"Last week we received first quarter results for 2015 from JNJ which slightly beat expectations. Remember that this multinational business has serious currency headwinds because it reports in dollars but sells products all over the world. Sales came in at $17.37bn which is down 4.1% from last year but if you exclude those currency movements it represents organic growth of 5.7%. In dollars, US sales increased 5.9% whilst international sales decreased 12.4%."

To market, to market to buy a fat pig. Markets in New York drifted lower over the session, so far earnings which are flying in thick and fast look OK. And by OK, I mean that expectations had possibly gotten a little bearish, so expectations being beaten must be contextualised. Obviously the stronger Dollar and overseas operations, and by that I mean non Dollar areas. Locally the market topped 54 thousand again, it felt like another record, it was not however, there was a better close last Thursday. Naspers powered ahead, up nearly four percent, early signs are that the stock will have another good day, up one and a half percent at the start. Steinhoff offered the minorities in JD Group 34 Rand a share, for the 10 percent that they do not own. It looks like Regarding Capital Management might have been a smaller minority there. Perhaps a bunch of others too, maybe some shareholders asleep at the wheel, Steinhoff is marginally higher at the start here.

Richemont with a complicated announcement this morning, Significant movement in net profit for the year ended 31 March 2015. Remember that this company has the majority of their manufacturing costs in Swiss Francs, they report in Euros and most (if not all) of their raw materials (diamonds, expensive and rare gems, precious metals) are denominated in Dollars. Net profits are going to decrease by 36 percent. Sales are however expected to increase 5 percent, strip out the currency moves and it is a more muted 2 percent. The operating profits however, excluding the once offs of course, are expected to be 10 percent higher. The stock at the get go this morning is down 1.7 percent, wait for the 22nd of May to see the full results.

Company corner

L'Oreal released a trading update for their first quarter a couple of days ago, and by couple I mean it in the classic sense, i.e. two. Talking of two's, today is the 22nd and the AGM of the company is today. Remember that the company has a pretty interesting set of shareholders, there is the history between the Bettencourt family and Nestle, which came about as a result of the French government wanting to nationalise everything in the 70's. The founder's (Eugene Schueller) daughter, Liliane Bettencourt was active in the business for years. According to Wiki, Liliane worked in the business from the age of 15, as an apprentice she would label shampoo bottles and mix cosmetics.

Indeed the roots of the business, excuse the pun, were in hair dyes. The very name Societe Francaise de Teintures Inoffensives pour Cheveux translates to the Safe Hair Dye Company of France. Bettencourt's daughter, Françoise Bettencourt Meyers and son-in-law, Jean-Pierre Meyers are both directors. The old man, Eugene Schueller was of German descent, he was of course French though. Wait, there is more. The next generation, the soon to be 29 year old Jean-Victor Meyers (the great grandson of the founder) is also a director in the business. Fourth generation ownership. I guess what you need to know as a shareholder is that there is a professional manager in the form of Jean-Paul Agon, a lifer at the company. He is 58 years old and has worked at the company since 1981. He knows the business as well as anyone else.

Who are the shareholders? On the front page of the digital annual report is the stunning Lupita Nyong'o, the Kenyan woman born in Mexico who starred in the equally stunning movie "12 years a slave". That movie was so sad that my wife could not watch it, have a read through to find all the information that you need, starting with brands. As per the website, the Bettencourt family owns 33.09 percent of the shares, Nestle own 23.14 percent, International Institutions own 28.06 percent, French institutional investors own 8.43 percent, Individual shareholders own a mere 5.22 percent. Staffers own 0.81 percent and the balance, 1.25 percent is Treasury stock. The family is still large and in charge, the last move by Nestle was to reduce their stake. We often thought that Nestle would be tempted to own the rest of it, perhaps the French government would never let it happen and the Swiss company knows this.

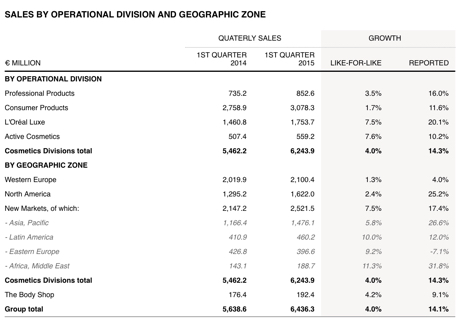

Background info finished, back to the FIRST QUARTER 2015 SALES. I took the table of the sales update so that you can see which areas are strongest, compared to the others. You can see that the currency had a marked impact on the Euro reported sales, on a constant basis (i.e. all currency moves are ignored, local sales only) growth was a reasonable 5.2 percent. That is OK, their two biggest areas of sales are still North America and Europe. Eastern Europe was the only territory to go backwards, notwithstanding the fact that L'Oreal are winning market share there. Here goes, see for yourself:

What to do about your shares? Nothing. Doing nothing means that you are not tempted to sell, the Dollar returns for L'Oreal have not actually been as good as the Euro returns, understandably of course. What do I mean by that? Over the last 12 months the ADR in New York has returned 13.65 percent (not too shabby Nige), whilst the French listed business is up a whopping 46.8 percent, the market cap is about to crest exactly 100 billion Euros. We continue to hold the company through the wild currency gyrations, knowing that a weaker Euro has an impact on the Dollar share price (negatively), at the same time a weaker Euro is positive for reported sales. Take the currency fluctuations out and know that you have a quality business that is beating their peers globally, taking market share in the mature markets and growing fast in the developing world, which now represents more than 35 percent of the business. We maintain our accumulate stance.

Byron beats the streets

Johnson & Johnson was established in 1886 when the Johnson brothers created a line of ready to use surgical dressings. It listed in 1944 and within that period until now, managed a run of 52 consecutive years of dividend increases. Today it operates over 275 companies around the world, 144 manufacturing plants occupying 21.7 million square feet of floor space and has a market cap of $277bn. The company is broken up into 3 business segments, namely Consumer, Pharma and Medical Devices and Diagnostics.

Last week we received first quarter results for 2015 from JNJ which slightly beat expectations. Remember that this multinational business has serious currency headwinds because it reports in dollars but sells products all over the world. Sales came in at $17.37bn which is down 4.1% from last year but if you exclude those currency movements it represents organic growth of 5.7%. In dollars, US sales increased 5.9% whilst international sales decreased 12.4%. Earnings per share came in at $1.56 which was 2c above consensus. EPS growth ex currency movements came in at 3.7%.

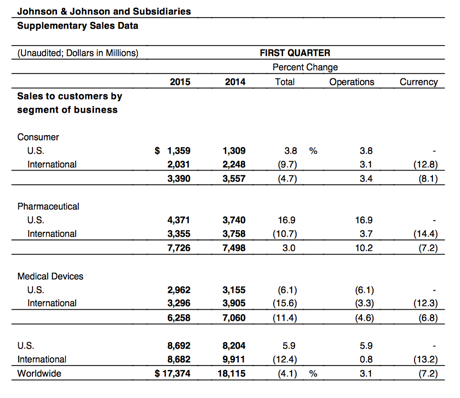

To get a good feel of their sales mix I have hacked a table from the presentation which shows you sales by divisions as well as splitting each division between U.S sales and international.

As you can see, the US is doing well while the international business is suffering from currency movements. Because of the growth in the US and the slow down internationally the split in sales is now almost exactly 50-50. As I have said before, currency swings happen, long term investment decisions should not be based on these swings. Sometimes they work for you, sometimes against. The US dollar is strengthening because the US economy is strong. If you gave companies a choice they would certainly take a strong US economy and strong dollar over a weak economy with a weak dollar.

Amongst the divisions, pharma is clearly the dominant sales and growth driver. That is a trend we have seen throughout the whole healthcare sector for a while now. If you had invested in a pure pharma business it would have outperformed JNJ. But these businesses go through cycles and we like the diversification. I read an analyst report which has a price target of $108 ( currently $100) for JNJ. They value the pharma business at $59 a share, the devices business at $36 and the consumer business at $12 a share. It's like investing in an index. The slower growing divisions have less influence over time.

Within the Pharma business there are lots of moving parts. Products coming off patent, others awaiting FDA approval. This is strategically and very well managed by management. Of the $17.374bn in sales for the quarter, they invested $1.9bn in research and development. You can be assured that they are on top of things. If you would like to take a closer look at their brands within the divisions go to the report here and scroll to the bottom, the last 6 pages give you all the details. JNJ Q1 2015

Fundamentally the stock trades in line with the market. Earnings for the year are expected to come in at $6.14. Trading at $99.58 it attracts a forward PE rating of 16.2 and a solid yield of 3%. It has about $5bn more in cash than debt and is sitting pretty financially. Earnings growth for 2015 is expected to come in at 5%.

Our thesis is that the healthcare sector globally will grow even faster than market expectations, JNJ is a solid entry into the sector. It won't blow the lights out, that is why we also like Cerner and Stryker, but you will get solid growth amongst all the divisions they operate in. And don't forget the room for innovation in the sector. It's the big players like this, with massive balance sheets who can change the face of healthcare. For example JNJ are partnering with Google to improve robot surgery. We continue to add JNJ as a core holding in our US portfolio's.

Things we are reading

What happens to sectors where government helps and intervenes? Prices generally go up - What economic lessons about health care can we learn from the market for cosmetic procedures?. The main reason is probably because people are not price sensitive to a service when they are not personally paying for it. The other reason is that more people can now have access to these services, so increased demand leading to increased prices.

Efficient transportation is important, the less time spent traveling the more time can be spent doing productive things or relaxing thus creating value for all involved - A new Japanese train has broken the world speed record twice this week. Interesting to see that they have already planned as far ahead as 2045. Given that there hasn't been a major change in how get from A to B for a number of decades, I wonder if by the time 2045 comes around, there will be a whole new way to replace rail?

Here is a thought experiment from the WSJ, I doubt that it will get to a point of a second currency but interesting to think about - Could Greece End Up With Two Currencies?. As a shop owner would you accept an IOU signed by the Greek government? I doubt many would and if it did catch on, I would see the IOU currency devaluing very quickly.

Home again, home again, jiggety-jog. Stocks have started lower here, following selling on Wall Street late in the session. We are down one third of a percent at the get go here. Gold stocks have turned to their "winning ways" again.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment