"Even though they may be seeming to be paying a massive premium, the share price of BG Group is down 20 percent in the last five years, and since the highs of March 2012, it is down a whopping 40 percent since the middle of March 2012. Over the last year the stock is down nearly twenty percent, the share price has obviously done very little over that time."

To market, to market to buy a fat pig. It certainly felt quit on the "desk" yesterday, not too many calls. We were quiet, I am guessing that the overindulgence of the weekend got the better of most. Not letting anything get the better of them was a large bounce back in the commodity producers, having taken a beating (down 29 percent over the last year), a little Easter respite was served up. Collectively the commodity stocks, driven by a large gain in Sasol, were up 1.4 percent on the day. The big move northwards in the oil price, as a result of the Saudis raising prices (on higher demand) from some of their key Asian trading partners had everything to do with that. The oil price rose another 3 percent yesterday, I guess in part sinking stocks in a late Wall Street reversal.

Following Friday's disappointment on the jobs number there was a better than anticipated ISM services number released on Monday, more importantly the JOLTS report, a jobs opening report was at the highest level since 2007 data showed yesterday. There are now over 5 million job openings in the US, listed that is, there are comfortably over 8 million people unemployed there. It is not about the job only, it is the skill set required to "do" the job. This is apparently an indicator of sorts that the Fed looks at for full employment.

If you are looking for the full report, here goes: Job Openings and Labor Turnover Survey. There, now you know what JOLTS stands for. It looks to me, if you scroll down and check out the tables that everyone is hiring. And I guess that is a good sign. Fastest growing; food services and accommodation. If that doesn't tell you that "things" are better, people are eating out more and travelling, then I guess nothing will.

The strong Dollar has not been bad for everyone. FedEx CEO Fred Smith in his southern drawl outlined all the rights reasons for the company he founded (FedEx) to buy the Dutch business TNT Express, for 4.8 billion Dollars -> FedEx and TNT Express Agree on Recommended All-Cash Public Offer for All TNT Express Shares.

Those of you who do not know the story of Fred Smith, I shall let you know that he once wrote an economics paper in his time spent at Yale, it had all the ideas and building blocks for what was to become the first overnight delivery company in the world. He served in the military for three years, did two years in Vietnam and used his time in airplanes (he was a forward air controller, sitting in the planes, not flying them) to mastermind his idea of overnight delivery. Using military precision.

Wikipedia suggests that Smith was a real cowboy: "In the early days of FedEx, Smith had to go to great lengths to keep the company afloat. In one instance, he took the company's last $5,000 to Las Vegas and won $27,000 gambling on blackjack to cover the company's $24,000 fuel bill." In an interview with CNBC's Jim Cramer, Smith said that Cramer's observation was spot on about a stronger Dollar and a European market that was getting better, thanks to Central Bank intervention. The confidence of doing an all cash 4.8 billion Dollar deal. This would give FedEx the third largest presence in Europe, so from a competitions point of view, not too much standing in the way.

Another deal, far more sizeable and the biggest of its kind in a LONG time was the news broken by the WSJ that Royal Dutch Shell would be looking to acquire BG Group for around 50 billion Dollars, one quarter of their market capitalisation. We knew that there was likely to be deals across the oil and gas complex, this is sizeable however. I guess being in Europe with stricter competitions rules, it might turn out to be a long affair. Remembering that the very name of the company, now over 100 years old, tells you that the roots lie in both The Netherlands and the UK.

The Shell name coincidently comes from the companies (the Shell Transport and Trading company) first line of business in the UK, the import and selling of sea shells. To collectors, you know. It was the son of the founder (surname Samuel) that first imported lamp oil from the Caspian sea, the first ever tanker built specifically for that purpose can be attributed to Shell. Funny isn't it, how businesses change over time. Read the full WSJ article: Shell in Advanced Talks to Buy BG Group.

As this still evolves, the newsletter that is, we have just had news in that Royal Dutch Shell has announced that they are in advanced talks in a (you may have to go through the disclaimer process): Cash and Share Offer for BG Group of a whopping (nearly) 70 billion Dollars. Even though they may be seeming to be paying a massive premium, the share price of BG Group is down 20 percent in the last five years, and since the highs of March 2012, it is down a whopping 40 percent since the middle of March 2012. Over the last year the stock is down nearly twenty percent, the share price has obviously done very little over that time. It just represents the willingness to bite now, the timing is more right. I cannot see the BG Group shareholders saying no in a hurry, that is an 18 billion Pound premium to the close last evening, or 62 percent premium. That would be the highest price since late March 2012.

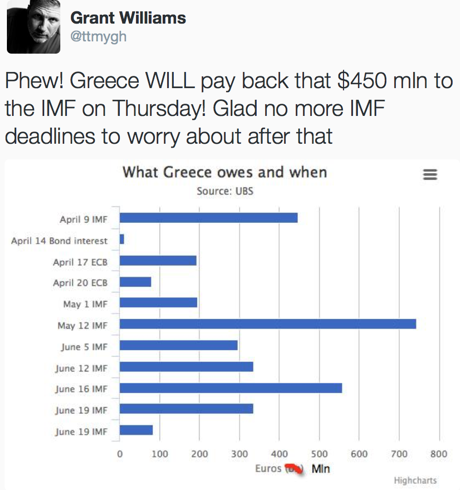

Greece. It is the story that actually CAN'T go away. Why? This is why, a picture tells you that the Greeks need to "get money" in order to pay others back, to meet their obligations. Check the Tweet from Grant Williams, it turns out that May 12 is a far bigger day, when the country needs to pay back the IMF a whopping 700 million Euros plus:

I am not too sure that Alexis Tsipras, the Greek leader heading off to Moscow to see Vladimir Putin is the best idea that I have ever heard. Perhaps it is only trying to extract a little more leverage, the problem is that the Russians have less now than when they were in a position to help the Cypriots. Apparently the big thing that the Russians could do for the Greeks is to buy their fruit. There is a Russian embargo on fruit from the EU. The Greeks export a large amount of strawberries to the Russians, as do they peaches. That would help in the next harvest I guess. And it would give the Russians much joy to thumb their noses at the Germans. Who has all the cards in all of this? I am guessing everyone has a pretty bad set of cards, who will have the best poker face is probably the one who gets what they want. Possibly still the Germans.

Things we are reading

Eeekkk! Is your job going to be made redundant by the machines? In this case it is the work of a New Zealand sheep farmer, who have replaced his border collie with a drone. Yes, really. They're Using Drones to Herd Sheep. Perhaps it is time to setup a drone repair centre, don't you think?

Hipsters are almost everywhere. Vinyl (Really? Over digital?), organic coffee and of course, craft beer. Yesterday was National Beer Day in the US. It was the day that prohibition ended, way back then. The associated graph confirms what you knew already, craft beer is exploding: Today April 7 is National Beer Day

Having bonds in your portfolio adds diversification and lowers volatility - A Historical Look at a 50/50 Portfolio. Due to the lower risk of bonds, your returns are also down. Still a fan of adding to stocks for as long as possible and if you are going to live till 90, investing in stocks is still appropriate past the traditional "retirement" age.

Glad to hear progress is being made on this front - Defeating Alzheimer's by 2025 could be within reach. The scary stat from the article, "Yet, deaths due to Alzheimer's disease have increased by 68% between 2000 and 2010"

Im sure that this operating system and the hardware operates slower than those in South Korea - See what it's like to use a computer in North Korea. Some beautiful pictures of North Korea that you can use as a wallpaper.

Given the high Gold price in the years following the financial crisis, companies spent large amounts of money on Capex. The result is record gold production and demand not keeping up with the increase in supply - Gold Bust Means Less Mine Spending.

Home again, home again, jiggety-jog. The IPL starts today. True story. Pretty darn amazing that we are licking the wounds (fresh ones) of the World Cup (four more years!) and we get this fast tournament. Guess what, the IPL is huge, big enough to get a serious mention in the FT, the advertising that is: Indian ecommerce start-ups pile into cricket sponsorship. Markets have started much better here, perhaps all the M&A activity.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter 087 985 0939

No comments:

Post a Comment