"The group CEO exercised 4,318,732 rights at 90 Rand, the total amount is a crazy 388,685,880 Rand. Read that again, 388 million Rand to maintain his holding in the company and to not be diluted. Obviously he does not have the money lying around, right? The less talked about Barry Swartzberg (the co-founder) had to shell out 198.9 million Rand to follow his 2,210,735 rights. Collectively Barry and Adrian are following their rights to the tune of 587.65 million Rands, over half a billion Rand."

To market, to market to buy a fat pig. A pretty broad based rally across the board, the Chinese markets have been on a tear lately. There was some oil and gas M&A afterglow, it is taking some time for people to digest the massive premium that Royal Dutch Shell are offering for BG Group, the biggest deal in the sector for a long, long time. There has not been a deal of this size and scale for quite some time, most of the stock mega-mergers, Time Warner/Historic TW being the biggest - 186.2 billion Dollars back in January of 2000 the best example of an overpriced merger of equals topping the table.

There are in fact very few deals in history at this sort of price, 70 billion Dollars and certainly the merger of Shell Transport and Trading together with Royal Dutch Shell (in 2004) of 80.1 billion Dollars is the biggest. Other than this one. I can't say that I remember that one too much, October 2004 was when we were starting to see the emergence of the Chinese economic miracle. There are many reasons why companies agree to sell themselves, there are many reasons why companies go on the hunt for acquisitions, one thing is for sure that both parties always agree on, and that is price. Why would the Royal Dutch Shell board and bankers agree that paying a 50 percent premium on the closing price Tuesday was a compelling deal?

If you read the FT article (subscription only, you can get your free bunch for the month) titled: Brazil is the big prize for Shell in BG deal, the heading tells you the first part of what you need to know (Brazil), the second part is that the combined company will become the largest oil and gas producer on the planet by 2018, trumping Exxon Mobil. If you needed reminding, from this table: List of largest corporate profits and losses, Exxon Mobil holds five of the top six quarterly corporate profit records of all time. Scroll down the table and you get to see that Exxon Mobil, as well as Royal Dutch Shell, appears many times.

The combined entity could be saddled with as much as 61 billion Dollars worth of debt, according to Jeffries analyst Jason Gammel, who is quoted in the FT article. There are several hurdles to overcome, shareholders of both entities must rubber stamp the deal, governments must be happy that the markets will be just as free and fair post the deal. The main unknown is the price of crude and natural gas, if those prices go up, then a combined entity would be a far more profitable entity, the world is currently awash with cheap crude. Better technologies have enabled the North American producers to get oil closer to home. The Saudis are pumping at record levels. The Russians too. The Iranians might be able to export oil like crazy, undercutting their neighbours in an attempt to get market share. Obviously the less profitable oil fields will fall by the way side, we still use 94 million odd barrels a day, until that changes, we are addicted to fossil fuels.

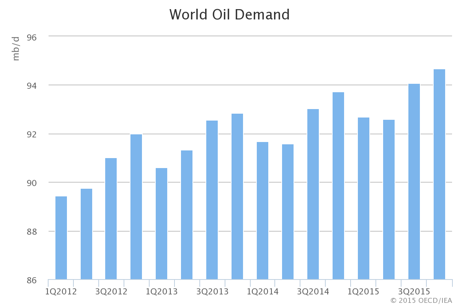

With this chart below, daily usage (per quarter) from the International Energy agency (IEA) comes the associated commentary that you should read: World Oil Demand.

The one paragraph about the demand side leaves you feeling the same way you did at the beginning, not too sure where the price will end up in the very medium to short term: "Demand may also have been supported by opportunistic buying and growing interest in storage plays. While that would have helped tighten product markets, such demand is less sustainable than that driven by underlying economic growth, and there are still few firm signs at this stage that lower prices are giving the economy a real boost. China, for one, remains in cooling mode. Then again, information about demand lags supply and tends to be sketchier, so it may take time for any pickup in demand to be fully captured in the data." Pfff .... your best guess is as good as my best guess, which seemingly is as good as the IEA's best guess. Royal Dutch Shell is making more than a little guess, it is a 70 billion Dollar guesstimate, that apparently has been 20 years a coming.

Company corner

An interesting couple of announcements from Discovery over the last couple of days, one relates to the directors and related parties with regards to following their rights. First, the quantum of Adrian Gore's share, looking to maintain his shareholding in the company. We were discussing this a little in the office yesterday. The group CEO exercised 4,318,732 rights at 90 Rand, the total amount is a crazy 388,685,880 Rand. Read that again, 388 million Rand to maintain his holding in the company and to not be diluted. Obviously he does not have the money lying around, right?

