"The company of course incorporates more than just the original desktop blue, 1.44 billion monthly users across mobile and desktop now use the network/service, 1.25 billion on their mobile phones. On mobile that represents a monster jump of 240 million. Daily that number is 936 million (not quite at 1 billion yet), 798 million on mobile phones."

To market, to market to buy a fat pig. Seeing as it is earnings season and there is a whole host of company data flying in, today will focus mostly on these businesses that we hold for our clients. Not all company earnings will be dealt with immediately, there are of course some releases that might be a day or two late. For instance there is a MTN announcement that is very important this morning, in terms of subscriber numbers for the first quarter, and an update. We'll have to deal with that one tomorrow. As I write this the share is down 0.4% so the news has not been a market mover.

Company corner

Stryker reported operating results for the first quarter of 2015, follow the link for all the numbers. The company is a global leader in medical equipment, better known for their selling of knee and hip replacements, as well as a whole host of other devices. Everything from a surgical drill, a saw, smart meters and high tech surgical equipment (screens and the like), to innovations like eliminating surgical smoke (important) to fluid disposal. The Neptune 2 is a fluid disposal product.

The business was founded post the war, by a orthopaedic surgeon of the same name, Dr. Homer Stryker. Stryker was 47 when he founded the company, one of his earliest inventions is still used, the vibrating saw to remove casts. Those of you who have ever broken a limb will know what I am talking about. Homer Stryker specialised after practicing for eight years as a GP, returning back to where the company still has their headquarters, his home town of Kalamazoo, a city that Wiki tells me is equidistant from Detroit and Chicago. Hipsters love the place, it is an important town with regards to craft beer. The other famous thing about the town is that it is the home of Gibson guitars.

In his final years he got to see the company list on the NYSE, Stryker died in 1980, the company listed on the NASDAQ (early days back then no doubt) in 1979, May the 2nd. Sadly his son had died 3 years earlier in 1976, in an airplane crash, along with his wife and two companions, leaving three kids sadly without parents. There are three siblings, Jon, Pat and Ronda Stryker, the grandchildren of Homer, they share a board seat.

Orthopaedics is the most profitable of the three divisions, it also represents 43 percent of group sales. Hips, knees and ankles, foot, and other reconstructive equipment, including a recent purchase of MAKO, robotic arm assisted surgery. MedSurg represents 39 percent of sales, the balance is the Neurotechnology and Spine, 18 percent. MedSurg includes all the instruments (drills etc.), medical equipment (including the biggest part of the business 50 years ago, beds and stretchers), as well as all the endoscopy business. Neurotechnology and Spine includes stroke therapies and spinal implants.

Revisit some of the other numbers quickly. Gross margins are a whopping 65.6 percent. Obviously the company spends heavily on research and development, 6.4 percent of total revenue. On the conference call, guidance for the quarter was given as 1.15 to 1.20 Dollars for the current quarter and 4.95 to 5.10 Dollars for the full year, currency headwinds trimming off 0.25 to 0.30 Dollars, 5 to 6 percent. Of course that is not insubstantial, what is important to remember in owning global businesses (remembering that US sales are 68 percent of total sales), you cannot get away from currency fluctuations. What we have seen here is pretty unprecedented, the massive moves in the developed world in a very short period of time. Normally currencies move 20-25 percent over years and not months.

We maintain our buy on Stryker. This is both a consistent business, since they have been listed, they have only once reported lower revenue than the prior year, and that was in 2009. Hospitals pulled back their spend sharply. The innovation and cutting edge surgical technology is evident from the company. In a world where more and more treatments and therapies are being administered on a population that is living longer and longer, their target market has more time and deeper pockets, and there are more of them. People I mean. With a price to earnings multiple of 19.3 times forward, a yield of 1.4 percent it hardly seems like a steal. I am more than happy to pay that price for a company growing profits at ten percent per annum however, a solid business.

Facebook reported numbers post the market last evening. Facebook, contrary to the chattering classes and naysayers, has turned out to be a solid business run by a fellow that has some serious skills. I think that Mark Zuckerberg is in a league with the business greats, obviously there is a lot of work to do. I get that he wants everyone to have access to the internet, I sometimes think that if I could give the Nobel peace prize to a thing, it would be the internet. Who would get the money, Al Gore? Ha ha, kidding, perhaps it can be donated to Wikipedia. Did you know that Zuckerberg's middle name is Elliot?

The company of course incorporates more than just the original desktop blue, 1.44 billion monthly users across mobile and desktop now use the network/service, 1.25 billion on their mobile phones. On mobile that represents a monster jump of 240 million. Daily that number is 936 million (not quite at 1 billion yet), 798 million on mobile phones. That is just the main service, the other businesses which we chatted about a few days ago, have massive numbers too. WhatsApp has 800 million proper and engaged users, 600 million people use Messenger, 700 million people use groups (the only one I don't use), 300 million active members use Instagram. Across all the networks, 45 billion messages are sent a day. That is around 6 per person on the planet per day.

Of all the services, I think that Instagram is the most beautiful, pictures are gorgeous and I would urge you, if you have a smartphone and like seeing and taking pictures for Facebook, to use that platform. Video of course is growing like gangbusters, there are 4 billion views a day. You can of course also post 15 second clips of video on Instagram, which is about the normal persons attention span. I am sure that it is more than that. Average time spent on Instagram is 21 minutes a day. I have never heard of the movie "Age of Adaline" which premiers this Friday, I may watch it on BoxOffice, or some other platform. Lionsgate has, via Instagram been targeting younger woman in the lead up to this movie, said Sheryl Sandberg on the conference call. The company has retargeted their efforts to Facebook, she said and they are expected to bear fruits, come the movie release this weekend.

You can have all the users that you want in the world, the fact of the matter is that the service is for free. You pay for the inter webs with your service provider, so I guess strictly speaking it is not for free. For advertisers however, it is the most pointed platform in the world. You can set your parameters as close as you need. I have used it, with mixed success I must say. Having said that, there are a mere 2 million advertisers on Facebook. That is all. They are responsible for quarterly revenue of 3.32 billion of the groups 3.543 billion in the last quarter. Revenue on a comparable quarter last year grew by 42 percent. If you excluded the strong Dollar, revenues would have increased by 49 percent. Around half of revenues are in the the US and Canada, one quarter in Europe, one sixth in Asia Pacific and the balance the Rest of the world. People like you and I. Mobile ad revenue is now 73 percent of total advertising revenue, if you recall there was a lot of anxiety around how the company would monetize mobile. Well, that is how.

ARPU's are still low however. Across the group, global ARPU's are 2.5 Dollars. That is the measure of revenue generated by the company per user. What the company are doing however is that they are spending a lot more on marketing than ever before, as a percentage of revenue, 17 percent this last quarter when compared to even the biggest revenue quarter (traditional the holidays quarter, Q4) where the company spent 16 percent. Research and Development expenses as a percentage of revenue topped 30 percent in the last quarter, we knew that the company was going to invest heavily, we were told that in the last quarter. Non GAAP operational income grew 28 percent when compared against Q1 2014, non GAAP diluted EPS clocked 42 cents for the last quarter.

The stronger Dollar and the increased spend (up heavily) means that earnings are going to be slim pickings for a while, I suspect that whilst revenues grow like crazy, expectations are for this year is 17 billion Dollars, over 23 next year and nearly 29 the year thereafter. EPS is however only expected to be around 1 Dollar this year, there is no prospect of a dividend as of yet. With a share price of 85 Dollars it is easy enough to figure that one out from a simple fundamentals point of view. This investment is not for everyone, the company has not put a foot wrong so far. They have a strong team, there is plenty of growth ahead.

Indeed last evening another new initiative was released: Introducing Hello. It is pretty darn cool, you can see more info. How does it work? Like this: You can also search for people and businesses on Facebook and call them with just one tap. So if a friend tells you about a new restaurant in your neighbourhood, you can use Hello to find their hours, make a reservation and get directions, all without leaving the app. Many different applications and bolt ons are coming, you must own a percentage of this company in your portfolio. We maintain our buy rating on Facebook, you are going to have to continue to be patient in order to see the big unwind from a valuations point of view, as in the case of growing businesses like Amazon, you can wait a decade.

Michael's musings

There have been two big announcements from GE in the preceding weeks;They are disposing most of GE Capital in the next 24 months and then they had their 2015 Q1 figures. The GE of late has always been a tale of two segments, industrials (for which they are known) and then GE Capital (which makes up the largest part of earnings). The share price jumped around 10% when they announced the sale of a large chunk of GE capitall, so the market likes the idea of moving to a more pure industrial play.

The theory is that the financial arms' earnings are too volatile for an industrial player like GE. The industrial assets don't get the same valuation in the market because they are diluted by the banking part of GE. (You can see it is not an ideal mix of assets).

The bulk of GE Capitals real estate assets will be bought by private equity company Blackstone and some of the loans business will be bought by Wells Fargo. The goal is to have GE Capital contribute only 10% of the earnings in 2018, from the current 42%.

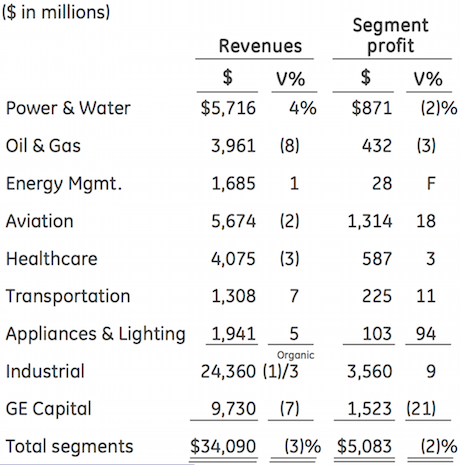

There are many moving parts to GE, here is the easiest way to see what is going on:

You will note that the industrial segments revenue went backwards by 1% but if we exclude the impact of the stronger dollar, revenue would have grown by 3%. Both Healthcare and Oil & Gas have positive organic growth but due to currency impact they also went backwards. In total the stronger dollar impacted revenues by $950 million.

Looking forward our focus needs to be on the Industrial segment as it is going to be the business post 2018. The industrial segment looks strong with earnings growth of 9% and operating margin expansion of 120 basis points. The company has nice diversification across many sectors, with one of them being the high growth healthcare sector. Add to all of this, GE plans to return to investors $90 billion in the form of dividends and share buy backs up until 2018. The conclusion drawn by all these numbers is that GE is a solid blue chip company that will probably be one of your most boring investments, they will chug along giving you a nice dividend yield (currently 3.2%) and grow earnings regularly.

Things we are reading

Owning sports teams is definitely a vanity project. Heck, Steve Balmer bought the Clippers for 2 billion Dollars! Manchester United has a market cap of 2.6 billion Dollars, annual turnover of around 650 million, profits of 35 million. The players however collectively earn 215 million pounds, or 323 million Dollars: United overtake Man City with Premier League's highest wage bill

This battle is over but the war between publishers and Amazon is not, and probably won't be over until one of the sides no longer exists - Amazon, HarperCollins deal opens door for smaller e-book battles

Another shift away from analog - In 2017, Norway will be first country to shut down FM radio and this is the technology that will be replacing it, Digital Audio Broadcasting(DAB)

Depending on when you invest has long lasting impact on your future returns - The Impact of the Tech Bubble on Future Returns. The basic moral of the numbers (story) is to be constantly adding, which gives you the advantage of average pricing. Remember that if you are constantly adding, which means buy when the market is "expensive" and "cheap", you will be buying more shares with the same money during down turns. Which results in your average entry prices being biased to the "cheaper" side. "Patience can be a great equalizer in the financial markets, but it usually has to be measured in decades, not just years."

Home again, home again, jiggety-jog. Earnings, earnings, earnings. Exciting times in the office! The local bourse is at an all time high, stemmed partially by a weaker a Rand.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment