"I kid you not, a 2 percent difference in market capitalisation exists between Anglo American and Steinhoff at this point. Steinhoff as of last evening, have a market capitalisation of 243 billion Rand, Anglo American have a market cap of 254 billion Rand. And you will be more surprised to know that Anglo American have fallen out of the top ten companies by market cap in the South African market."

To market, to market to buy a fat pig. Resource stocks were slam dunked, mostly as a result of the falling iron ore price. Below 50 Dollars a ton. The worst level since May of 2009, that is a long time ago. From May the 8th, 2009 to present day, your return in Anglo American securities would be minus 3.82 percent. That is in Rand terms. In Pound Sterling that same return has been minus 31.5 percent, your Rands have been somewhat protected by a weakening currency. The yield in Pounds is around 5.6 percent, could that be right? A payment of 85 US cents last year (at around 12 Rand to the Dollar, that is 10.2, after tax that equals 8.67 Rand) translates to a post tax yield of 4.8 percent for Anglo American. Obviously that is dependent on commodity prices, Mr. Market is telling you that the company might struggle to meet that 85 US cent obligation this year.

I kid you not, a 2 percent difference in market capitalisation exists between Anglo American and Steinhoff at this point. Steinhoff as of last evening, have a market capitalisation of 243 billion Rand, Anglo American have a market cap of 254 billion Rand. And you will be more surprised to know that Anglo American have fallen out of the top ten companies by market cap in the South African market. They only represent 2 and a quarter percent of the entire market capitalisation, obviously not on a weighted basis where large parts of the market caps of SABMiller and BATS have foreign registers in London that are larger.

Lean in a little, you are going to find this even more surprising and this represents all the heavy lifting that Marcus Jooste has done at Steinhoff, in June of 2010, Steinhoff had a market cap of 25 billion Rand, much fewer shares in issue (1.4 billion then versus 3.184 billion shares now). Anglo, in December of 2010 had a market cap in Rand terms of 413 billion Rand (shares in issue have not changed that much), that has shrunk by 160 billion Rand as commodity prices have softened. The divergence of an old South African champion that is closely associated with the mining activity in this town of ours and a new champion of retail across the globe, in the form of Steinhoff has been nothing short of breathtaking. And if you had to ask me to stick my neck out as to who has the better prospects over the next half a decade, I would back Christo Wiese throwing in his lot with Steinhoff every single time.

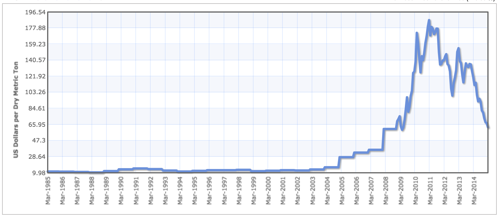

As spectacular have been the vicious moves by Kumba Iron Ore and AngloGold Ashanti, southwards, in terms of moves to the bottom of the 40 biggest companies by market cap. Those companies find themselves in places 40 and 42 respectively, Redefine sandwiched between the two and Brait breathing down their necks. Again, if you had to stick a gun to my head I would rather choose Brait and Redefine over the iron ore and gold producer. I suspect that Mr. Market will continue to do the same too, the prospects just seem better. Paul did a show on Hot Stocks on the commodity producers, with a focus on iron ore and him and Wayne did not make an investment, even at these depressed prices. I am afraid that until something changes structurally, i.e. there is strong demand from either India, or a pickup in demand from the rest of the globe, the medium term looks like a hard battle. To let you know how "bad" it has been for producers, here is as long a graph I could get on the iron ore price from IndexMundi:

What becomes evident is that the price of iron ore, over 17 years up to 2002, "did nothing" for a long time. Demand was muted and it was unattractive to push volumes. The opposite changes. And now there is an enormous amount of volume being brought online and demand is softening from the Chinese. Yowsers. At the opposite end of the spectrum as far as poor performance was concerned on the day, was MTN, which was up over 6 percent, dragging the rest of the market higher. The favourable outcome in Nigeria, i.e. no violence with a political shift in power represents a new maturity with regards to African politics. I like it a lot.

Not a prank, quite simply put, as per the FT (subscription only, they have a free subscription option that lets you view a couple articles a month) article: Greece submits new list of reforms to eurozone. You can actually read the whole list of reforms on this document, which was "obtained" by the FT, titled: Greek Reforms. I read most of it. I was quite interested in the "VAT lottery", a system whereby if you insist on obtaining a receipt with the VAT amount from a retailer, you can enter that receipt into a lottery. i.e. By being a good citizen, you get a chance to win the lottery.

Another one of the points, and I think that spelling it out word for word, explains it all: "The initial goal for revenues from privatizations was 50 billion Euros between 2011 and 2016, with a 5 billion target for 2011, 10 billion for 2012 and 5 billion for 2013. In practice, proceeds from privatizations amounted to 1.6 billion in 2011, no revenues in 2012 and 1 billion in 2013. Seldom has a privatization program failed so spectacularly!" Wow. I guess practically speaking shifting government obligations onto the private sector means less government outlays.

There was also some cryptic explanation of how small business in Greece exists, a segment titled: Reducing undeclared work and reinforcing monitoring mechanisms: Undeclared work is prevalent in Greece, and it has risen alarmingly during the previous 4 years. The main reasons include the structural peculiarities of the Greek economy, dominated almost entirely by small and medium-sized businesses and an admittedly high degree of tolerance of shadow labor forms with fully undeclared labor at the extreme end of the spectrum. What does that sound like to you? Shadow labour forms? Man, I don't understand any of it, we cannot understand it, we don't live there. And guess what, early signs are that the new proposals have been rejected. Back to the drawing board, try harder.

Things we are reading

Ha, ha, ha. This is simply amazing, one of the best stories I have read in a long time. It starts badly when the guys iPhone gets stolen, he ends up travelling for nearly a whole day to find it and then is very surprised at some sort of culture that has developed between him and the chap who ended up with the stolen phone. Fun read: How I Became A Minor Celebrity In China (After My Stolen Phone Ended Up There). The second hand phone market in China is massive, the biggest in the world!

I know that you have always wanted to know, yet you have never quite found out where or who to ask, relax, here it is: 8 things worth knowing about eating sushi. I plan to do this too, to get to the Tsukiji fish market. The one in New York (new location Hunts Point) has annual sales of 1 billion Dollars and is second in size to the Tokyo one.

A big debate on the recovery has been where the jobs have been created - Duetsche Bank: No, This Is Not A Low-Wage Recovery. Having jobs growth in the higher paying jobs is good news for the economy, the data also highlights the need to upscale yourself.

This is not the first app to offer voice calls it is one of the biggest though which makes it far more useful - WhatsApp finally adds voice calls for all Android users, iOS coming soon. For companies like MTN and Vodacom we have already seen a shift in the number of voice calls and we will continue to see it. Data consumption is increasing at a faster rate than prices are falling, which means these companies can still see growth going forward.

Home again, home again, jiggety-jog. We are up one quarter of a percent today. Naspers got to 1900 ZAR a share. Turn down for what??

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter 087 985 0939

No comments:

Post a Comment