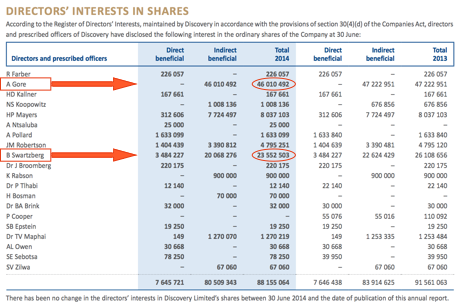

The less talked about Barry Swartzberg (the co-founder) had to shell out 198.9 million Rand to follow his 2,210,735 rights. Collectively Barry and Adrian are following their rights to the tune of 587.65 million Rands, over half a billion Rand. Both of them are huge shareholders in their personal capacities, according to the last annual report, I have done my best to circle and show the extent of their huge holdings. Via the Discovery annual report.

So after this rights issue, Barry Swartzberg has (presuming he has not sold in-between now and then, June 2014) 25,763,238 shares, worth 3.413 billion Rand at the closing price of 132.49 Rand a share. And Adrian Gore? Presuming the same, that he has the same amount of shares from back then, Gore has 50,329,224 shares worth 6.668 billion Rand at the closing price. Collectively between themselves, they are not a Dollar billionaire yet. That must be the next stop!

And then a more significant announcement from Discovery, introducing a US life insurance and investment business, John Hancock, which will essentially white label the Vitality product. Here is the official announcement: DISCOVERY AND JOHN HANCOCK ANNOUNCE STRATEGIC PARTNERSHIP. John Hancock is a really old US based investments business named after one of the US "founding fathers". Hancock has the longest serving President of the Continental Congress. Remember the Lincoln speech about four score and seven years? That refers to the Continental Congress, so Hancock has an important name in American history.

Quite simply, as a Vitality user and how the program encourages you to perform better and make sure that you continue to get healthier, make smarter choices and live longer. Drive better. And so on. According to the release the Vitality program is not new to the US, there are 700 thousand members across 50 US states.

There is quite a cute advert for the product, if you follow the following John Hancock Vitality page. Well made and well done, with visuals of sports, exercise, healthy living and so on. All the stuff that we know really well, we know that we have to be fit, eat better and not have as much stress. Work out more. I think that this is pretty big. It turns out that Americans, like almost everyone globally, are underinsured on the life side. The chaps over at John Hancock had Tal Gilbert (one of the top guys at Vitality who has been there since 2004) at the release. Tal is a Joburger, guess what, like Barry and Adrian went to Wits and is an actuary. Excellent.

Good work Discovery, finding partners in well established markets and shaking it up a little. The health and wellness revolution (which is why we like this business) and more focus on a lifestyle that leads to a longer life. We all want to live healthier and longer.

Things we are reading

Given the huge economic growth that China has had, they are in a position to start targeting pollution - China's Pollution Assault Boosting Solar, Electric Vehicles. Green power generation is still more expensive, which could place it in the luxury realm. As China gets richer, it can focus more on green power. As the world of innovation focuses more on clean energy it will also get cheaper.

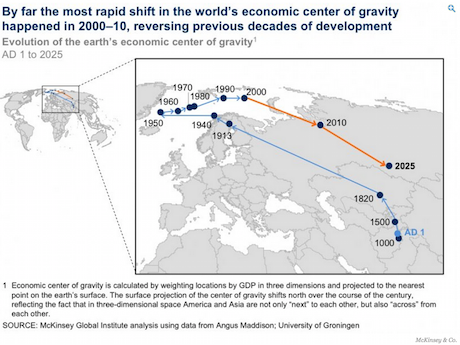

This is not a new graphic, interesting to be reminded of it - The world's economic center is quickly moving toward China

With the Apple watch becoming available to the retail market tomorrow, this is the most comprehensive review that I have seen so far - Apple Watch Review: You'll Want One, but You Don't Need One. The general consensus is that no one really knows how well the watch is going to do. Great looking product though!

Uber is one of the best disruptors around, and Google own part of the company - Uber's popularity surges, as business travellers avoid taxis

Home again, home again, jiggety-jog. What we describe as winter is closing in on us. Jerseys all around here in Joburg, it has been a cool and rainy two days, unseasonal weather. Stocks at the get go here marginally higher, commodity stocks with the lower prices are getting crushed at the beginning. Naspers nearly hit 2000 Rand a share, time for a share split is what we are saying in the office here!

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment