"Over the weekend, ECB governor Mario Draghi said that he could not even contemplate a Greek default, saying that he wants the Greeks to "do well" and succeed as well the answer being in the hands of the Greek government. Which is possibly code for "you have little choice but to continue" with the list of measures imposed by the rest of Europe. When you are down to a king and a pawn (and a prayer) surely there can be little wriggle room against the collective might who have all 16 pieces left?"

To market, to market to buy a fat pig. Whoa! Markets across the globe were dealt more than a little tap on Friday. I saw a meme about the weekend, it said Friday, my second favourite F word. One of these words were applicable on the last trading day of the week, and it was not Friday. US markets sold off sharply, down one and a half percent for the Dow Jones and for the nerds of NASDAQ, the S&P 500 ended the session down 1.1 percent, perhaps the 270 odd billion giant General Electric helped the cause a little. After a set of results that the market received favourably on Friday, the company was able to avoid the general market rout, closing down a little over one-tenth of a percent. And that was the good news?

Locally we ended a percent lower on Friday, Naspers was smashed, one day up and one day down. I think what people need to understand is the following. In China there has been a massive property boom, locals pouring their life savings into that market. Why? There is very little, by way of investable assets in China, the social security programs are not efficient at all. There is a deep culture of saving in China, part historical and planning, part as a result of the one child policy, that is more recent. What I mean about the one child policy is that if your parents are married and you live in an urban area (and you are say, 20 years old), and your grandparents are all still around, then you have 6 people above you. You are the only grandchild. Four grandparents. Your grandparents know that their single grandkid will never look after them, hence they have to save like crazy.

Mix together a culture that embraces gambling as part of life. Although it is illegal in China, mainland China that is, Hong Kong and Macau, that is OK. You may, or may not have heard of Mahjong. In China, Japan, Vietnam and Korea it is huge. Mix together aggressive savings, limited asset classes and choices (we are generalising here a LOT, apologies for that) as well as embracing risk, you are bound to see equity markets in China deliver that kind of volatility. Plus of course the sheer size and scale of it all, a country with an enormous population. The last estimate is that the population has ticked over to 1.4 billion souls, as at the beginning of the year.

You may actually be surprised that the percentage of Chinese people relative to the rest of the globe has actually been falling over the last 35 years, according to this table anyhow, scroll down a little to see it: Population of China (2015 and historical). Expectations are for peak population in China over the next 10-15 years. All the info via this pretty cool website: Worldometers. According to that website there are less than 40 years left of oil at current production/use and reserves, 170 odd years of natural gas left by the same metrics, over 400 years of coal left. So Eskom is OK for now. Most people freak out when trying to process these clocks and counters that tick furiously.

So that is my crude and simple explanation why the Chinese stock market has been so volatile and until recently, one way traffic. There is news referencing Bloomberg that suggests that 30 percent of the newest equity investors in China's stock market have only an elementary education. And buying on margin, meaning borrowed money. So why would the People's Bank of China cut the reserve requirement ratio by 100 basis points to 18.5 percent. This is the biggest cut since 2008. Is this to "protect" the equities rally? This is in response to the China Securities Regulatory Commission (CSRC) changing the margin trading rules, making them stricter to "protect" the average Chinese margin trader. I suspect it is just a case of the Chinese authorities doing what they do, using the tools (like all central bankers) available to them.

The other "thing" that is worrying Mr. Market is Greece. Again. And again. The actual modern Greek state dates to around 1828, when they gained independence from the Ottoman Empire. Which in turn (the Ottomans) had gained ascendancy from the Byzantine Empire, which ruled over all the Mediterranean from 5th century AD to 1453. Nearly 900 odd years. And then another 375 years before the Greeks gained independence from what is modern day Turkey. You can see why there is not too much love lost between the Turkish and Greek people, which explains Cyprus. Although the Cypriots will tell you that they are not Greek, which is true. As far as my reading of the situation (challenges, sorry) in Greece goes, they need 1 billion Euros to pay back the IMF by mid May and 1.7 billion Euros by the end of April to pay pensions and civil service salaries. The IMF do not want to extend the timelines for the pay backs. No developed economy has ever not paid back the IMF.

