"The growth continues to amaze, WhatsApp I think was responsible for the breakdown of the popularity of the messaging platforms such as BBM and MXit to an extent. Back in early January Jan Koum announced that the messaging app had passed 700 million, and that the platform was available for 30 billion messages."

To market, to market to buy a fat pig. Resource stocks were the drivers of the market yesterday, with the broader market ending the session up 0.2 percent to 53840 points. The Chinese cutting of Reserve Ratio Requirements for their banks being the big driver there, resource stocks collectively added a little over two percent on the day. For stocks in that part of the world however, the fellows over at the securities authorities in China have clamped down on margin trading activities. The one hand giveth, whilst the other hand taketh away. Thanks to the Chinese in part, the resource markets got a boost across the globe. At the same time the outlook for one of the biggest bulk commodities, iron ore, looks muted in terms of the price, that is. Few expect the price to bounce back quickly.

I suspect that the same folks did not foresee prices getting hammered to this point either, it has been ugly for all and sundry. As a consequence of the lower commodity prices, there is a knock on impact to housing associated with mining, and I am not talking about the cheap kind: Mine Bust Halves Home Prices in Australia Outback as Jobs Vanish. In two years house prices in the place called Blackwater (one consonant away from a backwater) have fallen 57 percent. Meanwhile, as the Bloomberg piece points out, location is everything, Sydney property continues to hit record highs.

Location, location, location. You can try, you however cannot replicate natural beauty and climate. In terms of the Economist Intelligence Unit liveability ranking, Melbourne, Sydney and Perth are in the top ten, alongside Auckland as Southern Hemisphere cities. The honourable Robert Gabriel would be shocked to know that Harare unfortunately is at the bottom of that list.

Not at the bottom of any list were US markets overnight, the Dow cresting 18 thousand again, the S&P 500 2100 points, the nerds of NASDAQ ended within 6 points of 5000. It is a massive week for US earnings, there are 147 of the 500 S&P 500 companies reporting this week, there is enough information to keep you reading until Christmas. Unfortunately you cannot know everything, equally you cannot own everything if you plan to be a ordinary stock picker rather than someone who owns the index. Big drivers of the market in the US were the big tech names, Apple, Amazon, Microsoft, IBM (which reported average results after the close) and Google all up between two and three percent. At the other end of the spectrum comes energy, over the last year energy as a whole is down 7.8 (the combined sector) relative to the S&P 500, which is up nearly 12 percent over the same time frame.

Company corner

WhatsApp Y'all? A monster drive to 800 million users is what the company announced on Friday, although the information itself was not on the WhatsApp Blog, you would have thought that might have been a good place to announce it. The company is a little over six years old. In other words, if this were a little human (I have good recent experience with little people of this age), they would be in their first year of school. They would recognise words and numbers, reading would come next year. Not on the Facebook platform ever, not via their investor relations pages. So where was the "official" release that WhatsApp had passed through that milestone? Via a Facebook post by co-founder of WhatsApp, Jan Koum. I took a screen grab of the post, for the simple reason of who liked it:

Strangely I follow Jan Koum and missed this, I am obviously not very good at Facebook. If there is a such a thing as "being good" at Facebook. The growth continues to amaze, WhatsApp I think was responsible for the breakdown of the popularity of the messaging platforms such as BBM and MXit to an extent. Back in early January Jan Koum announced that the messaging app had passed 700 million, and that the platform was available for 30 billion messages. Since Facebook announced that they were buying the messaging service -> Facebook to Acquire WhatsApp in February of last year, the number of users has swelled from 450 million to 800 million in 14 months. The purchase price was 19 billion Dollars, 12 billion in shares initially and another 3 billion later, vesting over four years, the rest (4 billion Dollars) cash.

Jan Koum and co-founder Brian Acton have been at it since February of 2009. Both were former employees of Yahoo! and famously failed to land jobs at Facebook. Irony is sometimes very sweet, right? So sweet actually that Koum and Facebook founder, Mark Zuckerberg ironed out the details of the purchase over a box of chocolate covered stories, according to a Forbes article that I read. The first year the service is free, thereafter it is 1 Dollar (or 99 cents) per user, so 800 million Dollars, not everyone pays apparently however. I guess there is a fair amount of costs associated with the messaging servers, the employees don't come cheap either is my best guess. When the business was bought, there were roughly 32 engineers in a workforce of 55. Perhaps more insight in the Facebook numbers, which arrive and cross our screens Wednesday after the market closes. And to think that Instagram was bought for a "mere" 1 billion Dollars (300 million in cash and 23 million shares at the time of the Facebook listing), the platform now has 300 billion users, as at December 2014.

According to Marketwatch, 53 analysts cover the stock, in terms of the estimates, the share price trades at 42 times current year estimates and 31 times next years estimates. The founder Mark Zuckerberg turns 31 in around three weeks time, the same as next years earnings multiple. I think that the future is indeed very bright for this company, granted that they are going to have to work hard. Or smart. Or both.

Oh, who would have thought that something of this nature was kept under wraps. Apparently there was a verbal agreement between Elon Musk and Larry Page, in which Google would have acquired Tesla for 6 billion Dollars back in 2013. This was revealed in a book on Elon Musk, from a writer of the name of Ashlee Vance. Ashlee writes for Bloomberg Newsweek. He shares something with Elon Musk and many of you, he was born here in South Africa, growing up in Texas however. The book itself has been available for pre order, only being released 19 May 2015. Well, good thing that Musk did not sell, Tesla has a market capitalisation of 26 billion Dollars. Good work for having not ironed out the kinks, on paper Musk is worth a whole lot more as a result of the company clicking at the right time. In another positive, around three quarters of a year on: Tesla's gigafactory is coming together, thanks to satellite images. Nice. Next set of news relatively soon, the last reporting quarter was 11 Feb, I guess some time in early May.

Two bits of news yesterday from Naspers. The first being that non exec chair of Naspers, Ton Vosloo has resigned from the group. He has been chairman for 23 years. He has been a board member for 32 years. Ton was a journalist from 1956 to 1983, he was editor of the Beeld from 1977 to 1983. He knows how to use a typewriter, I am guessing that he has not used one for two decades however, I may be wrong. He is 76, been working for 50 years plus (admittedly in a non executive capacity since 1998 at Naspers, it is still hard and stressful work). Ton was managing director of Naspers from 1984 to 1992, executive chair thereafter until 1997, and has been in this role since then. Ton will take 160 thousand shares, currently worth 292.8 million Rand into retirement with him.

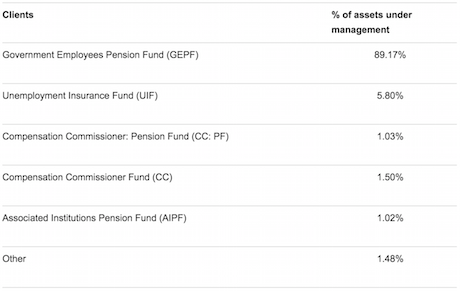

Koos Bekker at the same time as Ton heading into the sunset, returns to take the role from his old friend, Bekker becomes non executive chair of Naspers. Bekker is worth a little more, directly and indirectly he owns 16 376 499 shares. Which at last evenings closing price is worth 29 968 993 170 Rand. A big number. An after tax dividend of 59 million Rand per annum. These share figures are as of March last year, from the annual report. When it gets to this level, I guess for Koos Bekker it is not really about the money, it is not the fact that he has made MANY South Africans directly and indirectly a lot wealthier - The Public Investment Corporation of South Africa owns 60 382 560 shares, worth 110.5 billion Rand. The PIC is 4 years older than Naspers, Naspers turns 100 this year. As at the end of the 2014 financial year, the PIC managed around 1.6 trillion Rand in assets, with a mere 385 employees. If you ever wanted to know who the PIC manages money for, here goes, from their last annual report:

Good work, the GEPF has 1.2 million active members (from more than 325 government departments), 350 thousand beneficiaries and pensioners. Those 385 employees have a great responsibility to 3 out of every 100 South Africans. The other bit of Naspers news, a little off the radar was Naspers Drops Off $40 Million For Brazilian Mobile Conglomerate Movile. Who? Well, here goes: Movile is the industry leader for development of mobile content and commerce platforms in Latin America. It is a Brazilian App designer. Local commerce, local content. 40 million dollars is nearly half a billion Rand. Founder Fabricio Bloisi is listed as one of the contact people on the Internet CEO's in the Naspers Fact Sheet - January 2015. Naspers is always looking for quality people to partner with, this chap and this company Movile looks fabulous.

I saw an announcement from MTN this morning, here is the story via Business Wire: Vodafone M-Pesa and MTN Mobile Money Agree to Interconnect Mobile Money Services. It is always going to be about size and scale in this case, the two businesses have to talk to one another to make customers feel like they have choice. Pretty darn good news I suspect, it means that if you want to choose your network in East Africa, you do not have to do it on the basis of whether you have to transfer money to x or y on the same network.

Things we are reading

kalahari.com which is owned by Naspers merging with Takealot is not new news - What Kalahari's closure means for e-commerce. The article gives the final numbers for the merged entity, Naspers will own 41%. Given the resources and the first movers advantage you would have though that Kalahari would have been further ahead than 550 thousand more users; " in December 2014 with 2 277 636 visitors to the site, while takealot.com had 1 737 672 visitors."

Expectations play a big part in the functioning of the economy, the better that people feel about their futures the more they spend on consumption now and the more likely they are going to invest their money in the economy - For the First Time Since 2007, Most Americans Feel Good About Money

Perspective and relativity matter, the 1950s where a lot better than the 30s and 40s and even though relatively the current 10s are not significantly better than the 00s, things are a lot better than the 50s - The Good Old Days Were Fine. These Days Are Better

As South Africans, we are currently very aware of power generation. Thanks to technology we are making green energy cheaper to produce which means we will be using more of it - Solar power will soon be as cheap as coal.

Home again, home again, jiggety-jog. The Greeks are paying more and more for their three year debt. Not that anyone wants to buy it really. Not exactly the best news: Tsipras to Seize Public-Sector Funds to Keep Greece Afloat. There is perhaps a referendum pending, or even new elections. It seems that everyone has gotten to the point where it may be that Greece and its citizens want the Troika money, and don't want to use theirs, the reality however is that without a lifeline, they cannot pay their own people. And now will have to use internal resources. Once that becomes "real", it then shows that in the end the one with the reserves, the cash, the real cash that is, actually calls the shots. I suspect that we are closer to some sort of resolution in this tragedy, sooner rather than later. Once the cookie jar is empty, it is empty. European stocks are set to open marginally higher, Asian stocks are roaring ahead catching up to a strong close in New York last night.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment