"Naspers had a market capitalisation of 813 billion Rand at the open today, up 3.7 percent as I write this in early morning trade which equals 843 billion Rand. The difference between what the stake in Tencent is worth, relative to what the JSE buyers are willing to pay is roughly 8 billion Rand. Effectively, the South African asset management community is telling you that the people of Hong Kong, or the folks valuing Tencent on a 53 multiple are overpaying."

To market, to market to buy a fat pig. Another jam packed weekend of kids stuff for me, it was fun as ever! Another Lions victory, the home team from the coast was beaten under raining skies, unseasonable at this time of the year, not so? Markets across the vast Atlantic Ocean ended around half a percent higher on Friday, closing near the highs of the session. Locally it was a pretty broad based rally, resource stocks lagged, gold stocks popped hard as the precious metal price ran through 1200 Dollars a fine ounce. What? This is starting to sound like a market report, I must stop this immediately at once.

I had a look at the market capitalisation tables, there are only 22 companies that have a market cap of more than 100 billion Rand. In Dollar terms with the exchange rate at 12 to the US Dollar, there are only 18 companies with a market cap of more than 10 billion Dollars. There are less than 100 companies with a market cap of over 1 billion Dollars here in South Africa. 97 to be exact, Curro Holdings (which has been on a tear, the share price that is) just sneaks in and out of that list. If I apply the same criteria to the NYSE, there are 1903 companies with market capitalisations greater than 1 billion Dollars. Greater than 10 billion Dollars? 553 companies. Imagine if our listed companies were part of that massive pool of investments? Going a little further, there are 61 meg caps listed on the New York Stock Exchange, the choice of monster businesses is actually enough.

The only point I was trying to illustrate is that in a deep and liquid market like the US, investment mismatches are more easily available. The market here is a little more crowded, you must always be looking for global diversification and owning big businesses that are able to operate across a multitude of geographies. I do not know why there is this perception of South African businesses that they are not patriotic when they go abroad? Surely if you are looking for newer customers, you cannot be confined to 54 million souls? I encourage South African businesses to trade wherever they think there are opportunities.

If you think about it, if all the consumers in Sub Saharan Africa started using products that are manufactured on the continent, most especially here, that would be better for trade across Africa, not so? As a collective, we need to recognise that there is a world of opportunities out there, stopping and routing out Xenophobia. There is a reason why people want to live and do business here, it is better than their country. Great risks are taken by people who travel and move out of their comfort zones, there is no plan B. That is why you often find that countries that readily accept immigrants into their systems have a greater rate of productivity than the locals, as a result of only Plan A.

The long and the short of it all is that you should have a globally diversified portfolio with big companies that have better than average growth prospects. You must own high quality, almost always. As they say in the classics, invest in what you know. Rather than going beyond the tried and tested, there is a reason that large and sizeable companies remain enduring parts of the investable world, there is a reason for size and scale and more importantly longevity.

Company corner

At the start here Naspers have blown through 2000 Rand, as a result of TenCent having crested 170 Hong Kong Dollars for the first time. Perhaps it is time for a refresher in terms of the, what Naspers is worth question. Their results for the full year to end March were released in June of last year. If there is to be a trading update, there could be one at any time in-between now and then, looking back over the years and more especially at the interim phase, the trading statement was ten days before results. End of June says the investor relations calendar, 29 June to be precise.

Our trusty Naspers/Tencent calculator is as follows: Take the Tencent market cap in Hong Kong, which right now is 1.58 trillion HKD. Naspers owns 33.85 percent of TenCent, that translates to 534 billion Hong Kong Dollars. One Hong Kong Dollar at the current exchange rate is 1.56 Rand. So, quite simply, multiply 534 billion HKD by 1.56 and that equals 834.8 billion Rand. Naspers had a market capitalisation of 813 billion Rand at the open today, up 3.7 percent as I write this in early morning trade which equals 843 billion Rand. The difference between what the stake in Tencent is worth, relative to what the JSE buyers are willing to pay is roughly 8 billion Rand. Effectively, the South African asset management community is telling you that the people of Hong Kong, or the folks valuing Tencent on a 53 multiple are overpaying. With growth rates in the mid 30's, the PEG ratio is somewhere in the region of 1.43 times, which is starting to reach expensive levels.

I am reminded many times that a) the internet is still at early stages in China and there is plenty of room to grow rapidly, b) there is very little entertainment in China, that is why the Tencent platforms are so successful and c) the Chinese authorities like having control over the local companies that operate in that space, equally the companies there now will keep external competitors at bay. So whilst Tencent may be at the edge of what is "full" in terms of price, the rest of Naspers is effectively "free". This phenomenon of "getting the rest for free" with regards to the rest of the Naspers businesses has ALWAYS been around, somehow our wisdom amongst South African investors is arrogantly miles better than those folks closer to the action of the business who actually live in the region. Yes. Perhaps it is worthwhile to ask the investor relations person at Naspers this very question, and why she thinks it exists.

Remembering that last year the TV business at Naspers recorded revenues of 36.271 billion Rand and registered EBIDTA of 10.370 billion Rand. You could easily pay 150 billion Rand for that as a standalone business. And yet, I recall over a year ago Koos Bekker thought that the business was a "legacy" business. He is right, more and more content will be available online when the faster internet speeds become available in South Africa (sometime in 2030 - maybe, I am of course kidding), that is a threat to their very own business. Perhaps when the ecommerce businesses are fully fledged and making money (instead of losing A LOT), the TV business will be floated separately. Who knows, for now the cash cow is available for the heavy investments in the ecommerce businesses.

Things we are reading

This is clever. Via AEI. 33 Insanely Clever Innovations That Need To Be Everywhere Already. They include traffic lights with countdown lights, a folding bike helmet, tile attachments to your keys and wallets to make sure that you can find them, always. Encouraging innovation drives wealth creation.

Phew. This takes a giant sideswipe at the Hedge Fund industry, written by Morgan Housel: Two hedge fund managers walk into a bar. It turns out that the market has crushed hedge funds over ten years. And they were supposed to be "neutral", so much for paying all the fees.

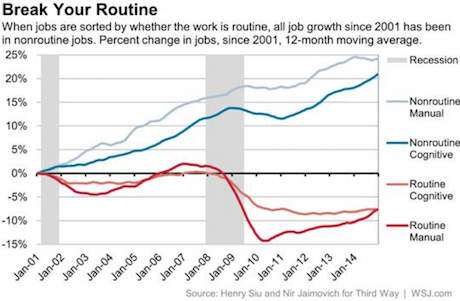

This article has received a fair amount of attention over the last week, I expect this trend to continue - Is Your Job 'Routine'? If So, It's Probably Disappearing. The need for quality education is more now than ever and is a great story for a company like Curro or Advtech.

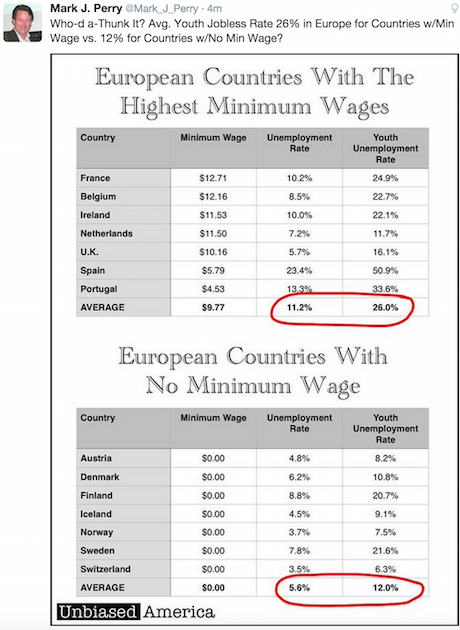

I found this infographic on twitter over the weekend. You could say that this is economics 101.

When using financial/ mathematical models stop working, the temptation with low interest rates is to double down on the original position - Doubling Down on Risk

Arguably the most important thing for start ups is access to capital, the easier it is to get capital, the innovation a country will have - SEC: Startups Can Now Raise $50 Million in 'Mini IPO'.

Home again, home again, jiggety-jog. Stocks are up. This is a record, I think. Interestingly we always measure ourselves in Rand terms, the currency that we transact in of course. You cannot go to the shops and buy bread in Dollars, this is not Zimbabwe. It is therefore interesting to note that the iShares MSCI South Africa Index ETF (share code EZA) is 8.78 percent higher in Dollar terms thus far, year-to-date. Over a year however, the ETF is up only 6 percent, meaning that the Dollar return has been quite poor, relative to the S&P 500, which has returned 15.76 percent. Over five years however, it becomes even more apparent that you should and must have offshore investments in a Dollar based environment, owning high cap quality companies. The S&P 500 is up 76 percent, whilst the EZA is up a mere 13.38 percent. Inside of the EZA there are 53 stocks, Naspers is the biggest (nearly 20 percent), with MTN around 9.6 percent. Over five years the Dollar is 65 percent stronger against the Rand, there is your difference. The Rand is nearly 40 percent weaker to the Dollar over the same time.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment