"The buy side (or those generating the ideas internally for trading and investment houses) are far more focussed on shorter term market movements, and typically generate the short term ideas, like this looks too cheap right now, this looks too expensive. Sell side analysts research, and this is the difference between the two, is disseminated amongst their clients, from short term traders to long term investors. Traditionally the higher worth the client to the firm, the sooner that the detailed reports will land in their inboxes."

To market, to market to buy a fat pig. We closed a percent higher here in the local market, above 54 thousand points for the very first time. We are in fact up nearly 11 percent since the middle of January. Yesterday however was a broad based rally, including amongst the resource companies where I am afraid that I saw a whole host of downgrades from buy to hold, from hold (neutral) to sell, the one exception was Glencore.

Neutral and hold basically imply that you are neither positive or negative on the prospects (of the share price) relative to the companies potential right now. In other words, where the share price trades today, right now, is where you make your "call" as an equity analyst. These calls are 12 month in nature. Ironically, if you like the longer term prospects of the business, you should always be in accumulation mode, regardless of what the sell side (the research analysts) think. Their time frames are 12 months and typically their job is to produce trade ideas for the part of the business that is client front facing.

The buy side (or those generating the ideas internally for trading and investment houses) are far more focussed on shorter term market movements, and typically generate the short term ideas, like this looks too cheap right now, this looks too expensive. Sell side analysts research, and this is the difference between the two, is disseminated amongst their clients, from short term traders to long term investors. Traditionally the higher worth the client to the firm, the sooner that the detailed reports will land in their inboxes. Securities analysis is something that almost anyone can do, you have to be smart however. In fact the third kind is an independent analyst, who sells their research to either the sell side or the buy side. I have read many research reports, they are detailed and have an enormous amount of information in them.

The part that I guess is always a moving target is the complex modelling around earnings two and three years out. 1000 days is a long time to model revenue expectations and by extension earnings numbers and of course suggesting that the share price based on forward valuations should be at X or Y or Z. Businesses that are excellent are doing what they do, innovate and keep up the pace relative to their competitors. Good businesses with excellent management teams, wonderful products and services tend to trounce their peers in the short term.

You and I have very little idea of knowing for certain that a company like Apple will continue to produce excellent products year in and year out, we have no way of knowing if the premium pricing is something that customers will continue to be drawn to. Obviously quality is everything. That is why I am keen to see adoption of the Watch. Early signs are that Apple sold between 2 and 2.4 million last weekend, they were ordered. Good work, so far the early adopters are many!

Company corner

SABMiller released a trading update yesterday that was well received, the stock in London (that removes the currency trade) closed the day 1.42 percent higher. The five year performance of the stocks in Pound Sterling has been nothing short of amazing, the stock is up 91 percent in that time. In Rand terms the stock is up 200 percent. That tells you everything you need to know about the Rand, right? 5 years ago you could buy one pound for 11.40 Rand, today that ratio stands at 17.88. The classic Rand hedge, although not entirely, as the company has a large business here in South Africa. The only way to really hedge against the currency is always to externalise money.

Whilst many folks in the developed world may have been pushing back against soft drinks, their high sugar content being linked to obesity as a main concern from consumers opting for healthier consumption patterns (Coke shed 1800 jobs earlier in the year in response to lower sales), in the developing world a Coca-Cola is not just a soda that you enjoy with a meal, or on the fly. It is a drink that shows brand association, it is a soft luxury, it is in a sense an aspirational thing. This is a beer company, not so? They are of course a massive bottler of Coca-Cola products. Plus, it is important to note that a Coke in India does not cost the same as a Coke in South Africa, which does not cost the same in France.

For instance, if I wanted to buy a 2 litre Coke right now (the shops are not open) I can at Woolies for 15.95 Rand or at the current exchange rate, it is 1.33 Dollars. Or 66.5 US cents per litre. In India (via an online shopping website), I can buy a 2.25 litre of Coke for 66.5 Rupees or 1.07 Dollars, 47.5 US cents per litre. I actually found a Coca Cola 2 litre pricing in the US, via Amazon (Target and Walmart will not give you pricing on those items), here goes: Coca Cola Classic 2 Liter (Pack of 4) , excluding shipping, costs 6.47. Or 80.80 US cents per litre. It differs you see. I bet someone has done the exercise using PPP (Purchasing power parity), it comes out about right.

Anyhow, back to the sales update, you can find it here: FY15 Q4 Trading Update. I guess you could argue that with a historic earnings multiple of around 24 times, and with pretty ordinary volume growth that the stock is expensive. Historically it has always been that way, for a pretty simple reason. When looking for a consumer stock globally and trying to pick out one consumer stock that is as geographically diverse and has fast growing consumer businesses in the developing world, this is one of the go-to companies globally. There is that overhang of the big Altria shareholder, equally the Santo Domingo family owns a lot. A very well known bunch of brands in their geographies. The only concern that I have heard lately is that their management structure and team in London is under more than a little pressure, putting it politely.

I see in time more push backs to their business, if their product is enjoyed in the right quantities, all good, if not then there are broad "challenges" in society. Good company, you cannot own everything however. If I like consumers globally, I am more inclined to invest in health and wellness businesses, like Nike who sell apparel, it is a growing business in both developed and developing markets.

Etsy announced that they had raised an enormous amount of money to grow their business. Etsy is interesting, you can manufacture your craft stuff and hook up with buyers online. As a customer you can own bespoke goods, made to order. It is not too dissimilar to your online flea market. Peak hipster? Maybe. Vinyl? Why? Digital music is SO much better. I love old stuff, I love antiques, must they always work? Etsy soared 87 percent on their first day of trading to settle at 30 Dollars a share, down from their high of 35.74. The company trades at a price to book ratio of 50 times. Yowsers. The company loses money. Whilst it may be fun to be a customer and manufacturer, there is no real edge here, right? I can imagine you and I could start something similar. We could also start Amazon, it will take a long time however. Fun to watch, as an investor however, this is an ignore, you cannot own everything. Nor would you want to.

Things we are reading

The man who moved the markets has now joined a hedge fund - Ben Bernanke's decision to join a hedge fund will cost him something, too. If it wasn't for the policies implemented by Bernanke, I think the world would be a worse place at the moment. Working for the FED is a public sector job, so remuneration is nowhere close to that of their private sector colleagues; I'm glad to see that he can now cash in on the yards he put in at the FED.

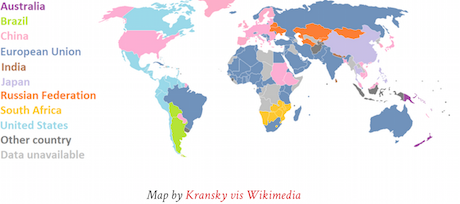

Always interesting to see who trades with who and in our case our neighbours are important to us - The Largest Source Of Imports By Country.

Things change a bit if you consider all the European countries as one:

As we move to a wireless and battery powered society, these will help make the transition a bit easier - Kickstarter solves the new MacBook's USB issue

Home again, home again, jiggety-jog. The Rand is stronger, the Dollar is marginally weaker, the retail stocks are lower. Negative sentiment towards SA inc. I am afraid. Life should not be so cheap, I feel desperate for all involved. Earnings so far have been really upbeat, beating expectations. In the end that is all that it is about, earnings, earnings and earnings. That drives share prices.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment