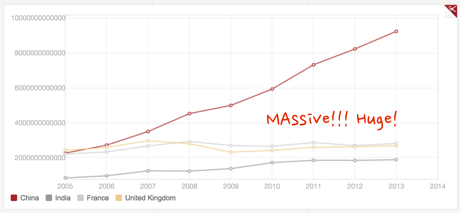

"If you add the UK, France and India together, it is still not bigger than the second biggest economy in the world. See? Amazing to think that just a little bit of context is needed to stop people running around like lunatics telling you that Chinese growth is slowing and that this is the worst news that they have ever heard. If China grows at 6.5 percent this year, that is an extra 650 billion odd added to their GDP, which is, if you needed reminding, around the entire economic output in China sometime between 1994 and 1995."

To market, to market to buy a fat pig. The big story yesterday was the big drop in the Naspers share price, this after Pony Ma indicated that he had sold a portion of his Tencent stock. Just how much? Well, according to Bloomberg, he cut his stake from 9.86 percent to 9.65 percent. That is 0.21 percent of his wealth now in cash, of a 1.55 trillion Hong Kong Dollar market cap, which is 3.15 billion Hong Kong Dollars. Which is 4.9 billion Rand. Which is 410 million Dollars. Which is a lot of money in anyones language. So what is Pony Ma telling you by selling shares? I don't know, really, there is one reason you sell, it is taking some money off the table.

You must remember that Pony Ma (actually his real name is Ma Huateng) is inside of the top 100 richest people on the planet and amongst the top handful of richest people in China. He is worth around 20 billion Dollars, somewhere around there. I am pretty sure that it is not about the money, and I know that he would care if the Tencent share price was at 130 Hong Kong Dollars, that is actually where it was in March this year. The 52 week low is 90 odd Hong Kong Dollars, the high is 171 from a few trading sessions ago. He took a little off the table, good for him. Should you worry? No. Pony Ma still owns 9.65 percent.

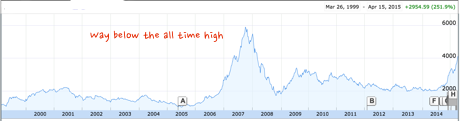

And by the way, it suddenly occurred to me yesterday that Naspers themselves have never sold a single share. Koos Bekker is a genius, his timing is almost always spot on. Let the team at Naspers decide when it is time to sell, OK? It is a bit disconcerting that the Chinese have such wild swings in their share prices as a collective, all in or all out, this is what this graph below tells me, courtesy of Google Finance, this is a (maximum) 16 year view of the Shanghai Stock Exchange:

The point that I make in the "way below the all time high" is that for the Shanghai Composite. Over the same time period, the S&P 500 is up 70 percent. That is it. 16 years, 70 percent gain in the US Stock market. The Shanghai Composite is up 251 percent. Chinese GDP, seeing as that is the "other" thing that people are talking about? It clocked 7 percent growth for the first quarter, that is not good and the trajectory of growth in India is expected to eclipse that of China. Which is good, right? For the time being the slowing Chinese economy needs a little bit of context. In 1999 Chinese GDP was 1.083 trillion Dollars, according to Index Mundi -> China - GDP.

In 2013 it was 9.24 trillion Dollars. With a 7 odd percent growth rate in 2014, let us say 7.5 percent, GDP would have crested 10 trillion Dollars for the first time. GDP in aggregate went from 1 trillion Dollars in 1998 to more than 10 trillion Dollars in 2014. A 10 fold increase in GDP, the stock market only registered a 251 percent return. Remembering always that we stress that the market is not the economy, the economy is not the market. If you have a look at the Chinese GDP trajectory from 2005 onwards, you will see that ten years ago the Chinese economy was roughly the same size as the French and UK economies.

And now? If you add the UK, France and India together, it is still not bigger than the second biggest economy in the world. See? Amazing to think that just a little bit of context is needed to stop people running around like lunatics telling you that Chinese growth is slowing and that this is the worst news that they have ever heard. If China grows at 6.5 percent this year, that is an extra 650 billion odd dollars added to their GDP, which is, if you needed reminding, around the entire economic output in China sometime between 1994 and 1995. True story. So whilst the pace of growth is slowing, that is natural, you cannot deliver the same year after year as the base grows.

Company corner

Oh no. It is sad when a company of any sort goes into business rescue. In this case it is Evraz Highveld Steel and Vanadium, see the announcement: SUSPENSION OF LISTING AND CAUTIONARY ANNOUNCEMENT. Why? The announcement fleshes it out: "Shareholders of Highveld are hereby advised that the board of directors of Highveld ("the Board") has resolved that the Company does not have adequate funding to meet its obligations for the short term. This is primarily as a result of historical operational difficulties and sustained financial losses within a capital constrained operating environment"

Anglo American owned this business for a long time, as part of their divestment from noncore assets, the majority of the shares ended up in the Evraz stable, the giant Russian company (31 percent of which is in the hands of Chelsea football club owner, Roman Abramovich) listed in London. So they lose everything, is my best guess, the part that irks me is that monster dividends were ripped out of the company during the period 2006 to 2008. This is however a sign of the times, the unfortunate thing will mean that eMalahleni (Michael's home town) will suffer here, we have heard a few horror stories already, none confirmed however. Another sign that the business of business is tough, ordinary workers need to understand that this can happen.

Things we are reading

Peoples creativity is what pushes us forward as a species - Here's what the world's design mavericks created in the last year

Sasol is up close to 8% this week, here is the reason why - Oil Bulls Boost Wagers by Most Since 2010 as Output Seen Peaking. I think the only consensus about the oil price is that it is going to be volatile over the short run - Shale Oil Boom Could End in May After Price Collapse

Learning from history helps us put things into perspective - 9 Lessons From The Great Depression. The one thing that I have noticed about any author from the depression is their aversion to leverage, watching the damage of being over geared makes a life long imprint. I like number 6, "It's right to be an optimist, but be prepared for the worst."

Home again, home again, jiggety-jog. Resource stocks are on fire, up sharply. With the collective resources up nearly three percent today, the rest of the market is being dragged much higher.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment