"The Apple products are awesome, it is hard to wrap your head around the fact that the iPod is only 14 years old, and that is in October this year. iTunes is 11 years old. The iPhone turns only 8 this year in late June. The iPad is only 5 years old. The watch is a few days old, in fact you could argue that many people will take time to adopt the technology."

To market, to market to buy a fat pig. Another day, another closing record high, is that the case? Yes, we beat out the late February highs yesterday, the all share index, which comprises all of the listed companies here in South Africa closed out at 53589 points, after registering an intraday high of 53750 points. There are two points worth making here, over and over again. All of our clients do not own the index, they own companies that are represented in various percentages as a result of their market capitalisation and free float. Simply put, the free float is the portion of shares that are in the hands of public investors. Remembering that the big companies listed here are often secondary listings, which means that large portions of the shareholder register is not here, in most cases it is London.

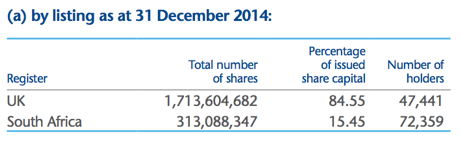

For instance, the largest listed company here, by market capitalisation, is British American Tobacco. Currently the market cap is 1.317 trillion Rand, a reflection of the primary market where BATS, listed in London has a market cap of 67.53 billion Pound Sterling. It is easy enough to find which share register owns what, all that information is available in the annual report, under "Shareholder and contact information". Here it is, a simple little graphic that shows you that only 15.45 percent of all the shares are held on the South African register:

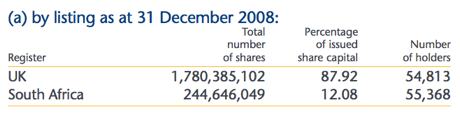

Remembering that BATS only obtained a JSE listing here in 2008, October the 28th of the year 2008. What was the ownership back at the end of 2008? Easy enough, once again remembering that annual report is a wealth of information, the only thing required is to read it, right? Here goes, same number back from 2008:

As you can see, South African shareholders have changed their holdings over 6 years by less than 70 million shares. UK shareholders have reduced their exposure by a lesser amount, there have of course been some serious buybacks in-between. Quite simply, if the number has not changed too much from the end of December and now, the South African value relative to the overall market cap is 15.45 percent of the current value. Or even easier, take the number of shares that is owned on the South African share register and multiply it by the share price. 313,088,347 shares multiplied by the closing price of 650.22 Rand. That equals 203,576,304,986.34 Rand. Which is just a fraction less than Old Mutual (also two share registers) and Vodacom, both have market caps of 206 billion Rand.

Obviously both those companies will have smaller free floats themselves, in the case of Vodacom, they are 65 percent owned by Vodafone. The free float is reduced significantly, with around 72.1 billion Rand in "public" hands. Although it is worth noting that Government owns 13.9 percent (they have sort of indicated that they are sellers) and the PIC, who own over 3.1 percent, you would think are firm holders.

An index is a complicated measure done on free floats of specific companies. So suggesting that the "market is overdone here" or the "market is way too hot" is possibly not right, I would guess that there are very few people who know the exact composition of the overall market at any one given time. I was asked this very question yesterday on the telly and my response was similar, although I used the examples of Steinhoff and Naspers being at all time highs in Rand terms, whilst the hapless commodity stocks were trading at multi year lows, the example I used was Kumba Iron Ore and Impala Platinum. Since the all time high of Impala Platinum shares, reached in May of 2008, the stock price is down over 80 percent.

To get back to the same level it would have to increase six fold. No markets are the same, ever. Equity market levels are not companies, it is more accurate to address the prospects of a specific company and determine whether or not their price presents an opportunity for you the shareholder. That was the only point I wanted to make.

Company corner

I saw a tweet that suggested that it took Apple 74 days to sell their first one million iPhones, you know, the first version. According to some early projections, they may very well have sold 1 million Apple watches on Friday. There was something interesting about that, expectations were probably for more, signs are that there are production problems with the watch. The company will no doubt put on a brave face through these "challenges". Some are cheering the fact that Apple are failing to meet the demand, they were just being cautious is my best guess. The Apple products are awesome, it is hard to wrap your head around the fact that the iPod is only 14 years old, and that is in October this year. iTunes is 11 years old. The iPhone turns only 8 this year in late June. The iPad is only 5 years old. The watch is a few days old, in fact you could argue that many people will take time to adopt the technology.

From the time that the first major global consumer product in the form of the iPod was released, Apple clocked just over five billion Dollars worth of annual sales. That number is close to 183 billion now, it is very difficult to try and wrap your head around a 10-fold increase in sales in less than ten years, for a small company that is "ok", for the largest company by market capitalisation that is difficult to get used to. That aside, we were discussing the people who would be early adopters of the watch and more importantly, the longevity of the watch.

If the watch is well received, well accepted as being an integral part of the Apple ecosystem, then I have no doubt that it will sell well. What is more important is the ability to be an early warning system for healthcare, that is why I was not surprised when I saw these types of articles, this one from the FT: IBM strikes digital health deal with Apple, Medtronic and J&J.

Health and wellness are becoming huge investment trends and themes, the whole idea of early detection, prevention coupled with healthy eating. Add into this the ability to be able to Help Transform Medical Research, in the words of the IBM release. There will be an amazing amount of data, scientists and medical professionals will like never before have more data to use than they would have ever dreamed of.

Apple is slowly with all the pharma companies, the technology companies, and with the sharing of information, going to help modern medicine like never before. Lastly, as strange as it may sound from an aesthetic point of view, I see people wearing a timepiece and a tool, being their Vacheron Constantin (timepiece) and their Apple Watch (the tool). Not everyone agrees with me, wearing two watches might look very weird at first, so was wearing headphones all the time and that has become mainstream.

Things we are reading

A little pocket change collected over and over adds up to a lot. In the case of US airports and travellers change, a whole lot: U.S. Airports Make Thousands From Lost Change Every Year. 675 thousand Dollars in coins each and every year? Wow. I wonder how many jars that would fill.

An interesting look at how we perceive the world, what reality looks like and how we think the world should look - Dan Ariely: How equal do we want the world to be? You'd be surprised. The clip is a bit over 8 minutes long.

Low interest rates are not a new thing, from 1934 to 1953 they were under 3%. The article has a look at what stocks did over that period - Stock Market Losses With Low Interest Rates. The point made by the author is that even with low interest rates, stock prices can fall. During this really volatile time, buying quality and reinvesting dividends meant that you come out ahead of the rest over the long term.

Another push from China to curb smoking, I think this will be a long battle as the government makes huge amounts of cash from the cigarette companies. At some point the public health bill will weigh more heavily - Beijing Turns to Social Media Tattletales in Battle Against Smoking.

Home again, home again, jiggety-jog. Resource stocks are up sharply here, the market as a collective is down however. Naspers is down around 2 percent as a result of weaker Tencent price, one of the steam is coming out of the rally in Chinese stocks. Again, I have no way of knowing when people are going to stop buying stocks and turn tail and sell them aggressively. What we do have control over as investors is the ability to buy quality businesses, watch them, get less anxious about the price and more entrenched in the idea of owning the company.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment