"At the same time you do not want to ignore the people, most especially young people entering into the workforce at this time. Paint this scenario quickly, you entered university and graduated in 2009, at the end of that year. Older folks, who may have thought about retirement a couple of years earlier when asset prices were much higher and the future looked more certain (it never does) were getting used to the idea of enjoying their golden years."

To market, to market to buy a fat pig. I really like Mario Draghi. In fact, I really like most central bankers. In the old days they were not really household names, people knew who they were in the news, people did not see them on the telly's. Perhaps the crises that ensued during the tenures of both Alan Greenspan and Ben Bernanke changed that a little. Most Central bankers I have seen in my time had and have a great sense of humour. Yesterday when a young woman jumped on the desk in front of Mario Draghi and shouted: End the ECB Dictatorship. With slightly more colourful wording. He Was very cool and collected, as he always is.

It did not take too long to find out who she is, her name is Josephine Witt, a 21 year old German woman, who has a message for the ECB. Yes, she even tweeted her "manifesto", which was part of the confetti that she threw at Mario Draghi as she stood on the desk in front of him, here it is, taken from Witt's tweet:

Now excuse me whilst I go on a little rant here. Life is hard, I understand that. Life is tough, I understand that. Life is a lot less tough for someone in the German system than someone born in Somalia at the same time as Witt. There is absolutely nothing stopping her getting the necessary grades in order to enter the German tertiary education system. In order to make progress inside of the ECB and change (or lobby to change) the mandate of the central bank you have to do more than wangle your way into an ECB conference. Good skills in that part, poor message relaying, even as I read her message and Twitter timeline I have no idea what she wants. Change happens through more than a protest. I get the sense that people always feel that change must happen yesterday, it cannot.

What was most impressive about the ECB governor is that after the scuffle, literally minutes later we went on to continue with the press conference and take questions as if nothing happened at all. You can watch the recorded webcast (if you have a spare hour, nobody seemingly has a spare hour any more), or read the text at the bottom: Webcast of the press conference 15 April 2015. If you are hoping to see the incident, forget it on that platform, a small line there: The video has been edited to remove an interruption. I know you want to see it, so I found a clip on Youtube: Josephine Witt Stages Confetti Protest At ECB President.

At the same time you do not want to ignore the people, most especially young people entering into the workforce at this time. Paint this scenario quickly, you entered university and graduated in 2009, at the end of that year. Older folks, who may have thought about retirement a couple of years earlier when asset prices were much higher and the future looked more certain (it never does) were getting used to the idea of enjoying their golden years.

Giant pause, work another five years, the natural attrition in the workforce that makes way for younger entrants does not happen. Youngsters find the going tough in an environment when jobs are being shed. That happened and the jobs have not really come back in the manner that everyone hoped. In the end frustration leads to protests when people feel they are not heard. It is no different here in South Africa, violence is somehow easier than words, perhaps as a result of fewer and fewer platforms to express those views. Perhaps the lack of quality education which should be more than a human fundamental right. With education, everything changes, you cannot take a brain away.

Away from philosophy, those discussions never end. Back to markets. Apart from the ECB news conference disruptions, the real issue that continues to dominate is an almost certain Greek default. Yes, the time has almost come. We have suggested over months and years that this is the case, that Greece will not want to leave the Euro zone. Yes. There is however a time when the other side is frustrated. Frustrated to the point where they are suggesting that there cannot be a solution, there cannot be middle ground met.

Company corner

Wow. That was pretty big. Standard Bank executive Bruce Hemphill is going to join Old Mutual and run the whole business, replacing Julian Roberts. Group Chief Executive succession is where you can find the official announcement from the company. Obviously this is a big loss for Standard Bank, what it confirms (and you all know this already) is the fact that there is an enormous amount of quality here in South Africa.

Hemphill goes to London, leaves Joburg. He actually returns, he did his articles in London at a law firm by the name of Farrer & Co. Some more snooping reveals that Hemphill has a strong non-banking background in asset management, an area where obviously Old Mutual is strong. He is 51 years old, he has been at the group for 22 years, an executive at Standard Bank in his 2nd year. Perhaps in his (Hemphill) second year in senior management there is a realisation that Sim Tshabalala, four years his junior at co-CEO will own the top job at some stage. And as such, a bold move will see to it that Hemphill carves his own name at another organisation. Well done. Good work.

Holy smokes. Brait with a monster announcement this morning, out of Malta, the little European island. Here it is, the proposed acquisition of a c.80% interest in Virgin Active and withdrawal of cautionary announcement. Brait Mauritius is proposing that they buy 80 odd percent of Active Topco, which trades under the brand Virgin Active, for 682 million Pound Sterling, or 12.21 billion Rand. The group owns 267 clubs in 9 countries across 4 continents. And of course you will know well that they are gyms, clubs, places where you can keep and get fit and healthy. Places that you know and understand that an investment in your health is an investment in the future. The health and wellness theme is something that you know we like, it is evident in our investments in healthcare and more specifically in businesses like Discovery and Nike. People who are making your life healthier and better. The share price is around half a percent off, it seems that all and sundry, the competitions authorities and the shareholders will have to now decide whether this goes ahead.

Brait has a market cap of 44 billion Rand, this is huge. Remember that they have all the cash from the exit from Pepkor, Brait sold their 37.06 percent stake for 200 million Steinhoff shares and 15.086 billion Rand. 200 million Steinhoff shares at 77.52 Rand per share is worth 15.5 billion Rand, which is a lot more combined (30.5 billion Rand) versus the 25.7 billion that Brait valued the stake at. If this purchase goes through, the health club investment will be their second biggest investment after Steinhoff. And there will still be enough cash left over to do something else with. Good work and definitely left field.

Things we are reading

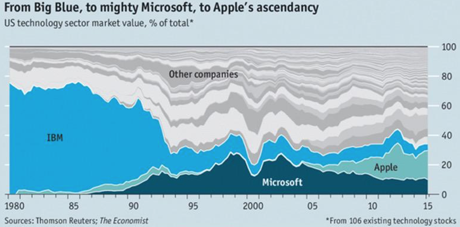

This is via Marc Andreessen, who is a well know venture capital chap and founder of Netscape (remember that browser?), his firm does work for airbnb, Buzzfeed, Facebook, the list goes on. A picture, via the Economist, tells 1000 words:

What the future of air travel may look like and taking the term "cattle class" to a whole new level - The terrible, claustrophobic airplane seat redesign that could soon be how we fly. I would not be a fan of flying like this but if it was only a short distance flight and it saved a chunk of money, flying becomes even more affordable to everyone.

Driverless cars? What about planes that fly themselves, well they already mostly do - Planes Without Pilots. Take off and landing is all a pilot needs to do - "In a recent survey of airline pilots, those operating Boeing 777s reported that they spent just seven minutes manually piloting their planes in a typical flight. Pilots operating Airbus planes spent half that time."

What impact will buy backs have on EPS and share prices? - The legend of buybacks outperforming the market has outlived the reality Buy backs are great if stocks are fairly valued or in a company that has a bright future.

Home again, home again, jiggety-jog. Going to another record high here at the start, the local market touched 54 thousand points for the very first time. Another day, if we close here that would be three out of four days that the local index registers another high. So far the big earnings this week in the US have been nothing short of excellent, the strong Dollar theme continues to weigh heavy.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment