"The point that I am trying to make is that nobody knows the future. Nobody knew that Apple was going to return 1924 percent over the last ten years. Equally nobody knew that Eastman Kodak (an iconic brand of yesteryear) would go to zero. The irony was that the highest price that Eastman Kodak ever reached was moments before the October 1987 stock market draw down, the single worst day percentage wise known to all of us."

To market, to market to buy a fat pig. I really enjoyed the opening line of the Crossing Wall Street weekly newsletter today, it is a Peter Lynch quote in which he quite simply says that more money is lost by investors preparing for corrections or trying to anticipate corrections, than has been lost in the corrections themselves. Lynch was at Fidelity Investments, the behemoth (that is not nice) which as at September last year had nearly 2 trillion Dollars under management, total customer assets at Fidelity was nearly 5 trillion Dollars. Lynch managed the Fidelity Magellan Fund, the best known actively managed mutual fund in the world, according to Wikipedia. Magellan of course was one of the earliest explorers, Portuguese, funded by the Spanish however.

From the time that Lynch managed the fund, assets went from 18 million Dollars to 14 billion Dollars. Such was the consistency of Peter Lynch that he attracted more and more assets. The fund averaged 29 percent per annum during his 13 year tenure at the helm. So Lynch deserves a place in investing folklore, he is credited with the saying ten bagger, the stock that goes up tenfold is a ten bagger. He left a nice job to manage his own families money, he had enough of doing it. In this amazing interview with Charlie Rose: Peter Lynch Journeys From Funds to Philanthropy, you get a sense of where he is now. Part of the reason why he quit so early was to spend more time with his family, his dad died at the age of 46, he didn't want to work all that time in order to not see his family. Good lesson there for all of us I guess. Pressure too, 1 in 100 Americans had money invested in that fund, Lynch felt responsible, he cared.

Back to what Lynch was trying to say however, the anxiety part in us is different, per individual. I speak to many entrepreneurs who are clients, some of them exceptionally cautious and others very positive about the future almost always. Worrying about the next draw down in the market and not investing any money whatsoever (being too scared to part with cash, staying liquid), as you are too worried about losing money is a far worse trait to have than buying businesses today and accepting that market draw downs are part of investing. Markets always go up and down as a function of the current mood, the global economy, the future prospects based on earnings estimates.

I suspect that it is a control thing. Pretty much like a fear of flying, where you have absolutely no control, you are in an enclosed environment with strangers, sitting on a seat with just a seat belt. You had no fear of driving to the airport, yet statistically you should have been petrified driving next to people who have far fewer skills than the people who built and fly the aircrafts. However, you sit in the drivers seat, there is an element of control, you can brake, accelerate, turn, change lanes and so on. The only thing that you have control over in investing is what you buy and when you buy it. You have very little control in big and medium cap stocks over the price. The price is what it is, right now. You can only have control over a companies destiny if you have a board seat and have accumulated enough stock in order to get there, in a way that Carl Icahn does. There are very few individuals who can do that.

So if you can control what you buy and when you buy it, that gives you an element of sitting in the drivers seat. The other thing worth noting is that as intimately as you can know a business, you will never know it better than insiders who are in control of the business. Do you think that Stephen Saad has control over the sales of Aspen products? Yes and no. Yes, he can make sure that he is in all the "right" territories, has the right distribution mechanisms. If everyone was healthy and had no need for the therapies, as brilliant as Stephen Saad is, he cannot control that at all. If suddenly everyone was healthy and well, the need for new therapies would not exist. The Discovery Vitality platform would have done their job finally. However, that is not the case.

The point that I am trying to make is that nobody knows the future. Nobody knew that Apple was going to return 1924 percent over the last ten years. Equally nobody knew that Eastman Kodak (an iconic brand of yesteryear) would go to zero. The irony was that the highest price that Eastman Kodak ever reached was moments before the October 1987 stock market draw down, the single worst day percentage wise known to all of us. Worse than any flash crash. By the mid nineties the stock nearly recovered to the 1987 highs, but then the digital era saw the company expunged from usefulness. Not true, the company still exists and employs over 7000 people, ready for the digital era. Stock holders however got wiped out in September 2013. The irony was that Kodak were the first inventor of the digital camera, around 40 years ago, the board was however worried that the product would cannibalise their existing business. Oh, the horrible and dreadful irony.

So ironically the one thing that you have control over, when you are going to buy the stock (of the company) and how much, has nothing to do ultimately with the investment itself. The stock is merely the quoted price of the company. What is far more important than the stock price is the business, what they do and what their prospects are. Quite clearly the price matters, if you are paying 30 times worth of current earnings then you had better be completely sure that the company produces the necessary earnings for that "expensive" multiple to unwind. If a company valued at 30 times earnings grows earnings by 15 percent per annum for three years and the share prices "goes nowhere", what is the Price to Earnings multiple unwind? Not quick enough, the unwind is to 19 times in three years. The PEG ratio was something made popular by Peter Lynch, Price to Earnings over the Growth Rate. A number closer to 1 represents that the market has got it right. If you put yourself in a box, I won't buy this, it is too expensive, I however like the business, is that not too constricting?

Hard and fast rules again give us an element of control, not too dissimilar in sports such as cricket and golf. There are multiple rules, half the reason that cricket and golf confuse many. Possibly too many rules. Investing can be confined by a set of rules. If that is the case, you often miss fantastic opportunities as a result of being too expensive. And too much anxiety is crazy too, keeping you from buying quality as a result of being too expensive today. I hear the same people who call a company too expensive "fantastic" and then profess to have a forever holding period. Huh? Keep calm, keep investing, keep buying quality, keep paying attention. Don't fret about the Fed, people talking corrections and levels. When you own a stock of a company, you own a claim on future profits. As a shareholder of common stock you have the right to dividends. Let us presume that the same company that is expensive, in growth mode then beds down their recent growth mode and suddenly starts paying big dividends. And then you can buy them for the yield. Yes, owning stocks is like having a family, there are many challenges there too.

Company corner

Why would Woolworths partner with Pharrell Williams? Sure, he wears great hats, he has similar sounding (too similar) songs to Marvin Gaye. He gave an interview with Seth Meyers two nights ago in which he (Williams) suggested that he was fired from his job at McDonald's for being lazy. True story, not just once, three times in total. Pharrell actually wrote the song "I'm Lovin' It", which was then used as a jingle by McDonald's. The song was sung (and co-written) by Justin Timberlake, back in 2003. You know the jingle part on the McDonald's adverts. Irony, getting fired by McDonald's three times and then having them using your song for their jingle. Oh, and did we say that Williams is pretty darn cool, he looks great for a 42 year old (yes) and has pretty good style, even as a fashion loser I can see that.

There was no SENS announcement. There was no media release on their investor relations website. There was however a pretty big release, Ian Moir the CEO was interviewed by CNBCAfrica yesterday and he said that the new target market in South Africa (younger urbanites) would not listen to a suit like him, they were more likely to listen to Pharrell. His daughter, Ian Moir said (who is 23) LOVES Pharrell, a journalist that he met around the release, LOVES Pharrell, what is not to like. Other than the obvious of course -> The 'Blurred Lines' Legal Battle Explained: What Comes Next.

Here it is on the Woolies website: Are U With Us? It is for clean oceans and rivers, it is for making a difference with regards to creating different and sustainable products. Many people are attracted to the idea of shopping at a place that is conscious of the environment, changing it for the better. Better farming methods. And even more importantly, funding education in South Africa which is another big push behind the initiative. Time will tell whether or not the collaboration will bear fruit, Pharrell is cool, will Woolworths shoppers associate with him as a brand ambassador for change though? I hope so, the change for everything, including sustainable farming methods occurs only when consumers adopt it whole heartedly.

Things we are reading

A view from an entrepreneur on how the digital age operates - The platform age is upon us..will you be a landlord or tenant?. Having someone focus on the platform (shopping mall) allows you to focus on building an app (shop), making it easier to launch new cool products.

Here are the numbers on how much water is used to bring us everyday food - If Californians want to really conserve water, they should cut down on coffee, rice, and beef. To save the planet does that mean we have to give up our morning coffee and that fillet steak for supper?

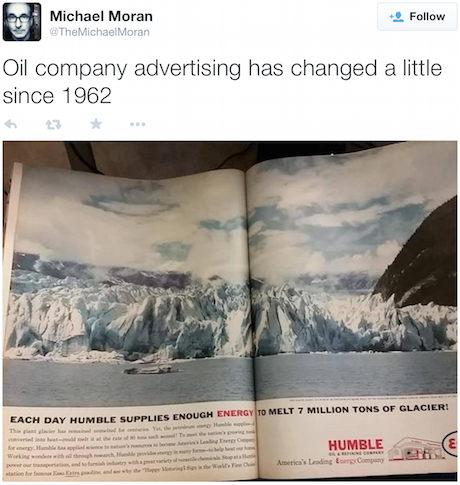

How times have changed, imagine if an advertisement like this was placed today

What should you expect from your equity investment? - Average Returns Are Exceedingly Rare

Home again, home again, jiggety-jog. The great one, all hail the great one in the words of the "12th man" is no longer, Richie Benaud passed away last evening at the age of 84. Richie Benaud was captain of Australian cricket for 6 years, possibly better known to all of us as an exceptionally insightful cricket commentator and writer. Of course he bowled Leg Spin and could bat well enough, he never lost a single series as a captain. His highest test score, 122, was made here in Johannesburg, at the "New" Wanderers stadium just up the road from us. The Old Wanderers was at present day Park Station. Check out the Cricinfo tribute: Richie Benaud dies. So long Richie, thanks for all the memories.

Markets are marginally higher at the open here, dollar strength has translated through to weakness in the Rand, which is giving us a marginal boost at the get go here. Chinese stocks continue to be on an absolute tear.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

Shop your office suits for your professional look !!

ReplyDelete