As Michael said, there is always a first. The fact is, Greece has defaulted 5 times since independence, admittedly things were so different now that the two professors (Carmen M. Reinhart, Kenneth Rogoff) who wrote "This time is different", even suggested that Greece had broken the default cycle. That is my go to on this subject of Greece and their borrowings. They called Greece a "graduation candidate", alongside Portugal, Poland, Chile and South Korea, as well as Malaysia. Admittedly the data is taken from Institutional Investor ratings. It is supposed to represent the graduation too from emerging to developed status. So I guess the data is as good as it is presented to anyone. And if there is a default, that would have catastrophic implications (worse than now) for ordinary Greeks.

From this NYT article (Greece Flashes Warning Signals About Its Debt), the suggestion is that private investors own only 10 percent of Greek bonds, the rest are institutions -> After two international bailouts for Greece since 2010, about 90 percent of its debt is owed to its eurozone neighbors, the I.M.F. and the European Central Bank. At the moment, not one of those lenders is showing a willingness to give any additional payback relief to Mr. Varoufakis and the new left-leaning government in Athens.

I wonder how ordinary people feel on the ground? Are they feeling cheated that the folks they elected have not made good on the election promises? Syriza through Alexis Tsipras planned to halve the debt and end austerity. Easier when campaigning and not so easy when put into practice. Over the weekend, ECB governor Mario Draghi said that he could not even contemplate a Greek default, saying that he wants the Greeks to "do well" and succeed as well the answer being in the hands of the Greek government. Which is possibly code for "you have little choice but to continue" with the list of measures imposed by the rest of Europe. When you are down to a king and a pawn (and a prayer) surely there can be little wriggle room against the collective might who have all 16 pieces left? Currently it seems like a stalemate.

Things we are reading

Stay long Nike. Why? It turns out that sweatpants are becoming a fashion item, but you knew that, right? For the next generation, sweatpants will be what jeans were to us.

The huge value of backing the right "horse" - Jordan Spieth's win at The Masters is worth $3 per share. "So Spieth's Masters win is worth, in Piper's view, $3 per share for Under Armour. There are 218 million Under Armour shares outstanding, Spieth's win is worth around $654 million of earnings for the company."

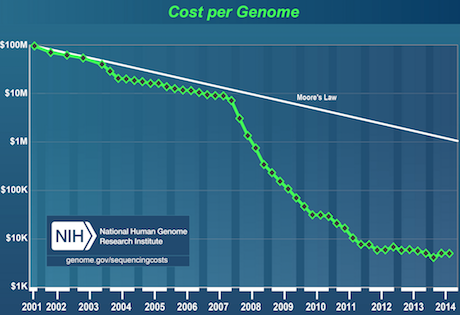

Technology helping make things cheaper - DNA Sequencing Costs. As DNA sequencing gets cheaper we can better understand our DNA which opens the door to finding better health innovations.

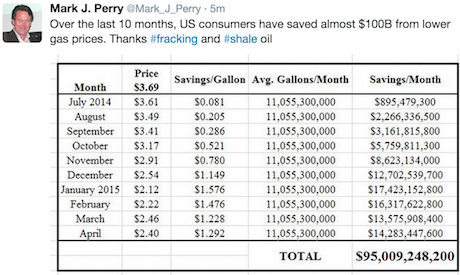

I found this table on twitter over the weekend, cheaper oil is good for everyone except the oil sector; it means that as a society we have more to spend on other things.

Given that Bloomberg terminals were down last week, Here's how Wall Street traded before Bloomberg terminals were everything. Amazing to see guys standing in the snow shouting orders to a trader standing in a window. Also all the telegraph wires that criss-crossed the street, all carrying stock prices.

Home again, home again, jiggety-jog. It is tech reporting week this week, not all tech companies and certainly not Apple. Apple of course will be reporting on the Monday, next Monday that is. So inside of the next week there will be results from IBM, Yahoo!, Microsoft, Facebook. There will also be results from Starbucks, McDonald's as well as Google and Amazon. This is the best part about being invested, listening to what real companies have to say about their operating conditions. In the end it is all about earnings from the choices that you do have as an equity investor, you can choose what companies to own and what companies to not own.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment