollars, that is 1.54 percent yield. Better than the 2 year government debt, which is 0.53 percent. I have seen some analyst reports that suggest that the company by 2017 can register sales of 270 billion Dollars plus. That is a long way away, projected sales for this year is expected to be somewhere around 225 to 230 billion Dollars. With earnings expected to be around 9 Dollars, the stock hardly looks expensive at current levels, less than 15 times current year earnings. Earnings are expected to grow somewhere in the region of 17-18 percent, meaning that the multiple forward to 2016 is around 12.5 times.

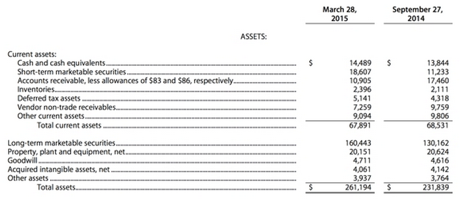

By that measure I think that there is still huge upside. Not as before where the base was lower, the fact that there is however new markets, the Chinese specifically. 6 new stores were opened in mainland China last quarter, there are expected to be another 40 by this time next year. Guidance is around the middle of most folks estimates for the current quarter, a foreign exchange "element" is expected to impact margins. There is something amazing in these Apple numbers. See if you can spot it:

190 billion Dollars worth of cash. No wonder Apple can expand their capital return program from 2012 to 200 billion Dollars through to 2017.

As a shareholder, what do you do? What is there to do? Nothing. If you own the shares, then enjoy the performance of the stock price now, in the past, and expectations based on future earnings. We continue to recommend that you accumulate the shares at current levels, buy. Be mindful that there are other products out there, Apple has only 20 percent of the smartphone market. Meaning that there is plenty of room to grow, plenty of people to convince that this is the best product, the best all around hardware and software combined.

Things that we are reading

I cannot believe it. The Fast and Furious 7 is on fire, past Avatar to take fastest $1billion box office gross world record. It proves that whilst it is never going to win any Oscars for best picture, or best actor(s), actress, it is what people want to see. Don't poo-poo what passes for entertainment. For the record (the other less important one), I have not see a single one in the franchise.

This story boggles the mind, safety in the work place is only as good as execution. I could not believe this when I saw it, very sad: Bumble Bee Foods, 2 others charged after employee died in pressure cooker. Astonishing.

Wow. It is clear that these answers should be easy, unfortunately they are not for most people, including kids in the US: Kids in the US don't know much about money - and teaching them doesn't work. Can your kids answer these questions correctly?

Home again, home again, jiggety-jog. Michael got married this weekend, I only posted a single pic to Twitter, here goes: Congrats @mwtreherne Sealed the deal!. Here goes Paul's Tweet: Team Vestact at @mwtreherne's wedding! Congrats, he is away this week, as is Byron.

The Rand is firmer, the Dollar trade taking a large pause here. GDP data later this week and non-farm payrolls no doubt are set to take centre stage. More important to us however are the earnings, those have not slowed. If anything, we need to review Amazon and Starbucks, hopefully tomorrow we will have had a full look!

If you wanted to know how you can help with the disastrous Nepal earthquake, you can. Thanks to Facebook matching donations made via their portal: Support Nepal Earthquake Survivors: An Easy Way to Donate, Facebook to Match up to $2 Million. If you can, lend more than a hand. Send funds to the International Medical Corps.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment