"Surely that time spent researching what business you can buy and own is far more useful that getting anxious over something that you have absolutely no control over, like what the Fed does next?"

To market, to market to buy a fat pig. Have you ever seen the clip of the German coast guard chap who asks the British ship sending an SOS what he is sinking about? No? It is actually an advert for the Berlitz language courses, if you are looking for a little pre weekend fun, check it out: German Coastguard Sinking - Learn English Commercial. That fellow coincidently is far more superior in the command of the English language (with his accent) than I have any degree of proficiency in the German language, before you think that I am being rude.

What are you sinking about, markets? Unfortunately the first look at GDP for the first quarter in the US was weak, much weaker than anticipated, sending equity markets lower. There was a similar number in the UK the other day, that must have delivered David Cameron, the leader of the Conservative Party (Tories) a blow ahead of the elections next Thursday. Mike Bloomberg, whom I follow on Instagram had some pretty kind words to say about Cameron however, in this Instagram post ->

Nice support, of course Mike Bloomberg is pro business, as are the Tories. The word Tories is derived from the Middle Irish word that means outlaw or robber, a pursued man. Robber. That is strange that the word is associated with robber, Margaret Thatcher implied that the Labour party were the ones who took away, this famous quote that capitalists LOVE so much: The problem with socialism is that you eventually run out of other people's money. Meaning that you can extend as many benefits as you want, you do however need someone to pay for it, and somehow soaking the rich has never quite worked. Neither has neglecting the poor, the French have tried both, neither has worked. You can neither prevent people from baking cakes, nor can you deny them their daily bread. Balance. The trick of course for all governments is to be re-elected without breaking the bank.

Away from politics, one of my least favourite subjects and the self importance associated with many politicians, the very word public service means you are accountable to the public and not the other way around. Something that you do have control over is what companies you own, for how long you want to own it and your investment portfolio. You have no control over what the Fed says or does, if you are basing your investment strategy around that, then I guess you are doing it all wrong. Last evening the Federal Reserve open market committee (the FOMC) released a statement, they do so at regular intervals, you can see it here -> Press release, April 29, 2015.

There are blogs and reporters who try and pick apart each and every word, searching for clues as to when the Fed are going to "act" next, when are they going to raise rates. Or give clues. They pick apart each and every sentence, interpreting "Fedspeak". The language of economists and central bankers. Too much time is wasted on what the members are saying, in my opinion. That valuable time could be spent (in my case) reading annual reports, reading company websites and brochures, finding out who has the best service and the best product. Who is buying them, what are the margins that the company is selling that product, relative to their competitors. Surely that time spent researching what business you can buy and own is far more useful that getting anxious over something that you have absolutely no control over, like what the Fed does next? It certainly is in my case, those in fixed income markets would of course disagree with me, they need to be on the money as to what the next possible move is in government issued securities and company debt. Anyhow, everyone is interpreting the "transitory factors" of the first quarter slow economic growth in the US as temporary, at least that is what Janet Yellen the Fed chair is saying.

For the record, the US markets ended the session down 0.37 percent, in the case of the broader market S&P 500, the nerds of NASDAQ lost nearly two-thirds of a percent, telecommunication and tech stocks were sold off a little more than the rest of the market. Energy rebounded, the oil price has been on a tear, along with the rest of the commodities market. Locally when the read of US GDP hit the screen around two thirty in the afternoon, there was a swoon lower, a trend that was intact until the session ended, at the lows of the day. The equities market, the JSE ALSI closed down 0.9 percent on the day. The Dollar of course took some punishment, that is why the Rand was stronger. Amazing how I have not seen any of the chattering classes saying that the Rand has improved significantly as a result of a better performance from Eskom, have you seen anything to suggest that?

Company corner

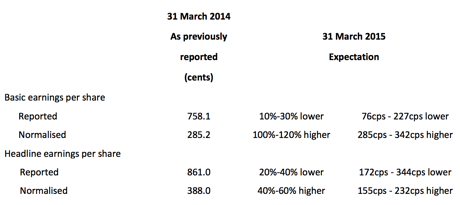

Telkom released a trading statement that was difficult at face value to make head or tails of, here is the Trading statement and operational update. Too many moving parts there for my liking:

In the trading statement the company says that you should look at normalised headline earnings per share. The company has been a huge benefactor of benefits from lower interconnect rates, remember as that trends lower there are no more benefits for anyone, other than the consumer. The company should return to dividend paying ways, that should please the government, who own 40 percent of the business, seeing as the last dividend paid by Telkom was four years ago. Results are expected in the second week of June. The trend is still mobile, I came across this article from Duncan McLeod (you should also follow him on Instagram/Twitter and so on) on TechCentral: Africa smartphone sales up 83%. Stay long MTN rather.

Remember when we compared BAT and Unilever yesterday and suggested that one was more compelling than the other, over the longer term? See the Interim Management Statement for the three months ended 31 March 2015. I was reminded why we do not like the sector, regardless of how wrong we have been on the stock, Chairman Richard Burrows had these prepared statements: Whilst group cigarette volume was down by 1.4 per cent - against a backdrop of an estimated industry decline of 2.5per cent - we continued to grow overall market share. This is a mark of good management of the business. I do not care what you sell, when the whole market for your product is shrinking over time, that sounds like an industry in decline and unlikely to grow, we continue to avoid!

Things that we are reading

Fun today, seeing as we are in a shortened week: Things People Say During a Bull Market. My two favourites on "Fair Value": The Bulls argument: "We think the market is fairly valued at current levels. (Translation: I have no idea what the fair value of the market is and neither does anyone else.)" Value Investors: "The market is overvalued but our stocks are trading at a 30-40% discount to fair value."

Goodbye testing on animals, or so it seems. We dislike the fact that animals are injected with stuff they did not ask for. This Bloomberg story tells you how it will happen: Drug Testing, Now Without the Chimp

The father of our nation, Nelson Mandela, was quoted as saying: "Education is the most powerful weapon which you can use to change the world." He is right. Unfortunately it seems like it is going to take a looooong time to get there. Global '100-year gap' in education standards

Samsung have been having a decent time of it, their latest smartphone is pretty awesome. They managed to claim back number one spot last year, they did however not experience as quick growth as Apple, see the BusinessInsider chart of the day: Samsung was the only big smartphone maker whose sales dropped from last year

The headline says it all: One Dozen Reasons Why the Average Person Underperforms In Investing, Part 2. The first two are really important, arriving and leaving at the wrong time. Never try and time it, spend time in and on it rather.

Would you let someone sleep in your bed? For money? I am talking about Airbnb, get your mind out the gutter!! The evolution of the sharing economy means that mainstream "old" businesses may have to get proactive, and quickly: How Airbnb could spawn an M&A frenzy in the hotel industry

I was pretty surprised to see this number: Facebook Hits 40 Million Page Milestone, Launches Live Chat for Businesses. Why was I surprised? In the Facebook numbers last week, the company said that they only had 2 million advertisers. The other 38 million companies obviously don't advertise. I could have it wrong, that is the math that I do.

Howard Lindzon took a huge sideswipe at the company management of Twitter (and apologised to his audience) in a fairly simple post, I agree with him on periscope, I think that user adoption is going to take a while: Twitter - Great Platform ... Sh1tty Stock - a Mea Culpa. Dear Google, please buy the company, you can do amazing things with it. Regards. Me.

I find it really hard to believe that a single person, living at their parents home at the age of 36 (now) was repressible for a 1000 point decline on the Dow Jones in a matter of minutes, a few years ago. Dubbed the flash crash, Navinder Singh Sarao is currently on trial, having been charged 5 years after the event. Read a little more from the NYT: British Trader Charged in 'Flash Crash' Fails to Post Bail. If found guilty, the question must then be asked of the exchange, how is it possible that someone can sit in a study at their parents house and with a simple internet connection and not much capital, "break the market"?

Home again, home again, jiggety-jog. Most Asian markets are lower, they did not have the benefit of the US data, the US numbers. We are still in the middle of earnings season, markets at the beginning of trade this morning are flat. I got it wrong, non farm payrolls are next week, too early on the first of May. There is a European inflation read today, the fixed income market has been abuzz with the Bill Gross called German Bunds a short of a lifetime. Jeff Gundlach called it too. We shall see who gets it right.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment